- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 01-02-2018.

(index / closing price / change items /% change)

Nikkei +387.82 23486.11 +1.68%

TOPIX +33.73 1870.44 +1.84%

Hang Seng -245.18 32642.09 -0.75%

CSI 300 -30.00 4245.90 -0.70%

Euro Stoxx 50 -31.94 3577.35 -0.88%

FTSE 100 -43.16 7490.39 -0.57%

DAX -185.58 13003.90 -1.41%

CAC 40 -27.38 5454.55 -0.50%

DJIA +37.32 26186.71 +0.14%

S&P 500 -1.83 2821.98 -0.06%

NASDAQ -25.62 7385.86 -0.35%

S&P/TSX -90.75 15860.92 -0.57%

Major US stock indexes mostly fell on Thursday, responding to a series of unconvincing quarterly reports and mixed economic data for the US.

As it became known, the number of Americans applying for new unemployment benefits fell last week, remaining near historically low levels. Initial applications for unemployment benefits, an indicator of layoffs in all US states, fell by 1,000 to 230,000 people for the week ending January 27, the Ministry of Labor said. Economists were expecting 238,000 new applications last week.

However, employee productivity in the US unexpectedly fell in the fourth quarter, the first decline since early 2016 and evidence that it will be difficult to increase annual economic growth to 3% on a sustainable basis. The Ministry of Labor reported on Thursday that labor productivity in the non-agricultural sector, which measures hourly output per employee, in October-December decreased by 0.1% year-on-year. This was the first drop and the weakest performance since the first quarter of 2016.

In addition, a report published by the Institute for Supply Management (ISM) showed: in January, activity in the US manufacturing sector weakened, but was better than economists' forecasts. The PMI index for the manufacturing sector in January was 59.1 points against 59.7 in December. Analysts had expected that the figure would drop to 58.8 points.

Components of the DOW index finished trading mixed (14 in positive territory, 16 in negative territory). Outsider shares were DowDuPont Inc. (DWDP, -2.60%). Exxon Mobil Corporation (XOM, + 2.18%) was the leader of growth.

Most S & P sectors recorded a decline. The utilities sector showed the greatest decrease (-1.4%). The base resources sector grew most (+ 0.3%).

At closing:

DJIA + 0.14% 26,186.71 +37.32

Nasdaq -0.35% 7.385.86 -25.62

S & P -0.06% 2,821.98 -1.83

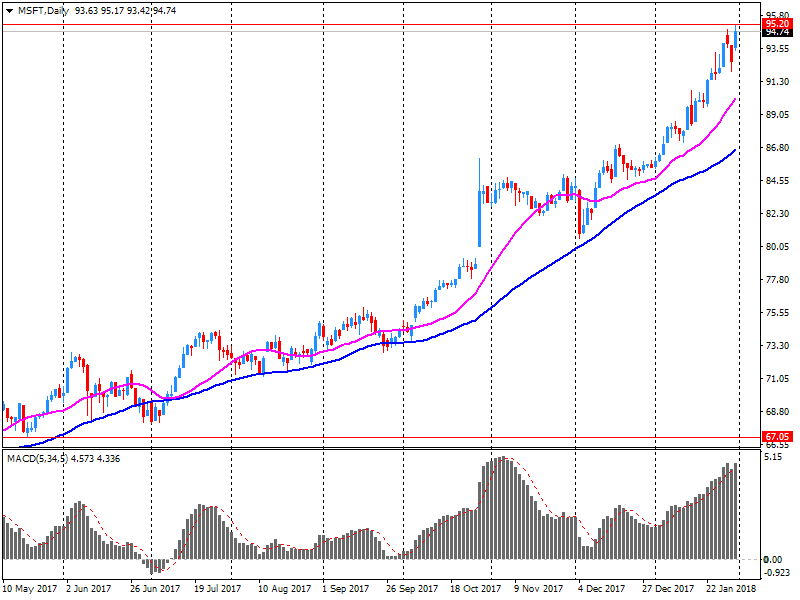

U.S. stock-index futures fell on Thursday after the Federal Reserve improved its inflation outlook and flagged "further gradual" interest rate hikes, and Microsoft (MSFT) shares dropped 0.8% despite its strong quarterly report.

