- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 10-11-2015.

U.S. stocks ended slightly higher as an increase in consumer stocks offset losses among materials producers including Freeport-McMoRan Inc. The dollar climbed to a six-month high against the euro, while Treasuries rose for the first time in seven days. Developing-country shares extended their losses since Friday's U.S. jobs report, which fueled speculation the Federal Reserve is preparing to raise interest rates next month. Base metals slipped as weak Chinese prices data reignited concern over the slowdown there.

Chinese consumer inflation waned in October, signaling policy makers may need to boost stimulus to ease deflationary pressures amid slackening growth. With China the world's biggest commodities consumer and Asia's largest economy, a surprise devaluation of the yuan in August spurred a rout in global financial markets and contributed to the Fed's decision to keep rates near zero in September. Renewed evidence of weakness abroad may limit the Fed's scope to tighten policy as the global economy remains fragile.

The S&P 500 rose 0.2 percent to 2,081.72 by 4 p.m. in New York after a four-day slide erased 1.5 percent. The index fell within 10 points of its average price for the past 200 days before erasing that decline. It hasn't fallen below that key technical level in two weeks.

Apple Inc. lost 3.2 percent with iPhone component orders recently down by as much as 10 percent, according to Credit Suisse Group AG. The firm attributed the drop to weak demand for the current model, the iPhone 6s.

Mining stocks were the biggest decliners on the S&P 500 amid mounting evidence of the slowdown in China. Natural resources company Freeport-McMoRan lost 6.3 percent for the second-biggest drop in the S&P 500. Anadarko Petroleum Corp. slid the most, falling 6.6 percent after it was said to have approached Apache Corp. with a takeover offer.

