- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 29-06-2016.

(index / closing price / change items /% change)

Nikkei 225 15,566.83 +243.69 +1.59 %

Hang Seng 20,436.12 +263.66 +1.31 %

S&P/ASX 200 5,142.4 +39.12 +0.77 %

Shanghai Composite 2,932.52 +19.96 +0.69 %

FTSE 100 6,360.06 +219.67 +3.58 %

CAC 40 4,195.32 +106.47 +2.60 %

Xetra DAX 9,612.27 +164.99 +1.75 %

S&P 500 2,070.77 +34.68 +1.70 %

NASDAQ Composite 4,779.25 +87.38 +1.86 %

Dow Jones 17,694.68 +284.96 +1.64 %

U.S. stocks advanced amid a global rally, with the S&P 500 Index posting its strongest two-day climb in four months, as tension eased over the impact of a U.K. exit from the European Union.

Fears that Britain's EU withdrawal will further stymie global growth continued to ebb, soothed by speculation policy makers will counter the effects. Energy shares capped their best two days since March as crude jumped. A Goldman Sachs Group Inc. basket of the most shorted shares in the Russell 3000 Index saw its biggest surge since 2009, while the Dow Jones Industrial Average stretched its rebound to more than 550 points since Monday's close.

With Britain in limbo as EU leaders gathered in Brussels to discuss the nation's withdrawal from the bloc, traders have pushed back bets on Federal Reserve interest-rate increases, indicating higher borrowing costs are unlikely before 2018. Meanwhile, a majority of economists surveyed by Bloomberg predict that the Bank of England will add more stimulus, including cutting rates in the third quarter.

Equities are recovering for a second session after two days of heavy selling sparked by the Brexit decision last week wiped $3.6 trillion from global equities. The S&P 500 had tumbled 5.3 percent to briefly erase its 2016 advance, and has since cut its post-vote drop by more than half. The CBOE Volatility Index tumbled for a third day, the longest in two weeks.

Investors are looking to policy makers for support as they await Britain's plan for its extrication from the EU. While European Central Bank President Mario Draghi called for global policy alignment, South Korea announced a fiscal stimulus package on Tuesday and Bank of Japan Chief Haruhiko Kuroda said Wednesday that more funds can be injected into the market should they be needed.

The turmoil spurred by the U.K. vote interrupted the S&P 500's march toward an all-time high this month, a move stoked by optimism that a mixture of low rates and moderate growth would bolster rising stock prices. The benchmark came within 1 percent of a record on June 8 and again last Thursday, on the day of the referendum as investors wagered Britain would remain in the EU. The gauge is now on track for its first monthly decline since February.

Major U.S. stock-indexes sharply higher on Wednesday, with the three major indexes recovering about half the losses suffered in the aftermath of Britain's shock vote to leave the European Union. Investors looked for bargains among beaten-down stocks, pushing up markets for the second day after the "Brexit" verdict wiped out about $3 trillion globally in a two-day selloff.

Almost all Dow stocks in positive area (29 of 30). Top looser - The Home Depot, Inc. (HD, -0,27%). Top gainer - Chevron Corporation (CVX, +2,58%).

All S&P sectors in positive area. Top gainer - Basic Materials (+2,7%).

At the moment:

