- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 29-06-2017.

(index / closing price / change items /% change)

Nikkei +89.89 20220.30 +0.45%

TOPIX +9.70 1624.07 +0.60%

Hang Seng +281.92 25965.42 +1.10%

CSI 300 +22.66 3668.83 +0.62%

Euro Stoxx 50 -64.37 3471.33 -1.82%

FTSE 100 -37.48 7350.32 -0.51%

DAX -231.08 12416.19 -1.83%

CAC 40 -98.55 5154.35 -1.88%

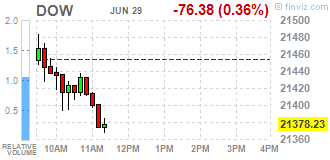

DJIA -167.58 21287.03 -0.78%

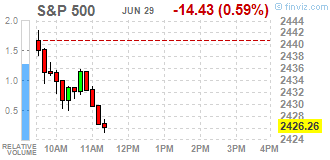

S&P 500 -20.99 2419.70 -0.86%

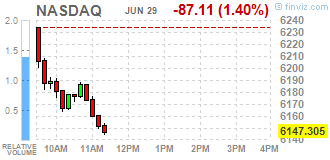

NASDAQ -90.06 6144.35 -1.44%

S&P/TSX -142.16 15213.42 -0.93%

The major US stock indexes fell significantly, as the losses incurred by shares of technology companies as a result of resumed sales in the sector significantly exceeded the growth in the financial sector, caused by a report on the successful passage of the US Federal Reserve stress tests by 34 largest US banks.

Investors also evaluated a block of important data. The report submitted by the Ministry of Trade showed that in the first quarter the US economy slowed less sharply than initially expected due to unexpectedly higher consumer spending and a larger export jump. According to the report, GDP increased by 1.4% year-on-year, and not by 1.2%, as reported last month. It was the slowest growth rate since the second quarter of last year. Economists had expected that GDP growth would remain unchanged at 1.2%. The growth in the economy in the first quarter was supported by a revised increase in consumer spending, accounting for more than two thirds of US economic activity. Consumer spending grew by 1.1%, and not by previously announced 0.6%. It was the slowest pace since the second quarter of 2013.

At the same time, the report of the Ministry of Labor showed that the number of Americans applying for unemployment benefits increased last week, although their total number still corresponds to a steady increase in employment. According to the Ministry of Labor, the initial applications for state unemployment benefits increased by 2000 to 244,000, seasonally adjusted for the week to June 24. Economists predicted that initial applications for unemployment benefits fell to 240,000 over the last week. The claims for unemployment benefits for the previous week were revised to 242,000 from 241,000.

Almost all components of the DOW index recorded a decline (28 out of 30). Most fell shares of Cisco Systems, Inc. (CSCO, -2.09%). The growth leader JPMorgan Chase & Co. (JPM, + 1.69%).

Almost all sectors of S & P finished trading in the red. The technological sector fell most of all (-1.7%). The increase was shown only by the financial sector (+ 0.1%).

At closing:

DJIA -0.78% 21,287.03 -167.58

Nasdaq -1.44% 6,144.35 -90.06

S & P-0.86% 2.419.70 -20.99

Major U.S. stock-indexes fell, as a renewed selloff in technology stocks outweighed gains in the financial sector, buoyed by the announcement the Fed approved all 34 banks required to take its annual stress test.

Most of Dow stocks in negative area (21 of 30). Top losers - Visa Inc. (V, -1.84%). Top gainer - The Goldman Sachs Group, Inc. (GS, +1.74%).

A majority of S&P sectors in negative area. Top loser - Technology (-1.6%). Top gainer Basic Materials (+0.6%).

At the moment:

Dow 21333.00 -69.00 -0.32%

S&P 500 2425.00 -13.50 -0.55%

Nasdaq 100 5661.25 -102.25 -1.77%

Crude Oil 45.39 +0.65 +1.45%

Gold 1243.70 -5.40 -0.43%

U.S. 10yr 2.28 +0.06

U.S. stock-index futures were mixed. The S&P 500 futures were edged up, a day after the S&P 500 index recorded its biggest one-day percentage surge in about two months. At the same time, stocks were declining once again, dragging the Nasdaq futures into negative territory.