Global Stocks:

Nikkei 23,486.11 +387.82 +1.68%

Hang Seng 32,642.09 -245.18 -0.75%

Shanghai 3,446.24 -34.59 -0.99%

S&P/ASX 6,090.10 +52.40 +0.87%

FTSE 7,506.06 -27.49 -0.36%

CAC 5,466.70 -15.23 -0.28%

DAX 13,049.38 -140.10 -1.06%

Crude $65.42 (+1.07%)

Gold $1,343.20 (+0.01%)

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 250.28 | -0.22(-0.09%) | 1007 |

| ALTRIA GROUP INC. | MO | 70 | -0.34(-0.48%) | 3382 |

| Amazon.com Inc., NASDAQ | AMZN | 1,451.48 | 0.59(0.04%) | 83002 |

| Apple Inc. | AAPL | 166.87 | -0.56(-0.33%) | 266191 |

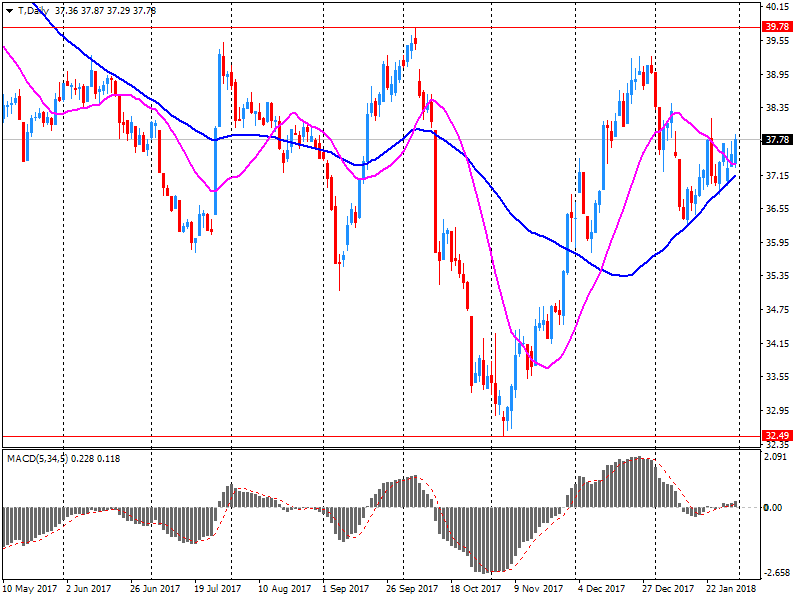

| AT&T Inc | T | 38.48 | 1.03(2.75%) | 846589 |

| Barrick Gold Corporation, NYSE | ABX | 14.3 | -0.08(-0.56%) | 2180 |

| Boeing Co | BA | 352.22 | -2.15(-0.61%) | 23268 |

| Caterpillar Inc | CAT | 162.51 | -0.27(-0.17%) | 8661 |

| Chevron Corp | CVX | 125.51 | 0.16(0.13%) | 2017 |

| Cisco Systems Inc | CSCO | 41.29 | -0.25(-0.60%) | 13018 |

| Citigroup Inc., NYSE | C | 78.25 | -0.23(-0.29%) | 12227 |

| Deere & Company, NYSE | DE | 166.29 | -0.13(-0.08%) | 1353 |

| Exxon Mobil Corp | XOM | 87.33 | 0.03(0.03%) | 6525 |

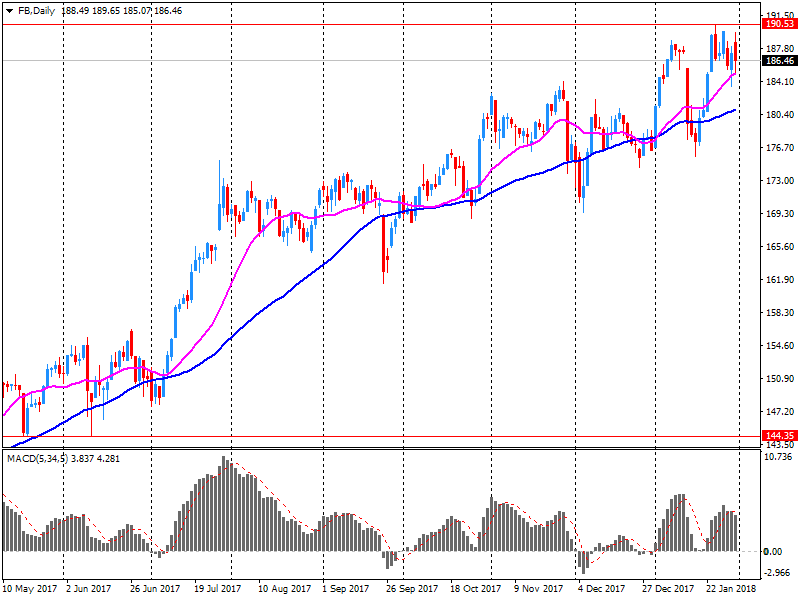

| Facebook, Inc. | FB | 189.1 | 2.21(1.18%) | 2162612 |

| FedEx Corporation, NYSE | FDX | 264 | 1.52(0.58%) | 1416 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 19.49 | -0.01(-0.05%) | 400 |