Dow 17535.00 +234.00 +1.35%

S&P 500 2056.50 +28.00 +1.38%

Nasdaq 100 4349.00 +68.00 +1.59%

Oil 49.12 +1.27 +2.65%

Gold 1329.50 +11.60 +0.88%

U.S. 10yr 1.46 +0.00

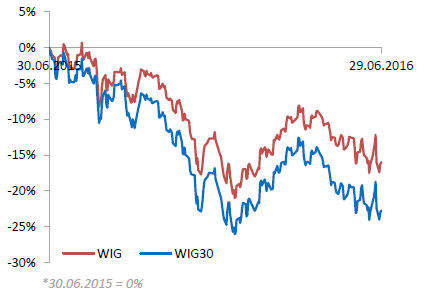

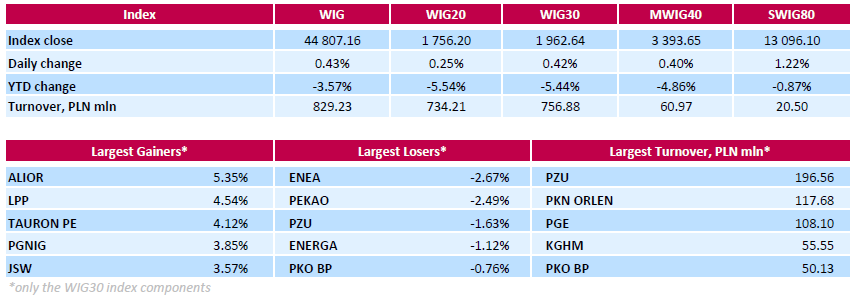

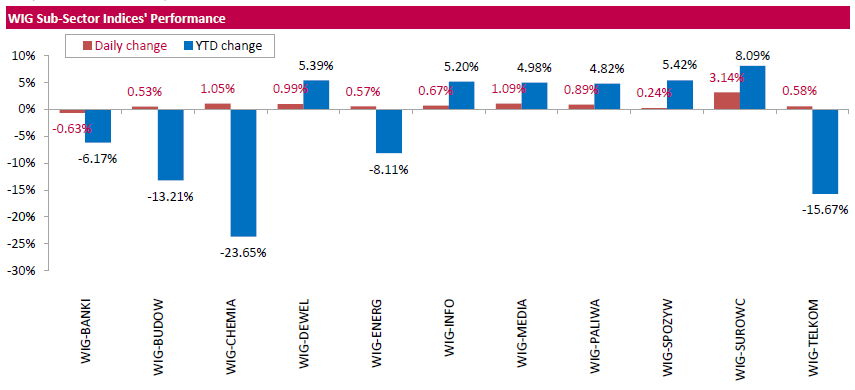

The Polish equity market continued its upward trend on Wednesday. The broad market measure, the WIG index, advanced 0.43%. Almost all sectors in the WIG generated positive returns. The only exception was banking sector (-0.63%). At the same time, materials (+3.14%) and media (+1.09%) were the best-performers.

The large-cap stocks' measure, the WIG30 Index, surged by 0.42%. In the index basket, banking sector name ALIOR (WSE: ALR), clothing retailer LPP (WSE: LPP) and genco TAURON PE (WSE: TPE) generated the biggest advances, soaring by 5.35%, 4.54% and 4.12% respectively. Other major gainers were oil and gas producer PGNIG (WSE: PGN), coking coal miner JSW (WSE: JSW) and copper producer KGHM (WSE: KGH), adding between 3.22% and 3.85%. On the other side of the ledger, genco ENEA (WSE: ENA) led the decliners, dropping by 2.67% on news that Poland's state treasury was in talks with Polish billionaire Zygmunt Solorz-Zak to swap his controlling stake in ENEA's rival ZE PAK for ENEA's new shares. It was followed by bank PEKAO (WSE: PEO) and insurer PZU (WSE: PZU), sliding by 2.49% and 1.63% respectively.

Start of trading by the Americans changed little in our market like the earlier handful of macro data. Surrounding holds firmly, but it does not tend to leave by the WIG20 the current, low volatility. Higher opening overseas resulted even in a slight decline in our index the largest companies.

Despite the weaker attitude of blue chips, the sWIG80 index recently established session highs gaining almost 1%. Small entities stand out positively after the turmoil associated with the Brexit and consistently work out related losses. Medium-sized entities (the mWIG40 index) in this respect are only a little worse and still retain the advantage over large companies.

U.S. stock-index futures advanced on speculation central bankers will counter the impact of a U.K. exit from the European Union.