Stocks:

Nikkei 20,220.30 +89.89 +0.45%

Hang Seng 25,965.42 +281.92 +1.10%

Shanghai 3,187.90 +14.70 +0.46%

S&P/ASX 5,818.10 +62.40 +1.08%

FTSE7,407.77 +19.97 +0.27%

CAC 5,206.76 -46.14 -0.88%

DAX 12,576.03 -71.24 -0.56%

Crude $45.25 (+1.14%)

Gold $1,244.80 (-0.36%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 33.1 | 0.15(0.46%) | 1125 |

| Amazon.com Inc., NASDAQ | AMZN | 986 | -4.33(-0.44%) | 23087 |

| American Express Co | AXP | 85.1 | 1.13(1.35%) | 4390 |

| AMERICAN INTERNATIONAL GROUP | AIG | 64.49 | 0.65(1.02%) | 12860 |

| Apple Inc. | AAPL | 144.94 | -0.89(-0.61%) | 136991 |

| AT&T Inc | T | 37.9 | -0.04(-0.11%) | 3788 |

| Barrick Gold Corporation, NYSE | ABX | 16.03 | -0.10(-0.62%) | 39668 |

| Boeing Co | BA | 199.15 | -0.47(-0.24%) | 279 |

| Caterpillar Inc | CAT | 106.7 | 0.25(0.23%) | 2990 |

| Chevron Corp | CVX | 104.3 | 0.02(0.02%) | 417 |

| Cisco Systems Inc | CSCO | 32 | -0.08(-0.25%) | 10438 |

| Citigroup Inc., NYSE | C | 67.17 | 1.99(3.05%) | 311014 |

| Exxon Mobil Corp | XOM | 81.89 | 0.36(0.44%) | 2166 |

| Facebook, Inc. | FB | 152.35 | -0.89(-0.58%) | 59099 |

| Ford Motor Co. | F | 11.1 | 0.01(0.09%) | 4847 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 12.2 | 0.21(1.75%) | 21429 |

| General Electric Co | GE | 27.18 | 0.10(0.37%) | 37354 |

| General Motors Company, NYSE | GM | 34.6 | 0.02(0.06%) | 1519 |

| Goldman Sachs | GS | 227 | 3.78(1.69%) | 26151 |

| Google Inc. | GOOG | 936 | -4.49(-0.48%) | 1158 |

| Hewlett-Packard Co. | HPQ | 18 | -0.03(-0.17%) | 500 |

| Johnson & Johnson | JNJ | 133.99 | 0.17(0.13%) | 692 |

| JPMorgan Chase and Co | JPM | 92.5 | 2.68(2.98%) | 362259 |

| McDonald's Corp | MCD | 154.58 | 0.28(0.18%) | 276 |

| Merck & Co Inc | MRK | 65.2 | 0.04(0.06%) | 860 |

| Microsoft Corp | MSFT | 69.45 | -0.35(-0.50%) | 13392 |

| Nike | NKE | 53.34 | -0.02(-0.04%) | 1720 |

| Pfizer Inc | PFE | 33.72 | -0.03(-0.09%) | 600 |

| Starbucks Corporation, NASDAQ | SBUX | 59 | -0.18(-0.30%) | 1850 |

| Tesla Motors, Inc., NASDAQ | TSLA | 369.9 | -1.34(-0.36%) | 39902 |

| The Coca-Cola Co | KO | 45.28 | -0.04(-0.09%) | 3476 |

| Twitter, Inc., NYSE | TWTR | 17.91 | -0.04(-0.22%) | 33122 |

| Visa | V | 96.5 | 0.27(0.28%) | 9026 |

McDonald's (MCD) target raised to $175 from $165 at BTIG Research

Barrick Gold (ABX) upgraded to Hold from Sell at Berenberg

General Electric (GE) upgraded to Hold from Sell at Standpoint Research; target $24

European stocks on Wednesday closed a topsy-turvy session at a two-month low, with the euro pulled lower intraday while the pound leapt as investors reassessed policy stances at both the European Central Bank and the Bank of England. Major European benchmarks turned modestly higher as the euro declined, but many of them eventually settled slightly in the red.

A rally by financial and technology stocks on Wednesday helped lift U.S. equity indexes, with the S&P 500 posting its largest one-day gain in two months while Nasdaq Composite recorded its best day in eight months. The large-cap index has been somewhat "fickle" this month with three of this year's biggest gains and two of its worst losses having occurred in June, according to Frank Cappelleri, executive director of Instinet.

Equity markets in Asia were higher early Thursday, with finance stocks broadly leading gains after all major U.S. financial institutions received approval from the Federal Reserve to ramp up dividend payouts and share buybacks. The approvals - the first time since the annual tests began in 2011 that all firms got passing grades - reflect a turning point for big financial institutions that have been shackled by tighter regulation since the crisis.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.