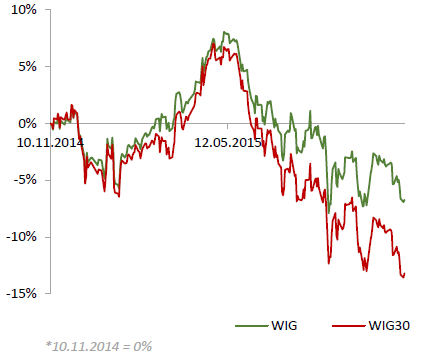

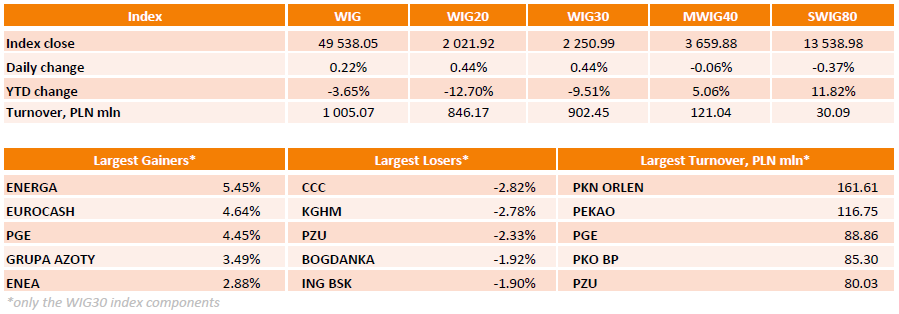

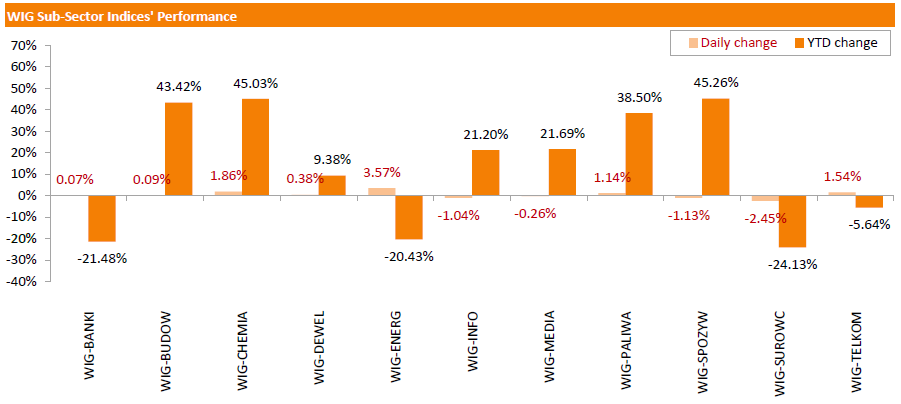

Polish equity market closed higher on Tuesday. The broad market measure, the WIG Index, rose by 0.22%. Sector-wise, utilities (+3.57%) performed best, while materials (-2.45%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, added 0.44%. Within the indicator's components, ENERGA (WSE: ENG) was the biggest advancer, jumping by 5.45%. EUROCASH (WSE: EUR) and PGE (WSE; PGE) also produced noticeable gains, up 4.64% and 4.45% respectively, supported by better-than-expected Q3 profits. The former reported Q3 net income of PLN 70.1 mln versus consensus of PLN 67.6 mln, while the latter posted Q3 profit of PLN 1029 mln versus consensus of PLN 1008 mln. Other major gainers were GRUPA AZOTY (WSE: ATT), ENEA (WSE: ENA) and LOTOS (WSE: LTS), surging by 3.49%, 2.88% and 2.87% respectively. On the other side of the ledger, CCC (WSE: CCC) and KGHM (WSE: KGH) were the worst-performing names, tumbling by 2.82% and 2.78% respectively. They were followed by PZU (WSE: PZU), slumping 2.33% as the company reported Q3 profit of PLN 510.9 mln (-39% y/y), whereas the analysts expected PLN 525.9 mln.

On 11 November Poland celebrates the National Independence Day. The Warsaw Stock Exchange will be closed for trading.

Stock indices closed mixed on the weak Chinese consumer inflation data. The Chinese National Bureau of Statistics released its consumer and producer price inflation data for China on Tuesday. The Chinese consumer price index (CPI) rose at annual rate of 1.3% in October, missing expectations for a 1.5% increase, after a 1.6% gain in September. The Chinese producer price index (PPI) dropped 5.9% in October, missing expectations for a 5.8% fall, after a 5.9% decline in September.

European Central Bank (ECB) Governing Council member Erkki Liikanen said on Tuesday that there are downside risks to the Eurozone's inflation and growth outlook, adding that the central bank is ready to act.

"The growth and inflation outlook is still subject to downside risks," he said.

"The Governing Council is willing and able to act by using all the instruments available within its mandate if warranted in order to maintain an appropriate degree of monetary accommodation," Liikanen noted.

Meanwhile, the economic data from the Eurozone was positive. The French statistical office Insee its industrial production figures on Tuesday. Industrial production in France rose 0.1% in September, exceeding expectations for a flat reading, after a 1.7% gain in August. August's figure was revised up from a 1.6% increase.

Manufacturing output was flat in September, while construction output slid 1.7%.

Output in mining and quarrying, energy, water supply and waste management increased 0.7% in September.

On a yearly basis, the French industrial production dropped 1.0% in September, after a 0.6% gain in August.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,275.28 -19.88 -0.32 %

DAX 10,832.52 +17.07 +0.16 %

CAC 40 4,912.16 +0.99 +0.02 %

The National Federation of Independent Business (NFIB) released its small-business optimism index for the U.S. on Tuesday. The index remained unchanged at 96.1 in October.

5 of 10 subindexes rose last month, three fell, while two were unchanged.

"The labour market components might have held at historically strong levels but this time owners reported no net growth in employment, which is a significant drop from reports in the previous four months," NFIB Chief Economist Bill Dunkelberg said.

Major U.S. stock-indexes lower on Tuesday, dragged down by Apple, as investors worried about China's economic health and braced for an interest rate hike by the Federal Reserve next month. Apple's shares (AAPL) fell 2.5 percent after Credit Suisse said the iPhone maker had lowered component orders by as much as 10%. The stock was the biggest drag on the three major indexes. The report on Apple added to fears of a slowdown in global growth, especially in China, a key market for many U.S. companies including Apple, ahead of the crucial holiday shopping season.

Most of Dow stocks in negative area (18 of 30). Top looser - Apple Inc. (AAPL, -2.53%). Top gainer - Visa Inc. (V, +0.94%).

Most of S&P index sectors also in negative area. Top looser Basic Materials (-1.0%). Top gainer - Utilities (+0,5%).

At the moment:

Dow 17626.00 -49.00 -0.28%

S&P 500 2067.50 -5.50 -0.27%

Nasdaq 100 4621.25 -31.50 -0.68%

Oil 44.32 +0.45 +1.03%

Gold 1087.30 -0.80 -0.07%

U.S. 10yr 2.33 -0.01

The U.S. Commerce Department released wholesale inventories on Tuesday. Wholesale inventories in the U.S. rose 0.5% in September, beating expectations for a flat reading, after a 0.3% increase in August. August's figure was revised up from a 0.1% gain.

