- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 26-06-2017.

(index / closing price / change items /% change)

Nikkei +20.68 20153.35 +0.10%

TOPIX +0.87 1612.21 +0.05%

Hang Seng +201.84 25871.89 +0.79%

CSI 300 +45.21 3668.09 +1.25%

Euro Stoxx 50 +18.08 3561.76 +0.51%

FTSE 100 +22.67 7446.80 +0.31%

DAX +37.42 12770.83 +0.29%

CAC 40 +29.63 5295.75 +0.56%

DJIA +14.79 21409.55 +0.07%

S&P 500 +0.77 2439.07 +0.03%

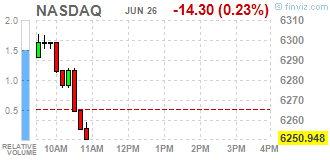

NASDAQ -18.10 6247.15 -0.29%

S&P/TSX -3.54 15316.02 -0.02%

The major US stock indexes ended the trading mixed, since the decline in the shares of the technology sector was opposed by the growth of the conglomerate sector.

In addition, the negative impact on the mood of investors had weak data on orders for durable goods and sluggish dynamics of oil quotes.

As it became known today, orders for non-military capital goods, with the exception of aircraft carefully monitored by the sensor for business expenses, fell by 0.2%. These so-called basic orders for capital goods were revised, and showed an increase of 0.2% in April. Earlier it was reported that they grew by 0.1%. At the same time, the supply of capital goods used to calculate equipment costs in the national GDP measurement decreased by 0.2% last month after rising 0.1% in April. Economists predicted that major orders for capital goods in May will grow by 0.3%. General orders for durable goods, goods from toasters to aircraft, which are designed for a lifetime of three years or longer, fell 1.1% after a decline of 0.9% in April.

Most components of the DOW index closed in positive territory (17 out of 30). Most fell shares of The Boeing Company (BA, -1.03%). The leader of growth was the shares of The Goldman Sachs Group (GS, + 1.66%).

Most sectors of the S & P index showed an increase. The technological sector fell most (-0.4%). The growth leader was the conglomerate sector (+ 0.9%).

At closing:

DJIA + 0.07% 21.405.55 +14.79

Nasdaq -0.29% 6.247.15 -18.10

S & P + 0.03% 2.439.07 + 0.77

Major U.S. stock-indexes demonstrated mixed dynamics on Monday. Declines in technology and health-care sectors were the major drivers of the market's sharp downward move after positive opening. Investors' sentiment was also impacted by weaker-than-expected data on durable goods orders for May and stalled oil prices.

A majority of Dow stocks in positive area (17 of 30). Top loser - Exxon Mobil Corp. (XOM, -0.65%). Top gainer - The Goldman Sachs Group (GS, +1.04%).

Most of S&P sectors in positive area.Top loser - Technology (-0.2%) и Healthcare (-0.2%). Top gainer - Utilities (+0.8%).

At the moment:

Dow 21347.00 +8.00 +0.04%

S&P 500 2438.00 +3.00 +0.12%

Nasdaq 100 5800.25 -12.00 -0.21%

Oil 42.65 -0.36 -0.84%

Gold 1245.30 -11.10 -0.88%

U.S. 10yr 2.13 -0.01

U.S. stock-index futures rose moderately, as oil prices continued to rebound, while investors assessed the May data on durable goods orders.

Stocks:

Nikkei 20,153.35 +20.68 +0.10%

Hang Seng 25,871.89 +201.84 +0.79%

Shanghai 3,186.05 +28.17 +0.89%

S&P/ASX 5,720.16 +4.29 +0.08%

FTSE 7,471.97 +47.84 +0.64%

CAC 5,318.50 +52.38 +0.99%

DAX 12,818.73 +85.32 +0.67%

Crude $43.12 (+0.26%)

