- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 03-07-2017.

Major US stock indices showed mixed dynamics, as sales of shares in the technology sector were sent to the minus the Nasdaq index, but had a limited impact on the broader market. At the same time, the rally in the banking sector pushed the Dow Jones Industrial Average to new records.

Today's session was shortened on the occasion of tomorrow's Independence Day holiday.

Investors also reacted positively to the report of the Institute for Supply Management (ISM), which showed that activity in the US manufacturing sector increased significantly in June, surpassing the average forecasts, and reaching the highest level since August 2014. According to the report, the PMI index for the manufacturing sector was 57.8 points in June against 54.9 points in May. Analysts had expected that this figure will grow only to 55.1 points. Recall, the value of the ISM index, exceeding 50, is usually considered as an indicator of growth in production activity, and less than 50, respectively, the fall.

Meanwhile, the final data presented by Markit Economics showed: with seasonal fluctuations, the manufacturing PMI index for the US fell to 52.0 points in June from 52.7 points in May. The latter value was lower than the preliminary estimate (52.1 points) and worse than the experts' forecasts (52.1 points).

In addition, the US Department of Commerce said that construction costs unexpectedly remained at the same level in May, but federal government spending on construction projects was the highest for more than four years. According to the data, construction costs remained unchanged in May, at $ 1.23 trillion. Meanwhile, expenses for April were revised towards improvement - to -0.7 percent from -1.4 percent. Economists forecast an increase of 0.3 percent. Compared with May 2016, construction spending increased by 4.5 percent.

Most components of the DOW index recorded a rise (20 out of 30). The leader of growth was the shares of The Goldman Sachs Group, Inc. (GS, + 2.42%). Most fell shares of Microsoft Corporation (MSFT, -1.10%).

Most sectors of S & P completed the auction in positive territory. The leader of growth was the base resources sector (+ 1.3%). Most fell the technological sector (-0.7%).

At closing:

DJIA + 0.61% 21.479.27 +129.64

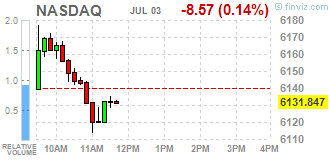

Nasdaq -0.49% 6,110.06 -30.36

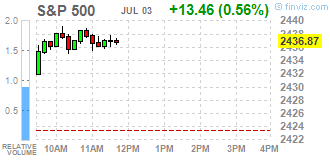

S & P + 0.23% 2.429.01 +5.60

Major U.S. stock-indexes were mixed, as a selloff in the technology sector pushed the tech-heavy Nasdaq into the negative territory but had a limited impact on the broader market. Moreover, a rally in banks took the Dow Jones Industrial Average to a record high. Investors' optimism was also bolstered by the ISM's report, which showed the U.S. factory activity rose to a three-year high in June.

Most of Dow stocks in positive area (22 of 30). Top gainer - The Goldman Sachs Group, Inc. (GS, +3.00%). Top loser - Wal-Mart Stores, Inc. (WMT, -0.61%).

A majority of S&P sectors in positive area. Top gainer - Financials (+1.50%). Top loser - Conglomerates (-0.45%).

At the moment:

Dow 21488.00 +188.00 +0.88%

S&P 500 2434.00 +13.00 +0.54%

Nasdaq 100 5623.75 -29.00 -0.51%

Crude Oil 46.84 +0.80 +1.74%

Gold 1222.20 -20.10 -1.62%

U.S. 10yr 2.35 +0.05

U.S. stock-index futures indicated the equity market would begin the third quarter on a higher note.

