- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 06-11-2015.

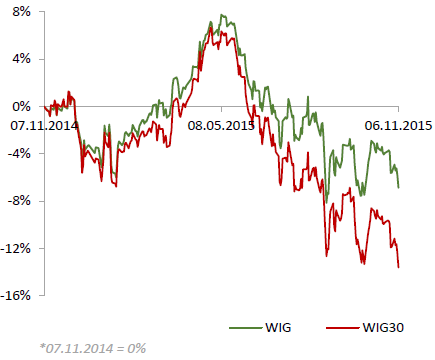

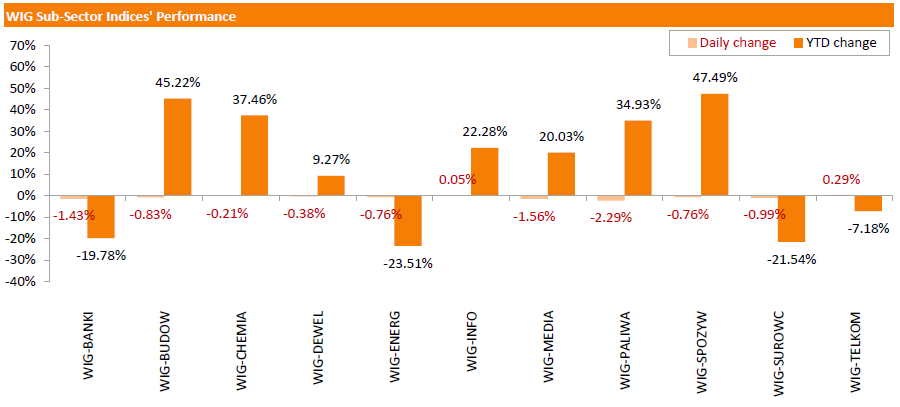

Polish equities declined on Friday. The broad market benchmark, the WIG Index, lost 1.05%. Most sectors fell, with oil and gas sector stocks (-2.29%) posting the sharpest drop.

The large-cap stocks plunged by 1.26%, as measured by the WIG30 Index. Within the index components, CCC (WSE: CCC) and PGNIG (WSE: PGN) were the biggest laggards, plunging by 7.14% and 6.56% respectively after publishing quarterly reports. The former reported Q3 net income of PLN 33.8 mln, beating consensus of PLN 31.1 mln.; the company, however, lowered its full year 2015 expectations. The latter posted Q3 profit of PLN 291 mln versus consensus of PLN 512.7 mln. All banking sector names, but for PKO BP (WSE: PKO; +0.32%) also suffered steep losses, tumbling by 1.09%-4.84% as stronger USD is seen unfavorable for them. At the same time, BOGDANKA (WSE: LWB) and PKP CARGO (WSE: PKP) led a handful of gainers, advancing by 2.58% and 2.11% respectively.

Major U.S. stock-indexes near zero level on Friday after a stronger-than-expected October jobs report boost prospects that the Federal Reserve will raise interest rates next month.

The Labor Department's report showed nonfarm payrolls increased by 271,000 in October, beating the 180,000 expected. Data for August and September were revised to show 12,000 more jobs on average were created than previously reported. The unemployment rate fell to 5.0%, the lowest since April 2008, from 5.1% in September. The jobless rate is now at a level many Fed officials view as consistent with full employment.

Most of Dow stocks in negative area (20 of 30). Top looser - Chevron Corporation (CVX, -2.24%). Top gainer - The Goldman Sachs Group, Inc. (GS, +3.21%).

Most of S&P index sectors in negative area. Top gainer - Conglomerates (+3,2%). Top looser - Utilities (-3.6%).

At the moment:

Dow 17769.00 -33.00 -0.19%

S&P 500 2085.25 -8.75 -0.42%

Nasdaq 100 4693.25 -2.00 -0.04%

Oil 44.58 -0.62 -1.37%

Gold 1086.70 -17.50 -1.58%

U.S. 10yr 2.34 +0.09

U.S. stock-index futures declined.

Global Stocks:

Nikkei 19,265.6 +149.19 +0.78%

Hang Seng 22,867.33 -183.71 -0.80%

Shanghai Composite 3,589.76 +66.94 +1.90%

FTSE 6,355.48 -9.42 -0.15%

CAC 4,951.92 -28.12 -0.56%

DAX 10,923.2 +35.46 +0.33%

Crude oil $45.29 (+0.20%)

Gold $1093.60 (-0.96%)

(company / ticker / price / change, % / volume)

