- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 01-07-2016.

Major U.S. stock-indexes rose for the fourth straight day as increased prospects of central bank stimulus around the world bolstered investor confidence. Investors were also taking stock of their holdings after a tumultuous week in the wake of Britain's vote to leave the European Union. The vote sparked a two-day panic selloff, but markets clawed back their losses in the last three days.

Most of all Dow stocks in positive area (20 of 30). Top looser - JPMorgan Chase & Co. (JPM, -1,13%). Top gainer - The Home Depot, Inc. (HD, +1,85%).

Most of all S&P sectors also in positive area. Top looser - Utilities (-0,3%). Top gainer - Services (+1,0%).

At the moment:

Dow 17857.00 +38.00 +0.21%

S&P 500 2095.50 +5.25 +0.25%

Nasdaq 100 4433.75 +26.75 +0.61%

Oil 48.33 0.00 0.00%

Gold 1339.50 +18.90 +1.43%

U.S. 10yr 1.46 -0.03

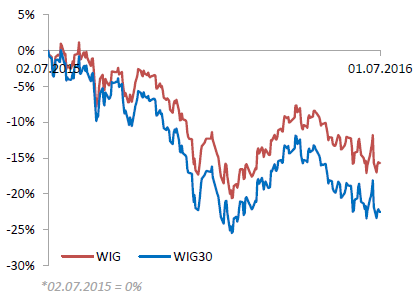

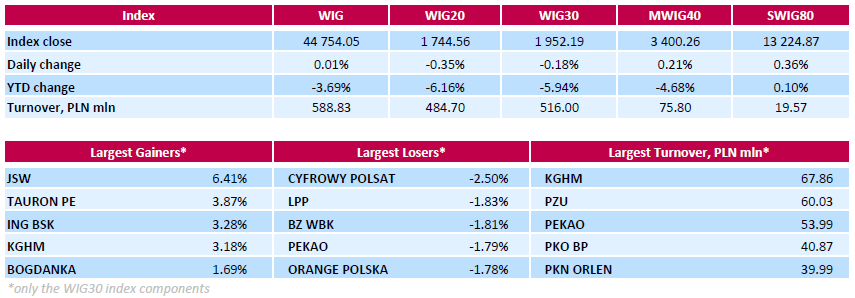

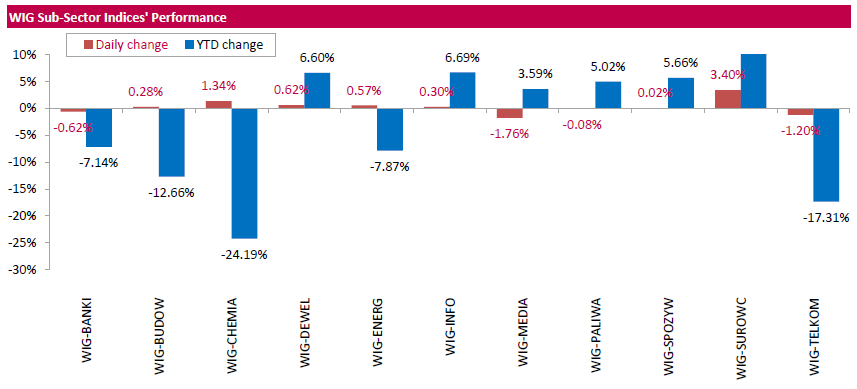

Polish equity market closed flat on Friday. The broad market measure, the WIG Index, inched up 0.01%. Sector performance within the WIG Index was mixed. Media (-1.76%) and telecoms (-1.20%) recorded the most notable declines, while materials (+3.40%) and chemicals (+1.34%) fared the best.

The large-cap stocks' measure, the WIG30 Index fell by 0.18%. Within the Index components, media group CYFROWY POLSAT (WSE: CPS), clothing retailer LPP (WSE: LPP), telecommunication services provider ORANGE POLSKA (WSE: OPL) and two banking sector names BZ WBK (WSE: BZW) and PEKAO (WSE: PEO) were the weakest performers, returning losses between 1.83% and 2.5%. On the other side of the ledger, coking coal miner JSW (WSE: JSW) led the advancers pack with a 6.41% growth, bouncing back after yesterday's sharp decline. It was followed by genco TAURON PE (WSE: TPE), bank ING BSK (WSE: ING) and copper producer KGHM (WSE: KGH), gaining 3.87%, 3.28% and 3.18% respectively.

