- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 16-04-2018.

| index | closing price | change items | % change |

| Nikkei | +56.79 | 21835.53 | +0.26% |

| TOPIX | +6.86 | 1736.22 | +0.40% |

| Hang Seng | -492.79 | 30315.59 | -1.60% |

| CSI 300 | -62.28 | 3808.86 | 3808.86 |

| Euro Stoxx 50 | -6.96 | 3441.04 | -0.20% |

| FTSE 100 | -66.36 | 7198.20 | -0.91% |

| DAX | -50.99 | 12391.41 | -0.41% |

| CAC 40 | -2.06 | 5312.96 | -0.04% |

| DJIA | +212.90 | 24573.04 | +0.87% |

| S&P 500 | +21.54 | 2677.84 | +0.81% |

| NASDAQ | +49.64 | 7156.29 | +0.70% |

| S&P/TSX | +26.41 | 15300.38 | +0.17% |

Major US stock indexes finished trading in positive territory, helped by the growth of the services sector and easing fears that recent air strikes on Syria will escalate into a wider conflict.

In addition, investors were acting out data on the United States. The Commerce Department reported that sales in retail stores rose 0.6% in March, and stopped a succession of three consecutive declines, highlighting the improved financial picture of American households and the sustainability of economic expansion. Economists had expected an increase of 0.4%. The Easter holiday, which fell on the last weekend of the month, helped attract more visitors to the stores.

Meanwhile, the results of the research published by the Federal Reserve Bank of New York showed that the region's production index declined significantly in April, while the fall was stronger than the average forecasts of economists. According to the data, the production index fell to +15.8 points from +22.5 points in March. Previous value was not revised. It was expected that the index will be 19.80 points.

In addition, the National Association of Home Builders (NAHB) / Wells Fargo said that the confidence of builders in the market of newly built houses for one family in April fell by 1 point to the level of 69. The sub-index of HMI, measuring consumer traffic, remained at 51, and The indicator measuring sales expectations for the next six months fell by one point to 77, and the component measuring current sales conditions fell by two points to 75.

Most components of the DOW index finished trading in positive territory (27 out of 30). The leader of growth was UnitedHealth Group Incorporated (UNH, + 3.02%). Outsider were shares of General Electric Company (GE, -1.41%).

All sectors of the S & P index recorded an increase. The services sector grew most (+ 1.1%).

At closing:

Index

Dow 24,574.04 +213.90 +0.88%

S&P 500 2,677.88 +21.58 +0.81%

Nasdaq 100 7,156.28 +49.64 +0.70%

U.S. stock-index futures rose on Monday, as investor fears that the weekend's U.S.-led attack on the Syrian government would escalate into a broader conflict, eased, while Q1 corporate earnings came into focus.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 21,835.53 | +56.79 | +0.26% |

| Hang Seng | 30,315.59 | -492.79 | -1.60% |

| Shanghai | 3,110.75 | -48.30 | -1.53% |

| S&P/ASX | 5,841.30 | +12.20 | +0.21% |

| FTSE | 7,236.74 | -27.82 | -0.38% |

| CAC | 5,311.22 | -3.80 | -0.07% |

| DAX | 12,442.33 | -0.07 | 0.00% |

| Crude | $66.86 | | -0.79% |

| Gold | $1,349.80 | | +0.13% |

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 217.35 | 1.83(0.85%) | 2763 |

| ALCOA INC. | AA | 55.79 | 0.83(1.51%) | 3291 |

| ALTRIA GROUP INC. | MO | 63.92 | -0.03(-0.05%) | 2563 |

| Amazon.com Inc., NASDAQ | AMZN | 1,444.85 | 14.06(0.98%) | 34496 |

| American Express Co | AXP | 93.93 | 0.90(0.97%) | 1513 |

| Apple Inc. | AAPL | 175.89 | 1.16(0.66%) | 88254 |

| AT&T Inc | T | 35.25 | 0.11(0.31%) | 8312 |

| Barrick Gold Corporation, NYSE | ABX | 13.18 | 0.03(0.23%) | 12053 |

| Boeing Co | BA | 331.95 | 2.67(0.81%) | 13727 |

| Caterpillar Inc | CAT | 151.5 | 1.27(0.85%) | 3621 |

| Chevron Corp | CVX | 120.5 | 0.58(0.48%) | 1096 |

| Cisco Systems Inc | CSCO | 43.23 | 0.23(0.53%) | 13548 |

| Citigroup Inc., NYSE | C | 70.95 | -0.06(-0.08%) | 59220 |

| Deere & Company, NYSE | DE | 150.47 | 0.49(0.33%) | 531 |

| Exxon Mobil Corp | XOM | 78.13 | 0.29(0.37%) | 7889 |

| Facebook, Inc. | FB | 165.59 | 1.07(0.65%) | 89303 |

| Ford Motor Co. | F | 11.33 | 0.05(0.44%) | 5498 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 17.99 | 0.12(0.67%) | 338 |