The increase was mainly driven by a rise in inventories of non-durable goods. Inventories of non-durable goods increased 1.9% in September as farm products jumped 6.7%, while inventories of durable goods fell 0.4%.

Wholesale sales climbed by 0.5% in September, after a 0.9% decrease in August.

The U.S. Labor Department released its import and export prices data on Tuesday. The U.S. import price index fell by 0.5% in October, missing expectations for a 0.1% decrease, after a 0.6% decline in September. September's figure was revised down from a 0.1% drop.

The decline was mainly driven by lower prices for fuel imports.

A stronger U.S. currency lowers the price of imported goods.

U.S. export prices declined by 0.2% in October, after a 0.6% fall in September.

U.S. stock-index futures were little changed.

Global Stocks:

Nikkei 19,671.26 +28.52 +0.15%

Hang Seng 22,401.7 -325.07 -1.43%

Shanghai Composite 3,642.46 -4.42 -0.12%

FTSE 6,282.19 -12.97 -0.21%

CAC 4,906.48 -4.69 -0.10%

DAX 10,828.38 +12.93 +0.12%

Crude oil $44.18 (+0.71%)

Gold $1088.00 (-0.01%)

(company / ticker / price / change, % / volume)

| Merck & Co Inc | MRK | 54.49 | 0.46% | 2.6K |

| Caterpillar Inc | CAT | 72.08 | 0.26% | 3.0K |

| Visa | V | 78.05 | 0.19% | 9.1K |

| FedEx Corporation, NYSE | FDX | 160.85 | 0.19% | 0.2K |

| Pfizer Inc | PFE | 33.7 | 0.15% | 4.5K |

| International Business Machines Co... | IBM | 135.5 | 0.14% | 0.9K |

| ALCOA INC. | AA | 8.62 | 0.12% | 4.2K |

| Chevron Corp | CVX | 92.4 | 0.09% | 13.6K |

| Exxon Mobil Corp | XOM | 81.99 | 0.05% | 1.2K |

| Johnson & Johnson | JNJ | 100.86 | 0.02% | 1.4K |

| Verizon Communications Inc | VZ | 45.3 | 0.00% | 4.0K |

| United Technologies Corp | UTX | 99.01 | -0.01% | 0.2K |

| E. I. du Pont de Nemours and Co | DD | 66.38 | -0.02% | 0.8K |

| AT&T Inc | T | 32.83 | -0.03% | 3.6K |

| Walt Disney Co | DIS | 116.38 | -0.03% | 10.0K |

| General Motors Company, NYSE | GM | 35.66 | -0.03% | 39.7K |

| Procter & Gamble Co | PG | 75.35 | -0.07% | 8.0K |

| Goldman Sachs | GS | 196.6 | -0.08% | 11.0K |

| JPMorgan Chase and Co | JPM | 67.33 | -0.09% | 6.0K |

| Microsoft Corp | MSFT | 54.1 | -0.11% | 13.4K |

| Hewlett-Packard Co. | HPQ | 13.85 | -0.14% | 1.5K |

| Citigroup Inc., NYSE | C | 55.6 | -0.20% | 8.2K |

| Intel Corp | INTC | 33.28 | -0.21% | 0.1K |

| Yahoo! Inc., NASDAQ | YHOO | 33.61 | -0.21% | 0.2K |

| McDonald's Corp | MCD | 112.65 | -0.25% | 0.5K |

| Cisco Systems Inc | CSCO | 28.1 | -0.27% | 0.6K |

| Ford Motor Co. | F | 14.29 | -0.28% | 1.8K |

| American Express Co | AXP | 73.2 | -0.30% | 60.7K |

| Wal-Mart Stores Inc | WMT | 58.31 | -0.31% | 0.4K |

| Boeing Co | BA | 145.5 | -0.33% | 0.1K |

| Facebook, Inc. | FB | 106.14 | -0.33% | 34.6K |

| Amazon.com Inc., NASDAQ | AMZN | 653.29 | -0.34% | 3.7K |

| Google Inc. | GOOG | 722.27 | -0.36% | 1.2K |

| 3M Co | MMM | 156.8 | -0.43% | 0.1K |

| Starbucks Corporation, NASDAQ | SBUX | 61.06 | -0.46% | 1.7K |

| General Electric Co | GE | 29.61 | -0.47% | 43.1K |

| Yandex N.V., NASDAQ | YNDX | 15.98 | -0.56% | 4.9K |

| Twitter, Inc., NYSE | TWTR | 26.88 | -0.78% | 26.0K |

| Tesla Motors, Inc., NASDAQ | TSLA | 223.55 | -0.79% | 3.2K |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 10.4 | -0.86% | 6.1K |

| Barrick Gold Corporation, NYSE | ABX | 7.28 | -1.09% | 6.0K |

| Apple Inc. | AAPL | 117.78 | -2.31% | 682.2K |

Upgrades:

Downgrades:

Other:

Microsoft (MSFT) target raised to $64 from $53 at Piper Jaffray

The National Australia Bank (NAB) released its business confidence index for Australia on Tuesday. The index fell to 2 points in October from 5 points in September.

"Business confidence remains somewhat fickle, despite persistent strength in business conditions," the NAB said.

The main business conditions index remained unchanged at 9 points in October, while employment remained unchanged at 3 points.

The Australian Bureau of Statistics released its home loans data on Tuesday. Home loans in Australia increased 2.0% in September, exceeding expectations for a flat reading, after 1.5% rise in August. August's figure was revised down from 2.9% gain.

The value of home loans slid at a seasonally adjusted 1.6% in September, investment lending dropped 8.5%, while the number of loans for the construction of dwellings rose 1.9%.

Stock indices traded lower on the weak Chinese consumer inflation data. The Chinese National Bureau of Statistics released its consumer and producer price inflation data for China on Tuesday. The Chinese consumer price index (CPI) rose at annual rate of 1.3% in October, missing expectations for a 1.5% increase, after a 1.6% gain in September. The Chinese producer price index (PPI) dropped 5.9% in October, missing expectations for a 5.8% fall, after a 5.9% decline in September.

Meanwhile, the economic data from the Eurozone was positive. The French statistical office Insee its industrial production figures on Tuesday. Industrial production in France rose 0.1% in September, exceeding expectations for a flat reading, after a 1.7% gain in August. August's figure was revised up from a 1.6% increase.

Manufacturing output was flat in September, while construction output slid 1.7%.

Output in mining and quarrying, energy, water supply and waste management increased 0.7% in September.

On a yearly basis, the French industrial production dropped 1.0% in September, after a 0.6% gain in August.

Current figures:

Name Price Change Change %

FTSE 100 6,271.34 -23.82 -0.38 %

DAX 10,764.39 -51.06 -0.47 %

CAC 40 4,891.36 -19.81 -0.40 %

The Hellenic Statistical Authority released its consumer price inflation data for Greece on Monday. Greek consumer prices decreased 0.1% in October, after the 0.8% drop in September.

On a yearly basis, the Greek consumer price index declined 0.9% in October, after a 1.7 fall in September. Consumer prices in Greece declined since March 2013.

Housing prices plunged at an annual rate of 5.4% in October, transport costs dropped by 0.5%, clothing and footwear prices declined 1.7%, while household equipment prices were down 1.5%.

Prices of food and non-alcoholic beverages decreased at an annual rate of 1.1% in October, while alcoholic beverages and tobacco prices climbed by 2.0%.

European Central Bank (ECB) Governing Council member Erkki Liikanen said on Tuesday that there are downside risks to the Eurozone's inflation and growth outlook, adding that the central bank is ready to act.

"The growth and inflation outlook is still subject to downside risks," he said.

"The Governing Council is willing and able to act by using all the instruments available within its mandate if warranted in order to maintain an appropriate degree of monetary accommodation," Liikanen noted.

The Italian statistical office Istat released its industrial production data on Tuesday. Industrial production in Italy increased at a seasonally-adjusted rate of 0.2% in September, after a 0.5% fall in August.

On a yearly basis, industrial production in Italy jumped at a seasonally-adjusted rate of 1.7% in September, after a 1.0% increase in August.

The French statistical office Insee its industrial production figures on Tuesday. Industrial production in France rose 0.1% in September, exceeding expectations for a flat reading, after a 1.7% gain in August. August's figure was revised up from a 1.6% increase.

Manufacturing output was flat in September, while construction output slid 1.7%.

Output in mining and quarrying, energy, water supply and waste management increased 0.7% in September.

On a yearly basis, the French industrial production dropped 1.0% in September, after a 0.6% gain in August.

The Swiss State Secretariat for Economic Affairs released its unemployment data for Switzerland on Thursday. The Swiss unemployment rate remained at a seasonally adjusted 3.4% in October.