The US market started at neutral level, then began to gain and slightly exceeded the level of 2100 points on the S&P500 index, which is already at the levels of the last Friday opening. The movement from lows was very strong and it seems that today's session can only seal it before the long weekend in the US due to Monday's Independence Day.

Major European indices show good posture and both the DAX-a and the CAC40 are approx. + 0.8%. We also may see very well behavior in the British market, which set new highs this year, and maintains them. At the Warsaw market there is still no major changes, the WIG20 index is currently at the level of 1,744 points (-0.36%).

U.S. stock-index futures were little changed.

Global Stocks:

Nikkei 15,682.48 +106.56 +0.68%

Hang Seng Closed

Shanghai Composite 2,932.82 +3.22 +0.11%

FTSE 6,558.17 +53.84 +0.83%

CAC 4,275.23 +37.75 +0.89%

DAX 9,767.78 +87.69 +0.91%

Crude $48.19 (-0.29%)

Gold $1336.90 (+1.23%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 9.26 | -0.01(-0.1079%) | 54839 |

| ALTRIA GROUP INC. | MO | 68.96 | -0.00(-0.00%) | 20584 |

| Amazon.com Inc., NASDAQ | AMZN | 716.61 | 0.99(0.1383%) | 20590 |

| American Express Co | AXP | 61.18 | 0.42(0.6912%) | 848 |

| AMERICAN INTERNATIONAL GROUP | AIG | 52.73 | -0.16(-0.3025%) | 501 |

| Apple Inc. | AAPL | 95.56 | -0.04(-0.0418%) | 53214 |

| AT&T Inc | T | 43.35 | 0.14(0.324%) | 6675 |

| Barrick Gold Corporation, NYSE | ABX | 21.85 | 0.50(2.3419%) | 91962 |

| Boeing Co | BA | 129.31 | -0.56(-0.4312%) | 780 |

| Chevron Corp | CVX | 104.82 | -0.01(-0.0095%) | 687 |

| Cisco Systems Inc | CSCO | 28.77 | 0.08(0.2788%) | 113087 |

| Citigroup Inc., NYSE | C | 42.29 | -0.10(-0.2359%) | 97861 |

| Deere & Company, NYSE | DE | 80.8 | -0.24(-0.2961%) | 25266 |

| Exxon Mobil Corp | XOM | 93.26 | -0.48(-0.5121%) | 1139 |

| Facebook, Inc. | FB | 114.27 | -0.01(-0.0088%) | 114908 |

| FedEx Corporation, NYSE | FDX | 154 | 2.22(1.4626%) | 7568 |

| Ford Motor Co. | F | 12.64 | 0.07(0.5569%) | 63611 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11 | -0.14(-1.2567%) | 114660 |

