- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 05-02-2018.

(index / closing price / change items /% change)

Nikkei -592.45 22682.08 -2.55%

TOPIX -40.46 1823.74 -2.17%

Hang Seng -356.56 32245.22 -1.09%

CSI 300 +2.92 4274.15 +0.07%

Euro Stoxx 50 -44.51 3478.77 -1.26%

FTSE 100 -108.45 7334.98 -1.46%

DAX -97.67 12687.49 -0.76%

CAC 40 -79.15 5285.83 -1.48%

DJIA -1175.21 24345.75 -4.60%

S&P 500 -113.19 2648.94 -4.10%

NASDAQ -273.42 6967.53 -3.78%

S&P/TSX -271.22 15334.81 -1.74%

Major US stock indices fell significantly, which was due to increased fears about inflation and higher bond yields.

Negligible impact on the course of trading also provided data on the United States. The research data in January indicate a continuation of business activity growth in the US services sector, although growth slowed for the third month and reached a nine-month low. Nevertheless, new orders continued to expand sharply, and the growth rate accelerated to the fastest since September last year. Seasonally adjusted final index of business activity in the US services sector from IHS Markit was 53.3 in January against 53.7 in December. The last value of the index showed that business activity among service providers has reached its weakest level since April 2017. The survey data linked the current recovery with more favorable economic conditions.

Meanwhile, the index of business activity in the US services sector, calculated by the Institute for Supply Management (ISM), rose in January to a level of 59.9 points compared to 55.9 points in December. Analysts predicted that the figure will rise to 56.5 points. Recall, the indicator is the result of a survey of about 400 firms from 60 sectors across the US. A value greater than 50 is usually considered an indicator of the growth of production activity.

All components of the DOW index finished trading in the red (30 of 30). Outsider were shares of Exxon Mobil Corporation (XOM, -5.41%).

All sectors of the S & P index showed a fall. The largest decrease was registered in the sector of industrial goods (-4.1%).

At closing:

DJIA -4.60% 24,345.75 -1175.21

Nasdaq -3.78% 6,967.53 -273.42

S & P -4.10% 2,648.94 -113.19

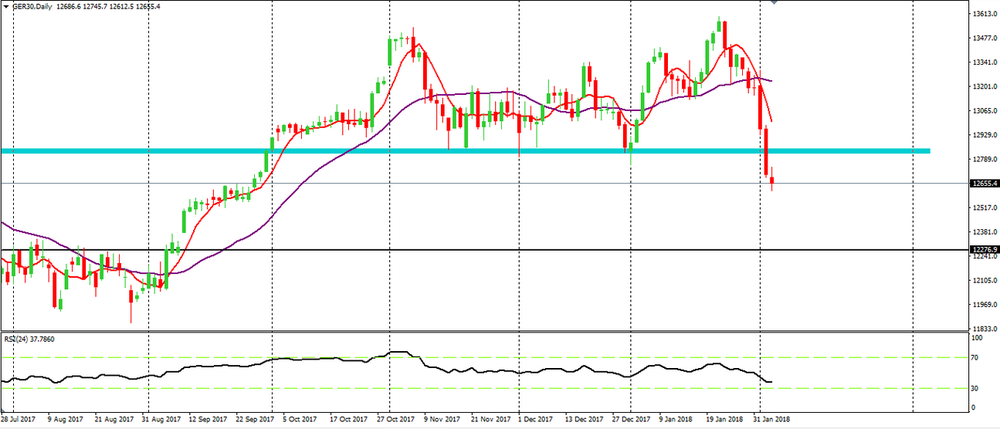

DAX on daily time frame chart, we can see that the price has broken a support zone which have been quite important.

Also, we have moving averages crossed above the price which can give us signs of a possible new bearish movement.

Therefore, we can expect a further bearish movement by DAX near to 12276 U.S. stock-index futures fell on Monday as bond yields continued to rise.

