- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 13-02-2015.

Stock indices traded closed higher on Eurozone's GDP data. Eurozone's preliminary gross domestic product (GDP) increased by 0.3% in the fourth quarter, exceeding expectations for a 0.2% rise, after a 0.2% gain in the third quarter.

On a yearly basis, Eurozone's preliminary GDP rose by 0.8% in the fourth quarter, exceeding expectations for a 0.8% increase, after a 0.8% gain in the third quarter.

For 2014 as a whole, GDP rose by 1.4% in the European Union. In comparison, the U.S. economy grew at an annual pace of 2.6% in 2014.

Germany's preliminary GDP gained by 0.7% in the fourth quarter, beating forecasts of a 0.3% rise, after a 0.1% increase in the third quarter.

France's preliminary GDP increased by 0.1% in the fourth quarter, in line with expectations, after a 0.3% gain in the previous quarter.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,873.52 +45.41 +0.67%

DAX 10,963.4 +43.75 +0.40%

CAC 40 4,759.36 +33.16 +0.70%

U.S. stock-index futures rose as German growth data signaled a strengthening in Europe's recovery and optimism increased about Greek debt talks.

Global markets:

Nikkei 17,913.36 -66.36 -0.37%

Hang Seng 24,682.54 +260.39 +1.07%

Shanghai Composite 3,204.61 +31.19 +0.98%

FTSE 6,878.78 +50.67 +0.74%

CAC 4,775.11 +48.91 +1.03%

DAX 11,000.76 +81.11 +0.74%

Crude oil $52.74 (+2.95%)

Gold $1229.20 (+0.70%)

(company / ticker / price / change, % / volume)

| Verizon Communications Inc | VZ | 49.53 | +0.02% | 1.8K |

| JPMorgan Chase and Co | JPM | 59.65 | +0.13% | 2.6K |

| McDonald's Corp | MCD | 95.25 | +0.17% | 0.2K |

| Intel Corp | INTC | 34.20 | +0.22% | 3.1K |

| Google Inc. | GOOG | 544.30 | +0.25% | 0.3K |

| Goldman Sachs | GS | 190.30 | +0.27% | 0.8K |

| Boeing Co | BA | 148.49 | +0.27% | 0.3K |

| Twitter, Inc., NYSE | TWTR | 48.10 | +0.31% | 63.6K |

| General Electric Co | GE | 24.97 | +0.32% | 8.7K |

| Facebook, Inc. | FB | 76.49 | +0.34% | 36.3K |

| General Motors Company, NYSE | GM | 38.15 | +0.34% | 9.2K |

| Microsoft Corp | MSFT | 43.24 | +0.35% | 19.6K |

| Citigroup Inc., NYSE | C | 51.07 | +0.35% | 13.1K |

| AT&T Inc | T | 34.74 | +0.38% | 30.1K |

| Caterpillar Inc | CAT | 83.85 | +0.38% | 0.9K |

| Procter & Gamble Co | PG | 86.42 | +0.45% | 0.1K |

| Apple Inc. | AAPL | 127.05 | +0.47% | 366.1K |

| Johnson & Johnson | JNJ | 99.00 | +0.57% | 0.8K |

| Exxon Mobil Corp | XOM | 93.00 | +0.68% | 22.2K |

| ALCOA INC. | AA | 15.77 | +0.77% | 3.7K |

| Nike | NKE | 92.72 | +0.78% | 1.0K |

| Chevron Corp | CVX | 111.80 | +0.85% | 10.9K |

| Yahoo! Inc., NASDAQ | YHOO | 44.31 | +0.88% | 1.9K |

| Barrick Gold Corporation, NYSE | ABX | 12.28 | +1.24% | 9.9K |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 19.90 | +2.21% | 5.8K |

