- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 17-01-2018.

(index / closing price / change items /% change)

Nikkei -83.47 23868.34 -0.35%

TOPIX -3.43 1890.82 -0.18%

Hang Seng +78.66 31983.41 +0.25%

CSI 300 -10.35 4248.12 -0.24%

Euro Stoxx 50 -9.23 3612.78 -0.25%

FTSE 100 -30.50 7725.43 -0.39%

DAX -62.37 13183.96 -0.47%

CAC 40 -19.83 5493.99 -0.36%

DJIA +322.79 26115.65 +1.25%

S&P 500 +26.14 2802.56 +0.94%

NASDAQ +74.60 7298.28 +1.03%

S&P/TSX +27.82 16326.70 +0.17%

Major US stock indices rose strongly, while the DJIA index closed for the first time above 26,000, helped by a rise in the price of shares of technological and industrial companies. Meanwhile, further increases were limited to losses of General Electric Company and The Goldman Sachs Group.

The focus was also on the United States. The Fed said industrial production rose 0.9 percent in December, helped by sustained growth in the mining industry following a revised 0.1 percent decline in November. Economists predicted that industrial production will grow by 0.3 percent after a 0.2 percent growth was registered in November. Industrial production grew at an annualized rate of 8.2 percent in the fourth quarter, which was the largest increase since the second quarter of 2010. For the whole of 2017, the volume of industrial production grew by 1.8 percent, which is the first and largest increase since 2014. The growth of the industrial sector is facilitated by the strengthening of the global economy and the weakening of the dollar, which helps make US exports more competitive than the country's main trading partners.

Meanwhile, the confidence of builders in the market of newly built houses for a single family fell by 2 points to a level of 72 in January, showed the housing market index (HMI) from the National Association of Housing Owners / Wells Fargo. "The builders are confident that changes in the tax code will promote the development of small businesses and lead to wider economic growth," said NAHB chairman Randy Noel. - Our participants are very happy about what awaits them ahead. However, they still face rising prices for materials and a shortage of labor and plots.

Almost all components of the DOW index finished trading in positive territory (25 out of 30). The leader of growth was the shares of The Boeing Company (BA, 4.85%). Outsider were shares of General Electric Company (GE, -4.91%).

All sectors of the S & P index recorded an increase. The technological sector grew most (+ 1.2%).

At closing:

DJIA + 1.25% 26,115.65 +322.79

Nasdaq + 1.03% 7,298.28 +74.59

S & P + 0.94% 2,802.56 +26.14

U.S. stock-index futures rose on Wednesday as investors assessed fourth-quarter earnings from Bank of America (BAC) and Goldman Sachs (GS).

Global Stocks:

Nikkei 23,868.34 -83.47 -0.35%

Hang Seng 31,983.41 +78.66 +0.25%

Shanghai 3,445.36 +8.76 +0.26%

S&P/ASX 6,015.80 -32.80 -0.54%

FTSE 7,738.09 -17.84 -0.23%

CAC 5,507.33 -6.49 -0.12%

DAX 13,209.47 -36.86 -0.28%

Crude $63.66 (-0.11%)

Gold $1,336.60 (-0.04%)

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 245.73 | 0.99(0.40%) | 1583 |

| ALCOA INC. | AA | 55.85 | -0.39(-0.69%) | 1134 |

| ALTRIA GROUP INC. | MO | 69 | 0.08(0.12%) | 410 |

| Amazon.com Inc., NASDAQ | AMZN | 1,315.40 | 10.54(0.81%) | 74889 |

| American Express Co | AXP | 101.45 | 1.11(1.11%) | 1816 |

| AMERICAN INTERNATIONAL GROUP | AIG | 61.2 | 0.14(0.23%) | 313 |

| Apple Inc. | AAPL | 176.04 | -0.15(-0.09%) | 275180 |

| AT&T Inc | T | 36.75 | 0.03(0.08%) | 9597 |

| Barrick Gold Corporation, NYSE | ABX | 15.16 | -0.04(-0.26%) | 7575 |

| Boeing Co | BA | 337.8 | 2.64(0.79%) | 43177 |

| Caterpillar Inc | CAT | 170.4 | 1.09(0.64%) | 15316 |

| Chevron Corp | CVX | 132.5 | 0.49(0.37%) | 4134 |

| Cisco Systems Inc | CSCO | 40.87 | 0.33(0.81%) | 17030 |

| Citigroup Inc., NYSE | C | 76.94 | -0.17(-0.22%) | 30457 |

| Deere & Company, NYSE | DE | 168.98 | 1.44(0.86%) | 300 |

| Exxon Mobil Corp | XOM | 87.32 | 0.35(0.40%) | 3148 |

| Facebook, Inc. | FB | 178.99 | 0.60(0.34%) | 93203 |

| FedEx Corporation, NYSE | FDX | 269 | -0.58(-0.22%) | 811 |

| Ford Motor Co. | F | 12.63 | -0.47(-3.59%) | 539327 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 19.4 | 0.08(0.41%) | 5100 |

