- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 25-01-2018.

(index / closing price / change items /% change)

Nikkei -271.29 23669.49 -1.13%

TOPIX -16.67 1884.56 -0.88%

Hang Seng -304.24 32654.45 -0.92%

CSI 300 -24.81 4365.08 -0.57%

Euro Stoxx 50 -13.07 3630.15 -0.36%

FTSE 100 -27.59 7615.84 -0.36%

DAX -116.38 13298.36 -0.87%

CAC 40 -13.95 5481.21 -0.25%

DJIA +140.67 26392.79 +0.54%

S&P 500 +1.71 2839.25 +0.06%

NASDAQ -3.89 7411.16 -0.05%

S&P/TSX -80.20 16204.01 -0.49%

Major US stock indices showed mixed dynamics, as optimism about solid corporate revenues was partially offset by a sharp strengthening of the US dollar after statements by US President Trump.

The focus was also on the United States. As it became known today, the number of Americans applying for new unemployment benefits rose last week, partially replacing the sharp decline in the previous week and continuing the trend of a gradual increase in applications. Primary claims for unemployment benefits increased by 17,000 to 233,000, seasonally adjusted for the week to January 20. Economists were expecting 240,000 applications.

At the same time, sales of new single-family homes in the US fell more than expected in December, recording the largest decline in almost 1.5 years, probably as a result of the disappearance of the effect of replacing houses damaged by floods in the southern states, destroyed by hurricanes . The Ministry of Commerce reported that sales of new homes fell 9.3% to 725,000 units, taking into account seasonal fluctuations last month. The reduction percentage was the highest since August 2016. The November sales were revised to 689,000 units, which is still the strongest indicator since July 2007, from the previously reported 733,000 units. Economists predicted that sales of new homes would fall by 7.9% to 679,000 units last month.

Most components of the DOW index finished the session in positive territory (17 out of 30). The leader of growth was the shares of The Boeing Company (BA, + 2.48%). Outsider were the shares of Apple Inc. (AAPL, -1.88%).

Most sectors of the S & P recorded a rise. The utilities sector grew most (+ 1.1%). The largest decline was registered in the consumer goods sector (-0.9%).

At closing:

DJIA + 0.54% 26,392.79 +140.67

Nasdaq -0.05% 7,411.16 -3.90

S & P + 0.06% 2,839.25 +1.71

U.S. stock-index futures rose on Thursday as investors assessed corporate earnings.

Global Stocks:

Nikkei 23,669.49 -271.29 -1.13%

Hang Seng 32,654.45 -304.24 -0.92%

Shanghai 3,548.30 -11.16 -0.31%

S&P/ASX 6,050.00 -4.70 -0.08%

FTSE 7,658.64 +15.21 +0.20%

CAC 5,520.92 +25.76 +0.47%

DAX 13,439.45 +24.71 +0.18%

Crude $66.45 (+1.28%)

Gold $1,358.30 (+0.15%)

(company / ticker / price / change ($/%) / volume)

