- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: raw news — 20-08-2013.

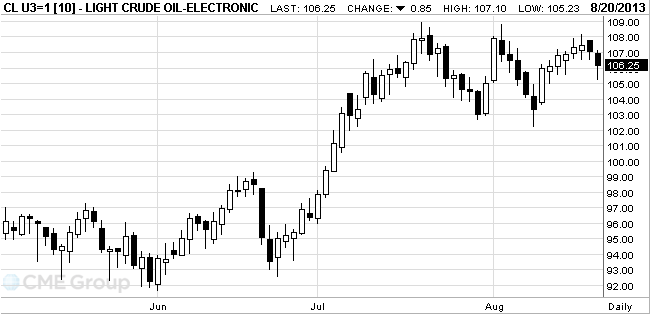

West Texas

Intermediate crude fell for a second day amid speculation that the Federal

Reserve will reduce stimulus measures next month, curbing investors’ appetite

for commodities.

Futures

slid as much as 1.8 percent. Minutes from the Fed’s July meeting, scheduled to

be published tomorrow, will probably provide details about deliberations on

when to taper $85 billion in monthly bond buying. Government data tomorrow may

show that

Es Sider,

the largest Libyan oil terminal with a capacity of 350,000 barrels of day, has

been shut since July 28 because of the petroleum guard protest. State-run

National Oil Corp. halted exports of crude and refined products from the Es

Sider, Ras Lanuf, Zueitina and Brega terminals, according to a document

obtained by Bloomberg.

The country

produced 800,000 barrels a day last month, half the rate pumped a year earlier,

according to a Bloomberg survey of output from the 12-member Organization of

Petroleum Exporting Countries. Libya holds Africa’s largest oil reserves.

WTI for

September delivery dropped 88 cents, or 0.8 percent, to $106.22 a barrel at

11:05 a.m. on the New York Mercantile Exchange. It slipped 0.3 percent

yesterday, snapping a six-day rally that was the longest since April 25.

The

September contract expires at the close of floor trading today. The more-active

October contract decreased 70 cents to $106.16. Trading volume was about 7.1

percent below the 100-day average, according to data compiled by Bloomberg.

Brent for

October settlement slid 26 cents to $109.64 on the London-based ICE Futures

Europe exchange. Volume was 16 percent below 100-day average. Brent’s premium

over WTI widened for the first time in three days to $3.48.

The value of gold is increasing on weaker dollar ahead of the publication of minutes of the last meeting of the Federal Open Market Federal Reserve. Investors expect that the protocols will clarify the situation with a program of bond purchases.

In addition, the pressure on the U.S. dollar index was weaker than the national activity Chicago Fed, which destroys the hopes of positive GDP data for the 2nd quarter, which will be published next week. National Activity Index Chicago Fed in July rose to -0.15 from -0.23 in June, while the less volatile moving average index for the three months increased to -0.15 from -0.24. July was the fifth month in a row that the index itself and its moving average are in negative territory, indicating growth below trend.

The cost of the October gold futures on COMEX today rose to $ 1377.20 per ounce.

Change % Change Last

GOLD 1,367.50 -4.20 -0.31%

OIL (WTI) 107.00 -0.46 -0.43%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.