Global Stocks:

Nikkei 20,055.80 +22.37 +0.11%

Hang Seng 25,784.17 +19.59 +0.08%

Shanghai 3,194.79 +2.36 +0.07%

S&P/ASX 5,684.49 -37.01 -0.65%

FTSE 7,336.06 +23.34 +0.32%

CAC 5,173.01 +52.33 +1.02%

DAX 12,410.88 +85.76 +0.70%

Crude $46.31 (+0.59%)

Gold $1,231.90 (-0.84%)

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 210 | 1.81(0.87%) | 200 |

| Amazon.com Inc., NASDAQ | AMZN | 971.8 | 3.80(0.39%) | 15159 |

| Apple Inc. | AAPL | 144.71 | 0.69(0.48%) | 30642 |

| AT&T Inc | T | 37.98 | 0.25(0.66%) | 49468 |

| Barrick Gold Corporation, NYSE | ABX | 15.7 | -0.21(-1.32%) | 12210 |

| Caterpillar Inc | CAT | 106.9 | -0.56(-0.52%) | 9474 |

| Cisco Systems Inc | CSCO | 31.41 | 0.11(0.35%) | 2133 |

| Citigroup Inc., NYSE | C | 67.13 | 0.25(0.37%) | 20654 |

| Deere & Company, NYSE | DE | 124.42 | 0.83(0.67%) | 1332 |

| Exxon Mobil Corp | XOM | 80.75 | 0.02(0.02%) | 7783 |

| Facebook, Inc. | FB | 151.57 | 0.59(0.39%) | 38913 |

| Ford Motor Co. | F | 11.24 | 0.05(0.45%) | 2052 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 12.05 | 0.04(0.33%) | 2300 |

| General Electric Co | GE | 27.11 | 0.10(0.37%) | 1368 |

| Goldman Sachs | GS | 223.3 | 1.40(0.63%) | 7447 |

| Google Inc. | GOOG | 913.19 | 4.46(0.49%) | 2199 |

| Hewlett-Packard Co. | HPQ | 17.5 | 0.02(0.11%) | 2100 |

| Intel Corp | INTC | 33.79 | 0.05(0.15%) | 229 |

| International Business Machines Co... | IBM | 153.57 | -0.26(-0.17%) | 3573 |

| Johnson & Johnson | JNJ | 133.25 | 0.96(0.73%) | 4754 |

| JPMorgan Chase and Co | JPM | 91.4 | 0.50(0.55%) | 6701 |

| McDonald's Corp | MCD | 153.15 | -0.01(-0.01%) | 318 |

| Merck & Co Inc | MRK | 64 | -0.09(-0.14%) | 472 |

| Microsoft Corp | MSFT | 69.24 | 0.31(0.45%) | 8968 |

| Nike | NKE | 58.65 | -0.35(-0.59%) | 45762 |

| Pfizer Inc | PFE | 33.45 | -0.14(-0.42%) | 1422 |

| Starbucks Corporation, NASDAQ | SBUX | 58.5 | 0.19(0.33%) | 1046 |

| Tesla Motors, Inc., NASDAQ | TSLA | 370 | 8.39(2.32%) | 138191 |

| The Coca-Cola Co | KO | 45.17 | 0.32(0.71%) | 1656 |

| Twitter, Inc., NYSE | TWTR | 18.03 | 0.16(0.90%) | 25210 |

| Verizon Communications Inc | VZ | 44.65 | -0.01(-0.02%) | 36344 |

| Visa | V | 93.85 | 0.07(0.07%) | 250 |

| Wal-Mart Stores Inc | WMT | 75.95 | 0.27(0.36%) | 430 |

| Walt Disney Co | DIS | 106.97 | 0.72(0.68%) | 6148 |

| Yandex N.V., NASDAQ | YNDX | 26.1 | -0.14(-0.53%) | 200 |

Germany's DAX 30 joined other European benchmarks in closing lower Friday, with Bayer AG ending a losing month for regional equities by cautioning investors that its profit was under pressure.

U.S. stocks closed modestly higher Friday after trimming gains in the last few minutes of the session. However, steep losses in technology and health-care stocks earlier in the week resulted in poor weekly and mixed monthly performances for all three benchmarks.

Equity markets struggled to find direction in Asia as the second half of the year kicked off, tracking mixed signals from U.S. markets. Market participants were expected to focus more closely on the Chinese bond and currency markets with the launch of a new program allowing global investors to invest in the world's third-largest market for fixed income via Hong Kong.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.