- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: raw news — 05-08-2015.

(raw materials / closing price /% change)

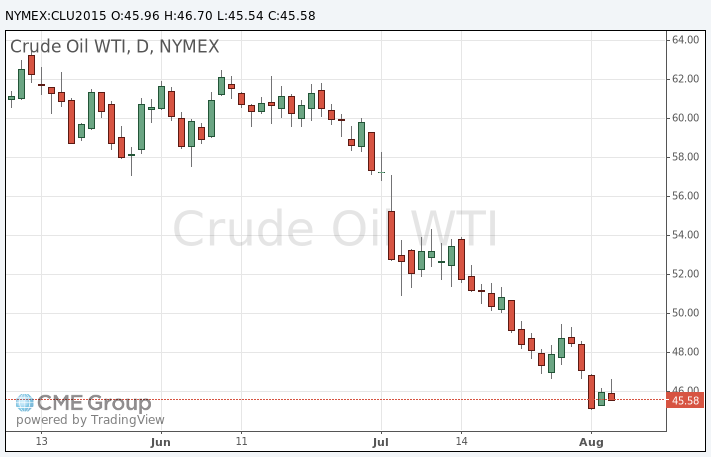

Oil 45.11 -0.09%

Gold 1,084.00 -0.15%

Oil prices increased on U.S. crude oil inventories data. The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories fell by 4.407 million barrels to 455.3 million in the week to July 31.

Analysts had expected U.S. crude oil inventories to decline by 1.95 million barrels.

Gasoline inventories climbed by 811,000 barrels last week, according to the EIA.

Crude stocks at the Cushing, Oklahoma, declined by 542,000 barrels.

U.S. crude oil imports decreased by 370,000 barrels per day.

Refineries in the U.S. were running at 96.1% of capacity.

Gains were limited due to a stronger U.S. dollar. The U.S. dollar rose against other major currencies after the release better-than-expected ISM non-manufacturing PMI. The index soared to 60.3 in July from 56.0 in June, exceeding expectations for an increase to 56.2. It was the highest level since August 2005.

A reading above 50 indicates a growth in the service sector.

The increase was driven by rises in in business activity, employment and new orders.

WTI crude oil for September delivery increased to $46.70 a barrel on the New York Mercantile Exchange.

Brent crude oil for September rose to $50.80 a barrel on ICE Futures Europe.

Gold traded lower due to a stronger U.S. dollar. The U.S. dollar rose against other major currencies after the release better-than-expected ISM non-manufacturing PMI. The index soared to 60.3 in July from 56.0 in June, exceeding expectations for an increase to 56.2. It was the highest level since August 2005.

A reading above 50 indicates a growth in the service sector.

The increase was driven by rises in in business activity, employment and new orders.

Earlier, gold price rose after the release of the ADP employment report. Private sector in the U.S. added 185,000 jobs in July, according the ADP report on Wednesday. June's figure was revised down to 229,000 jobs from a previous reading of 237,000 jobs.

Analysts expected the private sector to add 215,000 jobs.

"Job growth is strong, but it has moderated since the beginning of the year. Layoffs in the energy industry and weaker job gains in manufacturing are behind the slowdown. Nonetheless, even at this slower pace of growth, the labour market is fast approaching full employment," the Chief Economist of Moody's Analytics Mark Zandi said.

Market participants are awaiting the release of the U.S. labour market data.

Gold price is under pressure due to speculation that the Fed may start raising its interest rate soon.

October futures for gold on the COMEX today declined to 1081.70 dollars per ounce.

The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories fell by 4.407 million barrels to 455.3 million in the week to July 31.

Analysts had expected U.S. crude oil inventories to decline by 1.95 million barrels.

Gasoline inventories climbed by 811,000 barrels last week, according to the EIA.

Crude stocks at the Cushing, Oklahoma, declined by 542,000 barrels.

U.S. crude oil imports decreased by 370,000 barrels per day.

Oil production in the U.S. rose to 9.47 million barrels in last week from 9.41 million in the previous week.

Refineries in the U.S. were running at 96.1% of capacity.

The Caixin/Markit Services Purchasing Managers' Index (PMI) for China increased to 53.8 in July from 51.8 in June. It was the highest level since August 2014.

A reading above 50 indicates expansion in the sector.

The new business sub-index rose to 54.0 in July from 54.2 in June, while the employment sub-index also increased. Input prices and selling prices climbed in July.

West Texas Intermediate futures for September delivery rebounded to $46.03 (+0.63%), while Brent crude climbed to $50.32 (+0.66%). Investors are waiting for data from the U.S. Energy Information Administration to assess condition of the global supply glut. A report from the American Petroleum Institute showed on Tuesday that the country's crude inventories declined by 2.4 million barrels to 459.7 million barrels last week.

At the same time a stronger dollar makes the dollar-denominated commodity for importers holding other currencies.

OPEC members seem to be determined to maintain output at record levels.

Gold fell to $1,085.80 (-0.45%) approaching a 5-1/2-year low after Federal Reserve Bank of Atlanta President Dennis Lockhart said in an interview with the Wall Street Journal that the U.S. economy is ready for higher short-term interest rates and only significantly weaker data could change his opinion. He intends to vote in favor of a rate hike when Federal Open Market Committee meets in September.

Higher interest rates would curb demand for the non-interest bearing bullion.

Holdings of the SPDR Gold Trust, the largest gold-backed exchange-traded fund in the world, fell further on Tuesday to 21.56 million ounces, the lowest since September 2008.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.