- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: raw news — 25-11-2015.

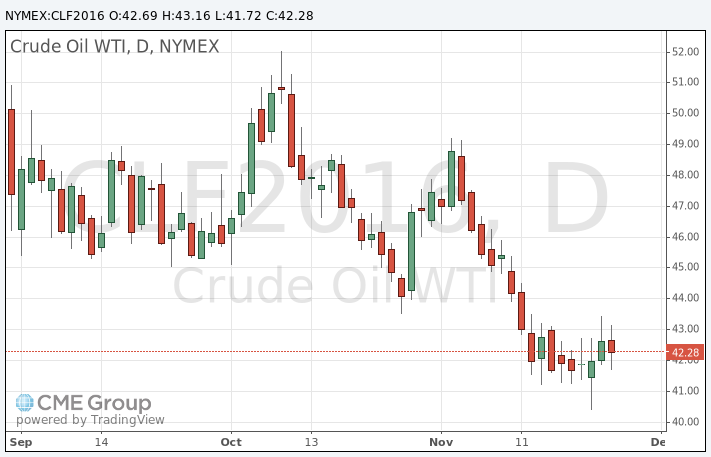

Oil prices declined on the U.S. crude oil inventories data. The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories increased by 0.96 million barrels to 488.2 million in the week to November 20. It was the ninth consecutive increase.

Analysts had expected U.S. crude oil inventories to rise by 1.0 million barrels.

The U.S. oil production declined by 17,000 barrels per day to 9.165 million barrels per day.

Gasoline inventories increased by 2.5 million barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, climbed by 1.744 million barrels.

U.S. crude oil imports increased by 424,000 barrels per day.

Refineries in the U.S. were running at 92.0% of capacity, up from 90.3% the previous week.

WTI crude oil for January delivery declined to $41.72 a barrel on the New York Mercantile Exchange.

Brent crude oil for January fell to $45.38 a barrel on ICE Futures Europe.

Gold price declined on a stronger U.S. dollar. The greenback rose on a positive U.S. economic data. The U.S. Labor Department released its jobless claims figures on Wednesday. The number of initial jobless claims in the week ending November 21 in the U.S. fell by 12,000 to 260,000 from 272,000 in the previous week, exceeding expectations for a decline to 270,000. Jobless claims remained below 300,000 the 38th straight week. This threshold is associated with the strengthening of the labour market.

The U.S. Commerce Department released durable goods orders data on Wednesday. The U.S. durable goods orders climbed 3.0% in October, exceeding expectations for a 1.5% rise, after a 0.8% drop in September. September's figure was revised up from a 1.2% fall.

Personal spending rose 0.1% in October, missing expectations for a 0.3% gain, after a 0.1% increase in September.

This data added to speculation that the Fed will start raising its interest rate next month.

December futures for gold on the COMEX today fell to 1067.10 dollars per ounce.

The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories increased by 0.96 million barrels to 488.2 million in the week to November 20. It was the ninth consecutive increase.

Analysts had expected U.S. crude oil inventories to rise by 1.0 million barrels.

The U.S. oil production declined by 17,000 barrels per day to 9.165 million barrels per day.

Gasoline inventories increased by 2.5 million barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, climbed by 1.744 million barrels.

U.S. crude oil imports increased by 424,000 barrels per day.

Refineries in the U.S. were running at 92.0% of capacity, up from 90.3% the previous week.

The U.S. Labor Department released its jobless claims figures on Wednesday. The number of initial jobless claims in the week ending November 21 in the U.S. fell by 12,000 to 260,000 from 272,000 in the previous week, exceeding expectations for a decline to 270,000. The previous week's figure was revised up from 271,000.

Jobless claims remained below 300,000 the 38th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims increased by 34,000 to 2,207,000 in the week ended November 14.

West Texas Intermediate futures for January delivery climbed to $43.07 (+0.47%), while Brent crude advanced to $46.48 (+0.78%) after Turkey shot down a Russian warplane on the border of Syria. Turkey claims the plane strayed in its airspace and that it received several warnings, while Russia insists its plane was inside Syrian territory.

Russian President Vladimir Putin warned of consequences to this "stab in the back". Turkey imports more than 90% of its oil and gas (the latter comes mostly from Russia). However around two million barrels of Russian crude out of over seven million barrels produced daily pass through the Bosphorus and Dardanelles, which are controlled by Turkey.

Investors are also waiting for new data on U.S. crude oil inventories due later today and preparing for OPEC meeting on December 4.

Gold climbed to $1,079.00 (+0.48%) amid escalating geopolitical tensions after Turkey downed a Russian warplane on a Syrian border. However bullion's gains are limited by expectations for an imminent interest rate hike in the U.S. Higher rates would harm demand for the non-interest-bearing precious metal.

The North Atlantic Treaty Organization and the U.S. supported Turkey's position saying that it had a right to defend its sovereignty.

This tension boosted gold's safe-haven appeal, however it may be short-lived. "While we think gold may be supported, we are not anticipating a robust rally, and look for only moderate gains, with a lot of upside resistance," HSBC analyst James Steel said.

Liquidity is likely to be thin ahead of Thanksgiving Day on Thursday.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.