- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 06-01-2017.

Major US stock indices are moderately higher after data showed that employment in December increased less than expected, but the rebound wages signaled steady growth in the labor market.

As it became known, job creation slowed in December and the unemployment rate rose slightly, but wage growth was the strongest since 2009, pointing to a tightening of the labor market for more than seven years after the beginning of the expansion. The number of people employed in non-agricultural sectors of the economy rose to a seasonally adjusted 156 000 in December from the previous month, the Labor Department said Friday. The unemployment rate rose slightly to 4.7% last month from 4.6% in November, reflecting more Americans entering the labor market. Economists had expected 178,000 new jobs, and the unemployment rate to 4.7%.

In addition, new orders for manufactured goods in the US fell by reducing the pressure in November in a volatile category of civilian aircraft, but the underlying trend suggests that production is gradually being strengthened. The US Commerce Department said today that production orders for goods decreased by 2.4%, after a revised increase of up to 2.8% in October. The November decline followed a growth for four consecutive months and was the biggest drop since December 2015. Economists predicted that factory orders decline by 2.2% in November after being shown previously reported increase of 2.7% in October.

DOW index components closed mostly in positive territory (23 of 30). Most remaining shares rose NIKE, Inc. (NKE, + 1.78%). Outsider were shares of Verizon Communications Inc. (VZ, -2.56%).

Sector S & P index also ended the day mostly in positive territory. The leader turned out to be the technology sector (+ 0.3%). Most of the basic materials sector fell (-0.3%).

Major U.S. stock-indexes slightly hgigh on Friday after data showed employment in December rose less than expected but a rebound in wages suggested sustained growth in the labor market. The public and private sectors together added 156000 jobs last month, a U.S. Labor Department report showed, compared with 204000 jobs added in November. Average hourly earnings increased 10 cents, or 0,4%, after slipping 0,1% in November. That pushed the year-on-year increase in average hourly earnings to 2,9%, the largest increase since June 2009.

Most of Dow stocks in negative area (17 of 30). Top gainer - The Walt Disney Company (DIS, +1.51%). Top loser - Verizon Communications Inc. (VZ, -2.26%).

Most of S&P sectors also in negative area. Top gainer - Conglomerates (+0.4%). Top loser - Basic Materials (-0.6%).

At the moment:

Dow 19852.00 +31.00 +0.16%

S&P 500 2267.00 +2.75 +0.12%

Nasdaq 100 4990.25 +28.25 +0.57%

Oil 53.47 -0.29 -0.54%

Gold 1174.70 -6.60 -0.56%

U.S. 10yr 2.41 +0.04

U.S. stock-index futures were flat as investors assessed mixed data on the U.S. labour market .

Global Stocks:

Nikkei 19,454.33 -66.36 -0.34%

Hang Seng 22,503.01 +46.32 +0.21%

Shanghai 3,154.29 -11.12 -0.35%

FTSE 7,199.81 +4.50 +0.06%

CAC 4,897.45 -3.19 -0.07%

DAX 11,586.13 +1.19 +0.01%

Crude $54.22 (+0.86%)

Gold $1,179.20 (-0.18%)

(company / ticker / price / change ($/%) / volume)