Gold $1,239.70 (-1.33%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 30.9 | -0.19(-0.61%) | 1200 |

| Amazon.com Inc., NASDAQ | AMZN | 1,009.90 | 6.16(0.61%) | 31733 |

| American Express Co | AXP | 82.5 | 0.28(0.34%) | 100 |

| Apple Inc. | AAPL | 147.15 | 0.87(0.59%) | 127284 |

| AT&T Inc | T | 38 | 0.05(0.13%) | 1700 |

| Barrick Gold Corporation, NYSE | ABX | 16.19 | -0.29(-1.76%) | 50013 |

| Caterpillar Inc | CAT | 104.3 | 0.19(0.18%) | 1623 |

| Cisco Systems Inc | CSCO | 32.4 | 0.31(0.97%) | 25493 |

| Citigroup Inc., NYSE | C | 63.8 | 0.39(0.62%) | 17664 |

| Deere & Company, NYSE | DE | 124.65 | 1.05(0.85%) | 501 |

| Exxon Mobil Corp | XOM | 81.71 | 0.10(0.12%) | 3596 |

| Facebook, Inc. | FB | 155.95 | 0.88(0.57%) | 150617 |

| FedEx Corporation, NYSE | FDX | 216 | 0.65(0.30%) | 106 |

| Ford Motor Co. | F | 11.06 | 0.02(0.18%) | 22151 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11.84 | 0.08(0.68%) | 10982 |

| General Electric Co | GE | 27.67 | 0.10(0.36%) | 8629 |

| Goldman Sachs | GS | 218.1 | 0.91(0.42%) | 6466 |

| Google Inc. | GOOG | 972.5 | 6.91(0.72%) | 4227 |

| Hewlett-Packard Co. | HPQ | 17.84 | 0.04(0.22%) | 410 |

| Home Depot Inc | HD | 151.98 | 0.67(0.44%) | 5708 |

| Intel Corp | INTC | 34.25 | 0.06(0.18%) | 4393 |

| Johnson & Johnson | JNJ | 136.25 | -0.18(-0.13%) | 547 |

| JPMorgan Chase and Co | JPM | 87.15 | 0.29(0.33%) | 9426 |

| McDonald's Corp | MCD | 154.75 | 0.11(0.07%) | 1301 |

| Microsoft Corp | MSFT | 71.55 | 0.34(0.48%) | 16545 |

| Nike | NKE | 52.93 | 0.08(0.15%) | 891 |

| Pfizer Inc | PFE | 34.3 | 0.13(0.38%) | 1120 |

| Tesla Motors, Inc., NASDAQ | TSLA | 386.6 | 3.15(0.82%) | 66853 |

| Twitter, Inc., NYSE | TWTR | 18.61 | 0.11(0.59%) | 87799 |

| UnitedHealth Group Inc | UNH | 186.88 | 1.63(0.88%) | 130 |

| Verizon Communications Inc | VZ | 45.44 | 0.05(0.11%) | 2760 |

| Visa | V | 95.8 | 0.22(0.23%) | 1928 |

| Wal-Mart Stores Inc | WMT | 74.95 | 0.11(0.15%) | 2130 |

| Walt Disney Co | DIS | 104.75 | 0.39(0.37%) | 2087 |

Credit Suisse (CS) resumed with a Overweight at JP Morgan

McDonald's (MCD) target raised to $175 from $165 at Wells Fargo

Equities in Europe lost ground on Friday, as energy shares extended losses in what's been a dreadful week for oil prices, while investors assessed mixed signals about the eurozone economy. Stocks remained in the red as the first, or flash, reading of growth in the eurozone's manufacturing and services sector slowed for June, although the region is undergoing its best quarter of growth in six years. Markit's flash eurozone PMI composite output index came in at 55.7 in June, a five-month low.

U.S. stocks closed mostly higher on Friday, as energy shares staged a modest rebound after a recent selloff, while technology stocks extended their advance. The Nasdaq Composite COMP, +0.46% outperformed other indexes, rising 28.56 points, or 0.5%, to 6,265.25 on Friday and booking a 1.9% gain over the week, the largest in a month. The gains on the tech-heavy index were driven by a jump in biotechnology shares earlier in the week.

Tech stocks and stabilizing commodity prices helped stocks in Asia start the week on an up note amid a lack of major data releases or other market catalysts. Stabilization in commodities is helping beaten-down Australian stocks, noted Michael McCarthy chief market strategist at CMC. The S&P/ASX 200 fell 1% last week amid weakness in commodity stocks, with Australian equities notably lagging others in the region.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.