- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 08-02-2018.

(index / closing price / change items /% change)

Nikkei +245.49 21890.86 +1.13%

TOPIX +15.78 1765.69 +0.90%

Hang Seng +128.07 30451.27 +0.42%

CSI 300 -38.45 4012.05 -0.95%

Euro Stoxx 50 -77.22 3377.30 -2.24%

FTSE 100 -108.73 7170.69 -1.49%

DAX -330.14 12260.29 -2.62%

CAC 40 -104.22 5151.68 -1.98%

DJIA -1032.89 23860.46 -4.15%

S&P 500 -100.66 2581.00 -3.75%

NASDAQ -274.82 6777.16 -3.90%

S&P/TSX -264.97 15065.61 -1.73%

Major US stock indices fell significantly on Thursday, which was due to correction, the need for which had long been brewing, and with the increase in yield of government bonds against the background of increased inflation expectations

The focus was also on US data and statements by Fed officials Kashkari, Harker, and Dudley. As it became known, the number of Americans applying for unemployment benefits unexpectedly fell last week, dropping to the lowest level in almost 45 years, as the labor market becomes even tougher, reinforcing the expectations of a faster growth of wages this year. Initial claims for unemployment benefits fell by 9,000 to 221,000, seasonally adjusted for the week ending February 3, the Ministry of Labor said. Primary treatment fell to 216,000 in mid-January, the lowest level since January 1973. Economists predicted that over the last week of circulation will grow to 232,000.

As for the speech of the representative of the Federal Reserve Bank of Kashkari, he said that I would not want to rush to conclusions about further increases in rates. Meanwhile, Fed representative Harker noted that the outlook for inflation is still surrounded by considerable uncertainty. In addition, Fed spokesman Dudley said that the rate increase rate depends on the indications of the economy.

All components of the DOW index finished trading in the red (30 of 30). Outsider were shares of American Express Company (AXP, -5.63%).

All sectors of the S & P index are in negative territory. The largest decrease was observed in the sector of industrial goods (-2.6%) and in the technological sector (-3.9%).

At closing:

Dow -4.15% 23,860.46 -1032.89

Nasdaq -3.90% 6,777.16 -274.82

S & P -3.75% 2.581.00 -100.66

U.S. stock-index futures were higher on Thursday, signaling the market set sights on rebound as volatility eased after hitting its highest level in more than two-and-a-half years earlier in the week.

Global Stocks:

Nikkei 21,890.86 +245.49 +1.13%

Hang Seng 30,451.27 +128.07 +0.42%

Shanghai 3,262.15 -47.11 -1.42%

S&P/ASX 5,890.70 +13.90 +0.24%

FTSE 7,228.98 -50.44 -0.69%

CAC 5,223.37 -32.53 -0.62%

DAX 12,488.10 -102.33 -0.81%

Crude $61.58 (-0.34%)

Gold $1,316.70 (+0.16%)

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 233.01 | -0.18(-0.08%) | 13065 |

| ALCOA INC. | AA | 47.98 | 0.28(0.59%) | 810 |

| Amazon.com Inc., NASDAQ | AMZN | 1,431.00 | 14.22(1.00%) | 55705 |

| American Express Co | AXP | 93.73 | 0.12(0.13%) | 21565 |

| Apple Inc. | AAPL | 160.55 | 1.01(0.63%) | 255442 |

| AT&T Inc | T | 37.09 | 0.16(0.43%) | 9145 |

| Barrick Gold Corporation, NYSE | ABX | 13.44 | 0.05(0.37%) | 9857 |

| Boeing Co | BA | 347.89 | 1.48(0.43%) | 24919 |

| Caterpillar Inc | CAT | 154.55 | 0.21(0.14%) | 5444 |

| Chevron Corp | CVX | 115.35 | 0.06(0.05%) | 18649 |

| Cisco Systems Inc | CSCO | 40.45 | 0.11(0.27%) | 22648 |

| Citigroup Inc., NYSE | C | 75.21 | 0.22(0.29%) | 22367 |

| Exxon Mobil Corp | XOM | 77.45 | 0.51(0.66%) | 52609 |

| Facebook, Inc. | FB | 180.9 | 0.72(0.40%) | 309116 |

| FedEx Corporation, NYSE | FDX | 251.35 | 0.20(0.08%) | 223815 |

| Ford Motor Co. | F | 10.85 | 0.09(0.84%) | 31442 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 17.85 | -0.01(-0.06%) | 24018 |