Global Stocks:

Nikkei 15,566.83 +243.69 +1.59%

Hang Seng 20,436.12 +263.66 +1.31%

Shanghai Composite 2,932.52 +19.96 +0.69%

FTSE 6,278.88 +138.49 +2.26%

CAC 4,188.57 +99.72 +2.44%

DAX 9,605.36 +158.08 +1.67%

Crude $48.40 (+1.15%)

Gold $1325.10 (+0.55%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 9.48 | 0.15(1.6077%) | 15545 |

| 3M Co | MMM | 170.34 | 0.75(0.4422%) | 2546 |

| ALTRIA GROUP INC. | MO | 68.1 | 0.19(0.2798%) | 3921 |

| Amazon.com Inc., NASDAQ | AMZN | 713.45 | 5.50(0.7769%) | 33782 |

| American Express Co | AXP | 58 | 0.39(0.677%) | 2255 |

| AMERICAN INTERNATIONAL GROUP | AIG | 49.9 | 0.08(0.1606%) | 440 |

| Apple Inc. | AAPL | 94.13 | 0.54(0.577%) | 97339 |

| AT&T Inc | T | 42.15 | 0.13(0.3094%) | 9890 |

| Barrick Gold Corporation, NYSE | ABX | 20.95 | 0.32(1.5511%) | 54601 |

| Boeing Co | BA | 125 | 1.11(0.896%) | 1675 |

| Caterpillar Inc | CAT | 73.23 | 0.71(0.979%) | 1160 |

| Chevron Corp | CVX | 102.68 | 1.05(1.0332%) | 490 |

| Cisco Systems Inc | CSCO | 28.1 | 0.31(1.1155%) | 7826 |

| Citigroup Inc., NYSE | C | 41.14 | 0.70(1.731%) | 179778 |

| Exxon Mobil Corp | XOM | 91.25 | 0.34(0.374%) | 4227 |

| Facebook, Inc. | FB | 113.55 | 0.85(0.7542%) | 125840 |

| Ford Motor Co. | F | 12.53 | 0.14(1.1299%) | 27226 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 10.96 | 0.27(2.5257%) | 156258 |