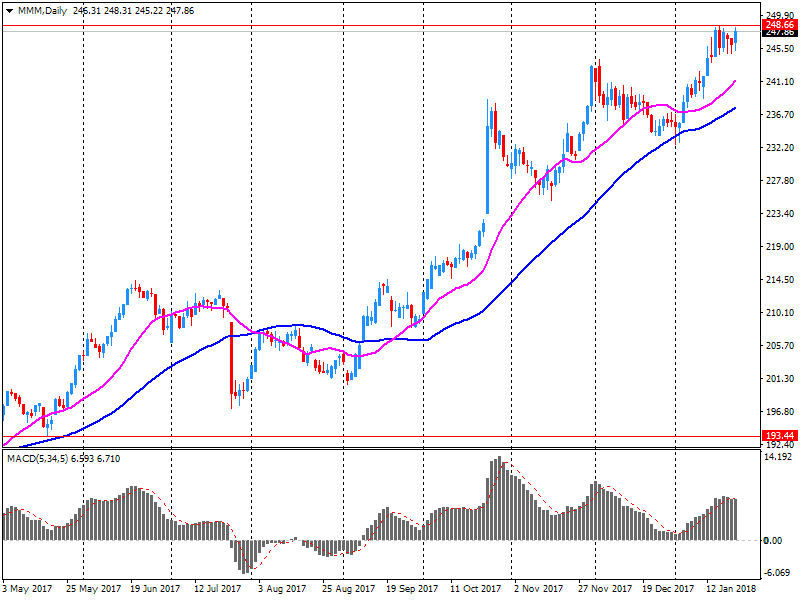

| 3M Co | MMM | 255.5 | 7.81(3.15%) | 33227 |

| ALCOA INC. | AA | 53.47 | 0.17(0.32%) | 772 |

| Amazon.com Inc., NASDAQ | AMZN | 1,370.00 | 12.49(0.92%) | 49029 |

| American Express Co | AXP | 99.5 | 0.20(0.20%) | 681 |

| Apple Inc. | AAPL | 174.77 | 0.55(0.32%) | 127730 |

| AT&T Inc | T | 37.1 | 0.08(0.22%) | 12815 |

| Barrick Gold Corporation, NYSE | ABX | 15.2 | 0.15(1.00%) | 35172 |

| Boeing Co | BA | 336.35 | 1.66(0.50%) | 10210 |

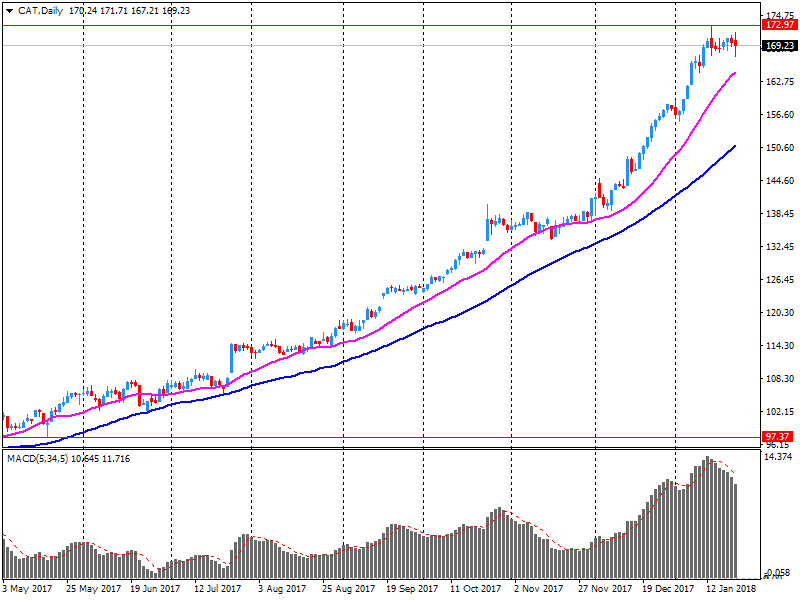

| Caterpillar Inc | CAT | 174.65 | 6.31(3.75%) | 476858 |

