- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: raw news — 10-12-2015.

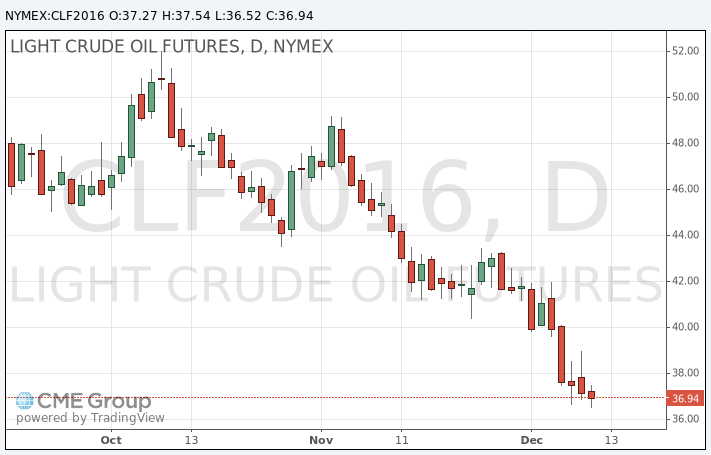

Oil prices plunged as the Organization of the Petroleum Exporting Countries (OPEC) reported the highest oil output in November since 2009. OPEC released its monthly report on Thursday. OPEC's oil output in November rose by 230,100 barrels per day (bpd) to 31.695 million bpd from October, mainly due to higher oil output from Iraq.

OPEC lowered its 2016 output forecasts for non-OPEC members by 250,000 bpd to average 57.14 million bpd. The downward revision was driven by a drop in U.S. shale-oil production.

Global oil demand growth is expected to be 1.25 million bpd in 2016, unchanged from its previous estimates and down from a 1.53 million bpd rise this year.

Oil prices yesterday rose on the U.S. crude oil inventories data. The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories dropped by 3.57 million barrels to 485.9 million in the week to December 04. It was the first decline since September. Analysts had expected U.S. crude oil inventories to remain unchanged.

WTI crude oil for January delivery slid to $36.52 a barrel on the New York Mercantile Exchange.

Brent crude oil for January dropped to $39.87 a barrel on ICE Futures Europe.

Gold traded mixed as market participants are awaiting the Fed's monetary policy meeting next week. Market participants speculate that the Fed will start raising its interest rate this month.

Gold is traded in U.S. dollars. It suffers when the U.S. dollar strengthens, becoming more expensive for holders of other currencies.

Physical demand for gold fell in India, but remained strong in China ahead of the Chinese New Year.

February futures for gold on the COMEX today traded at 1072.20 dollars per ounce.

The Organization of the Petroleum Exporting Countries (OPEC) released its monthly report on Thursday. OPEC's oil output in November rose by 230,100 barrels per day (bpd) to 31.695 million bpd from October, mainly due to higher oil output from Iraq. It was the highest output since 2009.

OPEC lowered its 2016 output forecasts for non-OPEC members by 250,000 bpd to average 57.14 million bpd. The downward revision was driven by a drop in U.S. shale-oil production.

Global oil demand growth is expected to be 1.25 million bpd in 2016, unchanged from its previous estimates and down from a 1.53 million bpd rise this year.

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending December 05 in the U.S. rose by 13,000 to 282,000 from 269,000 in the previous week. Analysts had expected jobless claims to remain unchanged at 269,000.

Jobless claims remained below 300,000 the 40th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims increased by 82,000 to 2,243,000 in the week ended November 28.

West Texas Intermediate futures for January delivery climbed to $37.45 (+0.78%), while Brent crude rose to $40.55 (+1.10%) on expectations of slightly better demand after the Energy Information Administration reported that U.S. crude inventories fell 3.6 million barrels in the week ending December 4.

Nevertheless market participants expect the current supply glut to continue in 2016 keeping prices under pressure and limiting gains. Investors are also waiting for the Federal Reserve's meeting scheduled for the next week. The central bank of the U.S. is likely to raise its interest rates for the first time in nearly a decade. This would boost the greenback making the dollar-denominated crude more expensive for customers using other currencies.

Gold is currently at $1,071.80 (-0.44%) trading in a narrow range ahead of next week's Federal Open Markets Committee meeting. The central bank of the U.S. is widely expected to raise interest rates in December. Higher rates increase the opportunity cost of holding the non-interest paying precious metal and reduce demand for it.

Generally weak commodity prices, particularly crude oil, weigh on gold as well. Weakness in oil could raise deflation fears, while gold is normally used to protect funds against inflation.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.