| General Motors Company, NYSE | GM | 42.8 | 0.41(0.97%) | 1488 |

| Google Inc. | GOOG | 1,050.01 | 1.43(0.14%) | 6300 |

| Home Depot Inc | HD | 192.03 | 0.74(0.39%) | 14107 |

| Intel Corp | INTC | 45.45 | 0.25(0.55%) | 52314 |

| International Business Machines Co... | IBM | 152.65 | 0.30(0.20%) | 8878 |

| Johnson & Johnson | JNJ | 132 | 0.58(0.44%) | 19299 |

| JPMorgan Chase and Co | JPM | 113.09 | 0.22(0.19%) | 8877 |

| McDonald's Corp | MCD | 165.93 | 0.22(0.13%) | 17221 |

| Merck & Co Inc | MRK | 55.94 | 0.06(0.11%) | 5014 |

| Microsoft Corp | MSFT | 90.32 | 0.71(0.79%) | 98731 |

| Nike | NKE | 65.55 | -0.08(-0.12%) | 8794 |

| Pfizer Inc | PFE | 34.9 | -0.08(-0.23%) | 51340 |

| Procter & Gamble Co | PG | 81.9 | 0.06(0.07%) | 28259 |

| Starbucks Corporation, NASDAQ | SBUX | 54.47 | 0.01(0.02%) | 1156 |

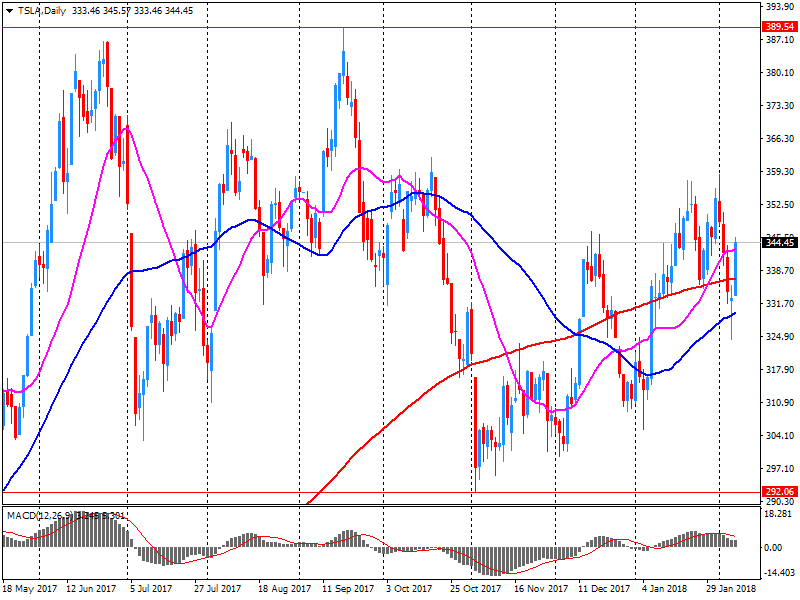

| Tesla Motors, Inc., NASDAQ | TSLA | 339.5 | -5.50(-1.59%) | 73996 |

| Travelers Companies Inc | TRV | 142.36 | 0.22(0.15%) | 15512 |

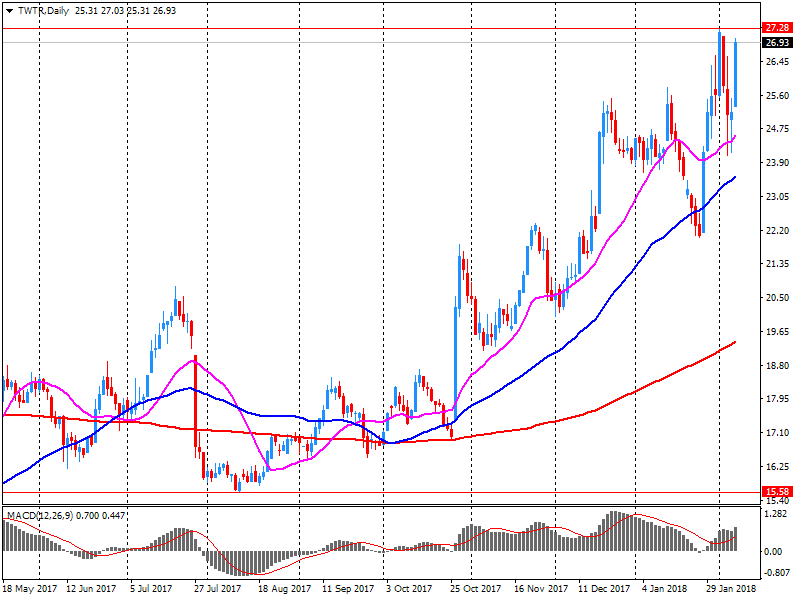

| Twitter, Inc., NYSE | TWTR | 33.91 | 7.00(26.01%) | 11674127 |

| United Technologies Corp | UTX | 132.23 | 0.26(0.20%) | 20619 |

| UnitedHealth Group Inc | UNH | 226.4 | 0.58(0.26%) | 9511 |

| Verizon Communications Inc | VZ | 51.05 | 0.04(0.08%) | 2771 |

| Visa | V | 120.12 | 0.47(0.39%) | 3556 |

| Wal-Mart Stores Inc | WMT | 103.15 | 0.30(0.29%) | 22323 |

| Walt Disney Co | DIS | 105 | 0.24(0.23%) | 22099 |

| Yandex N.V., NASDAQ | YNDX | 37.54 | 0.56(1.51%) | 1904 |

Yandex N.V. (YNDX) resumed with a Overweight at JP Morgan; target $47

Tesla (TSLA) target raised to $400 from $340 at Dougherty & Company

Tesla (TSLA) target raised to $200 from $170 at Cowen; maintain Underperform

Walt Disney (DIS) target raised to $95 from $90 at BMO Capital Markets; Underperform

