- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: raw news — 28-06-2016.

(raw materials / closing price /% change)

Oil 48.11 +0.54%

Gold 1,314.50 -0.26%

Oil prices rose today, rising for the first time in three sessions as investors took advantage of a drop in prices on the results of the referendum in the UK.

The British pound, the global stock market and most of the commodity markets rose as investor sentiment improved after the shocking results of Brexit.

Oil prices lost more than 7% in the last two sessions, as global stock markets lost $ 3 trillion in two days of trading.

Oil received additional support amid concerns about supply disruptions from Norway, where about 7,500 workers at seven oil and gas fields may go on strike from Saturday if will not agree on wages.

These fields account for nearly 18% of the total oil production in Norway, which has a negative impact on production in the North Sea's largest oil producer.

A day earlier, futures for Brent crude fell to seven-week low of $ 47.30, as investors dumped risky assets on the results of voting in the UK, where the majority of citizens were in favor of withdrawal from the European Union.

The news intensified fears that Europe will return to recession, putting increased pressure on the global economy and undermining prospects for future oil demand.

Bidders have focused on fresh weekly data on oil and petroleum products to gauge the strength of demand from the world's largest consumer.

The American Petroleum Institute is scheduled to release its report on stocks today, while on Wednesday, a government report may show a drop in crude oil reserves by 2.4 million barrels for the week ended June 24.

The cost of the August futures for US light crude oil WTI rose to 47.81 dollars per barrel.

The price of August futures for Brent crude rose to 48.58 dollars a barrel on the London Stock Exchange ICE Futures Europe.

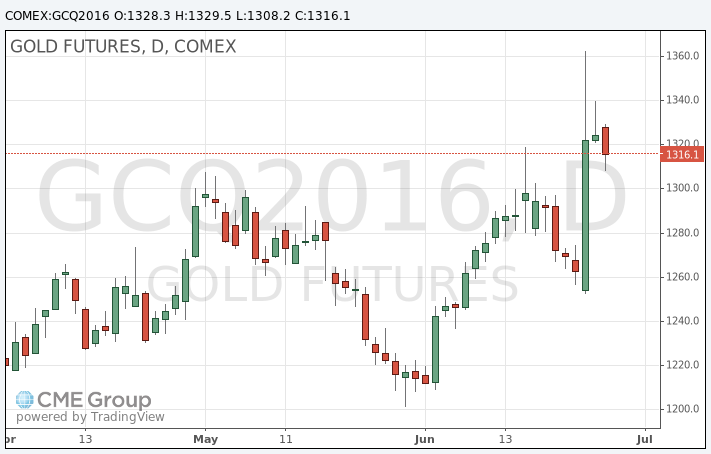

Gold prices declined in today's trading, falling for the first time in three sessions as investors took profits after futures jumped to their highest level since March 2014, after Brexit.

Last Friday, gold prices rose to 27-month high of $ 1,362.60 on the unexpected decision of the UK to leave the European Union, so that investors have turned to gold and other safe assets.

News raised fears that other countries may also withdraw from the block, and global growth will be under considerable pressure, while the actual British EU exit timing remain unclear.

On Monday, the rating Standard & Poor's downgraded the sovereign credit rating of the UK from "AAA" to "AA", refering to the outcome of the referendum.

At the moment, the precious metal rose in price by almost 25% for the year, helped by concerns about global growth and the introduction of negative interest rates by central banks worldwide.

The cost of the August gold futures on COMEX fell to $ 1308.2 per ounce.

Lukoil does not expect a major impact due to Brexit consequences on the company's operations, although predicts strengthening of volatility in the markets, Alexander Matytsyn told reporters.

"The consequences of Brexit will not have a material impact on the financial-economic activity of" Lukoil ". In the current situation, we can predict increase in volatility in the currency and commodity markets, but conservative financial and budgetary policy of the company allows to us feel confident in terms of price volatility" - he said.

This morning, New York crude oil futures WTI rose by 1.86% to $ 47.18 per barrel and crude oil futures for Brent rose 1.61% to $ 48.52 per barrel. Thus, the black gold appreciates, on the background of a strike in Norway, which may lead to a reduction in production of the largest oil producer in Western Europe. At the same time Britain's decision to withdraw from the European Union is still putting pressure on the markets. Production of oil increased in Nigeria about 1.9 million barrels per day from 1.6 million, after the repair of pipelines.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.