- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 12-02-2015.

(index / closing price / change items /% change)

Nikkei 225 17,979.72 +327.04 +1.85%

Hang Seng 24,422.15 +107.13 +0.44%

Shanghai Composite 3,173.42 +15.71 +0.50%

FTSE 100 6,828.11 +9.94 +0.15%

CAC 40 4,726.2 +46.82 +1.00%

Xetra DAX 10,919.65 +167.54 +1.56%

S&P 500 2,088.48 +19.95 +0.96%

NASDAQ Composite 4,857.61 +56.43 +1.18%

Dow Jones 17,972.38 +110.24 +0.62%

Stock indices traded closed higher on news about a cease-fire between Russian separatists and Ukrainian forces. Russian President Vladimir Putin said the agreement would mean the removal of heavy weapons and a full ceasefire would be in place on February 15.

Eurozone's finance ministers meeting has ended without an agreement on extending the Greece's bailout on late Wednesday. The next meeting is scheduled to be on Monday.

Industrial production in the Eurozone was flat in December, missing expectations for a 0.3% increase, after a 0.1% rise in November. November's figure was revised down from a 0.2 increase.

On a yearly basis, Eurozone's industrial production fell 0.2% in December, missing expectations for a 0.3% rise, after a 0.8% drop in November. November's figure was revised down from a 0.4 decrease.

The Bank of England (BoE) Governor Mark Carney said that the central bank could hike its interest rate sooner than expected.

The central bank expects the consumer price inflation in the U.K. to be at around zero in the second and third quarters this year before starting to increase towards the end of 2015.

The BoE said that it could lower interest rates below 0.5% or could expand its £375 billion asset buying programme if inflation remained below target for a longer period.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,828.11 +9.94 +0.15%

DAX 10,919.65 +167.54 +1.56%

CAC 40 4,726.2 +46.82 +1.00%

U.S. stock-index futures rose as optimism over a cease-fire in Ukraine offset an unexpectedly steep drop in American retail sales.

Global markets:

Nikkei 17,979.72 +327.04 +1.85%

Hang Seng 24,422.15 +107.13 +0.44%

Shanghai Composite 3,173.35 +15.65 +0.50%

FTSE 6,824.61 +6.44 +0.09%

CAC 4,731.23 +51.85 +1.11%

DAX 10,939.25 +187.14 +1.74%

Crude oil $49.90 (+2.17%)

Gold $1225.60 (+0.49%)

(company / ticker / price / change, % / volume)

