- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 30-01-2018.

(index / closing price / change items /% change)

Nikkei -337.37 23291.97 -1.43%

TOPIX -22.32 1858.13 -1.19%

Hang Seng -359.60 32607.29 -1.09%

CSI 300 -45.92 4256.10 -1.07%

Euro Stoxx 50 -36.29 3606.75 -1.00%

FTSE 100 -83.55 7587.98 -1.09%

DAX -126.77 13197.71 -0.95%

CAC 40 -47.81 5473.78 -0.87%

DJIA -362.59 26076.89 -1.37%

S&P 500 -31.10 2822.43 -1.09%

NASDAQ -64.02 7402.48 -0.86%

S&P/TSX -139.21 15955.51 -0.86%

Major US stock indexes finished the session in negative territory, while the Dow Jones Industrial Average and S & P indexes fell by more than 1%, as bond yields increased and companies' shares in the healthcare sector declined.

In addition, as it became known today, the housing price index from S & P / Case-Shiller for 20 cities increased seasonally by 0.7% over the three-month period ending in November, compared with the same period that ended in October , and grew by 6.4% compared to a year earlier. The national index grew seasonally adjusted by 0.7% MoM and 6.2% YoY.

At the same time, the index of consumer confidence from the Conference Board grew in January after a decline in December. The index is now 125.4, compared with 123.1 in December. The index of the current situation slightly decreased - from 156.5 to 155.3, and the index of expectations rose from 100.8 last month to 105.5 this month.

The cost of oil declined significantly on Tuesday, continuing yesterday's trend, which was caused by evidence of rising oil production in the US. In addition, cautious investors sold stocks, bonds and commodities.

Most components of the DOW index recorded a decline (27 of 30). Outsider were shares UnitedHealth Group Incorporated (UNH, -4.04%). The growth leader was the shares of Caterpillar Inc. (CAT, + 1.13%).

Almost all sectors of S & P finished trading in the red. The health sector showed the greatest decline (-1.7%). Only the utilities sector grew (+ 0.1%).

At closing:

DJIA -1.37% 26,076.89 -362.59

Nasdaq -0.86% 7.402.48 -64.02

S & P -1.09% 2,822.43 -31.10

U.S. stock-index futures fell on Tuesday, signaling the equities' readiness to extend losses into a second session. There is not one specific reason for the selling; rather, it is the result of some profit-taking following a strong start to 2018.

Global Stocks:

Nikkei 23,291.97 -337.37 -1.43%

Hang Seng 32,607.29 -359.60 -1.09%

Shanghai 3,488.19 -34.81 -0.99%

S&P/ASX 6,022.80 -52.60 -0.87%

FTSE 7,619.89 -51.64 -0.67%

CAC 5,494.30 -27.29 -0.49%

DAX 13,254.91 -69.57 -0.52%

Crude $64.97 (-0.90%)

Gold $1,343.80 (+0.26%)

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 255.8 | -0.21(-0.08%) | 4369 |

| ALCOA INC. | AA | 53.84 | -0.65(-1.19%) | 911 |

| ALTRIA GROUP INC. | MO | 69.09 | -0.74(-1.06%) | 1164 |

| Amazon.com Inc., NASDAQ | AMZN | 1,410.00 | -7.68(-0.54%) | 107277 |

| American Express Co | AXP | 99.29 | -0.12(-0.12%) | 7471 |

| Apple Inc. | AAPL | 166.21 | -1.75(-1.04%) | 442963 |

| AT&T Inc | T | 37.1 | -0.16(-0.43%) | 11793 |

| Barrick Gold Corporation, NYSE | ABX | 14.45 | 0.10(0.70%) | 21730 |

| Boeing Co | BA | 338.75 | -2.07(-0.61%) | 13183 |

| Caterpillar Inc | CAT | 160.38 | -2.20(-1.35%) | 29656 |

| Chevron Corp | CVX | 128 | -0.48(-0.37%) | 3750 |

| Cisco Systems Inc | CSCO | 42.7 | -0.15(-0.35%) | 46389 |

| Citigroup Inc., NYSE | C | 79.4 | -0.56(-0.70%) | 42669 |

| Exxon Mobil Corp | XOM | 87.5 | -0.51(-0.58%) | 10394 |

| Facebook, Inc. | FB | 184.05 | -1.93(-1.04%) | 151878 |

| Ford Motor Co. | F | 11.08 | -0.04(-0.36%) | 122178 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 19.5 | -0.13(-0.66%) | 19016 |

