- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 12-11-2015.

Stocks in the U.S. fell as comments from Federal Reserve officials reinforced the view that interest rates will rise this year, even as concerns that a global economic slowdown may spread rekindled a selloff in commodities.

The Standard & Poor's 500 Index tumbled through its average price for the past 200 days as resource producers retreated. Copper fell to the lowest level since 2009 and oil slid through $42 a barrel as the Bloomberg Commodity Index sank to the lowest since 1999. European equities slid as the outlook for earnings worsened even as Mario Draghi hinted at adding stimulus.

Divergent signals on monetary policy continued to dominate financial markets, as Fed officials reiterated the case for higher interest rates at their December policy meeting. The European Central Bank president's comments boosted bonds and weakened the euro. A mixed picture on China's economy did little to alleviate concern that demand for resources would continue to wane.

U.S. equities accelerated losses after normally dovish New York Fed President William Dudley said the central bank may need to begin tightening. Fed President James Bullard of St. Louis earlier urged raising target rates, while Chicago Fed leader Charles Evans stressed any increases should be "gradual." Draghi said in Brussels that downside economic risks are "clearly visible" and policy makers will reexamine the degree of accommodation in December.

The S&P 500 dropped 1 percent at 3:18 p.m. in New York, sliding below its 200-day moving average for the first time in two weeks. The gauge has advanced just once in the seven sessions since Yellen reminded investors that December's meeting could bring the first rate increase in six years. The index has failed to hold gains after rising within 1 percent of its all-time high on Nov. 3.

Major U.S. stock-indexes lower on Thursday as a fall in commodity prices weighed on energy and materials stocks and investors studied comments by several Federal Reserve policymakers for clues on a widely-expected interest rate hike next month.

Crude oil prices hit Aug lows, while copper and other metal prices tumbled to more than six-year lows, weighed down by a strong dollar, weak Chinese data and concerns about oversupply.

Investors are also keeping a watchful eye on whether the Fed will raise interest rates off near-zero levels in December, a possibility Fed Chain Janet Yellen alluded to last week. Yellen said on Thursday the Fed must weigh impact of the new financial market landscape, but did not comment on the economy or the timing of a rate hike.

Most of Dow stocks in negative area (28 of 30). Top looser - Caterpillar Inc. (CAT, -3.32%). Top gainer - United Technologies Corporation (UTX +0.99%).

All S&P index sectors also fell. Top looser - Conglomerates (-2.3%).

At the moment:

