- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: raw news — 27-06-2016.

(raw materials / closing price /% change)

Oil 46.61 +0.60%

Gold 1,327.60 +0.22%

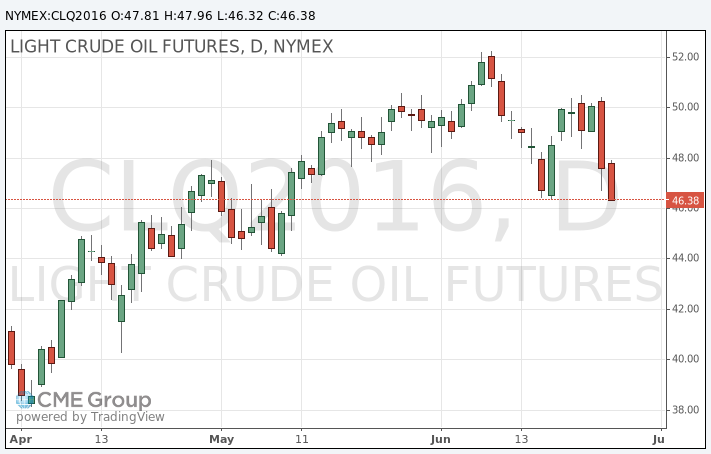

Oil prices fell as markets continue to show a decline in the unexpected results of the referendum in the UK, which led investors turn to safer assets.

On Friday, the contracts fell at the fastest pace since February - about 5%.

But on Monday, prices have stabilized, as market analysts argue that Brexit would have little impact on the levels of supply and demand on the world market.

Oil demand from the UK is less than 2% of the global demand.

On Friday, Baker Hughes said that the number of drilling rigs in the US fell for the first time in four weeks.

Increasing the number of drilling rigs in recent weeks intensified fears that the price of oil at $ 50 a barrel could push US producers to increase production volume and increase the already excessive supply of oil on the world market.

However, some analysts have warned that the global market is still oversupplied and prices could fall in the coming months.

The cost of the August futures for US light crude oil WTI fell to 46.32 dollars per barrel.

The price of August futures for Brent fell to 47.05 dollars a barrel on the London Stock Exchange ICE Futures Europe.

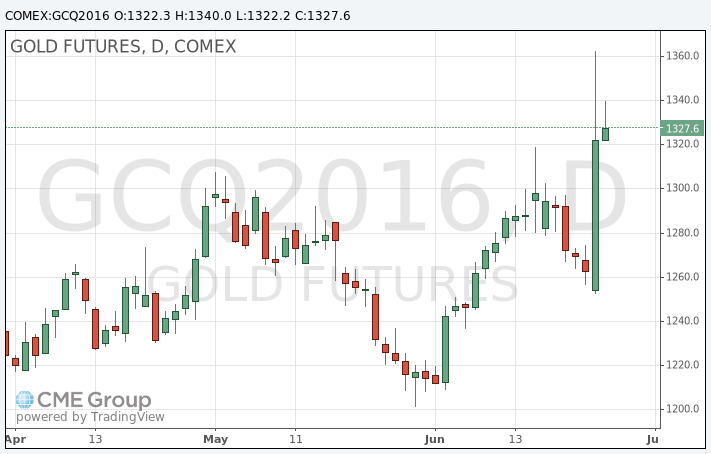

Gold rose more than 1% in today's trading, remaining near the highs of the last two years, recorded on Friday as uncertainty due to Britain's decision to withdraw from the European Union has forced investors to sell shares and invest in safe assets.

On Friday, the increase in the price of gold reached 8%, touching $ 1358.20 - the highest since March 2014.

"The uncertainty around the timing of talks on the withdrawal from the EU not only means that investors become more cautious and buy gold and dollars, but also continues to put pressure on the pound sterling and converted into an irreversible loss of economic activity at the domestic level," - Martin Arnold of ETF Securities said.

Goldman Sachs raised its forecast for gold prices, citing the fact that Brexit could have a more lasting impact on the trajectory of rising interest rates in the United States.

"The price of gold will rise in the third quarter, when they start to feel the full impact of Brexit, but expect it to fall in the fourth quarter after the elections in the United States and against the background of preparations for the next Fed raise rates", - said the financial company Macquarie.

The cost of the August gold futures on the COMEX rose to $ 1340.0 per ounce.

This morning, New York crude oil futures WTI rose by 0.46% to $ 47.85 per barrel and crude oil futures for Brent rose 0.69% to $ 49.37 per barrel. Thus, the black gold is recording some gains, after the recent collapse associated with market volatility after Brexit. It became known that the number of employees in the US oil rigs has decreased over the previous week for 7 to 330 and this could support the prices.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.