| General Electric Co | GE | 30.21 | 0.27(0.9018%) | 19372 |

| General Motors Company, NYSE | GM | 28.01 | 0.27(0.9733%) | 14063 |

| Goldman Sachs | GS | 144 | 1.59(1.1165%) | 13459 |

| Google Inc. | GOOG | 684.89 | 4.85(0.7132%) | 5837 |

| Home Depot Inc | HD | 127.88 | 0.35(0.2744%) | 4115 |

| HONEYWELL INTERNATIONAL INC. | HON | 114.06 | -0.00(-0.00%) | 1830 |

| Intel Corp | INTC | 31.49 | 0.30(0.9618%) | 3015 |

| International Business Machines Co... | IBM | 146.8 | 1.10(0.755%) | 886 |

| International Paper Company | IP | 40.39 | 0.13(0.3229%) | 229 |

| Johnson & Johnson | JNJ | 119 | 0.77(0.6513%) | 703 |

| JPMorgan Chase and Co | JPM | 60.2 | 0.68(1.1425%) | 53935 |

| McDonald's Corp | MCD | 118.52 | 0.02(0.0169%) | 3870 |

| Merck & Co Inc | MRK | 56.35 | 0.77(1.3854%) | 100 |

| Microsoft Corp | MSFT | 49.95 | 0.51(1.0316%) | 16407 |

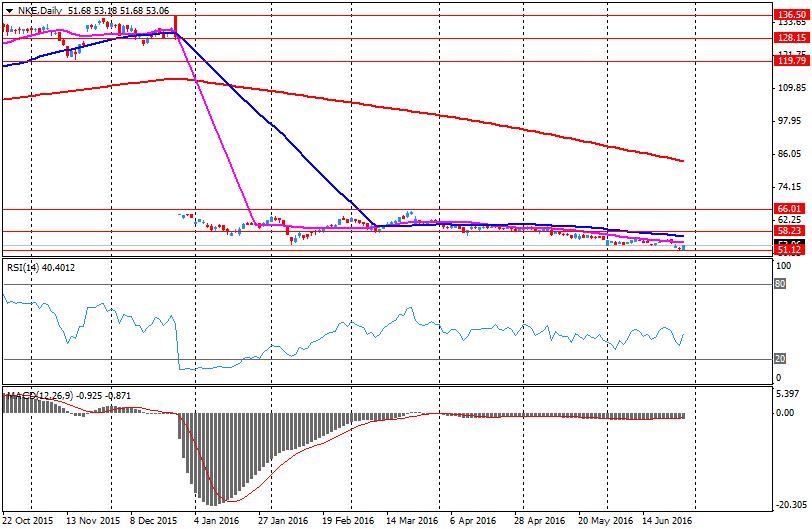

| Nike | NKE | 53.64 | 0.55(1.036%) | 1217450 |

| Pfizer Inc | PFE | 34.64 | 0.20(0.5807%) | 1608 |

| Procter & Gamble Co | PG | 82.71 | 0.25(0.3032%) | 235 |

| Starbucks Corporation, NASDAQ | SBUX | 55.4 | 0.55(1.0027%) | 3974 |

| Tesla Motors, Inc., NASDAQ | TSLA | 204.94 | 3.15(1.561%) | 32846 |

| Twitter, Inc., NYSE | TWTR | 16.61 | 0.19(1.1571%) | 114757 |

| UnitedHealth Group Inc | UNH | 140 | 1.29(0.93%) | 1028 |

| Verizon Communications Inc | VZ | 55.09 | 0.27(0.4925%) | 7140 |

| Visa | V | 76.09 | 0.93(1.2374%) | 1126 |

| Wal-Mart Stores Inc | WMT | 71.39 | -0.12(-0.1678%) | 21742 |

| Walt Disney Co | DIS | 96.6 | 0.55(0.5726%) | 778 |

| Yahoo! Inc., NASDAQ | YHOO | 36.39 | 0.35(0.9711%) | 12840 |

Upgrades:

Downgrades:

Other:

NIKE (NKE) target lowered to $58 from $69 at Piper Jaffray

NIKE (NKE) target lowered to $68 from $73 at Stifel

South phase of trading brought new highs in Europe, where the German DAX gaining around 2%, while the French CAC40 2.6%

On the Warsaw market we are dealing with stabilization at quite high turnover, what in recent times is not a common sight. The volatility is negligible.

Euroland encouraged to fight for higher levels, while the relative weakness in relation to the environment from the perspective of today's session may in turn suggest some caution.

In the mid-session the WIG20 index was at the level of 1,752 points (+ 0.03%) and with turnover of PLN 377 mln.

NIKE reported Q4 FY 2016 earnings of $0.49 per share (versus $0.98 in Q4 FY 2015), beating analysts' consensus of $0.48.

The company's quarterly revenues amounted to $8.244 bln (+6% y/y), slightly missing consensus estimate of $8.277 bln.

NIKE reiterates FY17 revenue guidance, projecting growth at a high single digit rate.

NKE fell to $51.07 (-3.80%) in pre-market trading.

European stocks rose for a second day, slowly recovering after a collapse on the background of the referendum on Britain's membership of the EU. Support to the markets was expectations that central banks will take additional stimulus measures to limit the impact of Brexit, as well as the rise in oil prices.

EU summit warned Britain that its decision is final, and called of the government of the country as soon as possible begin the formal exit procedures and discuss future relations. Financial markets are expected to remain volatile while the UK will try to resolve the issues with the EU.

However, market participants believe that the risks are now weaker than in the period of the bankruptcy of Lehman Brothers, which led to the global financial crisis, and as compared with the peak of the European debt crisis. "People are beginning to realize that the problem is more about a country and does not affect other markets, yet it does not pose a significant risk for the global economy." - Said Andrew Sheets, Morgan Stanley analyst.