| Cisco Systems Inc | CSCO | 42.36 | 0.19(0.45%) | 4510 |

| Citigroup Inc., NYSE | C | 79.98 | 0.53(0.67%) | 10054 |

| Deere & Company, NYSE | DE | 171.9 | 2.30(1.36%) | 6185 |

| Exxon Mobil Corp | XOM | 88.61 | 0.08(0.09%) | 1495 |

| Facebook, Inc. | FB | 188 | 1.45(0.78%) | 82917 |

| FedEx Corporation, NYSE | FDX | 270.99 | 0.58(0.21%) | 300 |

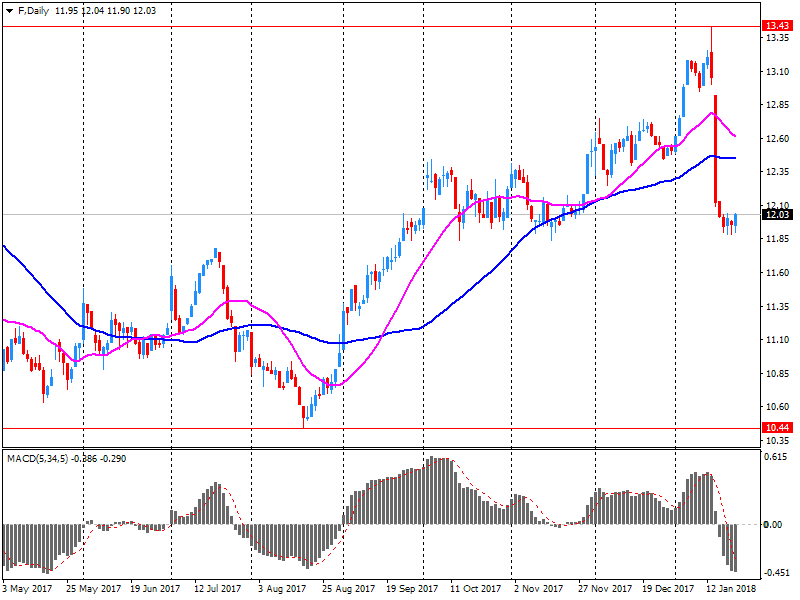

| Ford Motor Co. | F | 11.92 | -0.13(-1.08%) | 197291 |

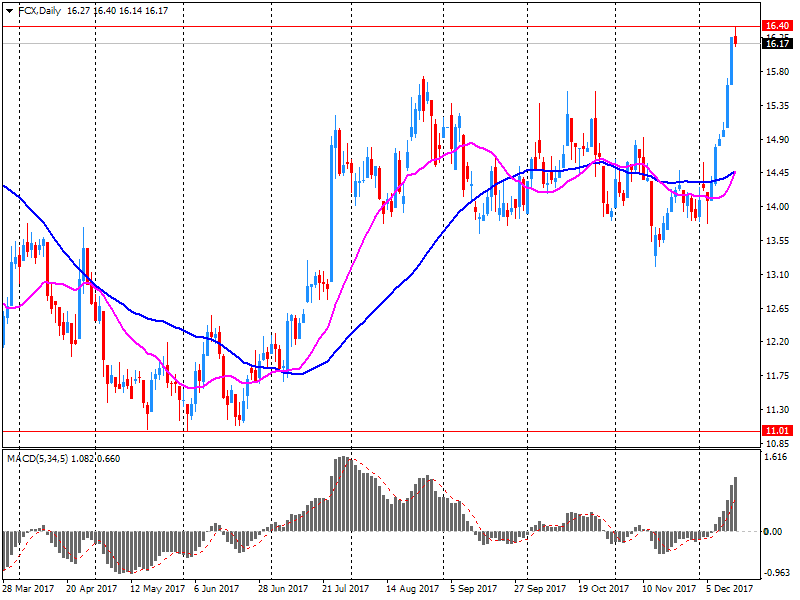

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 20.55 | 0.95(4.85%) | 273237 |

