- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 19-01-2018.

The main US stock indexes registered a moderate increase, which was promoted by the rise in price of shares in the consumer sector and conglomerate sector.

The focus was also on the United States. As shown by preliminary research results submitted by Thomson-Reuters and the Michigan Institute, a gauge of sentiment among US consumers fell in January despite the average predictions of experts. According to the data, in January the consumer sentiment index fell to 94.4 compared with the final reading for December 95.9. It was expected that the index will rise to the level of 97 points.

Quotes of oil moderately fell on Friday, as the rebound in oil production in the US outweighed the continued decline in crude oil reserves in the country.

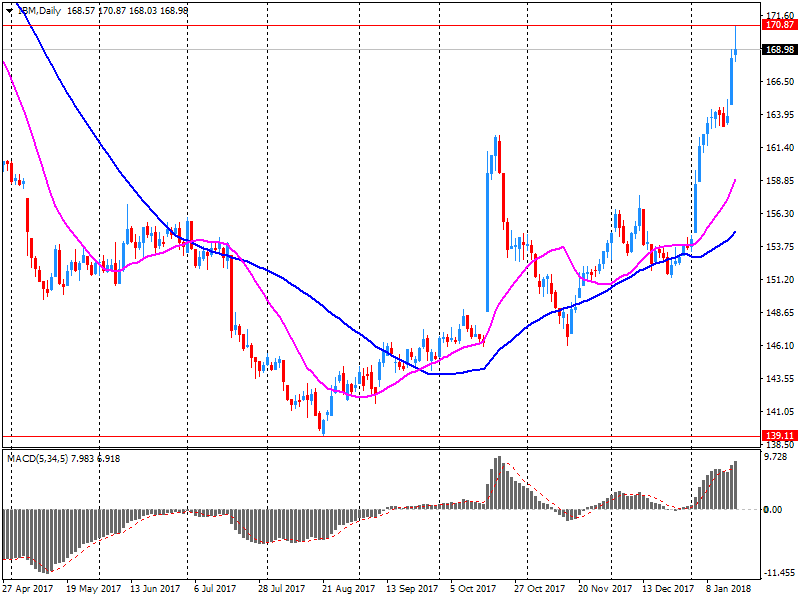

The components of the DOW index finished the auction mixed (15 in positive territory, 15 in negative territory). Leader of the growth were shares of NIKE, Inc. (NKE, + 4.73%). Outsider were shares of International Business Machines Corporation (IBM, -4.09%).

Most sectors of the S & P recorded a rise. The conglomerate sector grew most (+ 0.9%). The utilities sector showed the greatest decrease (-0.2%).

At closing:

Dow + 0.21% 26,071.72 +53.91

Nasdaq + 0.55% 7.336.38 +40.33

S & P + 0.44% 2,810.30 +12.27

U.S. stock-index futures rose slightly on Thursday, as investors looked eager to buy yesterday's dip, despite risks of a U.S. government shutdown.

Global Stocks:

Nikkei 23,808.06 +44.69 +0.19%

Hang Seng 32,254.89 +132.95 +0.41%

Shanghai 3,489.11 +14.35 +0.41%

S&P/ASX 6,005.80 -8.80 -0.15%

FTSE 7,709.25 +8.29 +0.11%

CAC 5,513.83 +19.00 +0.35%

DAX 13,406.71 +125.28 +0.94%

Crude $63.04 (-1.42%)

Gold $1,334.90 (+0.58%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 53.02 | 0.02(0.04%) | 2716 |

| ALTRIA GROUP INC. | MO | 70.63 | 0.60(0.86%) | 9858 |

| Amazon.com Inc., NASDAQ | AMZN | 1,298.00 | 4.68(0.36%) | 22324 |

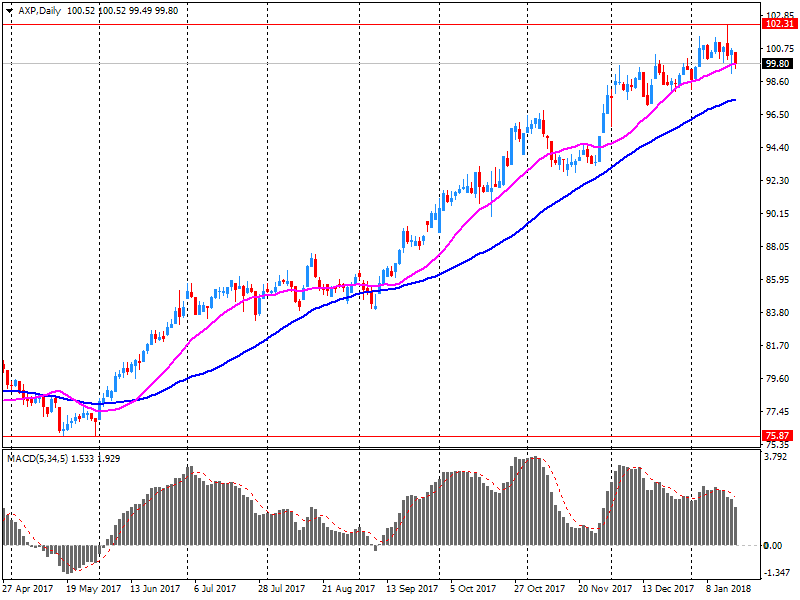

| American Express Co | AXP | 97 | -2.86(-2.86%) | 95157 |

| Apple Inc. | AAPL | 178.99 | -0.27(-0.15%) | 127089 |

| AT&T Inc | T | 37 | -0.15(-0.40%) | 3307 |

| Barrick Gold Corporation, NYSE | ABX | 14.46 | 0.18(1.26%) | 25167 |

| Boeing Co | BA | 340.51 | 0.35(0.10%) | 30833 |

| Caterpillar Inc | CAT | 169.1 | 1.05(0.62%) | 15662 |

| Chevron Corp | CVX | 131.46 | -0.13(-0.10%) | 15597 |

| Cisco Systems Inc | CSCO | 41.34 | 0.04(0.10%) | 800 |

| Citigroup Inc., NYSE | C | 77.41 | 0.02(0.03%) | 12675 |

| Facebook, Inc. | FB | 180.28 | 0.48(0.27%) | 122797 |

| FedEx Corporation, NYSE | FDX | 272.5 | 0.32(0.12%) | 836 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 19.33 | -0.07(-0.36%) | 6886 |