Dow 17441.00 -214.00 -1.21%

S&P 500 2049.75 -19.25 -0.93%

Nasdaq 100 4612.00 -19.75 -0.43%

Oil 41.73 -1.20 -2.80%

Gold 1079.80 -5.10 -0.47%

U.S. 10yr 2.31 -0.03

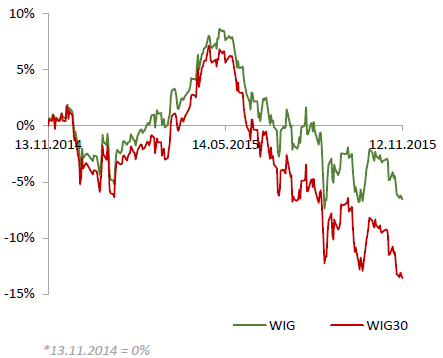

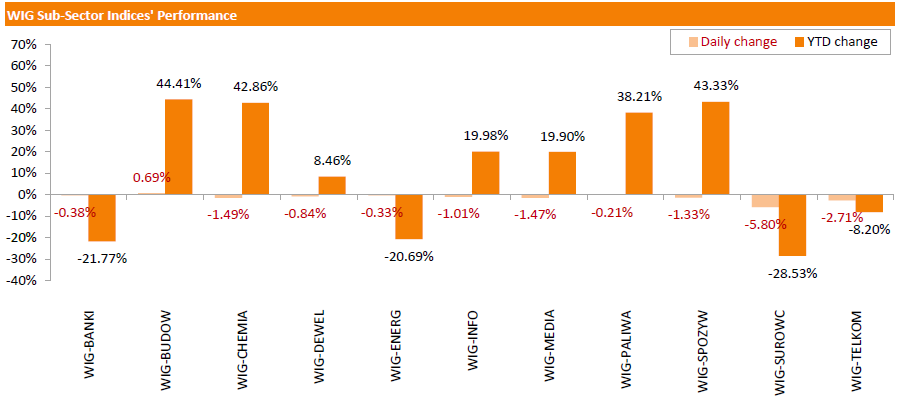

Polish equities shed on Thursday. The broad market measure, the WIG Index, fell by 0.36%. Construction sector (+0.69%) was the sole advancer among the WIG's 11 industry groups. At the same time, the materials (-5.80%) posed the biggest decline.

The large-cap stocks' measure, the WIG30 Index, dropped by 0.55%. In the index basket, KGHM (WSE: KGH) was the poorest performer, slumping 6.27% as copper prices skidded to a six-year low. It was followed by GRUPA AZOTY (WSE: ATT) and ENERGA (WSE: ENG), retreating by 4.28% and 3.43% respectively after recent gains. On the plus side, CCC (WSE: CCC) posted the best gains, up 2.56%, on news the stock will replace BOGDANKA (WSE: LWB; -1.54%) in the WIG20 Index. Other noticeable gainers included PKP CARGO (WSE: PKP), HANDLOWY (WSE: BHW) and PZU (WSE: PZU), adding 2.38%, 1.79% and 1.65% respectively.

Stock indices closed lower as oil prices dropped on the U.S. crude oil inventories data.

The European Central Bank (ECB) President Mario Draghi testified before the European parliament's Economic and Monetary Affairs Committee on Thursday. Draghi said that the central bank will review its monetary policy at its next meeting in December.

Regarding current economic outlook, he said that the Eurozone's economy recovered moderately, while the central bank's monetary policy and low energy prices supported consumption.

But there are downside risks to the growth and inflation outlook from the slowdown in the global economy and from a drop in oil prices, the ECB president added.

Meanwhile, the economic data from the Eurozone was mixed. Eurostat released its industrial production data for the Eurozone on Thursday. Industrial production in the Eurozone declined 0.3% in September, missing expectations for a 0.1% decrease, after a 0.4% fall in August. August's figure was revised up from a 0.5% drop.

The decrease was driven by declines in durable consumer goods, non-durable consumer goods and capital output. Durable consumer goods output dropped 3.9% in September, non-durable consumer goods were down 1.0%, while capital goods output fell by 0.3%.

Intermediate goods output was flat in September, while energy output climbed 1.2%.

On a yearly basis, Eurozone's industrial production gained 1.7% in September, exceeding expectations for a 1.3% rise, after a 2.2% increase in August. August's figure was revised up from a 0.9% gain.

The increase was driven by rises in durable and non-durable consumer goods, intermediate goods output and capital goods. Durable consumer goods climbed by 2.6% in September from a year ago, capital goods rose by 2.2%, intermediate goods output increased by 1.8%, while non-durable consumer goods gained by 2.1%.

Energy output was down by 1.4% in September from a year ago.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,178.68 -118.52 -1.88 %

DAX 10,782.63 -125.24 -1.15 %

CAC 40 4,856.65 -95.86 -1.94 %

The International Monetary Fund (IMF) said in a report on Thursday that the Fed should not start raising its interest rates before inflation in the U.S. will not begin to pick up toward the Fed's 2% target.

"The main near-term policy question is the appropriate timing and pace of monetary policy normalization. The Federal Open Market Committee's (FOMC) decision should remain data-dependent, with the first increase in the federal funds rate waiting until continued strength in the labour market is accompanied by firm signs of inflation rising steadily toward the Federal Reserve's 2 percent medium-term inflation objective," the IMF said.

Chicago Fed President Charles Evans said in a speech on Thursday that he wants to be confident that inflation begins to pick up toward the Fed's target before to start raising interest rates.