| General Electric Co | GE | 17.82 | -0.39(-2.14%) | 1081619 |

| General Motors Company, NYSE | GM | 44.4 | 0.21(0.48%) | 9204 |

| Goldman Sachs | GS | 256.53 | -1.93(-0.75%) | 144517 |

| Google Inc. | GOOG | 1,131.36 | 9.60(0.86%) | 7753 |

| Hewlett-Packard Co. | HPQ | 22.65 | -0.23(-1.01%) | 1912 |

| Home Depot Inc | HD | 197.37 | 1.06(0.54%) | 2899 |

| Intel Corp | INTC | 43.4 | 0.26(0.60%) | 14322 |

| International Business Machines Co... | IBM | 166.79 | 2.94(1.79%) | 74959 |

| Johnson & Johnson | JNJ | 147.65 | 0.79(0.54%) | 2226 |

| JPMorgan Chase and Co | JPM | 111.97 | -0.30(-0.27%) | 36437 |

| McDonald's Corp | MCD | 174.1 | 0.42(0.24%) | 2278 |

| Merck & Co Inc | MRK | 61.99 | -0.08(-0.13%) | 41665 |

| Microsoft Corp | MSFT | 88.87 | 0.52(0.59%) | 28647 |

| Nike | NKE | 63.96 | 0.54(0.85%) | 3037 |

| Pfizer Inc | PFE | 36.74 | 0.14(0.38%) | 3275 |

| Procter & Gamble Co | PG | 90.47 | 0.25(0.28%) | 3390 |

| Starbucks Corporation, NASDAQ | SBUX | 61.08 | 0.52(0.86%) | 4719 |

| Tesla Motors, Inc., NASDAQ | TSLA | 341.47 | 1.41(0.41%) | 11761 |

| The Coca-Cola Co | KO | 46.7 | 0.17(0.37%) | 2985 |

| Travelers Companies Inc | TRV | 136.33 | 0.81(0.60%) | 550 |

| Twitter, Inc., NYSE | TWTR | 24.8 | 0.14(0.57%) | 51284 |

| United Technologies Corp | UTX | 134.82 | 0.85(0.63%) | 1810 |

| UnitedHealth Group Inc | UNH | 234.85 | 1.95(0.84%) | 3316 |

| Verizon Communications Inc | VZ | 51.9 | 0.24(0.46%) | 2426 |

| Visa | V | 121.2 | 0.81(0.67%) | 10642 |

| Wal-Mart Stores Inc | WMT | 101.29 | 0.60(0.60%) | 7356 |

| Walt Disney Co | DIS | 111.4 | 0.71(0.64%) | 3721 |

| Yandex N.V., NASDAQ | YNDX | 35.12 | -0.06(-0.17%) | 1050 |

Deere (DE) target raised to $184 from $161 at Stifel

UnitedHealth (UNH) target raised to $268 from $235 at Citigroup

Merck (MRK) target raised to $72 from $68 at BMO Capital Markets

Apple (AAPL) downgraded to Neutral from Buy at Longbow