| General Electric Co | GE | 16.13 | -0.15(-0.92%) | 224186 |

| General Motors Company, NYSE | GM | 42.61 | -0.41(-0.95%) | 1916 |

| Goldman Sachs | GS | 271.1 | -1.38(-0.51%) | 6693 |

| Google Inc. | GOOG | 1,169.99 | -5.59(-0.48%) | 4491 |

| Hewlett-Packard Co. | HPQ | 23.7 | -0.11(-0.46%) | 464 |

| Home Depot Inc | HD | 202.7 | -2.22(-1.08%) | 11635 |

| HONEYWELL INTERNATIONAL INC. | HON | 160.1 | -1.37(-0.85%) | 793 |

| Intel Corp | INTC | 49.62 | -0.36(-0.72%) | 82415 |

| International Business Machines Co... | IBM | 165.75 | -1.05(-0.63%) | 10248 |

| International Paper Company | IP | 63.67 | -1.41(-2.17%) | 125 |

| Johnson & Johnson | JNJ | 143.14 | -0.54(-0.38%) | 7572 |

| JPMorgan Chase and Co | JPM | 115.41 | -0.79(-0.68%) | 43776 |

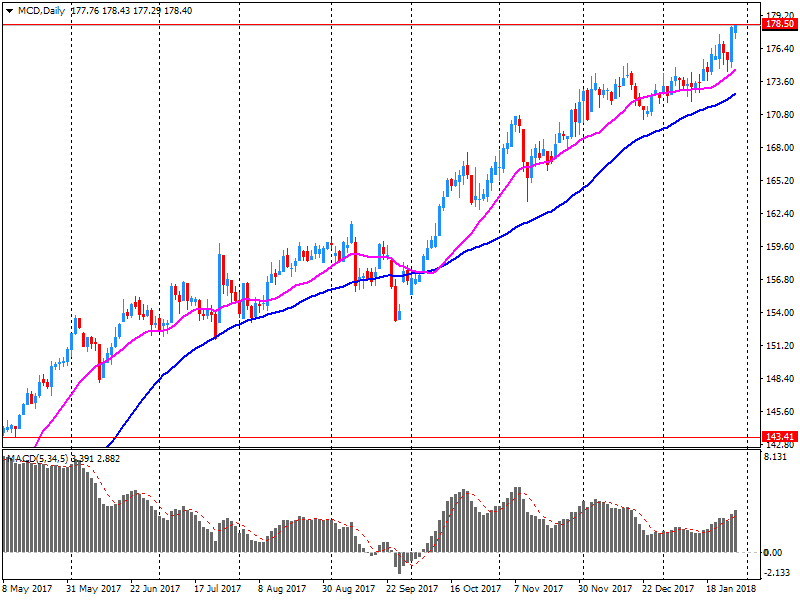

| McDonald's Corp | MCD | 176.27 | -1.50(-0.84%) | 181413 |

| Merck & Co Inc | MRK | 60.95 | -0.68(-1.10%) | 19973 |

| Microsoft Corp | MSFT | 93.6 | -0.32(-0.34%) | 133774 |

| Nike | NKE | 67.33 | -0.25(-0.37%) | 6860 |

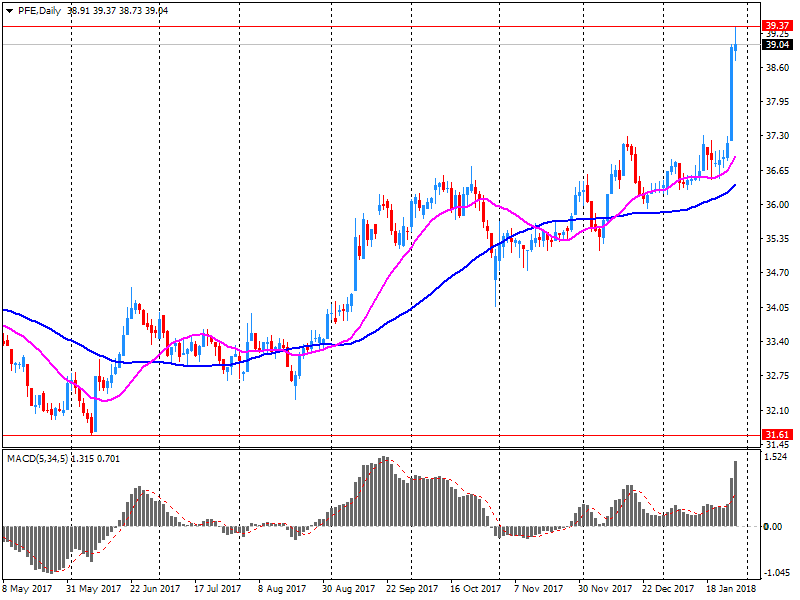

| Pfizer Inc | PFE | 38.4 | -0.62(-1.59%) | 384041 |

| Procter & Gamble Co | PG | 86.71 | -0.15(-0.17%) | 11332 |

| Starbucks Corporation, NASDAQ | SBUX | 56.75 | -0.27(-0.47%) | 19753 |

| Tesla Motors, Inc., NASDAQ | TSLA | 345.8 | -3.73(-1.07%) | 23251 |

| The Coca-Cola Co | KO | 47.62 | -0.08(-0.17%) | 4712 |

| Travelers Companies Inc | TRV | 148.5 | -0.46(-0.31%) | 1008 |

| Twitter, Inc., NYSE | TWTR | 25.04 | -0.14(-0.56%) | 271018 |

| United Technologies Corp | UTX | 136.2 | -0.47(-0.34%) | 3939 |

| UnitedHealth Group Inc | UNH | 233.6 | -13.81(-5.58%) | 653491 |

| Verizon Communications Inc | VZ | 53.85 | -0.28(-0.52%) | 8681 |

| Visa | V | 124.49 | -0.35(-0.28%) | 7958 |

| Wal-Mart Stores Inc | WMT | 109.46 | -0.09(-0.08%) | 9041 |

| Walt Disney Co | DIS | 111.21 | -0.33(-0.30%) | 7070 |

| Yandex N.V., NASDAQ | YNDX | 38.2 | -0.30(-0.78%) | 2460 |

Cisco Systems (CSCO) initiated with Hold at Loop Capital