| General Electric Co | GE | 13.45 | -0.04(-0.30%) | 322282 |

| General Motors Company, NYSE | GM | 38.97 | 0.24(0.62%) | 2387 |

| Goldman Sachs | GS | 257.4 | 1.48(0.58%) | 5684 |

| Google Inc. | GOOG | 1,034.75 | 5.48(0.53%) | 2895 |

| Hewlett-Packard Co. | HPQ | 21.91 | 0.14(0.64%) | 983 |

| Home Depot Inc | HD | 174 | 1.20(0.69%) | 698 |

| Intel Corp | INTC | 52.31 | 0.45(0.87%) | 37072 |

| International Business Machines Co... | IBM | 158 | 1.29(0.82%) | 3913 |

| International Paper Company | IP | 53.47 | 0.25(0.47%) | 188 |

| Johnson & Johnson | JNJ | 131.3 | 0.68(0.52%) | 3807 |

| McDonald's Corp | MCD | 161.19 | -0.54(-0.33%) | 10357 |

| Merck & Co Inc | MRK | 57.5 | 0.33(0.58%) | 8693 |

| Microsoft Corp | MSFT | 93.8 | 0.72(0.77%) | 38369 |

| Nike | NKE | 67.5 | 0.25(0.37%) | 546 |

| Pfizer Inc | PFE | 36.48 | 0.16(0.44%) | 4526 |

| Procter & Gamble Co | PG | 78.73 | 0.36(0.46%) | 5755 |

| Starbucks Corporation, NASDAQ | SBUX | 58.94 | -0.30(-0.51%) | 21399 |

| Tesla Motors, Inc., NASDAQ | TSLA | 301 | 0.66(0.22%) | 34576 |

| The Coca-Cola Co | KO | 44.69 | 0.18(0.40%) | 3535 |

| Twitter, Inc., NYSE | TWTR | 28.93 | 0.17(0.59%) | 29175 |

| United Technologies Corp | UTX | 123.75 | 1.04(0.85%) | 1623 |

| UnitedHealth Group Inc | UNH | 226.1 | 1.82(0.81%) | 1993 |

| Verizon Communications Inc | VZ | 47.9 | 0.24(0.50%) | 3116 |

| Visa | V | 121.41 | 0.66(0.55%) | 2261 |

| Wal-Mart Stores Inc | WMT | 86.43 | 0.41(0.48%) | 2367 |

| Walt Disney Co | DIS | 101.17 | 0.82(0.82%) | 3974 |

| Yandex N.V., NASDAQ | YNDX | 32.95 | -0.03(-0.09%) | 21843 |

McDonald's (MCD) downgraded to Equal-Weight from Overweight at Stephens

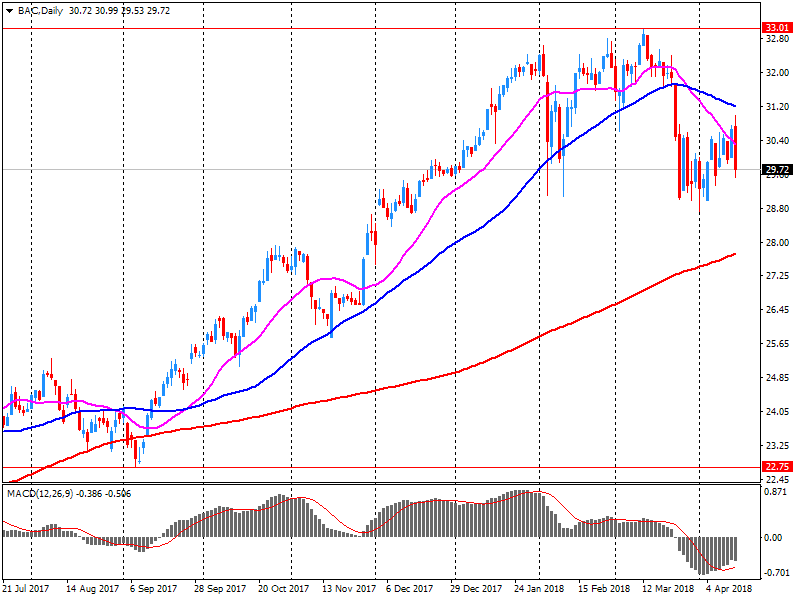

Bank of America (BAC) reported Q1 FY 2018 earnings of $0.62 per share (versus $0.41 in Q1 FY 2017), beating analysts' consensus estimate of $0.59.

The company's quarterly revenues amounted to $23.100 bln (+4.1% y/y), in-line with analysts' consensus estimate of $23.036 bln.

BAC rose to $29.94 (+0.47%) in pre-market trading.

April 16

Before the Open:

Bank of America (BAC). Consensus EPS $0.59, Consensus Revenues $23035.80 mln.

April 17

Before the Open:

Goldman Sachs (GS). Consensus EPS $5.57, Consensus Revenues $8727.11 mln.

Johnson & Johnson (JNJ). Consensus EPS $2.00, Consensus Revenues $19497.45 mln.

UnitedHealth (UNH). Consensus EPS $2.91, Consensus Revenues $54898.52 mln.

After the Close:

IBM (IBM). Consensus EPS $2.42, Consensus Revenues $18802.84 mln.

April 18

Before the Open:

Morgan Stanley (MS). Consensus EPS $1.25, Consensus Revenues $10369.14 mln.

After the Close:

Alcoa (AA). Consensus EPS $0.63, Consensus Revenues $3130.82 mln.

American Express (AXP). Consensus EPS $1.71, Consensus Revenues $9516.25 mln.

April 20

Before the Open:

General Electric (GE). Consensus EPS $0.11, Consensus Revenues $27316.83 mln.

Honeywell (HON). Consensus EPS $1.90, Consensus Revenues $10034.47 mln.

Procter & Gamble (PG). Consensus EPS $0.99, Consensus Revenues $16214.70 mln.

European stocks edged higher on Friday, with the benchmark index scoring a third straight week of gains, as investors watched for developments in the Syria situation and in the trade spat between the U.S. and China.

U.S. stock benchmarks on Friday wrapped up a solid week on a down note as better-than-expected first-quarter earnings failed to stir buying appetite on Wall Street, underlining concerns about lofty quarterly expectations for American corporations, high valuations and geopolitical anxiety.

Asian stocks saw early gains erode by midmorning Monday, led by declines in Hong Kong and Chinese equities as investors assess airstrikes against Syria over the weekend and focus on the start of earnings season in the U.S. as well as speeches by Federal Reserve officials.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.