| Amazon.com Inc., NASDAQ | AMZN | 376.00 | +0.23% | 4.8K |

| McDonald's Corp | MCD | 94.45 | +0.25% | 0.4K |

| Verizon Communications Inc | VZ | 49.94 | +0.26% | 5.7K |

| Google Inc. | GOOG | 537.36 | +0.26% | 1.3K |

| AT&T Inc | T | 34.49 | +0.29% | 2.0K |

| ALTRIA GROUP INC. | MO | 54.92 | +0.29% | 0.3K |

| The Coca-Cola Co | KO | 42.50 | +0.31% | 1.0K |

| International Paper Company | IP | 55.68 | +0.31% | 0.1K |

| 3M Co | MMM | 165.00 | +0.32% | 0.1K |

| General Electric Co | GE | 24.85 | +0.32% | 5.5K |

| Microsoft Corp | MSFT | 42.52 | +0.33% | 9.7K |

| Boeing Co | BA | 148.50 | +0.39% | 0.4K |

| Starbucks Corporation, NASDAQ | SBUX | 91.14 | +0.39% | 2.5K |

| Goldman Sachs | GS | 188.50 | +0.45% | 0.6K |

| Walt Disney Co | DIS | 102.33 | +0.45% | 37.7K |

| Nike | NKE | 91.75 | +0.48% | 4.4K |

| General Motors Company, NYSE | GM | 37.85 | +0.48% | 8.9K |

| International Business Machines Co... | IBM | 159.00 | +0.51% | 1.6K |

| Pfizer Inc | PFE | 34.43 | +0.53% | 0.3K |

| Procter & Gamble Co | PG | 86.10 | +0.54% | 45.1K |

| Visa | V | 267.50 | +0.57% | 2.3K |

| Facebook, Inc. | FB | 76.96 | +0.59% | 82.2K |

| Hewlett-Packard Co. | HPQ | 38.41 | +0.60% | 0.8K |

| Johnson & Johnson | JNJ | 100.99 | +0.61% | 1.8K |

| Home Depot Inc | HD | 111.00 | +0.63% | 0.2K |

| JPMorgan Chase and Co | JPM | 58.74 | +0.63% | 7.3K |

| Caterpillar Inc | CAT | 83.95 | +0.65% | 44.3K |

| Wal-Mart Stores Inc | WMT | 86.90 | +0.65% | 2.4K |

| Intel Corp | INTC | 33.77 | +0.66% | 5.4K |

| Citigroup Inc., NYSE | C | 50.02 | +0.68% | 8.7K |

| Exxon Mobil Corp | XOM | 91.25 | +0.72% | 8.0K |

| AMERICAN INTERNATIONAL GROUP | AIG | 52.64 | +0.75% | 0.1K |

| Chevron Corp | CVX | 109.90 | +0.91% | 3.8K |

| ALCOA INC. | AA | 15.60 | +0.91% | 16.7K |

| Ford Motor Co. | F | 16.40 | +0.92% | 2.0K |

| Apple Inc. | AAPL | 126.10 | +0.98% | 703.9K |

| Travelers Companies Inc | TRV | 109.00 | +1.14% | 0.2K |

| Twitter, Inc., NYSE | TWTR | 48.05 | +1.16% | 46.0K |

| Barrick Gold Corporation, NYSE | ABX | 12.09 | +1.26% | 18.0K |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 19.08 | +2.58% | 21.0K |

| Yandex N.V., NASDAQ | YNDX | 16.76 | +4.75% | 80.7K |

| Cisco Systems Inc | CSCO | 29.00 | +7.69% | 704.8K |

| Yahoo! Inc., NASDAQ | YHOO | 42.96 | 0.00% | 14.2K |

| American Express Co | AXP | 83.75 | -2.63% | 14.6K |

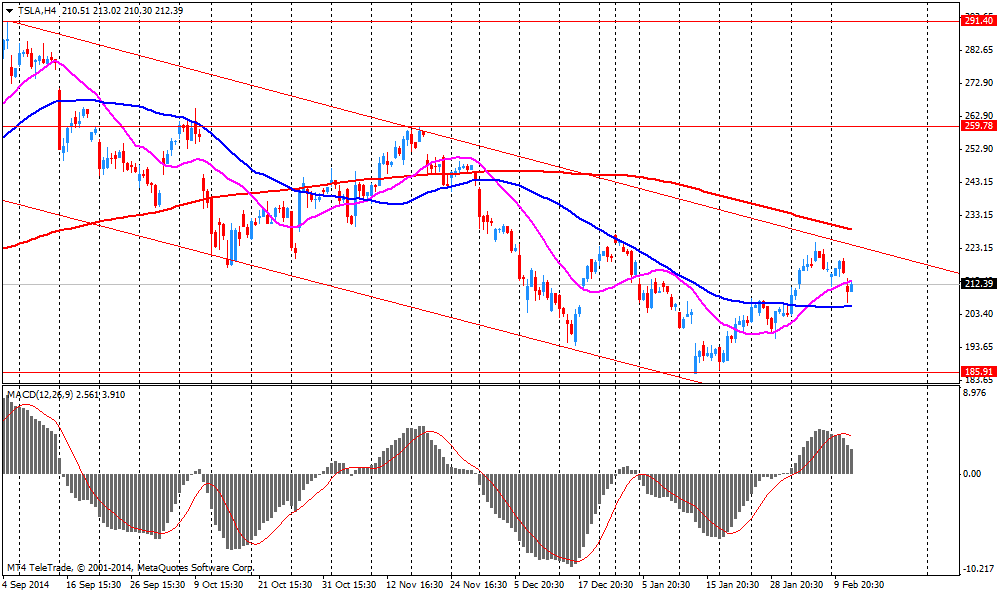

| Tesla Motors, Inc., NASDAQ | TSLA | 196.51 | -7.66% | 316.5K |

Upgrades:

Downgrades:

Tesla Motors (TSLA) downgraded from Neutral to Underweight at JP Morgan

Other:

Wal-Mart (WMT) target raised to $95 from $87 at Credit Suisse; Outperform

Cisco Systems (CSCO) target raised from $29 to $31 at RBC Capital Mkts, from $29 to $30 at Oppenheimer, from $28 to $29 at Wunderlich

Tesla Motors Inc (TSLA) earned $0.13 per share in the fourth quarter, missing analysts' estimate of $0.32. Revenue in the fourth quarter increased 43.9% year-over-year to $1.10 billion, but missing analysts' estimate of $1.23 billion.

