- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 15-03-2017.

(index / closing price / change items /% change)

Nikkei -32.12 19577.38 -0.16%

TOPIX -3.59 1571.31 -0.23%

Hang Seng -35.10 23792.85 -0.15%

CSI 300 +6.95 3463.64 +0.20%

Euro Stoxx 50 +9.89 3409.32 +0.29%

FTSE 100 +10.79 7368.64 +0.15%

DAX +21.08 12009.87 +0.18%

CAC 40 +11.22 4985.48 +0.23%

DJIA +112.73 20950.10 +0.54%

S&P 500 +19.81 2385.26 +0.84%

NASDAQ +43.23 5900.05 +0.74%

S&P/TSX +141.30 15520.91 +0.92%

Major US stock indexes finished trading with a moderate increase, receiving support from the outcome of the meeting of the Federal Reserve System, as well as statistics on the United States.

The leadership of the Fed decided to raise the key interest rate by 0.25%, to 0.75% -1%. The regulator said it expects a gradual rate hike if the economy develops in line with their forecasts. The so-called "point" diagram of the Fed, through which the Central Bank reflects its assessment of the interest rate trajectory, shows that officials expect two more increases this year. Meanwhile, the average forecasts indicated that by the end of 2018 the rate will be in the range 2.0% -2.25%, which implies three more rate increases of 0.25% in 2018. As for 2019, expectations have slightly increased, and now forecasts indicate that the rate will be 3% by the end of 2019. At the same time, the economic forecasts of the Fed have not changed much relative to December. According to the median forecast, GDP growth in 2017 and in 2018 will be 2.1%. Expectations for long-term unemployment fell to 4.7% from 4.8% in December.

As for the statistical data, the Ministry of Labor reported that consumer prices continued to rise in February. The consumer price index in February rose by 0.1% compared to the previous month. The cost of energy and food, so-called basic prices, increased by 0.2%. These figures corresponded to the expectations of economists and reinforced the opinion of the Fed on the underlying strength in the economy. Consumer prices rose by 2.7% compared to last year, which is the largest annual increase from 12 months to March 2012.

Meanwhile, the Ministry of Commerce said that retail sales in the US were practically not moving forward in February, which is a warning to consumers, which may be due to a brief delay in some tax refunds. Sales in retail stores and restaurants in the US rose 0.1% compared with the previous month and seasonally adjusted $ 473.99 billion. This was the weakest increase since August. Excluding cars and auto parts, sales rose 0.2% from January.

The components of the DOW index have mostly grown (24 out of 30). Caterpillar Inc. was the growth leader. (CAT, + 1.68%). More shares fell American Express Company (AXP, -0.53%).

All sectors of the S & P index showed an increase. The leader of growth was the sector of basic materials (+ 2.6%).

At closing:

Dow + 0.54% 20,949.75 +112.38

Nasdaq + 0.74% 5,900.05 +43.23

S & P + 0.83% 2,385.11 +19.66

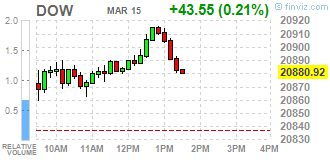

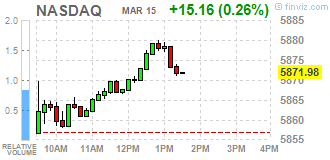

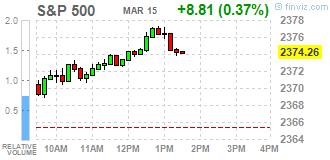

Major U.S. stock-indexes were mostly higher on Wednesday, with investors counting down to the conclusion of the Federal Reserve's two-day meeting, where the central bank is widely expected to raise rates for the first time this year.

Most of Dow stocks in positive area (21 of 30). Top loser - Intel Corporation (INTC, -1.73%). Top gainer - UnitedHealth Group Incorporated (UNH, +1.22%).

All S&P sectors in positive area. Top loser - Conglomerates (+1.5%).

At the moment:

Dow 20850.00 +47.00 +0.23%

S&P 500 2371.75 +8.75 +0.37%

Nasdaq 100 5396.00 +10.50 +0.19%

Oil 48.42 +0.70 +1.47%

Gold 1199.70 -2.90 -0.24%

U.S. 10yr 2.58 -0.01

U.S. stock-index futures rose slightly as investors focused on a Federal Reserve meeting, where the regulator is widely expected to hike interest rates for the second time in three months.