"Before raising rates, I would like to have more confidence than I do today that inflation is indeed beginning to head higher. Given the current low level of core inflation, some evidence of true upward momentum in actual inflation is critical to this assessment," he said.

"I believe that it could well be the middle of next year before the headwinds from lower energy prices and the stronger dollar dissipate enough so that we begin to see some sustained upward movement in core inflation," Evans added.

Chicago Fed president pointed out that the Fed should hike its interest rate gradually.

Evans is a voting member of the Federal Open Market Committee this year.

St. Louis Fed President James Bullard said in a speech on Thursday that the Fed should start raising its interest rate as the Fed's targets are reached.

"During 2015, I have been an advocate of beginning to normalize the policy rate in the U.S. My arguments have focused on the idea that the U.S. economy is quite close to normal today based on an unemployment rate of 5 percent, which is essentially at the Committee's estimate of the long‐run rate, and inflation net of the 2014 oil price shock only slightly below the Committee's target," he said.

"My current policy views have not changed," Bullard added.

He pointed out that the Fed's monetary policy should be changed if interest rate and inflation will remain low.

"Should we find ourselves in a persistent state of low nominal interest rates and low inflation, some of our fundamental assumptions about how U.S. monetary policy works may have to be altered," St. Louis Fed president noted.

The U.S. Bureau of Labor Statistics released its Job Openings and Labor Turnover Survey (JOLTS) report on Thursday. Job openings climbed to 5.526 million in September from 5.377 million in August. August's figure was revised up from 5.370 million.

The number of job openings rose for total private (5.020 million) and for government (506,000) in September.

The hires rate was 3.5% in September.

Total separations declined to 4.839 million in September from 4.886 million in August.

The JOLTS report is one of the Federal Reserve Chair Janet Yellen's favourite labour market indicators.

Fitch Ratings said on Wednesday that it could downgrade Portugal's credit rating if the opposition will form new government.

"Fiscal relaxation resulting in a less favourable trajectory in government debt/GDP levels could lead to negative rating action, as could weaker growth that had a negative effect on public finances," the agency said.

Portugal's credit rating is 'BB+'. The outlook is Positive.

Prime Minister Pedro Passos Coelho's minority government lost a confidence vote on Tuesday.

"The defeat of Portugal's minority government highlights the political instability created by October's elections and the resulting risks to fiscal consolidation and reform implementation. The extent of these risks will depend on any new government's cohesiveness, its policy programme, and whether political uncertainty damages economic and financial market confidence," Fitch said.

U.S. stock-index futures fell ahead of a busy day for Federal Reserve watchers.

Global Stocks:

Nikkei 19,697.77 +6.38 +0.03%

Hang Seng 22,888.92 +536.75 +2.40%

Shanghai Composite 3,633.67 -16.58 -0.45%

FTSE 6,231.87 -65.33 -1.04%

CAC 4,880.83 -71.68 -1.45%

DAX 10,815.44 -92.43 -0.85%

Crude oil $42.33 (-1.33%)

Gold $1080.40 (-0.41%)

Statistics Canada released its new housing price index on Thursday. New housing price index in Canada rose 0.1% in September, missing expectations of a 0.2% gain, after a 0.3% rise in August.

The increase was driven by gains in Toronto region and Vancouver. New home prices in Toronto and Oshawa region rose 0.2% in September, while new home prices in Vancouver climbed 0.4%.

On a yearly basis, new housing price index in Canada climbed 5.6% in September, after a 1.3% gain in August.

(company / ticker / price / change, % / volume)