Boeing (BA) target raised to $289 from $240 at Buckingham Research; Neutral

Twitter (TWTR) reported Q4 FY 2017 earnings of $0.19 per share (versus $0.16 in Q4 FY 2016), beating analysts' consensus estimate of $0.14.

The company's quarterly revenues amounted to $0.732 bln (+2.0% y/y), beating analysts' consensus estimate of $0.686 bln.

TWTR rose to $33.26 (+23.6%) in pre-market trading.

Tesla (TSLA) reported Q4 FY 2017 loss of $3.04 per share (versus -$0.69 in Q4 FY 2016), beating analysts' consensus estimate of -$3.15.

The company's quarterly revenues amounted to $3.289 bln (+43.9% y/y), generally in-line with analysts' consensus estimate of $3.261 bln.

TSLA fell to $343.80 (-0.35%) in pre-market trading.

European stocks finished with firm gains on Wednesday, breaking a seven-session losing run. The move tracked advances on Wall Street Tuesday and Wednesday, as U.S. equity markets managed to rally following the biggest global selloff in years. Bourses also got a lift from news that German Chancellor Angela Merkel's party and its former center-left partner agreed on a formal deal to set up a governing coalition for Europe's largest economy.

European stocks closed higher Wednesday, as markets worldwide attempted to shake off the major volatility seen in recent sessions. The pan-European Stoxx 600 closed at 2.06 percent, with all sectors and major bourses in positive territory.

Asian stocks vacillated Thursday as higher market volatility continued and investors struggled with what to make of the past week's global market selloff. Indexes in Hong Kong and China turned negative ahead of their midday break, with Shanghai's stock benchmark also turning negative for the year as large-cap stocks declined.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.