- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: raw news — 16-07-2012.

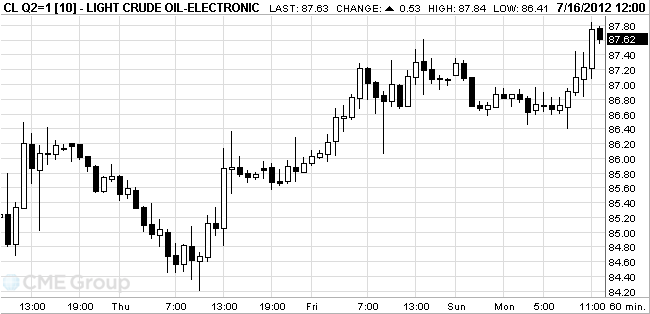

Oil rose for a fourth day as manufacturing in the New York region expanded in July at a faster pace than anticipated.

Futures advanced as much as 0.8 percent as the Federal Reserve Bank of New York’s general economic index, the Empire State Index, rose to 7.4 following a 2.3 increase in June. Oil also moved higher as U.S. stocks reduced losses and the dollar fell against the euro.

Oil for August delivery traded at range of $86,41 - $87,84 on the New York Mercantile Exchange. The contract rose 1.2 percent to $87.10 on July 13, the highest close since July 5. Prices have fallen 11 percent this year.

Brent crude for August settlement gained $1, or 1 percent, to $103.40 a barrel on the London-based ICE Futures Europe exchange. The contract expires today. The more-active September contract rose $1.25, or 1.2 percent, to $102.67.

Resistance of 3:1618 (resistance line from Jun 6)

Resistance of 2:1610 (area of Jul 6 high)

Resistance of 1:1600 (area of Jul 10 high)

Current Price: 1594.10

Support 1:1579 (session low)

Support 2:1560 (support line from May 16)

Support 3: 1548 (low of June)

Gold prices have played suffered losses early in the session after the released worse than expected data on retail sales have weakened the dollar.

For example, in U.S. retail sales in June fell by 0.5%, expected 0.2%.

Earlier, gold became cheaper amid fears of debt crisis and the growth of the eurozone government bond yields peripherals.

European Central Bank President Mario Draghi was made for the losses accruing to the bondholders most affected Spanish savings banks, the newspaper reported Wall Street Journal. However, the finance ministers of the eurozone declined his offer, fearing a negative reaction of financial markets, the article says. The ECB declined to comment on the report.

August gold futures on the COMEX today rose to 1593.8 dollars per ounce after falling to the level of 1577.2 dollars per ounce.

Resistance 3:91,70 (50,0% FIBO 106,10-77,20, Jun 29 high)

Resistance 2:88,70 (Jul 5 high)

Resistance 1:87,40 (Jul 13 high)

Current Price: 86.92

Support 1:85,70 (MA (200) for H1)

Support 2:83,40 (Jul 10 low)

Support 3:81,80 (Jul 2 low)

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.