Global Stocks:

Nikkei 22,682.08 -592.45 -2.55%

Hang Seng 32,245.22 -356.56 -1.09%

Shanghai 3,487.38 +25.30 +0.73%

S&P/ASX 6,026.20 -95.20 -1.56%

FTSE 7,359.44 -83.99 -1.13%

CAC 5,295.26 -69.72 -1.30%

DAX 12,678.68 -106.48 -0.83%

Crude $65.11 (-0.52%)

Gold $1,340.20 (+0.22%)

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 244.39 | -0.78(-0.32%) | 15231 |

| ALCOA INC. | AA | 48.75 | -0.34(-0.69%) | 9647 |

| ALTRIA GROUP INC. | MO | 68.9 | -0.50(-0.72%) | 9915 |

| Amazon.com Inc., NASDAQ | AMZN | 1,410.06 | -19.89(-1.39%) | 176597 |

| American Express Co | AXP | 96 | -0.68(-0.70%) | 3482 |

| Apple Inc. | AAPL | 159.75 | -0.75(-0.47%) | 828849 |

| AT&T Inc | T | 37.79 | -0.28(-0.74%) | 88342 |

| Barrick Gold Corporation, NYSE | ABX | 13.85 | 0.11(0.80%) | 13976 |

| Boeing Co | BA | 345 | -3.91(-1.12%) | 50211 |

| Caterpillar Inc | CAT | 155.2 | -2.29(-1.45%) | 30586 |

| Chevron Corp | CVX | 117.25 | -1.33(-1.12%) | 41916 |

| Cisco Systems Inc | CSCO | 40.99 | 0.06(0.15%) | 54550 |

| Citigroup Inc., NYSE | C | 75.64 | -1.38(-1.79%) | 55298 |

| Deere & Company, NYSE | DE | 163.1 | -1.86(-1.13%) | 1073 |

| Exxon Mobil Corp | XOM | 83.17 | -1.36(-1.61%) | 32321 |

| Facebook, Inc. | FB | 188.17 | -2.11(-1.11%) | 256337 |

| Ford Motor Co. | F | 10.65 | -0.06(-0.56%) | 97601 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 17.84 | -0.13(-0.72%) | 23759 |

