- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 09-02-2018.

Major US stock indexes fluctuated between profit and loss, but eventually completed the trading with a confident increase, having received support from reports of US President Trump signing a bill to extend government funding.

The focus was also on the United States. As it became known, wholesale stocks in the US grew stronger than expected in December, although more slowly than a month earlier. Commodity stocks in warehouses of wholesale trade increased by 0.4% to $ 612.1 billion, outperforming growth estimates of 0.2%. In November, the number of unsold stocks on wholesalers shelves increased by 0.6%, the November figure was revised from 0.8 percent in a preliminary report released on Friday. At current levels, it would take 1.22 months for wholesalers to free their shelves, which is more than last year's ratio of 1.29.

Oil prices fell more than 3%, recording a sixth consecutive shedding in a row and the largest weekly loss in 10 months, as the record volume of oil production in the US added to fears of a sharp increase in global supplies.

Most components of the DOW index finished trading in positive territory (26 out of 30). Leader of the growth were shares of NIKE, Inc. (NKE, + 5.15%). Outsider were shares United Technologies Corporation (UTX, -0.77%).

Almost all sectors of S & P recorded a rise. The technological sector grew most (+ 2.4%). Decrease showed only the conglomerate sector (-1.2%).

At closing:

Dow + 1.38% 24.190.90 +330.44

Nasdaq + 1.44% 6,874.49 +97.33

S & P + 1.49% 2,619.55 +38.55

U.S. stock-index futures pointув to a higher open on Friday after a sharp decline in the U.S. stock market in the previous session amid concerns about mounting volatility and worries about inflation and rising bond yields.

Global Stocks:

Nikkei 21,382.62 -508.24 -2.32%

Hang Seng 29,507.42 -943.85 -3.10%

Shanghai 3,130.93 -131.12 -4.02%

S&P/ASX 5,838.00 -52.70 -0.89%

FTSE 7,111.73 -58.96 -0.82%

CAC 5,091.42 -60.26 -1.17%

DAX 12,135.93 -124.36 -1.01%

Crude $60.53 (-1.01%)

Gold $1,317.40 (-0.12%)

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 225.4 | 2.51(1.13%) | 8063 |