| United Technologies Corp | UTX | 98.81 | 0.56% | 2.2K |

| General Motors Company, NYSE | GM | 35.69 | 0.38% | 0.3K |

| Wal-Mart Stores Inc | WMT | 57.75 | 0.30% | 9.0K |

| Starbucks Corporation, NASDAQ | SBUX | 61.91 | 0.06% | 0.9K |

| Merck & Co Inc | MRK | 53.73 | 0.02% | 1.1K |

| McDonald's Corp | MCD | 113.85 | 0.00% | 1.5K |

| AT&T Inc | T | 32.90 | -0.06% | 1.3K |

| Ford Motor Co. | F | 14.30 | -0.07% | 1.5K |

| American Express Co | AXP | 72.82 | -0.12% | 0.7K |

| Yandex N.V., NASDAQ | YNDX | 15.91 | -0.13% | 4.6K |

| Cisco Systems Inc | CSCO | 27.78 | -0.14% | 48.4K |

| Hewlett-Packard Co. | HPQ | 13.90 | -0.14% | 0.6K |

| Microsoft Corp | MSFT | 53.57 | -0.15% | 4.3K |

| Intel Corp | INTC | 32.80 | -0.18% | 3.1K |

| Deere & Company, NYSE | DE | 74.91 | -0.19% | 0.1K |

| Nike | NKE | 127.15 | -0.21% | 1.1K |

| Apple Inc. | AAPL | 115.85 | -0.22% | 50.8K |

| Amazon.com Inc., NASDAQ | AMZN | 671.70 | -0.23% | 28.4K |

| Procter & Gamble Co | PG | 75.75 | -0.28% | 0.7K |

| AMERICAN INTERNATIONAL GROUP | AIG | 60.44 | -0.38% | 0.9K |

| Goldman Sachs | GS | 196.63 | -0.39% | 0.8K |

| JPMorgan Chase and Co | JPM | 67.06 | -0.43% | 0.6K |

| Verizon Communications Inc | VZ | 45.12 | -0.44% | 0.5K |

| Walt Disney Co | DIS | 116.00 | -0.45% | 4.6K |

| Citigroup Inc., NYSE | C | 54.64 | -0.47% | 0.9K |

| Tesla Motors, Inc., NASDAQ | TSLA | 218.00 | -0.49% | 2.5K |

| International Business Machines Co... | IBM | 134.30 | -0.53% | 0.3K |

| Facebook, Inc. | FB | 108.43 | -0.53% | 36.7K |

| Visa | V | 78.75 | -0.54% | 0.2K |

| General Electric Co | GE | 30.49 | -0.59% | 62.8K |

| Yahoo! Inc., NASDAQ | YHOO | 33.16 | -0.66% | 2.2K |

| Twitter, Inc., NYSE | TWTR | 26.30 | -0.75% | 33.1K |

| Exxon Mobil Corp | XOM | 81.00 | -0.76% | 3.0K |

| Caterpillar Inc | CAT | 71.25 | -0.92% | 0.5K |

| Chevron Corp | CVX | 91.32 | -0.94% | 3.0K |

| Boeing Co | BA | 143.51 | -1.02% | 1.9K |

| ALCOA INC. | AA | 7.97 | -1.36% | 120.5K |

| Barrick Gold Corporation, NYSE | ABX | 7.18 | -1.37% | 38.4K |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 8.94 | -3.97% | 127.4K |

Upgrades:

Downgrades:

Other:

Yahoo! (YHOO) initiated with an Outperform at Boenning & Scattergood

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending November 01 in the U.S. remained unchanged at 276,000.

Analysts had expected the initial jobless claims to decrease to 270,000.

Jobless claims remained below 300,000 the 36th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims increased by 5,000 to 2,174,000 in the week ended October 31.

According to the Business NZ Survey published on late Wednesday evening, the Business NZ performance of manufacturing index (PMI) for New Zealand fell 53.3 in October to 55.4 in September.

A reading above 50 indicates expansion in the manufacturing sector.

The decline was mainly driven by a slower expansion in the production and new orders.

"Although the key sub-indices of production (53.1) and new orders (55.9) both experienced lower levels of expansion, they continued to lead the way for October. In addition, the proportion of positive comments for October (61.8%) picked up from September (58.7%), with many of these in relation to increased offshore orders and new customers," Business NZ's executive director for manufacturing, Catherine Beard, said.

Japan's Cabinet Office released its core machinery orders data on late Wednesday evening. Core machinery orders in Japan jumped 7.5% in September, exceeding expectations for a 3.3% rise, after a 3.5% fall in August.

On a yearly basis, core machinery orders slid 1.7% in September, beating expectations for a 4.0% drop, after a 3.5% fall in August.