| General Electric Co | GE | 16.58 | 0.14(0.85%) | 288290 |

| General Motors Company, NYSE | GM | 44.13 | -0.03(-0.07%) | 3914 |

| Goldman Sachs | GS | 266.9 | 1.22(0.46%) | 4486 |

| Google Inc. | GOOG | 1,174.88 | 10.64(0.91%) | 9232 |

| Hewlett-Packard Co. | HPQ | 23.7 | 0.04(0.17%) | 2673 |

| Home Depot Inc | HD | 206.85 | 0.63(0.31%) | 1234 |

| HONEYWELL INTERNATIONAL INC. | HON | 161.87 | 1.90(1.19%) | 939 |

| Intel Corp | INTC | 45.88 | 0.37(0.81%) | 56288 |

| International Business Machines Co... | IBM | 166 | 0.63(0.38%) | 3458 |

| Johnson & Johnson | JNJ | 142.5 | 0.43(0.30%) | 6874 |

| JPMorgan Chase and Co | JPM | 116.35 | 0.68(0.59%) | 13552 |

| McDonald's Corp | MCD | 176.6 | 0.48(0.27%) | 750 |

| Merck & Co Inc | MRK | 61.49 | 0.31(0.51%) | 854 |

| Microsoft Corp | MSFT | 92.58 | 0.76(0.83%) | 36849 |

| Nike | NKE | 68.03 | 0.03(0.04%) | 929 |

| Pfizer Inc | PFE | 37.08 | 0.15(0.41%) | 4145 |

| Procter & Gamble Co | PG | 88.66 | 0.35(0.40%) | 10374 |

| Starbucks Corporation, NASDAQ | SBUX | 61.07 | 0.24(0.39%) | 8008 |

| Tesla Motors, Inc., NASDAQ | TSLA | 348.11 | 2.22(0.64%) | 20781 |

| The Coca-Cola Co | KO | 47.85 | 0.02(0.04%) | 649 |

| Twitter, Inc., NYSE | TWTR | 22.62 | 0.25(1.12%) | 61746 |

| United Technologies Corp | UTX | 135.43 | -0.25(-0.18%) | 1608 |

| UnitedHealth Group Inc | UNH | 245.95 | 1.10(0.45%) | 659 |

| Verizon Communications Inc | VZ | 54.39 | 0.17(0.31%) | 334 |

| Visa | V | 124.8 | 0.25(0.20%) | 4129 |

| Wal-Mart Stores Inc | WMT | 106 | 0.21(0.20%) | 2449 |

| Yandex N.V., NASDAQ | YNDX | 38.39 | 0.52(1.37%) | 2450 |

Home Depot (HD) target raised to $230 from $209 at Stifel

Amazon (AMZN) target raised to $1800 from $1500 at DA Davidson

Alphabet A (GOOGL) target raised to $1250 from $1175 at Goldman

Ford Motor (F) reported Q4 FY 2017 earnings of $0.39 per share (versus $0.30 in Q4 FY 2016), in-line with analysts' consensus estimate.

The company's quarterly revenues amounted to $38.500 bln (+6.9% y/y), beating analysts' consensus estimate of $36.946 bln.

F fell to $11.94 (-0.91%) in pre-market trading.

Freeport-McMoRan (FCX) reported Q4 FY 2017 earnings of $0.51 per share (versus $0.25 in Q4 FY 2016), beating analysts' consensus estimate of $0.50.

The company's quarterly revenues amounted to $5.041 bln (+15.2% y/y), beating analysts' consensus estimate of $4.887 bln.

FCX rose to $20.35 (+3.83%) in pre-market trading.

Caterpillar (CAT) reported Q4 FY 2017 earnings of $2.16 per share (versus $0.83 in Q4 FY 2016), beating analysts' consensus estimate of $1.78.

The company's quarterly revenues amounted to $12.896 bln (+34.7% y/y), beating analysts' consensus estimate of $12.005 bln.

The company also issued upside guidance for FY 2018, projecting EPS of $8.25-9.25 versus analysts' consensus estimate of $8.29.

CAT rose to $173.50 (+3.07%) in pre-market trading.

3M (MMM) reported Q4 FY 2017 earnings of $2.10 per share (versus $1.88 in Q4 FY 2016), beating analysts' consensus estimate of $2.03.

The company's quarterly revenues amounted to $7.990 bln (+9.0% y/y), beating analysts' consensus estimate of $7.845 bln.

The company issued upside guidance for FY 2018, projecting EPS of $10.20-10.70 versus its prior guidance of $9.60-10.00 and analysts' consensus estimate of $9.90.

It also raised dividend by 16% y/y to $1.36/share for Q1 FY 2018.

MMM rose to $254.02 (+2.56%) in pre-market trading.

European stocks broke a four-session winning streak on Wednesday, yanked lower by a rally in the euro after U.S. Treasury Secretary Steven Mnuchin cheered the recent slide in the dollar. Utility companies were among biggest decliners after a profit warning from industry major Suez SA.

U.S. stocks retreated from record territory Wednesday as technology names came under pressure, but the Dow managed to buck the trend to close higher on the back of a few blue-chip financial shares.

Asian stocks retreated from record highs on Thursday as investors mulled rhetoric from Trump administration officials on trade and the dollar that roiled the foreign-exchange market. The U.S. currency extended its decline to a three-year low.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.