- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 26-01-2018.

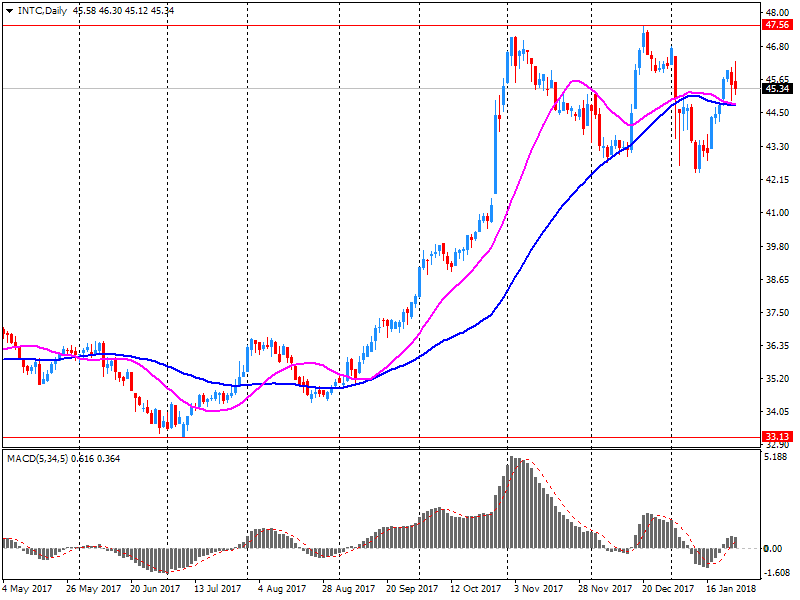

Major US stock indices rose strongly, reaching new record levels, supported by high incomes from Intel (INTC) and the pharmacist AbbVie (ABBV), as well as the weakness of the US dollar.

The focus was also on the United States. The Commerce Department reported that the US economy continued to grow in the fourth quarter, losing a little momentum from the summer, but gained enough strength to extend one of its best periods in recent years. Gross domestic product - the cost of all goods and services produced in the US - adjusted for inflation, from October to December increased by 2.6% on an annualized basis. Economists had expected growth of 2.9%. In the second and third quarters the output slightly exceeded 3%. The last growth, caused by a significant increase in the costs of US consumers and enterprises, has limited the best year of the economy since 2014. In the fourth quarter, the volume of output increased by 2.5% compared to the previous year. It grew by 1.8% in 2016 and by 2% in 2015. Last year was the fourth best calendar year of growth since expansion began in mid-2009.

Most components of the DOW index recorded a rise (24 out of 30). The leader of growth was shares of Intel Corporation (INTC, + 10.23%). Outsider were shares of Caterpillar Inc. (CAT, -1.43%).

All sectors of S & P finished trading in positive territory. The healthcare sector grew most (+ 1.7%).

At closing:

Dow + 0.85% 26.616.71 +223.92

Nasdaq + 1.28% 7.505.77 +94.61

S & P + 1.18% 2.872.87 +33.62

U.S. stock-index futures rose on Friday as investors assessed a raft of corporate earnings and economic data.

Global Stocks:

Nikkei 23,631.88 -37.61 -0.16%

Hang Seng 33,154.12 +499.67 +1.53%

Shanghai 3,559.09 +10.78 +0.30%

S&P/ASX -

FTSE 7,648.16 +32.32 +0.42%

CAC 5,537.59 +56.38 +1.03%

DAX 13,325.26 +26.90 +0.20%

Crude $65.57 (+0.09%)

Gold $1,351.30 (-0.86%)

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 255.5 | 7.81(3.15%) | 33227 |

| ALCOA INC. | AA | 53.47 | 0.17(0.32%) | 772 |

| Amazon.com Inc., NASDAQ | AMZN | 1,370.00 | 12.49(0.92%) | 49029 |

| American Express Co | AXP | 99.5 | 0.20(0.20%) | 681 |

| Apple Inc. | AAPL | 174.77 | 0.55(0.32%) | 127730 |

| AT&T Inc | T | 37.1 | 0.08(0.22%) | 12815 |

| Barrick Gold Corporation, NYSE | ABX | 15.2 | 0.15(1.00%) | 35172 |

| Boeing Co | BA | 336.35 | 1.66(0.50%) | 10210 |

| Caterpillar Inc | CAT | 174.65 | 6.31(3.75%) | 476858 |

| Cisco Systems Inc | CSCO | 42.36 | 0.19(0.45%) | 4510 |

| Citigroup Inc., NYSE | C | 79.98 | 0.53(0.67%) | 10054 |

| Deere & Company, NYSE | DE | 171.9 | 2.30(1.36%) | 6185 |

| Exxon Mobil Corp | XOM | 88.61 | 0.08(0.09%) | 1495 |

| Facebook, Inc. | FB | 188 | 1.45(0.78%) | 82917 |

| FedEx Corporation, NYSE | FDX | 270.99 | 0.58(0.21%) | 300 |

| Ford Motor Co. | F | 11.92 | -0.13(-1.08%) | 197291 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 20.55 | 0.95(4.85%) | 273237 |

