- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 09-01-2017.

(index / closing price / change items /% change)

Hang Seng +55.68 22558.69 +0.25%

CSI 300 +16.23 3363.90 +0.48%

Euro Stoxx 50 -12.20 3308.97 -0.37%

FTSE 100 +27.72 7237.77 +0.38%

DAX -35.02 11563.99 -0.30%

CAC 40 -22.27 4887.57 -0.45%

DJIA -76.42 19887.38 -0.38%

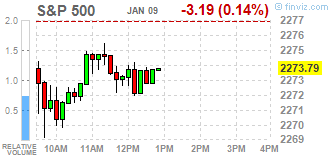

S&P 500 -8.08 2268.90 -0.35%

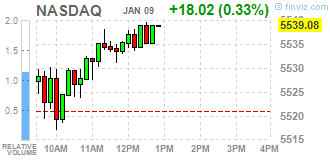

NASDAQ +10.76 5531.82 +0.19%

S&P/TSX -107.10 15388.95 -0.69%

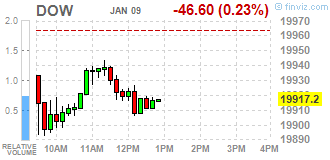

Major U.S. stock-indexes mixed on Monday. Declines in bank and energy companies distancing the Dow from the 20,000 mark, while gains in technology stocks pushed the Nasdaq to a record intraday high.

Most of Dow stocks in negative area (20 of 30). Top gainer - E. I. du Pont de Nemours and Company (DD, +1.83%). Top loser - Exxon Mobil Corporation (XOM, -2.01%).

Most of S&P sectors also in negative area. Top gainer - Healthcare (+0.4%). Top loser - Conglomerates (-1.0%).

At the moment:

Dow 19836.00 -61.00 -0.31%

S&P 500 2267.50 -4.00 -0.18%

Nasdaq 100 5020.00 +16.00 +0.32%

Oil 52.40 -1.59 -2.94%

Gold 1183.00 +9.60 +0.82%

U.S. 10yr 2.32 -0.04

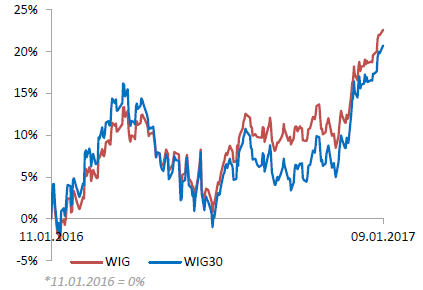

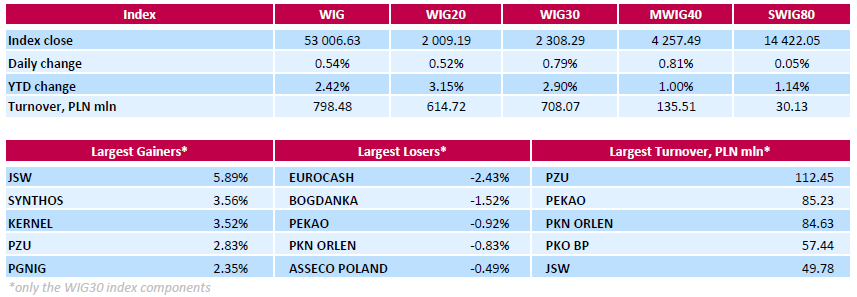

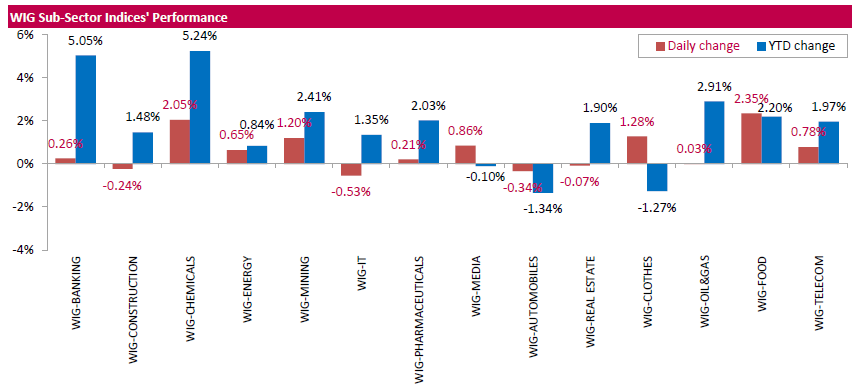

Polish equity market closed higher on Monday. The broad market measure, the WIG Index, rose by 0.54%. The WIG sub-sector indices were mainly higher with food stock gauge (+2.35%) outperforming.