HP (HPQ) downgraded to Equal Weight at Barclays

Citigroup (C) downgraded to Mkt Perform from Outperform at Keefe Bruyette

IBM(IBM) upgraded to Overweight at Barclays

Wal-Mart (WMT) added to US Focus List at Citigroup; Buy, target $117

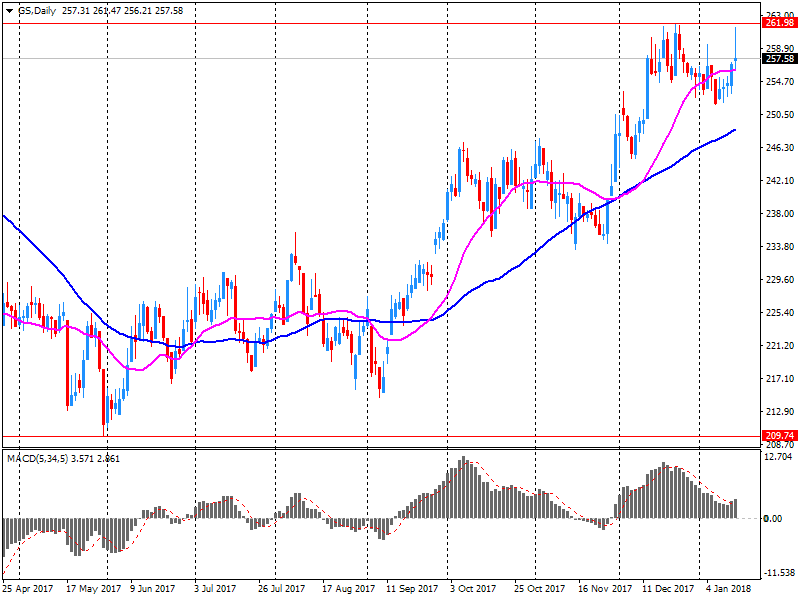

Goldman Sachs (GS) reported Q4 FY 2017 earnings of $5.68 per share (versus $5.08 in Q4 FY 2016), beating analysts' consensus estimate of $4.95.

The company's quarterly revenues amounted to $7.830 bln (-4.2% y/y), beating analysts' consensus estimate of $7.638 bln.

GS fell to $256.10 (-0.91%) in pre-market trading.

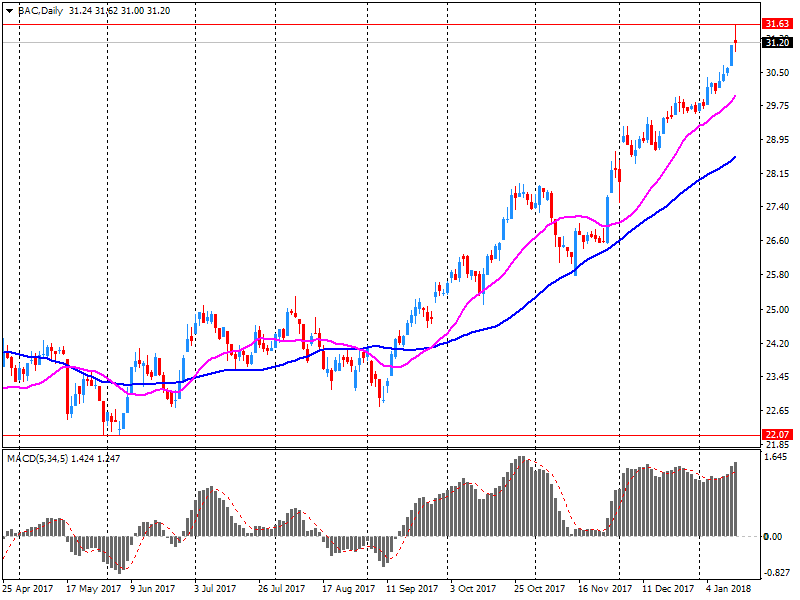

Bank of America (BAC) reported Q4 FY 2017 earnings of $0.47 per share (versus $0.40 in Q4 FY 2016), beating analysts' consensus estimate of $0.45.

The company's quarterly revenues amounted to $20.687 bln (+3.5% y/y), missing analysts' consensus estimate of $21.605 bln.

BAC rose to $31.36 (+0.38%) in pre-market trading.

British blue-chip stocks finished lower Tuesday, pulled down in part by a fall in shares of BP PLC after the energy heavyweight said it will take a $1.7 billion charge related to the Deepwater Horizon disaster. A selloff for miners also weighed on the main equity benchmark.

The Dow Jones Industrial Average closed marginally lower on Tuesday after the blue-chip index relinquished all its early gains in the sharpest daily reversal in nearly two years, according to FactSet. In early trade, Dow industrials were up more than 1% and set an intraday all-time high above 26,000.

Asian stocks were mostly lower Wednesday following a late selloff in U.S. equities and after some markets logged fresh highs Tuesday. Hong Kong's Hang Seng Index topped 2007's record-high close on Tuesday while Singapore's main stock index breached 2015's high, getting to levels last seen in 2007.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.