| Yandex N.V., NASDAQ | YNDX | 16.86 | +2.74% | 26.5K |

| Visa | V | 270.91 | 0.00% | 3.7K |

| Walt Disney Co | DIS | 103.55 | -0.03% | 1K |

| Ford Motor Co. | F | 16.35 | -0.06% | 51.2K |

| Amazon.com Inc., NASDAQ | AMZN | 376.71 | -0.12% | 2.2K |

| The Coca-Cola Co | KO | 42.07 | -0.24% | 5.6K |

| Tesla Motors, Inc., NASDAQ | TSLA | 202.10 | -0.38% | 31.6K |

| Pfizer Inc | PFE | 34.73 | -0.40% | 0.8K |

| Cisco Systems Inc | CSCO | 29.32 | -0.48% | 43.4K |

| American Express Co | AXP | 79.75 | -0.91% | 51.4K |

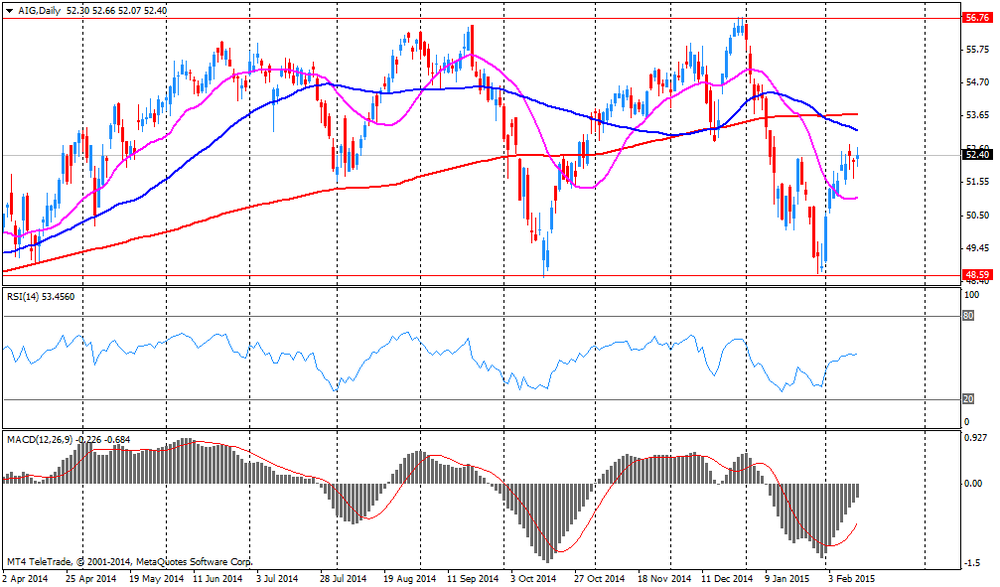

| AMERICAN INTERNATIONAL GROUP | AIG | 51.50 | -1.81% | 22.8K |

Upgrades:

Downgrades:

American Express (AXP) downgraded to Underperform from Buy at BofA/Merrill, target lowered to $78 from $109

Other:

Apple (AAPL) target raised to $150 from $130 at UBS

American Express (AXP) target lowered to $78 from $83 at Credit Suisse

American Intl (AIG) earned $0.97 per share in the fourth quarter, missing analysts' estimate of $1.03. Revenue in the fourth quarter decreased 1.8% year-over-year to $5.21 billion, missing analysts' estimate of $8.75 billion.

American Intl (AIG) shares decreased to $51.52 (-1.77%) prior to the opening bell.

European stocks trade steady on a light data day. The German DAX is heading for its 9th weekly gain, the longest winning streak in 17 years. The weaker euro is supporting export-heavy sectors.

Worries over Greece continue to weigh but equities remain supported by the ECB's quantitative easing started on Monday. The ECB is buying bonds worth 60 billion euros a month.

Today Greek Prime Minister Alexis Tsipras said that his country has already started fulfilling its commitments mentioned in the Eurogroup. He said he is optimistic about finding a solution as it is in common interest. He re-affirmed that he is pro-european.