| General Electric Co | GE | 16.58 | 0.14(0.85%) | 288290 |

| General Motors Company, NYSE | GM | 44.13 | -0.03(-0.07%) | 3914 |

| Goldman Sachs | GS | 266.9 | 1.22(0.46%) | 4486 |

| Google Inc. | GOOG | 1,174.88 | 10.64(0.91%) | 9232 |

| Hewlett-Packard Co. | HPQ | 23.7 | 0.04(0.17%) | 2673 |

| Home Depot Inc | HD | 206.85 | 0.63(0.31%) | 1234 |

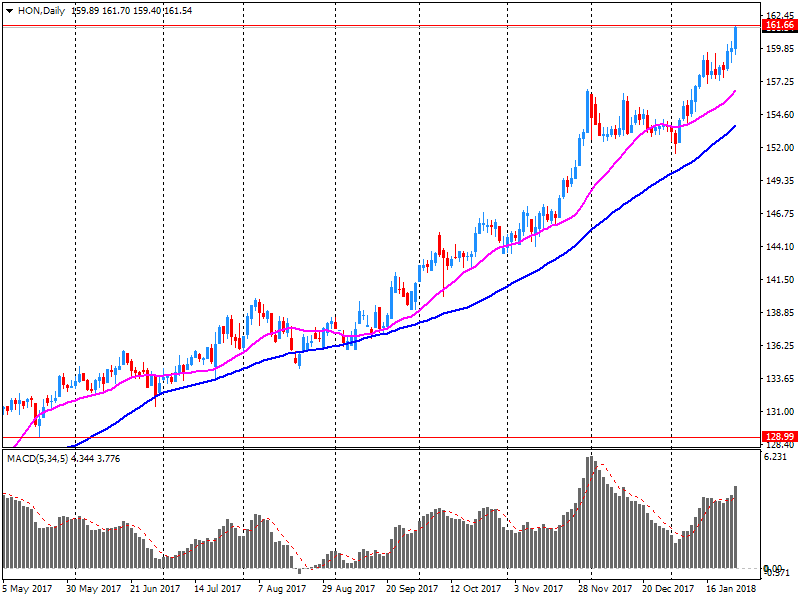

| HONEYWELL INTERNATIONAL INC. | HON | 161.87 | 1.90(1.19%) | 939 |

| Intel Corp | INTC | 45.88 | 0.37(0.81%) | 56288 |

| International Business Machines Co... | IBM | 166 | 0.63(0.38%) | 3458 |

| Johnson & Johnson | JNJ | 142.5 | 0.43(0.30%) | 6874 |

| JPMorgan Chase and Co | JPM | 116.35 | 0.68(0.59%) | 13552 |

| McDonald's Corp | MCD | 176.6 | 0.48(0.27%) | 750 |

| Merck & Co Inc | MRK | 61.49 | 0.31(0.51%) | 854 |

| Microsoft Corp | MSFT | 92.58 | 0.76(0.83%) | 36849 |

| Nike | NKE | 68.03 | 0.03(0.04%) | 929 |

| Pfizer Inc | PFE | 37.08 | 0.15(0.41%) | 4145 |

| Procter & Gamble Co | PG | 88.66 | 0.35(0.40%) | 10374 |

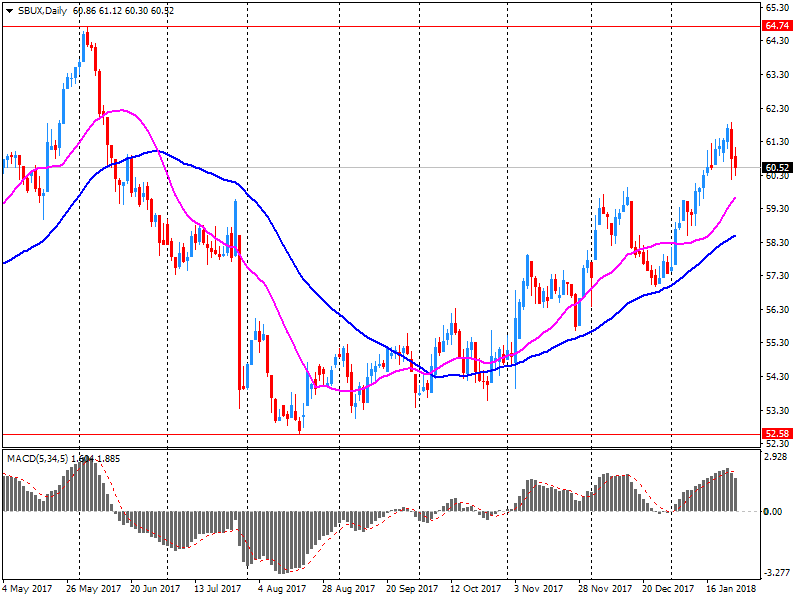

| Starbucks Corporation, NASDAQ | SBUX | 61.07 | 0.24(0.39%) | 8008 |

| Tesla Motors, Inc., NASDAQ | TSLA | 348.11 | 2.22(0.64%) | 20781 |

| The Coca-Cola Co | KO | 47.85 | 0.02(0.04%) | 649 |

| Twitter, Inc., NYSE | TWTR | 22.62 | 0.25(1.12%) | 61746 |

| United Technologies Corp | UTX | 135.43 | -0.25(-0.18%) | 1608 |

| UnitedHealth Group Inc | UNH | 245.95 | 1.10(0.45%) | 659 |

| Verizon Communications Inc | VZ | 54.39 | 0.17(0.31%) | 334 |

| Visa | V | 124.8 | 0.25(0.20%) | 4129 |

| Wal-Mart Stores Inc | WMT | 106 | 0.21(0.20%) | 2449 |

| Yandex N.V., NASDAQ | YNDX | 38.39 | 0.52(1.37%) | 2450 |

Intel (INTC) target raised to $52 from $47 at Mizuho

Intel (INTC) target raised to $55 from $53 at FB Riley

United Tech (UTX) target raised to $146 from $124 at Stifel

Starbucks (SBUX) removed from Conviction Buy List at Goldman

Travelers (TRV) upgraded to Neutral at Atlantic Equities

Intel (INTC) upgraded to Outperform from Neutral at Credit Suisse

Honeywell (HON) reported Q4 FY 2017 earnings of $1.85 per share (versus $1.74 in Q4 FY 2016), beating analysts' consensus estimate of $1.84.