On a seasonally unadjusted basis, the unemployment rate in Switzerland increased to 3.3 in October from 3.2% in September, in line with expectations.

The number of unemployed people in Switzerland rose by 3,043 to 141,269 in October from a month earlier.

The youth unemployment rate was down to 3.5% from 3.7% in September.

Japan's Cabinet Office released Eco Watchers' Index figures on Wednesday. Japan's economy watchers' current conditions index climbed to 48.2 in October from 47.5 in September, in line with expectations.

Japan's economy watchers' future conditions index remained unchanged at 49.1 in October.

A reading above 50 indicates optimism, while a reading below 50 indicates pessimism.

Japan's Ministry of Finance released its current account data for Japan late Tuesday evening. Japan's current account surplus fell to ¥1,468.4 billion in September from ¥1,653.1 billion in August, missing expectations for a surplus of ¥2,235.2 billion.

Japan benefits from a weaker yen, which supports income from overseas investments.

The goods trade deficit turned into a surplus of ¥82.3 billion in September from a deficit of ¥326.1 billion in August.

Exports rose at an annual rate of 2.8% in September, while imports dropped 7.4%.

The Chinese National Bureau of Statistics released its consumer and producer price inflation data for China on Tuesday. The Chinese consumer price index (CPI) rose at annual rate of 1.3% in October, missing expectations for a 1.5% increase, after a 1.6% gain in September.

Food prices rose at an annual rate of 1.9% in October, while non-food prices increased 0.9%.

On a monthly basis, consumer price inflation decreased 0.3% in October, after a 0.1% rise in September.

The Chinese producer price index (PPI) dropped 5.9% in October, missing expectations for a 5.8% fall, after a 5.9% decline in September.

The Conference Board released its Employment Trends Index (ETI) for the U.S on Monday. The index rose to 129.48 in October from 128.65 in September.

Six of the eight components increased.

"The Employment Trends Index continues to show solid and broad-based gains, with no significant slowdown in job growth expected through the first quarter of 2016. Solid job growth and the lack of recovery in labour-force participation suggest that the unemployment rate may dip below 4.5 percent by this time next year," Managing Director of Macroeconomic and Labour Market Research at The Conference Board, said Gad Levanon.

The Eurogroup decided on Monday not to transfer €2 billion to Greece as the Greek government has not fulfilled agreed obligations. Eurogroup President Jeroen Dijsselbloem said that Greek Finance Minister Euclid Tsakalotos claimed that Greece and its lenders will reach an agreement within this week.

"The 2 billion will only be paid out once the institutions give the green light and say that all agreed actions have been carried out and have been implemented. That still has not happened," Dijsselbloem noted ahead of the meeting.

Boston Fed President Eric Rosengren said on Monday that if there is a significant improvement in the U.S. economy, the Fed should start raising its interest rate.

"If we see continued gradual improvement in the U.S. economy, it will be appropriate to gradually increase short-term rates," he said.

Rosengren hinted the possible interest rate hike in December.

"I would highlight that the data received recently have been positive, reflecting real improvement for the economy," Boston Fed president noted.

He added that December "could be an appropriate time for raising rates, as long as the economy continues to improve as expected".

On Monday U.S. stock indices posted their biggest decline in six weeks amid Chinese trade data and a revised global growth forecast.

The Dow Jones Industrial Average fell 179.85 points, or 1%, to 17,730.48. The S&P 500 lost 20.60 points, or 1%, to 2,078.60 (9 out of its 10 sectors declined). The Nasdaq Composite fell 51.82 points, or 1%, to 5,095.30.

The Organization for Economic Co-operation and Development cut its global economic growth forecast citing weakness in China and other emerging markets. The 2015 forecast was lowered to 2.9% from 3% and the next year forecast was cut to 3.3% from 3.6%.

Sources reported that Chinese imports and exports fell in October leaving the country a record trade surplus.

This morning in Asia Hong Kong Hang Seng dropped 1.31%, or 297.07, to 22,429.70. China Shanghai Composite Index edged down 0.14%, or 4.94, to 3.641.94. The Nikkei 225 climbed 0.13%, or 24.87, to 19,667.61.

Asian indices mostly slid following declines in U.S. stocks.

Chinese consumer price index rose by 1.3% y/y in October after a 1.6% increase in September. Economists had expected a 1.5% reading. A decline in inflation growth pace suggests that domestic demand remains weak. Food prices are among major negative contributors.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.