| Amazon.com Inc., NASDAQ | AMZN | 780.53 | 0.08(0.0103%) | 18058 |

| American Express Co | AXP | 75 | -0.32(-0.4249%) | 5025 |

| AMERICAN INTERNATIONAL GROUP | AIG | 65.9 | 0.30(0.4573%) | 500 |

| Apple Inc. | AAPL | 116.58 | -0.03(-0.0257%) | 89918 |

| AT&T Inc | T | 42.22 | 0.06(0.1423%) | 31522 |

| Barrick Gold Corporation, NYSE | ABX | 17.16 | -0.21(-1.209%) | 109432 |

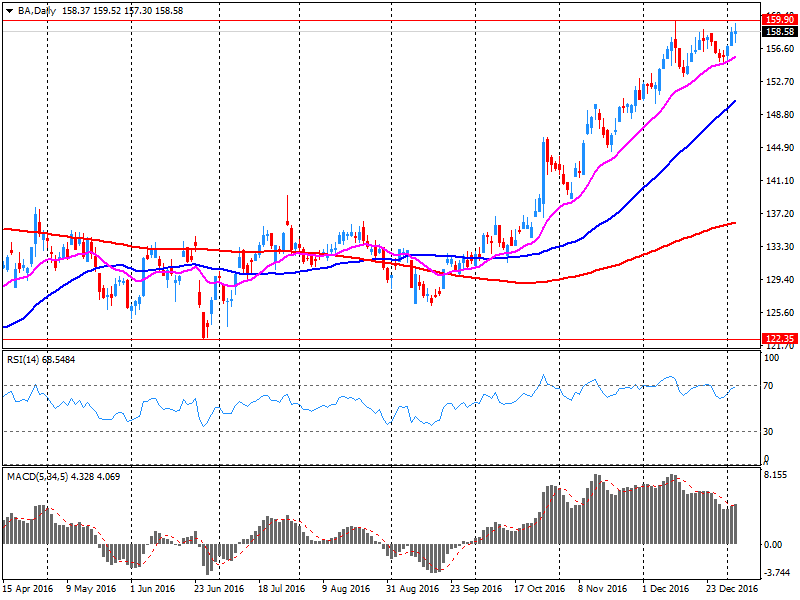

| Boeing Co | BA | 158.9 | 0.19(0.1197%) | 241 |

| Chevron Corp | CVX | 117.5 | 0.19(0.162%) | 342 |

| Cisco Systems Inc | CSCO | 30.24 | 0.07(0.232%) | 4625 |

| Exxon Mobil Corp | XOM | 88.89 | 0.34(0.384%) | 808 |

| Facebook, Inc. | FB | 120.83 | 0.16(0.1326%) | 38037 |

| Ford Motor Co. | F | 12.81 | 0.04(0.3132%) | 37564 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 14.7 | 0.08(0.5472%) | 103689 |

| General Electric Co | GE | 31.53 | 0.01(0.0317%) | 2557 |

| General Motors Company, NYSE | GM | 36.7 | 0.31(0.8519%) | 1294 |

| Goldman Sachs | GS | 241.99 | 0.67(0.2776%) | 4357 |

| Google Inc. | GOOG | 794.9 | 0.88(0.1108%) | 1838 |

| Intel Corp | INTC | 36.4 | 0.05(0.1376%) | 2481 |

| International Business Machines Co... | IBM | 168.2 | -0.50(-0.2964%) | 110 |

| Johnson & Johnson | JNJ | 117 | 0.14(0.1198%) | 998 |

| McDonald's Corp | MCD | 118.73 | -0.97(-0.8104%) | 1960 |

| Merck & Co Inc | MRK | 60.54 | 0.43(0.7154%) | 190 |

| Microsoft Corp | MSFT | 62.4 | 0.10(0.1605%) | 2207 |

| Nike | NKE | 53.01 | -0.05(-0.0942%) | 2511 |

| Pfizer Inc | PFE | 33.7 | 0.09(0.2678%) | 350 |

| Starbucks Corporation, NASDAQ | SBUX | 168.2 | -0.50(-0.2964%) | 110 |

| Tesla Motors, Inc., NASDAQ | TSLA | 226.25 | -0.50(-0.2205%) | 7929 |

| Travelers Companies Inc | TRV | 117.02 | -1.31(-1.1071%) | 1282 |

| Twitter, Inc., NYSE | TWTR | 17.19 | 0.10(0.5851%) | 24932 |

| United Technologies Corp | UTX | 112 | 0.65(0.5837%) | 175 |

| Verizon Communications Inc | VZ | 54.03 | -0.0325(-0.0601%) | 6388 |

| Wal-Mart Stores Inc | WMT | 158.9 | 0.19(0.1197%) | 241 |

| Walt Disney Co | DIS | 108.02 | 0.64(0.596%) | 9818 |

| Yahoo! Inc., NASDAQ | YHOO | 41.19 | -0.15(-0.3628%) | 6900 |

| Yandex N.V., NASDAQ | YNDX | 21.58 | -0.30(-1.3711%) | 15040 |

Upgrades:

Deere (DE) upgraded to Hold from Sell at Vertical Research

Walt Disney (DIS) upgraded to Outperform at RBC Capital Mkts; target raised to $130

Downgrades:

Travelers (TRV) downgraded to Underweight from Neutral at Atlantic Equities

McDonald's (MCD) downgraded to Neutral from Buy at UBS

Other:

U.K. stocks pushed further into record territory in bouncy trade on Thursday, supported by a rally in shares of house builders on the back of upbeat news from Persimmon PLC. The index was hovering around the flatline for most of the session as traders digested minutes from the U.S. Federal Reserve's meeting in December, released after Wednesday's close in London.

The tech-heavy Nasdaq closed at a record Thursday, as the broader stock market finished lower, dragged down by a steep slide in the financial sector and major retailers. Mixed data on jobs also raised concerns a day before the closely watched December employment report due Friday.

Japanese shares dropped Friday on yen-strengthening as traders awaited U.S. jobs data for clues on Federal Reserve rate actions. The yen's gain against the dollar comes as investors grow cautious about the U.S. economic outlook, and as traders second-guessed their once unshakeable belief in a continuous greenback rally driven by Fed rate rises.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.