The company's quarterly revenues amounted to $10.843 bln (+8.6% y/y), generally in-line with analysts' consensus estimate of $10.796 bln.

The company also issued updated guidance for FY 2018, projecting EPS of $7.75-8.00 (compared to its prior guidance of $7.55-7.80 and analysts' consensus estimate of $7.84) and revenues of $41.8-42.5 bln (versus analysts' consensus estimate of $42.23 bln).

HON fell to $160.00 (-1.14%) in pre-market trading.

Starbucks (SBUX) reported Q4 FY 2017 earnings of $0.58 per share (versus $0.52 in Q4 FY 2016), beating analysts' consensus estimate of $0.57.

The company's quarterly revenues amounted to $6.073 bln (+5.9% y/y), missing analysts' consensus estimate of $6.188 bln.

SBUX fell to $57.36 (-5.27%) in pre-market trading.

Intel (INTC) reported Q4 FY 2017 earnings of $1.08 per share (versus $0.79 in Q4 FY 2016), beating analysts' consensus estimate of $0.87.

The company's quarterly revenues amounted to $17.053 bln (+4.1% y/y), beating analysts' consensus estimate of $16.343 bln.

The company issued in-line guidance for Q1 FY 2018, projecting EPS of $0.65-0.75 (versus analysts' consensus estimate of $0.72) at revenues of $14.5-15.5 bln (versus analysts' consensus estimate of $15.03 bln).

Intel also raised quarterly dividend 10% to $0.30.

INTC rose to $47.63 (+5.14%) in pre-market trading.

European stock markets erased earlier gains and turned firmly lower on Thursday, yanked lower by a euro rally after the European Central Bank said eurozone growth was surprisingly strong and offered only limited pushback against the Trump administration's embrace of dollar weakness.

The S&P 500 and the Dow Jones Industrial Average logged fresh records on the back of robust earnings but both indexes finished off intraday highs in volatile trading as the buck rebounded following President Donald Trump's dollar-supportive comments.

Asian equities traded mixed Friday, while the dollar steadied after President Donald Trump waded into the unusual public discussion over exchange rates. Trump said that he favored a strong greenback, just a day after his Treasury secretary endorsed a weaker dollar as good for trade, sending the currency down.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.