The large-cap stocks' measure, the WIG30 Index, surged by 0.79%. A majority of the index components returned gains, with the way up led by coking coal miner JSW (WSE: JSW), which advanced 5.89% as the stock continued to recover after significant declines in late December through early January, which pushed its quotation down nearly 20%. Other major advancers were chemical producer SYNTHOS (WSE: SNS), agricultural producer KERNEL (WSE: KER) and insurer PZU (WSE: PZU), which soared 3.56%, 3.52% and 2.83% respectively. At the same time, FMCG-wholesaler EUROCASH (WSE: EUR) led a handful of decliners with a 2.43% drop, followed by thermal coal miner BOGDANKA (WSE: LWB), bank PEKAO (WSE: PEO), oil refiner PKN ORLEN (WSE: PKN) and IT-company ASSECO POLAND (WSE: ACP), tumbling between 0.49% and 1.52%.

The market in the United States opened quietly, and the S&P500 index began from discount of 0.14%. After the first transaction the bears took advantage and the S&P500 lost 0.3 percent, what turns out to be a weaker than expected scenario. The Warsaw WIG20 index is today one of the strongest indices in Europe and an hour before the close of trading the WIG20 index was at the level of 2,002 points (+0.17%).

U.S. stock-index futures were flat amid tumbling oil prices and due to lack of macroeconomic data.

Global Stocks:

Nikkei Closed.

Hang Seng 22,558.69 +55.68 +0.25%

Shanghai 3,171.60 +17.28 +0.55%

FTSE 7,229.73 +19.68 +0.27%

CAC 4,873.75 -36.09 -0.74%

DAX 11,535.19 -63.82 -0.55%

Crude $52.95 (-1.93%)

Gold $1,181.20 (+0.66%)

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 178 | -0.23(-0.129%) | 200 |

| ALCOA INC. | AA | 30.7 | 0.02(0.0652%) | 4033 |

| ALTRIA GROUP INC. | MO | 68.28 | 0.05(0.0733%) | 1314 |

| Amazon.com Inc., NASDAQ | AMZN | 796.48 | 0.49(0.0616%) | 20147 |

| American Express Co | AXP | 76.1 | 0.63(0.8348%) | 26338 |

| AMERICAN INTERNATIONAL GROUP | AIG | 66.82 | 0.01(0.015%) | 1594 |

| Apple Inc. | AAPL | 118.11 | 0.20(0.1696%) | 130921 |

| AT&T Inc | T | 41.34 | 0.02(0.0484%) | 3188 |

| Barrick Gold Corporation, NYSE | ABX | 17.24 | 0.31(1.8311%) | 98796 |

| Boeing Co | BA | 159.05 | -0.05(-0.0314%) | 416 |

| Caterpillar Inc | CAT | 92.62 | -0.42(-0.4514%) | 4240 |

| Chevron Corp | CVX | 116.36 | -0.48(-0.4108%) | 1005 |

| Cisco Systems Inc | CSCO | 30.29 | 0.06(0.1985%) | 1233 |

| Citigroup Inc., NYSE | C | 60.08 | -0.47(-0.7762%) | 7374 |

| Deere & Company, NYSE | DE | 105.8 | -0.69(-0.6479%) | 690 |

| Exxon Mobil Corp | XOM | 88.26 | -0.24(-0.2712%) | 2814 |

| Facebook, Inc. | FB | 123.47 | 0.06(0.0486%) | 74025 |

| Ford Motor Co. | F | 12.8 | 0.04(0.3135%) | 26810 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 14.79 | -0.11(-0.7383%) | 36704 |