The commodity heavy FTSE 100 index is currently trading -0.11% quoted at 6,753.38, down for the week. Germany's DAX 30 added +0.05% trading at 11,805.07, below its all-time high set at 11,845.9 yesterday. France's CAC 40 is currently trading at 4,987.98 points, +0.01%.

European stocks climbed, with Germany's DAX Index rising above 11,000 for the first time after a report

The DAX climbed as much as 0.9 percent to 11,013.85, before paring gains to 0.5 percent. The benchmark gauge is up 12 percent this year, making Germany the best performer among 24 developed markets. A report showed German gross domestic product surged 0.7 percent in the fourth quarter, a faster pace than the previous three months. The euro region's economy also gathered momentum.

Greece's ASE Index rallied 5.7 percent, heading for its best week since November. National Bank of Greece SA and Eurobank Ergasias SA jumped, pushing their weekly gains up more than 33 percent. Benchmark measures in Italy, Spain and Portugal advanced more than 1 percent.

Prime Minister Alexis Tsipras said yesterday that political will exists in the euro region for a deal. His government is seeking a six-month bridge agreement with creditors after its current aid program expires this month. German Chancellor Angela Merkel said her first meeting with Tsipras was friendly. Greek negotiators and officials from euro-area creditors plan to meet today.

Among stocks that moved on corporate news, L'Oreal SA rose 1.3 percent after the cosmetics maker reported faster-than-estimated quarterly revenue growth and expressed confidence for 2015.

Anglo American Plc gained 1.7 percent after posting full-year earnings that beat analysts' projections and writing down assets by $3.9 billion.

Seadrill Ltd. slumped 8.2 percent after the rig operator said it's removing $1.1 billion worth of contracts with Petroleo Brasileiro SA from its order book.

Mediaset SpA declined 4.8 percent after Silvio Berlusconi's Fininvest SpA sold a 7.8 percent stake in the broadcaster.

FTSE 100 6,868.42 +40.31 +0.59%

CAC 40 4,763.92 +37.72 +0.80%

DAX 10,986.18 +66.53 +0.61%

U.S. markets closed higher on Thursday despite weaker-than-expected Retail Sales data. Basic Materials, Technology and the Energy Sector drove indices higher. The U.S. retail sales dropped 0.8% in January, missing expectations for a 0.3% decrease, after a 0.9% decline in December. Retail sales excluding automobiles fell 0.9% in January, missing forecasts for a 0.4% decrease, after a 0.9% drop in December. December's figure was revised up from a 1.0% decline.

The number of initial jobless claims in the week ending February 07 in the U.S. rose by 25,000 to 304,000 from 279,000 in the previous week. The previous week's figure was revised down from 278,000. Analysts had expected the number of initial jobless claims to decrease to 278,000.

The U.S. business inventories rose by 0.1% in December, after a 0.2% gain in November. Analysts had expected a 0.2% increase.

Markets were supported by signs of easing tension between Greece and its euro-area creditors and the Ukraine resolution. The ECB raised the Emergency Liquidity Assistance cap for Greek banks by 5 billion euro.

The DOW JONES index added +0.62% closing at 17,972.38 points. The S&P 500 closed higher with a final quote of 2,088.48, +0.96%, 3 points from a record reached Dec. 29.

Chinese shares added gains on Friday in the wake of the Chinese New Year where volumes are expected to remain low. Speculations on further monetary easing supported the markets. Hong Kong's Hang Seng is trading +0.93% at 24,648.29 points. China's Shanghai Composite closed at 3,204.61 points +0.98%. The index has gained more than 50% over the past year boosted by monetary easing and the creation of an exchange link with Hong Kong.

Japanese markets retreated from yesterday's 7-1/2 -year highs. The Nikkei declined, closing -0.37% with a final quote of 17,913.36 points. Speculations that the Bank of Japan will not expand monetary easing weighed. Now all eyes are on Governor Kuroda and his comments on that matter next week.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.