The composite index Stoxx Europe 600 of the largest 600 companies in the region grew by 2.1 percent. Among the 19 industry groups shares of mining companies and energy producers grew the most.

Capitalization of GAM Holding AG rose 7.3 percent after the acquisition of Cantab Capital Partners LLP, a firm that uses mathematical models to determine when and which securities to buy and sell.

The cost of the tour operator TUI AG dropped 3.8 percent against the backdrop of coordinated terrorist attacks in Istanbul airport.

Shares of Deutsche Lufthansa AG fell 2.8 percent after the company announced plans to launch a internet satelite on board the short-haul flights, starting in October.

At the moment:

FTSE 100 6,294.28 +153.89 + 2.51%

CAC 40 4,196.98 +108.13 + 2.64%

DAX 9,626.13 +178.85 + 1.89%

WIG20 index opened at 1756.86 points (+0.29%)*

WIG 44835.96 0.50%

WIG30 1963.86 0.49%

mWIG40 3402.31 0.65%

*/ - change to previous close

The cash market (the WIG20 index) began from increase by 0.29% to 1,756 points with the traditionally modest turnover. The German DAX at the same time gaining more than 1%, which shows the apparent disparity since yesterday. On the Warsaw market negatively distinguished Enea (WSE: ENA; -3,3%) after the press release about the possible acquisition of stake in ZE PAK from Mr. Solorz. The WIG20 index remains below the close from Friday, which is the nearest resistance level.

Yesterday's session on Wall Street was as successful as in Europe and investors may breathe a little after two days of strong declines. It is not certain whether the return was due to the onslaught of buyers of overvalued stocks, or perhaps more temporary lack of people willing to dispose of the shares at these levels. The main thing that was able to somewhat make up for the loss and cool down after the first reflex of panic. The US indices grew by almost 2%. The strongest growth was seen among biotechnology companies, the Nasdaq Biotech index rose by 3.8%, and - as it did in Europe - banks and transport companies. Incoming data very little change the market sentiment. This happens when the market is dominated by emotions rather than rational valuation of companies and macroeconomic foundations of the economy.

To increasing in price of indices came correction on the commodity market and currency. At the end of the US session the price of crude oil rose already more than 3%, and gold moved down by almost 1% falling to 1,311 usd per ounce. Also got cheaper currencies from the "Safe Haven" basket, the dollar, yen and chf, which confirms a slight return of optimism on the markets. The most important barrier to overcome are the levels before the referendum. Return to levels before the shock will be the first test of strength of the market. Until that happens we have to treat current increase as a correction.

Stocks in Europe climbed by the most in a week Tuesday, getting a break after two back-to-back selloffs sparked by the U.K.'s Brexit vote.

In London on Tuesday, the FTSE 100 UKX, +2.64% tacked on 2.6% to end at 6,140.39, while the midcap FTSE 250 MCX, +3.58% added 3.6% to close at 15,503.06.

U.S. stocks on Tuesday rebounded to close higher as some of the initial shock over the U.K.'s decision to withdraw from the European Union receded. All 10 sectors in the S&P 500 closed higher, led by energy shares, while the tech-laden Nasdaq Composite had its best daily percentage gain since March 1. The S&P 500 SPX, +1.78% gained 36 points, or 1.8%, to close at 2,036 and the Dow Jones Industrial Average DJIA, +1.57% rose 270 points, or 1.6%, to finish at 17,410. The Nasdaq COMP, +2.12% rallied 97 points, or 2.1% to close at 4,692.

Asian share markets joined a global rebound on Wednesday as the immediate drag from the Brexit vote began to ebb and investors wagered central banks would ultimately ride to the rescue with more stimulus measures.

MSCI's broadest index of Asia-Pacific shares outside Japan rose 1 percent to recoup around a third of Friday's stinging loss. Japan's Nikkei climbed 1.4 percent, while Australian stocks added 0.8 percent.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.