| General Electric Co | GE | 31.63 | 0.02(0.0633%) | 10804 |

| General Motors Company, NYSE | GM | 35.85 | -0.14(-0.389%) | 31567 |

| Goldman Sachs | GS | 243.11 | -1.79(-0.7309%) | 14812 |

| Google Inc. | GOOG | 808 | 1.85(0.2295%) | 4601 |

| Home Depot Inc | HD | 134 | 0.47(0.352%) | 1649 |

| Intel Corp | INTC | 36.55 | 0.07(0.1919%) | 2054 |

| International Business Machines Co... | IBM | 169.37 | -0.16(-0.0944%) | 361 |

| Johnson & Johnson | JNJ | 116.8 | 0.50(0.4299%) | 570 |

| JPMorgan Chase and Co | JPM | 85.68 | -0.44(-0.5109%) | 28451 |

| McDonald's Corp | MCD | 121.09 | 0.33(0.2733%) | 211 |

| Microsoft Corp | MSFT | 62.95 | 0.11(0.175%) | 3971 |

| Nike | NKE | 53.89 | -0.02(-0.0371%) | 9005 |

| Pfizer Inc | PFE | 33.5 | 0.02(0.0597%) | 8029 |

| Procter & Gamble Co | PG | 84.19 | -0.84(-0.9879%) | 34478 |

| Starbucks Corporation, NASDAQ | SBUX | 57.39 | 0.26(0.4551%) | 17699 |

| Tesla Motors, Inc., NASDAQ | TSLA | 228.95 | -0.06(-0.0262%) | 6671 |

| The Coca-Cola Co | KO | 41.25 | -0.49(-1.1739%) | 81072 |

| UnitedHealth Group Inc | UNH | 161.58 | -0.83(-0.5111%) | 1720 |

| Visa | V | 82.2 | -0.01(-0.0122%) | 697 |

| Wal-Mart Stores Inc | WMT | 68.5 | 0.24(0.3516%) | 2310 |

Upgrades:

American Express (AXP) upgraded to Buy from Neutral at BofA/Merrill

Downgrades:

Procter & Gamble (PG) downgraded to Sell from Neutral at Goldman

Coca-Cola (KO) downgraded to Sell from Neutral at Goldman

Other:

Coca-Cola (KO) initiated with an Equal Weight at Barclays

During the first half of today's session the volatility was low and the graph of the WIG20 repeatedly pushed the level of 2,000 points. The Warsaw market today is more powerful than the environment where the German DAX lost approx. 0.6 percent.

At the halfway point of today's quotations the WIG20 index was at the level of 2,001 points (+0,13%) and the turnover in the segment of largest companies was amounted to PLN 273 million.

WIG20 index opened at 1999.15 points (+0.02%)*

WIG 52783.13 0.12%

WIG30 2292.94 0.12%

mWIG40 4233.58 0.24%

*/ - change to previous close

The cash market started the new week from the neutral level, similar like the German DAX. The first transactions brought a slight weakening, however, we still look at the round level of 2,000 points. The turnover in the segment of the largest companies are not large, which may mean that investors have not returned yet after the three-day break.

After fifteen minutes of trading the WIG20 index was at the level of 1,996 points (-0,13%).

Today's session for the Warsaw market will mean the need to adapt to the changes that took place on Friday, when the Warsaw Stock Exchange was not working. On Friday were published data from the US labor market, which were slightly worse than expected, although the positive revisions for November improved sentiment. After the publication slightly strengthened the dollar and increased interest rates on bonds. Slightly cheaper was gold, while oil and copper have reacted rather stable. Stock markets around the world rose a little bit. In the US on Friday, the indices S&P500 and Nasdaq set new highs, but with the rather small increases of 0.35% and 0.6% respectively. The DJIA index rose by 0.3%, but the psychological level of 20,000 points has not been defeated. Today in the morning changes in Asia are rather small and peaceful and quotations of futures on the US indices rise slightly.

From the point of view of the Warsaw Stock Exchange it means rather quiet entry into the new week with a continuous looking at the level of 2,000 points.

In the macro calendar today there is no publication which could have a significant impact on the markets. Today begins the resulting season in the US, after the session Alcoa will give their results.

Modest gains on Wall Street pushed the S&P 500 and Nasdaq Composite to record levels, while the Dow closed a fraction below the closely watched 20,000 level, following a December U.S. jobs report that investors interpreted as generally positive. All three benchmarks posted solid weekly gains, continuing the postelection rally on Wall Street. The U.S. economy created 156,000 jobs last month, below the consensus of 180,000 forecast by the economists polled by MarketWatch. However, sharp upward revisions for November jobs number and a slight trimming of October number means the latest payrolls were more or less in line, according to analysts.

Shares in Asia were broadly higher Monday, catching a further uplift from end-of-week gains in the U.S. The advance also follows strength last week in the region, where the Hang Seng saw its biggest weekly gain in three months and the Shanghai Composite SHCOMP, +0.47% snapped a five-week losing streak.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.