The company announced that it delivered 9,834 cars in the fourth quarter, missing analysts' estimate of 11,000 cars and the company's estimate of 11,200 cars. The company expects to deliver 55,000 cars in 2015 (analysts' estimate: 50,000 - 60,000 cars)

Tesla Motors Inc (TSLA) shares decreased to $196.85 (-7.50%) prior to the opening bell.

Cisco Systems Inc (CSCO) earned $0.53 per share in the second fiscal quarter, beating analysts' estimate of $0.51. Revenue in the second fiscal quarter increased 7.0% year-over-year to $11.94 billion, exceeding analysts' estimate of $11.80 billion.

The company announced a 10.5% rise in its quarterly dividend to $0.21 per share.

Cisco Systems Inc (CSCO) shares increased to $28.95 (+7.50%) prior to the opening bell.

European stocks add gains fuelled by the Swedish surprise move lowering benchmark interest rates and the Ukrainian peace deal. Leaders of Germany, France, Russia and Ukraine agreed on a deal to stop fighting. Sweden's central bank today unexpectedly lowered its benchmark interest rate by 10 basis points to -0.10% from 0.0% and launched quantitative easing measures to counter deflation in the largest Nordic economy.

Greek officials reaffirmed today that they are confident of reaching a deal with its creditors. Yesterday's emergency meeting of the E.U. finance ministers failed to reach an agreement and deliver a joint statement on the outcome. Greece presented a 10 point plan to replace 30% of the bailout deal but creditors are insisting on the terms of the original agreement. Greece's bailout will expire on February 28th. Fears that Greece might leave the Eurozone, the "Grexit" weigh on the markets as decisions on the bailout-deal are postponed until next week, February 16th, were the next meeting is scheduled. Today E.U. leaders will meet at a summit.

Consumer Price Inflation in the Eurozone's biggest economy declined more-than-expected to a seasonally adjusted -1.1% in January - down for the third consecutive month. Analysts expected inflation to stay at the same level as in December, at -1.0%. The decline was mainly driven by falling oil prices. Year on year German Consumer Prices fell -0.4%, more than the expected -0.3%.

Eurozone's Industrial Production came in unexpectedly flat in December according to Eurostat. The data fuels concerns over the economic outlook of the single currency bloc. Analysts had forecasted a growth around +0.3%. Novembers figures were revised down from +0.3% to +0.2%. Year on year Industrial Production declined by -0.2% in December from a year earlier, compared to forecast of an increase of +0.3%.

The FTSE 100 index is currently trading +0.19% quoted at 6,831.18 points. Germany's DAX 30 added +1.56% trading at 10,920.03. France's CAC 40 is currently trading at 4,721.76 points, +0.91%.

European stocks add gains in early trading. Investors focus on Greece. Yesterday's emergency meeting of the E.U. finance ministers failed to reach an agreement and deliver a joint statement on the outcome. Greece presented a 10 point plan to replace the bailout deal but creditors are insisting on the terms of the original agreement. Greece's bailout will expire on February 28th. Fears that Greece might leave the Eurozone, the "Grexit" weighs on the markets as decisions on the bailout-deal are postponed until next week, February 16th, were the next meeting is scheduled. Today E.U. leaders will meet at a summit.

Today a large number of quarterly reports are also in the focus.

The FTSE 100 index is currently trading +0.28% quoted at 6,837.50 points. Germany's DAX 30 rose +0.73% trading at 10,830.35. France's CAC 40 added +0.17%, currently trading at 4,687.11 points.

U.S. markets closed almost unchanged on Wednesday. The DOW JONES index lost -0.04% closing at 17,862.14 points. The S&P 500 closed flat at +0.00% with a final quote of 2,068.53as investors worried about the outcome of the negotiations with Greece. The Eurozone Finance Minister Meetings failed to reach an agreement and deliver a joint statement on the outcome. Officials stated that discussions will continue. Greece's bailout will expire on February 28th. Fears that Greece might leave the Eurozone, the "Grexit", add to uncertainty and weigh on the markets.

Today U.S. data on Initial Jobless Claims, Retail Sales and Business Inventories are due at 13:30 GMT

Chinese shares added gains on Thursday in the wake of the Chinese New Year were volumes are expected to remain low. Hong Kong's Hang Seng is trading +0.36% at 24,402.37 points. China's Shanghai Composite closed at 3,173.35 points +0.50%. The index has gained more than 50% over the past year boosted by monetary easing and the creation of an exchange link with Hong Kong.

Japanese markets after being closed yesterday for a public holiday, trade at 7-1/2 -year highs. The Nikkei skyrocketed, closing +1.85% with a final quote of 17,979.72 points on a weaker yen boosting exporter shares.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.