- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: raw news — 24-11-2015.

(raw materials / closing price /% change)

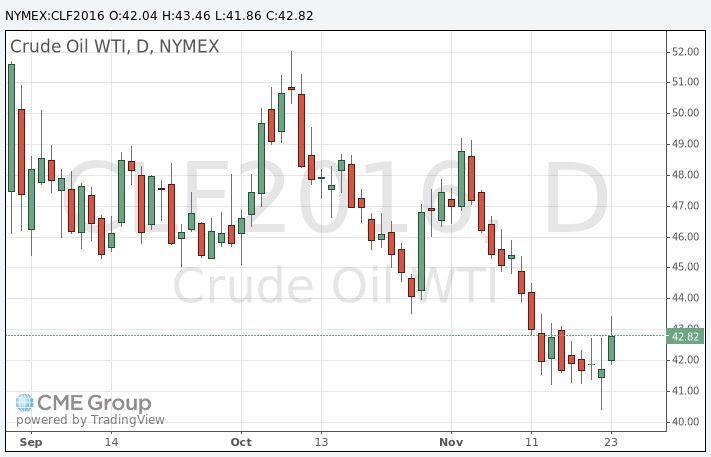

Oil 42.65 -0.51%

Gold 1,074.90 +0.10%

Oil prices rose on concerns over the situation in the Middle East. Turkey reported today that it shot down the Russian jet near the Syria's border. The jet should have violated Turkish airspace.

Russia's defence ministry said the jet did not violate Turkish airspace. Russian President Vladimir Putin said that Turkey's action was a "stab in the back by the terrorists' accomplices" and that this action would have serious consequences.

Market participants are awaiting the release of U.S. crude oil inventories data. The American Petroleum Institute (API) is scheduled to release its U.S. oil inventories data later in the day, and U.S. oil inventories data from the U.S. Energy Information Administration is expected on Wednesday.

WTI crude oil for January delivery climbed to $43.46 a barrel on the New York Mercantile Exchange.

Brent crude oil for January rose to $46.12 a barrel on ICE Futures Europe.

Gold price climbed due to increasing demand for safe-haven assets, driven by concerns over the situation in the Middle East. Turkey reported that it shot down the Russian jet near the Syria's border. The jet should have violated Turkish airspace.

Market participants eyed the U.S. economic data. The U.S. Commerce Department released gross domestic product (GDP) figures on Tuesday. The U.S. revised GDP climbed 2.1% in the third quarter, exceeding expectations for a 2.0% increase, up from the preliminary estimate of a 1.5% rise.

The upward revision was partly driven by an upward revision to business spending on equipment and investment in home building.

The Conference Board released its consumer confidence index for the U.S. on Tuesday. The index dropped to 90.4 in November from 99.1 in October, missing expectations for a rise to 99.5. October's figure was revised up from 97.6.

The decline was mainly driven by a less favourable assessment of the job market.

December futures for gold on the COMEX today rose to 1080.70 dollars per ounce.

The U.S. Commerce Department released gross domestic product (GDP) figures on Tuesday. The U.S. revised GDP climbed 2.1% in the third quarter, exceeding expectations for a 2.0% increase, up from the preliminary estimate of a 1.5% rise.

The upward revision was partly driven by an upward revision to business spending on equipment and investment in home building.

Consumer spending was revised down.

Consumer spending rose by 3.0% in the third quarter, down from the previous estimate of a 3.2% increase.

Exports climbed 0.9% in the third quarter, while imports were up 2.1%.

The PCE price index excluding food and energy costs increased 1.3% in the third quarter, in line with expectations, after a 1.9% rise in the second quarter.

The PCE price index is the Fed's preferred gauge for inflation.

These figures could mean that the Fed may start raising its interest rate next month.

West Texas Intermediate futures for January delivery climbed to $42.04 (+0.69%), while Brent crude climbed to $45.05 (+0.49%) after Saudi Arabia said on Monday it was ready to cooperate with OPEC and non-OPEC producers to stabilize prices. The news came days before the organization is set to hold a meeting in Vienna on December 4. However gains were limited by a stronger greenback, which makes the dollar-denominated commodity more expensive for buyers using other currencies. Some analysts also doubt that there will be a significant change in OPEC's policy.

Meanwhile investors are preparing to see a modest increase in U.S. crude stockpiles when the U.S. Energy Information Administration releases its report on Wednesday.

Gold climbed to $1,070.50 (+0.35%), but stayed near a six-year low amid expectations for an imminent interest rate hike by the Federal Reserve. Several Federal Reserve's officials signaled recently that they see sufficient improvements in the economy and they are ready for a liftoff soon.

Higher rates would harm demand for the non-interest-bearing precious metal.

Physical demand in top consumers China and India supports prices, however it cannot withstand falling investor demand. SPDR Gold Trust, the world's biggest gold-backed exchange-traded fund, said its holdings fell to 655.69 tonnes on Monday, the lowest since September 2008.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.