| JPMorgan Chase and Co | JPM | 68.00 | 2.35% | 62.7K |

| Citigroup Inc., NYSE | C | 55.30 | 2.12% | 1.2K |

| Goldman Sachs | GS | 195.40 | 1.76% | 0.1K |

| AMERICAN INTERNATIONAL GROUP | AIG | 62.84 | 1.35% | 1.1K |

| International Business Machines Co... | IBM | 139.49 | 0.65% | 0.3K |

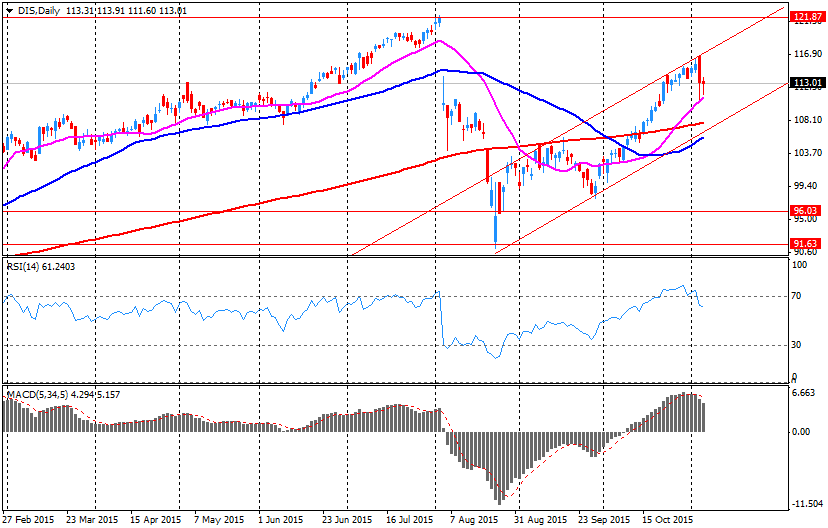

| Walt Disney Co | DIS | 113.65 | 0.58% | 31.5K |

| Travelers Companies Inc | TRV | 114.54 | 0.50% | 1K |

| Apple Inc. | AAPL | 121.48 | 0.46% | 120.3K |

| American Express Co | AXP | 74.10 | 0.23% | 1.4K |

| Facebook, Inc. | FB | 109.00 | 0.22% | 10.5K |

| Nike | NKE | 132.04 | 0.14% | 2.3K |

| Twitter, Inc., NYSE | TWTR | 28.70 | 0.14% | 12.7K |

| Wal-Mart Stores Inc | WMT | 58.68 | 0.12% | 0.5K |

| Visa | V | 79.30 | 0.05% | 0.1K |

| Amazon.com Inc., NASDAQ | AMZN | 656.00 | 0.05% | 13.5K |

| Cisco Systems Inc | CSCO | 28.44 | 0.04% | 0.5K |

| Microsoft Corp | MSFT | 54.40 | 0.04% | 1.1K |

| 3M Co | MMM | 158.99 | 0.00% | 37.0K |

| Pfizer Inc | PFE | 34.15 | 0.00% | 0.1K |

| ALCOA INC. | AA | 9.20 | 0.00% | 3.9K |

| Starbucks Corporation, NASDAQ | SBUX | 62.28 | 0.00% | 3.3K |

| E. I. du Pont de Nemours and Co | DD | 64.79 | -0.03% | 0.2K |

| Chevron Corp | CVX | 94.50 | -0.05% | 6.9K |

| Ford Motor Co. | F | 14.56 | -0.07% | 4.4K |

| Procter & Gamble Co | PG | 76.33 | -0.08% | 2.2K |

| Caterpillar Inc | CAT | 74.15 | -0.09% | 0.2K |

| Verizon Communications Inc | VZ | 46.15 | -0.11% | 0.1K |

| AT&T Inc | T | 33.30 | -0.12% | 2.8K |

| Home Depot Inc | HD | 125.57 | -0.12% | 0.1K |

| McDonald's Corp | MCD | 112.72 | -0.12% | 8.1K |

| Boeing Co | BA | 147.78 | -0.13% | 0.2K |

| General Electric Co | GE | 29.59 | -0.17% | 12.3K |

| Exxon Mobil Corp | XOM | 84.62 | -0.22% | 6.5K |

| Merck & Co Inc | MRK | 54.90 | -0.27% | 7.2K |

| Intel Corp | INTC | 33.90 | -0.29% | 2.0K |

| UnitedHealth Group Inc | UNH | 115.89 | -0.29% | 0.8K |

| Google Inc. | GOOG | 729.14 | -0.29% | 8.2K |

| General Motors Company, NYSE | GM | 35.33 | -0.31% | 1.8K |

| Johnson & Johnson | JNJ | 102.00 | -0.32% | 0.1K |

| Yandex N.V., NASDAQ | YNDX | 15.69 | -0.32% | 0.5K |

| Tesla Motors, Inc., NASDAQ | TSLA | 231.00 | -0.33% | 1.6K |

| Yahoo! Inc., NASDAQ | YHOO | 35.00 | -0.34% | 16.2K |

| The Coca-Cola Co | KO | 42.12 | -0.50% | 1.1K |

| ALTRIA GROUP INC. | MO | 57.70 | -0.60% | 1.8K |

| United Technologies Corp | UTX | 100.02 | -0.77% | 0.1K |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11.35 | -1.13% | 0.5K |

| Barrick Gold Corporation, NYSE | ABX | 7.05 | -4.21% | 3.1K |

Upgrades:

Downgrades:

Other:

Facebook (FB) target raised to $130 from $115 at Argus

HP Inc. (HPQ) initiated with a Buy at Brean Capital

U.S. stock indices edged lower on Thursday as investors were cautious ahead of a key jobs report, which could determine the Federal Reserve's decision at the next meeting.

The Dow Jones Industrial Average slid 4.15 points, or less than 0.1%, to 17,863.43. The S&P 500 lost 2.38 points, or 0.1%, to 2,099.93 (seven out of its 10 sectors fell with energy, utilities and materials leading declines). The Nasdaq Composite fell 14.74 points, or 0.3%, to 5,127.74.

According to the Labor Department the number of Americans who applied for unemployment benefits rose by 16,000 to 276,000 at the end of October marking the highest level in two months. Economists had expected 262,000 claims.

This morning in Asia Hong Kong Hang Seng fell 0.82%, or 189.84, to 22,861.2. China Shanghai Composite Index gained 0.52%, or 18.20, to 3.541.02. The Nikkei 225 rose 0.43%, or 81.53, to 19,197.94.

Asian indices are mixed. Japanese stocks rose due to a relatively weaker yen ahead of U.S. employment data. Recent comments by Fed officials intensified expectations for a rate hike in December pushing the dollar up against the yen.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.