Global Stocks:

Nikkei 19,577.38 -32.12 -0.16%

Hang Seng 23,792.85 -35.10 -0.15%

Shanghai 3,241.94 +2.61 +0.08%

FTSE 7,373.92 +16.07 +0.22%

CAC 4,978.42 +4.16 +0.08%

DAX 11,987.79 -1.00 -0.01%

Crude $48.71 (+2.07%)

Gold $1,198.20 (-0.37%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 34.57 | 0.38(1.11%) | 3115 |

| Amazon.com Inc., NASDAQ | AMZN | 854 | 1.47(0.17%) | 2659 |

| Apple Inc. | AAPL | 139.26 | 0.27(0.19%) | 39204 |

| AT&T Inc | T | 42.17 | 0.08(0.19%) | 217 |

| Barrick Gold Corporation, NYSE | ABX | 17.87 | 0.07(0.39%) | 27886 |

| Caterpillar Inc | CAT | 92.25 | 0.39(0.42%) | 1375 |

| Chevron Corp | CVX | 108.15 | 0.79(0.74%) | 4658 |

| Cisco Systems Inc | CSCO | 34.14 | 0.02(0.06%) | 557 |

| Citigroup Inc., NYSE | C | 61.63 | 0.19(0.31%) | 7942 |

| Exxon Mobil Corp | XOM | 81.46 | 0.47(0.58%) | 11251 |

| Facebook, Inc. | FB | 139.5 | 0.18(0.13%) | 17464 |

| Ford Motor Co. | F | 12.56 | 0.01(0.08%) | 28636 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 12.48 | 0.21(1.71%) | 25454 |

| General Electric Co | GE | 29.6 | 0.06(0.20%) | 2275 |

| General Motors Company, NYSE | GM | 37.04 | 0.08(0.22%) | 3465 |

| Goldman Sachs | GS | 248.82 | 1.10(0.44%) | 3606 |

| Intel Corp | INTC | 34.9 | -0.28(-0.80%) | 59426 |

| International Business Machines Co... | IBM | 175.99 | 0.27(0.15%) | 1181 |

| JPMorgan Chase and Co | JPM | 91.65 | 0.14(0.15%) | 2180 |

| Microsoft Corp | MSFT | 64.54 | 0.13(0.20%) | 2460 |

| Nike | NKE | 57.55 | 0.27(0.47%) | 6278 |

| Starbucks Corporation, NASDAQ | SBUX | 54.52 | 0.25(0.46%) | 1781 |

| Tesla Motors, Inc., NASDAQ | TSLA | 256.81 | -1.19(-0.46%) | 58558 |

| Twitter, Inc., NYSE | TWTR | 15.2 | -0.12(-0.78%) | 71415 |

| Visa | V | 90.05 | 0.50(0.56%) | 1027 |

| Wal-Mart Stores Inc | WMT | 70.75 | 0.03(0.04%) | 1265 |

| Walt Disney Co | DIS | 112.76 | 0.45(0.40%) | 1767 |

| Yandex N.V., NASDAQ | YNDX | 23 | 0.20(0.88%) | 1850 |

Upgrades:

Downgrades:

Intel (INTC) downgraded to Neutral from Outperform at Credit Suisse

Other:

Apple (AAPL) target raised to $155 from $140 at RBC Capital Mkts

European stocks closed with their first loss in four sessions Tuesday, with a selloff in the oil prices knocking down oil shares, while investors stepped back before this week's Dutch election and the Federal Reserve's policy meeting.

U.S. stocks finished lower Tuesday as a persistent slump in oil prices put pressure on energy shares, while investors were also making guarded moves as the Federal Reserve's two-day Federal Open Market Committee meeting got underway. Meanwhile, a winter storm bearing down on New York City cut into trading volumes, with thousands of flights canceled across parts of the East Coast and a state of emergency declared for the city itself.

Asian shares were broadly lower Wednesday, tracking losses in the U.S., as the market cautiously awaited a decision on interest rates by the Federal Reserve. In keeping with the theme of quiet anticipation that has dominated markets for much of the week, selling was modest ahead of the conclusion of the two-day Federal Open Market Committee meeting later in the global trading day.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.