- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: raw news — 08-12-2015.

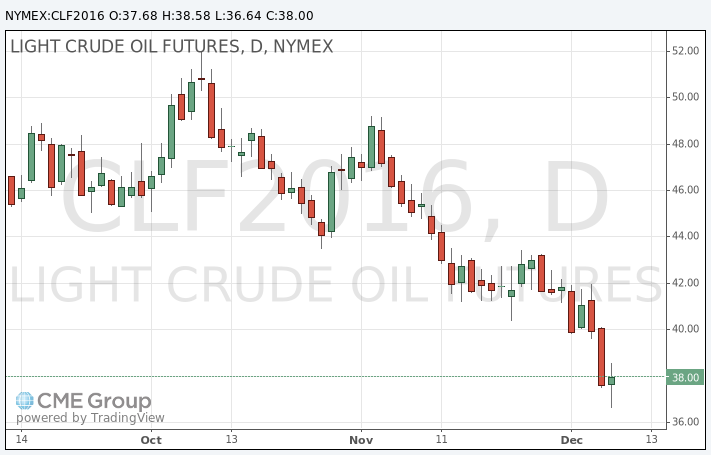

Oil prices pared some losses after hitting 7-year lows on concerns over the global oil oversupply.

Market participants are awaiting the release of U.S. crude oil inventories data. The American Petroleum Institute (API) is scheduled to release its U.S. oil inventories data later in the day, and U.S. oil inventories data from the U.S. Energy Information Administration is expected on Wednesday.

The weaker-than-expected Chinese economic data also weighed on oil prices. The Chinese Customs Office released its trade data on Tuesday. China's trade surplus fell to $54.1 billion in November from $61.64 billion in October, missing expectations for a rise to a surplus of $63.3 billion. Exports fell at an annual rate of 6.8% in November, while imports slid at an annual rate of 8.7%, the thirteenth consecutive decline.

WTI crude oil for January delivery rose to $38.58 a barrel on the New York Mercantile Exchange.

Brent crude oil for January climbed to $41.27 a barrel on ICE Futures Europe.

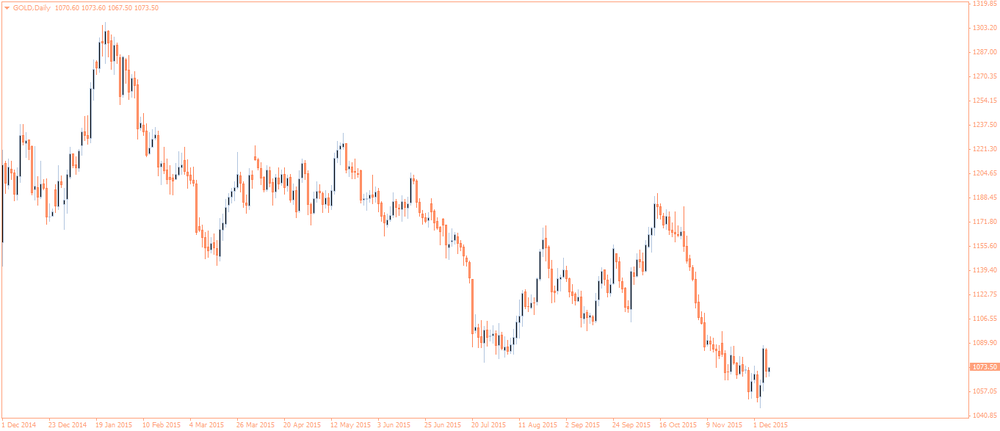

Gold price increased as market participants are awaiting the Fed's monetary policy meeting next week. Market participants speculate that the Fed will start raising its interest rate this month.

Gold is traded in U.S. dollars. It suffers when the U.S. dollar strengthens, becoming more expensive for holders of other currencies.

February futures for gold on the COMEX today rose to 1078.40 dollars per ounce.

The Chinese Customs Office released its trade data on Tuesday. China's trade surplus fell to $54.1 billion in November from $61.64 billion in October, missing expectations for a rise to a surplus of $63.3 billion.

Exports fell at an annual rate of 6.8% in November, while imports slid at an annual rate of 8.7%, the thirteenth consecutive decline.

West Texas Intermediate futures for January delivery is currently at $37.70 (+0.13%), while Brent crude is at $40.94 (+0.52%). Prices climbed slightly after heavy losses in the previous session, but remained under pressure amid persistent global supply glut. Concerns over excessive supplies rose after OPEC failed to come up with a plan to support prices at the cartel's meeting on December 4. OPEC was expected to stick to its current strategy and maintain output; however both types of crude still fell as investors prepared for a longer period of low prices.

Investors are waiting for the upcoming Federal Reserve meeting scheduled for December 15-16. Strong jobs data released on Friday intensified expectations for a rate hike in the U.S. Higher rates would boost the dollar and make the dollar-denominated commodity more expensive for customers using other currencies. This could suggest softer prices.

Gold is currently at $1,072.00 (-0.30%). Bullion gave up Friday's gains as investors prepared for the looming Federal Open Market Committee meeting on December 15-16. The central bank of the U.S. is widely expected to raise rates at this meeting. Higher rates increase the opportunity cost of holding the non-interest paying precious metal and reduce demand for it.

The People's Bank of China added 20.8 tonnes of gold to its reserves in November. However these purchases failed to support prices.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.