This data indicates that capital spending in Japan improved, and it could mean that the Bank of Japan may not expand its quantitative easing.

The total number of machinery orders declined 0.5% in September from a month earlier.

Orders from non-manufacturers jumped 14.3% in September, while orders from manufacturers slid 5.5%.

Stock indices traded lower after a speech by the European Central Bank (ECB) President Mario Draghi. He testified before the European parliament's Economic and Monetary Affairs Committee on Thursday. Draghi said that the central bank will review its monetary policy at its next meeting in December.

Regarding current economic outlook, he said that the Eurozone's economy recovered moderately, while the central bank's monetary policy and low energy prices supported consumption.

But there are downside risks to the growth and inflation outlook from the slowdown in the global economy and from a drop in oil prices, the ECB president added.

Meanwhile, the economic data from the Eurozone was mixed. Eurostat released its industrial production data for the Eurozone on Thursday. Industrial production in the Eurozone declined 0.3% in September, missing expectations for a 0.1% decrease, after a 0.4% fall in August. August's figure was revised up from a 0.5% drop.

The decrease was driven by declines in durable consumer goods, non-durable consumer goods and capital output. Durable consumer goods output dropped 3.9% in September, non-durable consumer goods were down 1.0%, while capital goods output fell by 0.3%.

Intermediate goods output was flat in September, while energy output climbed 1.2%.

On a yearly basis, Eurozone's industrial production gained 1.7% in September, exceeding expectations for a 1.3% rise, after a 2.2% increase in August. August's figure was revised up from a 0.9% gain.

The increase was driven by rises in durable and non-durable consumer goods, intermediate goods output and capital goods. Durable consumer goods climbed by 2.6% in September from a year ago, capital goods rose by 2.2%, intermediate goods output increased by 1.8%, while non-durable consumer goods gained by 2.1%.

Energy output was down by 1.4% in September from a year ago.

Current figures:

Name Price Change Change %

FTSE 100 6,260.09 -37.11 -0.59 %

DAX 10,861.56 -46.31 -0.42 %

CAC 40 4,914.61 -37.90 -0.77 %

The Hellenic Statistical Authority released its unemployment data on Thursday. The seasonally adjusted unemployment rate in Greece declined to 24.6% in August from 24.9% in July. July's figure was revised down from 25.0%.

The number of unemployed fell by 15,740 persons compared with July 2015.

The youth unemployment rate was 47.9% in August.

The Bank of France released its current account data on Thursday. France's current account surplus was €0.5 billion in September, up from a deficit of €0.1 billion in August.

The trade goods deficit widened to €1.6 billion in September from €1.2 billion in August, while the surplus on services rose to €1.8 billion from €0.7 billion.

The surplus on financial account decreased to €10.3 billion in September from €10.4 billion in August.

The European Central Bank (ECB) President Mario Draghi testified before the European parliament's Economic and Monetary Affairs Committee on Thursday. He said that the central bank will review its monetary policy at its next meeting in December.

"At our December monetary policy meeting, we will re-examine the degree of monetary policy accommodation," he said.

Regarding current economic outlook, he said that the Eurozone's economy recovered moderately, while the central bank's monetary policy and low energy prices supported consumption.

But there are downside risks to the growth and inflation outlook from the slowdown in the global economy and from a drop in oil prices, the ECB president added.

"However, downside risks stemming from global growth and trade are clearly visible. Moreover, inflation dynamics have somewhat weakened, mainly due to lower oil prices and the delayed effects of the stronger euro exchange rate seen earlier in the year," Draghi said.

He pointed out that the ECB will add further stimulus measures if needed to boost inflation in the Eurozone.

"If we were to conclude that our medium-term price stability objective is at risk, we would act by using all the instruments available within our mandate to ensure that an appropriate degree of monetary accommodation is maintained. Consistent with our forward guidance, the asset purchase programme is considered to be a particularly powerful and flexible instrument," Draghi said.