| General Electric Co | GE | 15.53 | -0.11(-0.70%) | 362576 |

| General Motors Company, NYSE | GM | 40.94 | -0.06(-0.15%) | 56979 |

| Goldman Sachs | GS | 257.6 | -2.44(-0.94%) | 23531 |

| Google Inc. | GOOG | 1,096.00 | -15.90(-1.43%) | 32346 |

| Hewlett-Packard Co. | HPQ | 22.3 | -0.18(-0.80%) | 4357 |

| Home Depot Inc | HD | 190.5 | -3.47(-1.79%) | 16336 |

| HONEYWELL INTERNATIONAL INC. | HON | 154.57 | -2.08(-1.33%) | 3546 |

| Intel Corp | INTC | 46.32 | 0.17(0.37%) | 129779 |

| International Business Machines Co... | IBM | 158.1 | -0.93(-0.58%) | 25756 |

| Johnson & Johnson | JNJ | 136.11 | -1.57(-1.14%) | 10069 |

| JPMorgan Chase and Co | JPM | 112.98 | -1.30(-1.14%) | 49345 |

| McDonald's Corp | MCD | 168.2 | -1.18(-0.70%) | 12569 |

| Merck & Co Inc | MRK | 58.37 | -0.19(-0.32%) | 21472 |

| Microsoft Corp | MSFT | 90.68 | -1.10(-1.20%) | 251662 |

| Nike | NKE | 66.33 | -0.89(-1.32%) | 8975 |

| Pfizer Inc | PFE | 36.42 | -0.19(-0.52%) | 11300 |

| Procter & Gamble Co | PG | 83.81 | -0.44(-0.52%) | 10181 |

| Starbucks Corporation, NASDAQ | SBUX | 55.7 | -0.07(-0.13%) | 20994 |

| Tesla Motors, Inc., NASDAQ | TSLA | 339.1 | -4.65(-1.35%) | 72923 |

| The Coca-Cola Co | KO | 46.47 | -0.26(-0.56%) | 7099 |

| Twitter, Inc., NYSE | TWTR | 25.34 | -0.58(-2.24%) | 175355 |

| United Technologies Corp | UTX | 133.1 | -1.51(-1.12%) | 2634 |

| UnitedHealth Group Inc | UNH | 229.1 | -2.78(-1.20%) | 3510 |

| Verizon Communications Inc | VZ | 52.5 | -0.48(-0.91%) | 22225 |

| Visa | V | 118.5 | -2.41(-1.99%) | 76685 |

| Wal-Mart Stores Inc | WMT | 103 | -1.48(-1.42%) | 19618 |

| Walt Disney Co | DIS | 107.91 | -0.79(-0.73%) | 8777 |

| Yandex N.V., NASDAQ | YNDX | 38 | 0.13(0.34%) | 226 |

Alcoa (AA) target raised to $71 from $68 at JP Morgan

Boeing (BA) target raised to $415 from $395 at Berenberg

Amazon (AMZN) target raised to $1700 from $1360 at Nomura

Exxon Mobil (XOM) target lowered to $80 from $84 at Credit Suisse

Arconic (ARNC) reported Q4 FY 2017 earnings of $0.31 per share (versus $0.12 in Q4 FY 2016), beating analysts' consensus estimate of $0.24.

The company's quarterly revenues amounted to $3.271 bln (+10.2% y/y), beating analysts' consensus estimate of $3.085 bln.

The company issued mixed guidance for FY 2018, projecting EPS of $1.45-1.55 (versus analysts' consensus estimate of $1.58) at revenues of $13.4-13.7 bln (versus analysts' consensus estimate of $13.05 bln).

ARNC fell to $28.80 (-1.06%) in pre-market trading.

February 5

Before the Open:

Arconic (ARNC). Consensus EPS $0.24, Consensus Revenues $3084.91 mln.

After the Close:

February 6

Before the Open:

General Motors (GM). Consensus EPS $1.43, Consensus Revenues $34279.69 mln.

After the Close:

Walt Disney (DIS). Consensus EPS $1.61, Consensus Revenues $15474.08 mln.

February 7

After the Close:

Tesla (TSLA). Consensus EPS -$3.15, Consensus Revenues $3260.65 mln.

February 8

Before the Open:

Twitter (TWTR). Consensus EPS $0.14, Consensus Revenues $686.13 mln.

After the Close:

American Intl (AIG). Consensus EPS $0.79, Consensus Revenues $12345.49 mln.

European stocks dropped for a fifth straight session on Friday, with the German market leading the charge south after Deutsche Bank posted a bigger-than-expected loss in the fourth quarter. A continued rise in bond yields also weighed on European equities, sparking a pullout of money from stocks after solid U.S. labor market data stoked fears of rapidly rising inflation.

Dow futures fell more than 200 points Sunday, following steep losses on Wall Street last week. Dow Jones industrial average futures YMH8, -0.45% were last down 194 points, or 0.7%, after being down as much as 250 points earlier in Sunday trading. S&P 500 futures ESH8, -0.24% were last down 12.70 points, or 0.4%, and Nasdaq futures NQH8, -0.17% fell 23.75 points, or 0.4%, recovering somewhat from deeper losses earlier.

The global stock-market rout continued Monday in Asia, with indexes in Japan and Taiwan down more than 2% following heavy selling in the U.S. and Europe on Friday. "Everyone is getting cautious," said Hisao Matsuura, chief strategist at Nomura Japan. He said the continuing rise in global bond yields caught investors unaware, weighing on stocks.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.