| General Electric Co | GE | 31.31 | -0.17(-0.54%) | 58687 |

| General Motors Company, NYSE | GM | 28.6 | 0.30(1.0601%) | 16432 |

| Goldman Sachs | GS | 148.04 | -0.54(-0.3634%) | 760 |

| Google Inc. | GOOG | 692.1 | -0.00(-0.00%) | 1138 |

| Intel Corp | INTC | 32.71 | -0.09(-0.2744%) | 107318 |

| JPMorgan Chase and Co | JPM | 61.44 | -0.22(-0.3568%) | 11398 |

| McDonald's Corp | MCD | 120 | -0.34(-0.2825%) | 2040 |

| Merck & Co Inc | MRK | 57.53 | -0.08(-0.1389%) | 582 |

| Microsoft Corp | MSFT | 51.21 | 0.04(0.0782%) | 152353 |

| Nike | NKE | 55.3 | 0.10(0.1812%) | 4782 |

| Pfizer Inc | PFE | 35.21 | -0.00(-0.00%) | 1115 |

| Procter & Gamble Co | PG | 84.64 | -0.03(-0.0354%) | 28705 |

| Starbucks Corporation, NASDAQ | SBUX | 56.7 | -0.42(-0.7353%) | 6283 |

| Tesla Motors, Inc., NASDAQ | TSLA | 208.11 | -4.17(-1.9644%) | 59588 |

| The Coca-Cola Co | KO | 45.37 | 0.04(0.0882%) | 12076 |

| Twitter, Inc., NYSE | TWTR | 16.9 | -0.01(-0.0591%) | 19853 |

| UnitedHealth Group Inc | UNH | 142.14 | 0.94(0.6657%) | 509 |

| Verizon Communications Inc | VZ | 55.71 | -0.13(-0.2328%) | 17734 |

| Visa | V | 74.5 | 0.33(0.4449%) | 44574 |

| Wal-Mart Stores Inc | WMT | 72.41 | -0.61(-0.8354%) | 38335 |

| Walt Disney Co | DIS | 97.82 | -0.00(-0.00%) | 14511 |

| Yahoo! Inc., NASDAQ | YHOO | 37.75 | 0.19(0.5059%) | 3175 |

| Yandex N.V., NASDAQ | YNDX | 21.82 | -0.03(-0.1373%) | 2700 |

After an unsuccessful morning try of clearance over the week high, in the last minutes of the session slightly higher initiative show bears. As a result, the WIG20 index went below 1,740 pts. The behavior of our market presents a detachment from the environment where demand is trying to keep the indexes in the vicinity of neutral. European indexes, the Dax and the CAC40 are listed on delicate pros. In this context, the decline in WIG20 by 0.5%, once again has reflected the weakness of the local market and at the same time resistance to the increases.

The half of the session is behind us, and the turnover on the WIG20 index is only PLN 172 mln. It is clearly seen, that the demand side is absent. Unfortunately, scrubbing in the mid-session on its minima forecasts rather more trouble in the second part of the day.

WIG20 index opened at 1756.47 points (+0.33%)*

WIG 44973.52 0.50%

WIG30 1964.32 0.44%

mWIG40 3396.07 0.09%

*/ - change to previous close

The WIG20 futures started trading with a slight indication on a plus, which distinguishes us from other European parquets, where the morning shows indication of contracts rather with cosmetic changes down.

The WIG20 index started from increase by 0.33% to 1,756 points. As might be expected spot market is opening with advantage of increases and the WIG20 is close the peaks of this week. Their eventual break-up would open the way for the closing "after-brexit" gap from last Friday. Unfortunately, a little bothered is the weaker-than-expected reading of the PMI index for Polish industry, which cosmetically falling from 52.1 points. to 51.8 pts., what is slightly disappointing.

Today's session begins the next month and the next half-year on the markets. The current week has brought the global improvement in sentiment and yesterday's session on Wall Street was another successful one, which resulted in the increase of the US indexes of more than 1%. The impact on this has probably the situation on the currency market, the weakening of the pound after the speech of Mark Carney, the head of the Bank of England, signaled the need for loosening monetary policy this summer. The Euro also weakened after the news of Bloomberg about the possibility of easing bond purchases conducted by the ECB. As a result of growth in the US market losses from Friday have been almost entirely made up and in the morning it should support the Warsaw Stock Exchange, which had no opportunity to react to it. The index in Shanghai maintains a relatively neutral stance, while other Asian parquets are on the gain. This day will show whether the Warsaw market will react positively to the global improvement or remain resistant, which we experienced in recent days.

European stocks closed higher Thursday following a choppy session where Deutsche Bank AG and Banco Santander SA shares fell under pressure fell further back into the rearview mirror

European stocks on Wednesday surged 3.1%, marking a second straight day of sharp gains after a two-session rout in the wake of the U.K.'s vote to leave the European Union. Stocks had appeared to have found, at least, a short-term foundation for gains as the U.K. government had yet to formally start the negotiation process for the U.K.'s exit from the 28-member bloc, or Brexit.

Further easing measures may be in the works to deal with heightened uncertainty created by the vote, Bank of England Gov. Mark Carney said in a speech, but he stressed there are limits as to what the central bank can do.

U.S. stocks rose for a third session on Thursday on mounting expectations for more accommodative policies from global central banks following the U.K.'s vote to leave the European Union last week.

The gains were the best three-day climb for the main stock-market gauges since Feb. 17, according to Dow Jones data. All three indexes are near the levels they were trading at ahead of last week's U.K. referendum as initial jitters over Brexit subsided.

July 1 Japan's Nikkei share average rose on Friday for a fifth day as bargain hunting continued and risk appetites remained solid after U.S. and European shares gained.

Japanese stocks have erased about the half of their losses in the wake of Britain's shock vote a week ago to leave the European Union.

For the week, the Nikkei has jumped 4.9 percent, the biggest weekly gain since mid-April.

Shares of securities firm gained ground, with Nomura Holdings rising 2.8 percent and Daiwa Securities advancing 1.2 percent.

Exporters were steady, with Toyota Motor Corp gaining 1.4 percent and Nissan Motor Co adding 1.1 percent.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.