Eurostat released its industrial production data for the Eurozone on Thursday. Industrial production in the Eurozone declined 0.3% in September, missing expectations for a 0.1% decrease, after a 0.4% fall in August. August's figure was revised up from a 0.5% drop.

The decrease was driven by declines in durable consumer goods, non-durable consumer goods and capital output. Durable consumer goods output dropped 3.9% in September, non-durable consumer goods were down 1.0%, while capital goods output fell by 0.3%.

Intermediate goods output was flat in September, while energy output climbed 1.2%.

On a yearly basis, Eurozone's industrial production gained 1.7% in September, exceeding expectations for a 1.3% rise, after a 2.2% increase in August. August's figure was revised up from a 0.9% gain.

The increase was driven by rises in durable and non-durable consumer goods, intermediate goods output and capital goods. Durable consumer goods climbed by 2.6% in September from a year ago, capital goods rose by 2.2%, intermediate goods output increased by 1.8%, while non-durable consumer goods gained by 2.1%.

Energy output was down by 1.4% in September from a year ago.

The French statistical office Insee released its consumer price inflation for France on Thursday. The French consumer price inflation increased 0.1% in October, after a 0.4% fall in September.

On a yearly basis, the consumer price index climbed 0.1% in October, after a flat reading in September.

Fresh food prices rose 7.1% year-on-year in October, while petroleum products prices dropped by 13.6%.

Destatis released its final consumer price data for Germany on Thursday. German final consumer price index were flat in October, in line with the preliminary estimate, after a 0.2% fall in September.

On a yearly basis, German final consumer price index rose to 0.3% in October from 0.0% in September, in line with the preliminary estimate.

The increase was partly driven by a slower decline in energy prices, which dropped 8.6% year-on-year in October.

Food prices climbed 0.5% year-on-year in October.

The Australian Bureau of Statistics released its labour market data on Thursday. Australia's unemployment rate dropped to 5.9% in October from 6.2% in September. Analysts had expected the unemployment rate to remain unchanged at 6.2%.

The number of employed people in Australia rose by 58,600 in October, beating forecast of a rise by 15,000, after a fall by 800 in September. September's figure was revised up from a drop by 5,100.

Full-time employment rose by 40,000 in October, while part-time employment climbed by 18,600.

The participation rate increased to 65.0% in October from to 64.9% in September.

The Royal Institution of Chartered Surveyors' (RICS) released its house price data for the U.K. on Thursday. The monthly house price balance increased to +49% in October from +44% in September. The increase was driven by higher demand and a shortage of properties.

"It is hard to get away from the issue of supply when it comes to the current state of the housing market. The legacy of the drop in new build following the onset of the global financial crisis is now really hitting home, with both the sales and letting markets continuing to show demand outstripping supply on a month by month basis," RICS Chief Economist, Simon Rubinsohn, said.

The European Central Bank (ECB) Vice President Vitor Constancio said on Wednesday that an interest rate hike in the U.S. will have no direct impact on the Eurozone's economy.

"We think there will not be any significant direct impact, indirectly (it could have an impact) in economic, trade terms by the possible effect on emerging countries," he said.

Constancio pointed out that the central bank made no decision yet what it will do at its December monetary policy meeting.

U.S. stock indices declined on Wednesday amid speculation that China's government would add more stimulus. A selloff in energy stocks also weighed on the indices.

The Dow Jones Industrial Average fell 55.99 points, or 0.3%, to 17,702.22. The S&P 500 lost 6.72 points, or 0.3%, to 2,075.00. The Nasdaq Composite declined 16.22 points, or 0.3%, to 5,067.02.

Macy's Inc. shares lost about 14% after the company reported weaker-than-expected third quarter sales and cut its guidance.

This morning in Asia Hong Kong Hang Seng gained 0.96%, or 214.71, to 22,566.88. China Shanghai Composite Index fell 0.92%, or 33.66, to 3.616.59. The Nikkei 225 climbed 0.09%, or 18.08, to 19,709.47.

Asian indices posted mixed results. Chinese stocks fell amid declines in commodity prices, while Hong Kong stocks climbed on earnings reports.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.