| General Electric Co | GE | 16.08 | -0.09(-0.56%) | 148717 |

| General Motors Company, NYSE | GM | 42.31 | -0.10(-0.24%) | 1480 |

| Goldman Sachs | GS | 266.5 | -1.39(-0.52%) | 1495 |

| Google Inc. | GOOG | 1,168.79 | -1.15(-0.10%) | 6972 |

| Home Depot Inc | HD | 200 | -0.90(-0.45%) | 2125 |

| Intel Corp | INTC | 47.65 | -0.49(-1.02%) | 55444 |

| International Business Machines Co... | IBM | 163.08 | -0.62(-0.38%) | 1788 |

| Johnson & Johnson | JNJ | 138.01 | -0.18(-0.13%) | 6448 |

| JPMorgan Chase and Co | JPM | 115.45 | -0.22(-0.19%) | 12433 |

| McDonald's Corp | MCD | 171.05 | -0.09(-0.05%) | 2673 |

| Microsoft Corp | MSFT | 93.65 | -1.36(-1.43%) | 423038 |

| Nike | NKE | 67.93 | -0.29(-0.43%) | 705 |

| Pfizer Inc | PFE | 36.66 | -0.04(-0.11%) | 32267 |

| Procter & Gamble Co | PG | 86.39 | 0.05(0.06%) | 9371 |

| Starbucks Corporation, NASDAQ | SBUX | 56.64 | -0.17(-0.30%) | 11783 |

| Tesla Motors, Inc., NASDAQ | TSLA | 351.5 | -2.81(-0.79%) | 21437 |

| The Coca-Cola Co | KO | 47.51 | -0.08(-0.17%) | 2344 |

| Twitter, Inc., NYSE | TWTR | 25.55 | -0.26(-1.01%) | 62079 |

| United Technologies Corp | UTX | 136.82 | -1.19(-0.86%) | 1313 |

| UnitedHealth Group Inc | UNH | 235.01 | -1.77(-0.75%) | 1772 |

| Verizon Communications Inc | VZ | 54.1 | 0.03(0.06%) | 22279 |

| Visa | V | 125.52 | 1.29(1.04%) | 70231 |

| Wal-Mart Stores Inc | WMT | 106.31 | -0.29(-0.27%) | 9309 |

| Walt Disney Co | DIS | 108.88 | 0.21(0.19%) | 8533 |

| Yandex N.V., NASDAQ | YNDX | 38.84 | 0.11(0.28%) | 518 |

Facebook (FB) reiterated with a Hold at Stifel; target $195

Facebook (FB) reiterated with a Buy at Needham; target $215

AT&T (T) reiterated with with a Perform at Oppenheimer

Microsoft (MSFT) target raised to $107 from $100 at BMO Capital Markets

Microsoft (MSFT) target raised to $105 from $92 at Stifel

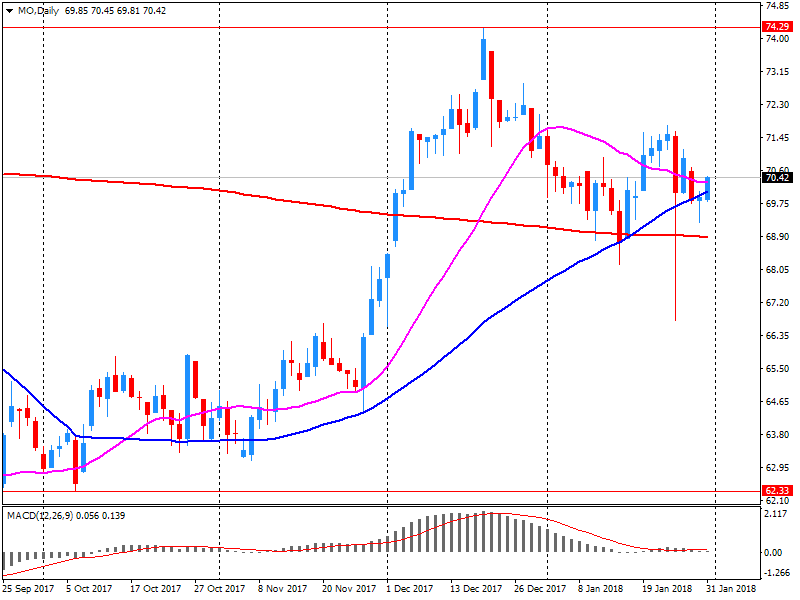

Altria (MO) reported Q4 FY 2017 earnings of $0.91 per share (versus $0.68 in Q4 FY 2016), beating analysts' consensus estimate of $0.80.