Intel (INTC) resumed with a Buy at Citigroup; target $58

Amazon (AMZN) target raised to $1500 at Monness Crespi & Hardt

Alphabet (GOOG) target raised to $1350 at Needham

Alphabet A (GOOGL) target raised to $1375 from $1200 at B. Riley FBR

AT&T (T) target raised to $40 from $36 at Scotia; Sector Perform

McDonald's (MCD) reported Q4 FY 2017 earnings of $1.71 per share (versus $1.44 in Q4 FY 2016), beating analysts' consensus estimate of $1.59.

The company's quarterly revenues amounted to $5.340 bln (-11.4% y/y), beating analysts' consensus estimate of $5.221 bln.

MCD fell to $176.31 (-0.82%) in pre-market trading.

Pfizer (PFE) reported Q4 FY 2017 earnings of $0.62 per share (versus $0.47 in Q4 FY 2016), beating analysts' consensus estimate of $0.56.

The company's quarterly revenues amounted to $13.703 bln (+0.6% y/y), generally in-line with analysts' consensus estimate of $13.675 bln.

The company also issued upside guidance for FY 2018, projecting EPS of $2.90-3.00 (versus analysts' consensus estimate of $2.78) at revenues of $53.5-55.5 bln (versus analysts' consensus estimate of $53.82 bln).

PFE fell to $38.90 (-0.31%) in pre-market trading.

European stocks ended a volatile session in negative territory on Monday, with losses for banks and commodity companies outweighing a rally for chip makers that came after Apple-supplier AMS AG reported a major jump in revenue and lifted its sales forecasts.

All major U.S. benchmarks closed lower on Monday, with the Dow and the S&P 500 having their worst day this year, as the appetite for equities was dampened by a pickup in borrowing costs.

Asia-Pacific equity markets followed U.S. stock benchmarks lower as global government borrowing costs continued to rise. Indexes in the region hit session lows by midday, with Japan's Nikkei Stock Average NIK, -1.34% falling 1.5%. Benchmarks in Taiwan Y9999, -1.08% , Hong Kong and Australia XJO, -0.82% were each nearly 1% lower in recent trading.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.