| ALCOA INC. | AA | 46.23 | 0.25(0.54%) | 600 |

| ALTRIA GROUP INC. | MO | 64.5 | 0.45(0.70%) | 5312 |

| Amazon.com Inc., NASDAQ | AMZN | 1,371.85 | 21.35(1.58%) | 119869 |

| American Express Co | AXP | 89.13 | 0.79(0.89%) | 5453 |

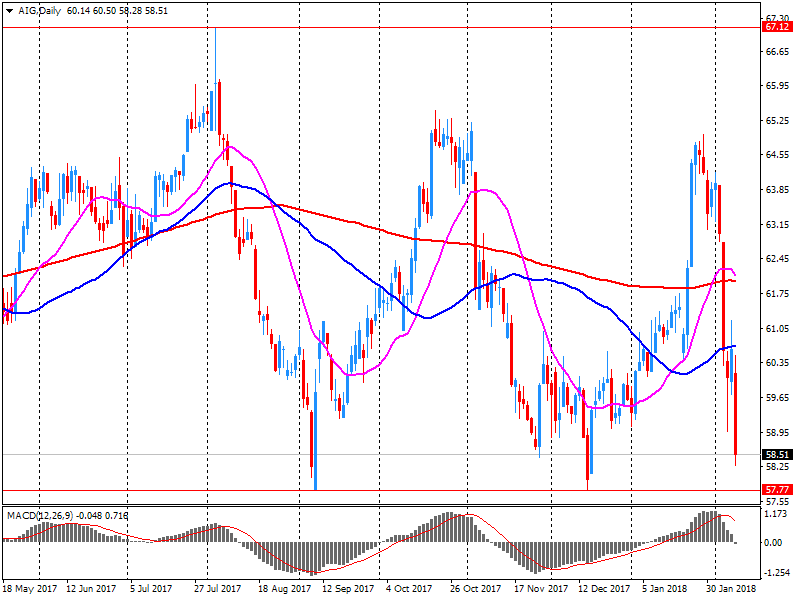

| AMERICAN INTERNATIONAL GROUP | AIG | 59.51 | 1.23(2.11%) | 11300 |

| Apple Inc. | AAPL | 156.51 | 1.99(1.29%) | 271597 |

| AT&T Inc | T | 35.75 | 0.18(0.51%) | 26180 |

| Barrick Gold Corporation, NYSE | ABX | 13.24 | 0.01(0.08%) | 10774 |

| Boeing Co | BA | 333.2 | 3.54(1.07%) | 39662 |

| Caterpillar Inc | CAT | 147.47 | 1.48(1.01%) | 11199 |

| Chevron Corp | CVX | 113.1 | 0.80(0.71%) | 4838 |

| Cisco Systems Inc | CSCO | 39.1 | 0.33(0.85%) | 41248 |

| Citigroup Inc., NYSE | C | 72.5 | 0.63(0.88%) | 7014 |

| Exxon Mobil Corp | XOM | 75.9 | 0.60(0.80%) | 38792 |

| Facebook, Inc. | FB | 173.51 | 1.93(1.12%) | 169573 |

| FedEx Corporation, NYSE | FDX | 232.88 | -6.39(-2.67%) | 133457 |

| Ford Motor Co. | F | 10.51 | 0.08(0.77%) | 56665 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 17.22 | 0.06(0.35%) | 6701 |

| General Electric Co | GE | 14.64 | 0.19(1.31%) | 325931 |

| General Motors Company, NYSE | GM | 41.1 | 0.35(0.86%) | 7970 |

| Goldman Sachs | GS | 248.82 | 2.47(1.00%) | 7490 |

| Google Inc. | GOOG | 1,007.25 | 5.73(0.57%) | 13237 |

| Hewlett-Packard Co. | HPQ | 20.21 | 0.29(1.46%) | 846 |

| Home Depot Inc | HD | 183.33 | 2.11(1.16%) | 11435 |

| HONEYWELL INTERNATIONAL INC. | HON | 148 | 1.98(1.36%) | 222 |

| Intel Corp | INTC | 43.12 | 0.37(0.87%) | 114376 |

| International Business Machines Co... | IBM | 148.98 | 1.39(0.94%) | 7428 |

| International Paper Company | IP | 56.3 | 0.25(0.45%) | 1348 |

| Johnson & Johnson | JNJ | 127 | 0.64(0.51%) | 8572 |

| JPMorgan Chase and Co | JPM | 108.87 | 0.99(0.92%) | 24749 |

| McDonald's Corp | MCD | 159.55 | 0.58(0.36%) | 5767 |

| Merck & Co Inc | MRK | 55.06 | 0.33(0.60%) | 4888 |

| Microsoft Corp | MSFT | 85.65 | 0.64(0.75%) | 150974 |

| Nike | NKE | 62.59 | 0.10(0.16%) | 6331 |

| Pfizer Inc | PFE | 33.91 | 0.28(0.83%) | 13757 |

| Procter & Gamble Co | PG | 80.68 | 0.46(0.57%) | 10036 |

| Starbucks Corporation, NASDAQ | SBUX | 54.04 | 0.27(0.50%) | 7098 |

| Tesla Motors, Inc., NASDAQ | TSLA | 318.89 | 3.66(1.16%) | 67745 |

| The Coca-Cola Co | KO | 43.35 | 0.25(0.58%) | 7969 |

| Travelers Companies Inc | TRV | 135.4 | 0.39(0.29%) | 2751 |

| Twitter, Inc., NYSE | TWTR | 30.47 | 0.29(0.96%) | 521993 |

| United Technologies Corp | UTX | 128.25 | 0.77(0.60%) | 2106 |

| UnitedHealth Group Inc | UNH | 216.95 | 0.49(0.23%) | 3739 |

| Verizon Communications Inc | VZ | 49.3 | 0.26(0.53%) | 9835 |

| Visa | V | 114.69 | 0.83(0.73%) | 8628 |

| Wal-Mart Stores Inc | WMT | 100.37 | 0.35(0.35%) | 9772 |

| Walt Disney Co | DIS | 102.07 | 0.72(0.71%) | 17755 |

| Yandex N.V., NASDAQ | YNDX | 35.56 | 0.36(1.02%) | 13700 |

United Tech (UTX) upgraded to Buy from Hold at Argus

Chevron (CVX) upgraded to Sector Perform from Underperform at RBC Capital Mkts

Twitter (TWTR) upgraded to Sector Perform from Underperform at RBC Capital Mkts

European stocks dropped on Thursday, taking their cues from a selloff on Wall Street as well as a plunge in oil prices that weighed on shares of the region's major energy companies.

The S&P 500 and the Dow extended their decline to close in correction territory Thursday after stocks went into a free fall late in the session on concerns about mounting volatility and worries about inflation and rising bond yields.

Asian shares took a tumble on Friday, taking cues from U.S. indexes which extended sharp losses in the last session. Japan's Nikkei 225 fell 2.51 percent, with losses seen in most sectors. Automakers, financials, manufacturers and technology stocks traded firmly in negative territory.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.