The company's quarterly revenues amounted to $4.714 bln (-0.4% y/y), missing analysts' consensus estimate of $4.803 bln.

MO fell to $70.01 (-0.47 %) in pre-market trading.

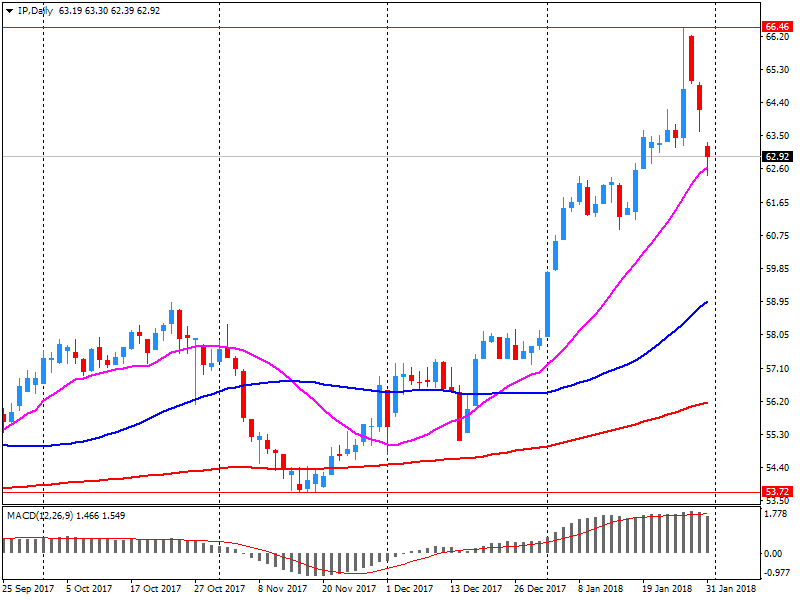

Int'l Paper (IP) reported Q4 FY 2017 earnings of $1.27 per share (versus $0.67 in Q4 FY 2016), beating analysts' consensus estimate of $1.19.

The company's quarterly revenues amounted to $5.711 bln (+14.2% y/y), missing analysts' consensus estimate of $6.006 bln.

IP closed Wednesday's trading session at $62.86 (-2.09%).

Microsoft (MSFT) reported Q4 FY 2017 earnings of $0.96 per share (versus $0.83 in Q4 FY 2016), beating analysts' consensus estimate of $0.87.

The company's quarterly revenues amounted to $28.918 bln (+11.9% y/y), beating analysts' consensus estimate of $28.420 bln.

MSFT fell to $94.32 (-0.73%) in pre-market trading.

Facebook (FB) reported Q4 FY 2017 earnings of $2.21 per share (versus $1.41 in Q4 FY 2016), beating analysts' consensus estimate of $1.97.

The company's quarterly revenues amounted to $12.972 bln (+47.3% y/y), beating analysts' consensus estimate of $12.547 bln.

FB rose to $190.47 (+1.92%) in pre-market trading.

AT&T (T) reported Q4 FY 2017 earnings of $0.78 per share (versus $0.66 in Q4 FY 2016), beating analysts' consensus estimate of $0.65.

The company's quarterly revenues amounted to $41.676 bln (-0.4% y/y), beating analysts' consensus estimate of $41.208 bln.

The company also issued upside guidance for FY2018, projecting EPS of $3.50 versus analysts' consensus estimate of $2.97.

T rose to $38.83 (+3.68%) in pre-market trading.

European stocks closed lower on Wednesday, but the region's benchmark still scored its best month since October. U.K. stocks, however, underperformed the wider market after a plunge of nearly 50% for shares of outsourcer Capita PLC rattled investors.

Some Asian stock markets rebounded after the broad pullback that started the week, but Chinese equities weakened again following another muted manufacturing reading, weighing on Hong Kong stocks. A gauge of manufacturing activity that some watch more closely than the official reading out Wednesday was flat for January and only modestly in expansion territory.

Stocks saw choppy trade Wednesday after the Federal Reserve did nothing to discourage expectations for a March rate rise, but ended the session with modest gains while booking the biggest monthly rise since March 2016. The Dow Jones Industrial Average DJIA, +0.28% rose 72.50 points, or 0.3%, to end at 26,149.39.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.