- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 14-03-2017.

(index / closing price / change items /% change)

Nikkei -24.25 19609.50 -0.12%

TOPIX -2.50 1574.90 -0.16%

Hang Seng -1.72 23827.95 -0.01%

CSI 300 -1.41 3456.69 -0.04%

Euro Stoxx 50 -16.06 3399.43 -0.47%

FTSE 100 -9.23 7357.85 -0.13%

DAX -1.24 11988.79 -0.01%

CAC 40 -25.34 4974.26 -0.51%

DJIA -44.11 20837.37 -0.21%

S&P 500 -8.02 2365.45 -0.34%

NASDAQ -18.97 5856.82 -0.32%

S&P/TSX -165.21 15379.61 -1.06%

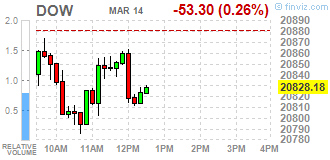

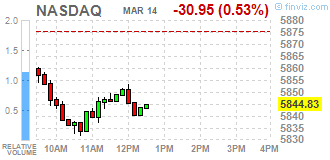

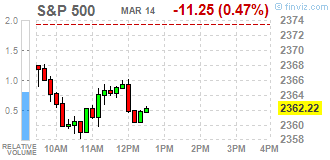

Major US stock indexes declined on Tuesday amid falling oil prices and expectations of the Fed meeting.

Investors focused on the Fed meeting, which is expected to raise interest rates. At the moment, the chances of a decision to raise rates at this meeting according to the dynamics of futures on federal funds are estimated at 93%. The head of the Federal Reserve, Janet Yellen, said earlier that the regulator is likely to raise the rate in March. However, investors are most interested in the Fed's signals about how quickly it is planned to raise rates this year. Now the probability of raising rates three or more times this year, they estimate in 64%.

The volume of trading was low, as the northeastern US state caught a snowstorm, leaving people at home.

The focus of investors' attention was also data on changes in producer prices last month. As it became known, in February, producer prices rose by 0.3% m / m, which is above the average forecast of analysts at + 0.1%. The base producer prices also rose by 0.3%, while analysts had expected growth of 0.2%.

The components of the DOW index mostly decreased (20 out of 30). The shares of Chevron Corporation fell more than others (CVX, -1.55%). Leader of growth were shares of Wal-Mart Stores, Inc. (WMT, + 1.34%).

All sectors of the S & P index ended the session in negative territory. Most of all, the main materials sector fell (-1.4%).

At closing:

Dow -0.21% 20,837.54 -43.94

Nasdaq -0.32% 5,856.82 -18.96

S & P-0.34% 2,365.38 -8.09

Major U.S. stock-indexes lower on Tuesday as oil prices fell and investors focused on the Federal Reserve's policy meeting, where it is widely expected to raise interest rates. Trading volumes were light as a blizzard in the northeastern United States grounded flights and kept people indoors.

Most of Dow stocks in negative area (21 of 30). Top loser - Chevron Corporation (CVX, -1.49%). Top gainer - Wal-Mart Stores, Inc. (WMT, +1.58%).

All S&P sectors in negative area. Top loser - Basic Materials (-1.4%).

At the moment:

Dow 20783.00 -60.00 -0.29%

S&P 500 2358.25 -13.50 -0.57%

Nasdaq 100 5373.75 -25.50 -0.47%

Oil 47.35 -1.05 -2.17%

Gold 1204.20 +1.10 +0.09%

U.S. 10yr 2.59 -0.01

U.S. stock-index futures fell ahead of the Federal Reserve's closely watched two-day meeting, where it is widely expected to raise interest rates.

Global Stocks:

Nikkei 19,609.50 -24.25 -0.12%

Hang Seng 23,827.95 -1.72 -0.01%

Shanghai 3,238.62 +1.60 +0.05%

FTSE 7,355.68 -11.40 -0.15%

CAC 4,971.34 -28.26 -0.57%

DAX 11,952.13 -37.90 -0.32%

Crude $47.83 (-1.18%)

Gold $1,204.80 (+0.14%)

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 191.1 | -0.42(-0.22%) | 500 |

| Amazon.com Inc., NASDAQ | AMZN | 852.04 | -2.55(-0.30%) | 1942 |

| Apple Inc. | AAPL | 138.9 | -0.30(-0.22%) | 25795 |

| Caterpillar Inc | CAT | 92.01 | -0.63(-0.68%) | 2312 |

| Chevron Corp | CVX | 108.53 | -0.82(-0.75%) | 4330 |

| Citigroup Inc., NYSE | C | 61.15 | -0.38(-0.62%) | 36839 |

| Exxon Mobil Corp | XOM | 81.15 | -0.27(-0.33%) | 22462 |

| Facebook, Inc. | FB | 139.25 | -0.35(-0.25%) | 27554 |

| Ford Motor Co. | F | 12.51 | -0.03(-0.24%) | 32778 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 12.45 | -0.11(-0.88%) | 102636 |

| General Electric Co | GE | 29.79 | -0.07(-0.23%) | 16499 |

| Goldman Sachs | GS | 247 | -1.16(-0.47%) | 2906 |

| Intel Corp | INTC | 35.1 | -0.06(-0.17%) | 25593 |

| International Business Machines Co... | IBM | 176.07 | -0.39(-0.22%) | 2233 |

| JPMorgan Chase and Co | JPM | 90.9 | -0.46(-0.50%) | 6112 |

| Merck & Co Inc | MRK | 64.17 | 0.02(0.03%) | 1350 |

| Microsoft Corp | MSFT | 64.58 | -0.13(-0.20%) | 6569 |

| Nike | NKE | 56.7 | 0.03(0.05%) | 3202 |

| Tesla Motors, Inc., NASDAQ | TSLA | 246.35 | 0.18(0.07%) | 7933 |

| Twitter, Inc., NYSE | TWTR | 15.15 | -0.06(-0.39%) | 13301 |

| Verizon Communications Inc | VZ | 49.42 | -0.05(-0.10%) | 13148 |

| Visa | V | 89.91 | -0.20(-0.22%) | 3819 |

| Wal-Mart Stores Inc | WMT | 70.55 | 0.60(0.86%) | 13607 |

| Walt Disney Co | DIS | 111.7 | 0.18(0.16%) | 7996 |

| Yandex N.V., NASDAQ | YNDX | 23 | -0.24(-1.03%) | 2020 |

Upgrades:

Walt Disney (DIS) upgraded to Buy from Neutral at Guggenheim

Downgrades:

Other:

FedEx (FDX) initiated with a Outperform at Wells Fargo

Wal-Mart (WMT) added to US 1 List at BofA/Merrill

European stocks climbed in volatile trade Monday, but with investors trading cautiously ahead of potentially market-moving events this week, including the Dutch election, the U.K.'s Brexit bill vote and a U.S. interest-rate decision.

Stocks closed marginally higher after switching between small gains and losses on Monday as investors refrained from making sizable bets ahead of a Federal Reserve meeting that is widely expected to deliver an interest-rate increase.

Stocks closed marginally higher after switching between small gains and losses on Monday as investors refrained from making sizable bets ahead of a Federal Reserve meeting that is widely expected to deliver an interest-rate increase.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.