- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: raw news — 22-08-2013.

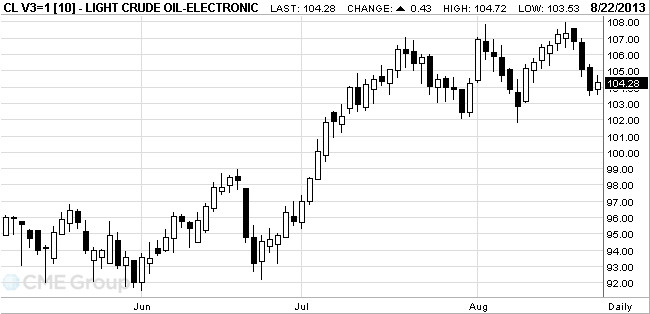

West Texas

Intermediate crude rose from a two-week low as the fewest U.S. workers in more

than five years applied for unemployment benefits over the past month,

bolstering optimism that fuel demand will accelerate.

Prices

gained as claims in the month ended Aug. 17 declined to

WTI for

October delivery rose 52 cents, or 0.5 percent, to $104.37 a barrel at 10:34

a.m. on the New York Mercantile Exchange. The volume of all futures traded was

22 percent below the 100-day average. The contract fell to $103.85 yesterday,

the lowest close since Aug. 8.

Brent for

October settlement increased 19 cents to $110 a barrel on the London-based ICE

Futures Europe exchange. Volume was 28 percent below 100-day average. The

European benchmark was at a premium of $5.63 to WTI. The spread was

$5.96 yesterday, the widest since June 26.

Gold prices rose after the publication of the minutes of the last meeting of the Open Market of the Federal Reserve System. The report did not give investors a clear picture of future monetary policy of the U.S. central bank.

Gold prices rose in recent weeks, however, this growth has stopped a few days before the publication of minutes of the Fed meeting, while some traders took a cautious stance.

One source of concern was the question of whether members of the Federal Reserve began to think more and more in the direction of minimizing the incentive program.

However, reports have indicated that the views of the leaders of the central bank on terms to minimize the program of bond purchases were divided, with some of them voted for a reduction in the program in a short time, while others called for greater caution. Fed officials also called exit in recent economic data "mixed", leaving traders in the dark as to the timing of the first reduction in monthly bond purchases by the central bank.

Gold fell by nearly 20 percent since the beginning of the year, but up 15 percent from a three-year low of $ 1.180,71 an ounce in late June.

The cost of the October gold futures on COMEX today rose to $ 1381.20 per ounce.

Change % Change Last

GOLD 1,370.60 -2.50 -0.18%

OIL (WTI) 103.91 -1.20 -1.14%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.