| General Electric Co | GE | 16.78 | 0.01(0.06%) | 703440 |

| General Motors Company, NYSE | GM | 43.61 | -0.25(-0.57%) | 650 |

| Goldman Sachs | GS | 251.22 | 0.25(0.10%) | 15486 |

| Google Inc. | GOOG | 1,134.00 | 4.21(0.37%) | 2090 |

| Home Depot Inc | HD | 199.4 | 1.07(0.54%) | 3159 |

| HONEYWELL INTERNATIONAL INC. | HON | 158.05 | 0.27(0.17%) | 236 |

| Intel Corp | INTC | 44.52 | 0.04(0.09%) | 18183 |

| International Business Machines Co... | IBM | 164 | -5.12(-3.03%) | 412534 |

| Johnson & Johnson | JNJ | 147.37 | 0.45(0.31%) | 511 |

| JPMorgan Chase and Co | JPM | 113.43 | 0.17(0.15%) | 19203 |

| McDonald's Corp | MCD | 174.75 | 0.18(0.10%) | 1119 |

| Merck & Co Inc | MRK | 61.15 | 0.02(0.03%) | 1905 |

| Microsoft Corp | MSFT | 90.31 | 0.21(0.23%) | 22777 |

| Nike | NKE | 64.9 | 0.79(1.23%) | 22863 |

| Pfizer Inc | PFE | 37.01 | 0.02(0.05%) | 13457 |

| Procter & Gamble Co | PG | 90.36 | 0.18(0.20%) | 100 |

| Starbucks Corporation, NASDAQ | SBUX | 61.4 | 0.31(0.51%) | 2642 |

| Tesla Motors, Inc., NASDAQ | TSLA | 345.49 | 0.92(0.27%) | 26716 |

| The Coca-Cola Co | KO | 46.73 | -0.15(-0.32%) | 4715 |

| Twitter, Inc., NYSE | TWTR | 24.18 | 0.14(0.58%) | 23490 |

| UnitedHealth Group Inc | UNH | 244.5 | 1.34(0.55%) | 4105 |

| Verizon Communications Inc | VZ | 51.65 | 0.10(0.19%) | 9104 |

| Visa | V | 123.19 | 0.08(0.07%) | 6177 |

| Wal-Mart Stores Inc | WMT | 104.48 | 0.18(0.17%) | 2061 |

| Walt Disney Co | DIS | 110.73 | 0.31(0.28%) | 2555 |

| Yandex N.V., NASDAQ | YNDX | 37.16 | -0.35(-0.93%) | 4900 |

Twitter (TWTR) resumed with a Hold at Stifel; target $21

Exxon Mobil (XOM) reiterated with an Outperform at Cowen; target $100

Home Depot (HD) target raised to $220 from $190 at Telsey Advisory Group

Apple (AAPL) target raised to $175 from $160 at Mizuho

Starbucks (SBUX) target raised to $70 from $66 at Telsey Advisory Group

IBM (IBM) target raised to $160 from $150 at Deutsche Bank

IBM (IBM) target raised to $170 from $160 at UBS

NIKE (NKE) upgraded to Outperform from Neutral at Wedbush

Altria (MO) upgraded to Buy from Hold at Jefferies

IBM (IBM) reported Q4 FY 2017 earnings of $5.18 per share (versus $5.01 in Q4 FY 2016), beating analysts' consensus estimate of $5.17.

The company's quarterly revenues amounted to $22.543 bln (+3.6% y/y), beating analysts' consensus estimate of $22.028 bln.

The company also said it expects to report 2018 operating EPS of 'at least $13.80' (flat y/y) versus analysts' consensus estimate of $13.92.

IBM fell to $163.48 (-3.33%) in pre-market trading.

American Express (AXP) reported Q4 FY 2017 earnings of $1.58 per share (versus $0.91 in Q4 FY 2016), beating analysts' consensus estimate of $1.54.

The company's quarterly revenues amounted to $8.839 bln (+10.2% y/y), beating analysts' consensus estimate of $8.730 bln.

The company also issued guidance for FY2018, projecting EPS of $6.90-7.30 versus analysts' consensus estimate of $7.29.

AXP also announced plans to suspend its share buyback program for the first half of 2018 "in order to rebuild our capital".

U.K. stocks dropped for a fourth straight session on Thursday, with pressure on London's blue-chips benchmark coming from continued strength in the pound and a decline in shares of Primark chain operator Associated British Foods following a trading update.

U.S. stock benchmarks finished lower Thursday, pressured by worries over the possibility of a partial government shutdown, as investors sorted through a fresh batch of quarterly earnings results. The Dow, however, managed to retain a foothold above 26,000 while the S&P 500 tied the longest stretch in history without a 5% pullback at 394 sessions.

Asia-Pacific stocks turned broadly higher by midday after a slow start to Friday's trading, as investors largely ignored ongoing U.S. budget negotiations. "Equities are the name of the game in Asia at the moment and it's going to continue," said Stephen Innes, head of trading in Asia at Oanda, in the wake of strong January gains in the region.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.