- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 18-07-2016.

(index / closing price / change items /% change)

Hang Seng 21,803.18 +143.93 +0.66 %

S&P/ASX 200 5,458.47 +28.90 +0.53 %

Shanghai Composite 3,043.91 -10.39 -0.34 %

FTSE 100 6,695.42 +26.18 +0.39 %

CAC 40 4,357.74 -14.77 -0.34 %

Xetra DAX 10,063.13 -3.77 -0.04 %

S&P 500 2,166.89 +5.15 +0.24 %

NASDAQ Composite 5,055.78 +26.20 +0.52 %

Dow Jones 18,533.05 +16.50 +0.09 %

Major stock indexes Wall Street gained slightly on Monday amid better-than-expected quarterly results report.

In addition, it became known that the index of builders confidence in the market of newly built, single-family homes in July fell by one point to 59 from June's reading of 60. "Over the past six months, the confidence builders remained in a relatively narrow range of positive, consistent with the continuing gradual housing market recovery that is underway, "said NAHB Chairman Ed Brady. "Nevertheless, we are still hearing reports from our members about the weakness in some markets, largely due to regulatory restrictions and the lack of land and labor."

Oil prices fell by about 2%, as the increase in oil and gasoline has strengthened concerns about oversupply. Today, the company Genscape reported that oil reserves in the terminal Cushing, Oklahoma, rose by 26,460 barrels for the week ended July 15th. Meanwhile, Morgan Stanley experts said they expected soon to a significant reduction in demand for oil from the refinery, which will eventually lead to an increase in reserves and will have a significant pressure on prices. Also at Morgan Stanley noted that it is still expected to change the balance of demand and supply of oil by mid-2017.

DOW index components finished trading in different directions (17 black, 13 red). Outsider were shares of Merck & Co. Inc. (MRK, -1,06%). More remaining stocks grown E. I. du Pont de Nemours and Company (DD, + 1,32%).

Almost all sectors of the S & P showed an increase. The leader turned out to be the technology sector (+ 0.9%). Decreased only the industrial goods sector (-0.1%).

At the close:

Dow + 0.08% 18,532.06 +15.51

Nasdaq + 0.52% 5,055.78 +26.19

S & P + 0.23% 2,166.79 +5.05

Major U.S. stock-indexes eked out gains on Monday as Bank of America's better-than-expected profit boosted optimism about the U.S. quarterly earnings season, but not by enough to send the Dow and the S&P 500 to fresh highs.

Dow stocks mixed (15 vs 15). Top looser - Caterpillar Inc. (CAT, -1,43%). Top gainer - The Home Depot, Inc. (HD, +1,15%).

S&P sectors also mixed. Top looser - Industrial Goods (-0,2%). Top gainer - Technology (+0,7%).

At the moment:

Dow 18440.00 +23.00 +0.12%

S&P 500 2158.50 +5.75 +0.27%

Nasdaq 100 4611.50 +32.25 +0.70%

Oil 45.93 -0.72 -1.54%

Gold 1328.50 +1.10 +0.08%

U.S. 10yr 1.58 -0.0

Polish equity closed higher on Monday. The broad market measure, the WIG Index, surged by 1.27%. Developing sector (-0.39%) was sole decliner within the WIG Index, while oil and gas (+2.18%) outpaced.

The large-cap stocks' benchmark, the WIG30 Index, grew by 1.57%. There were only three decliners among the index components. Thermal coal miner BOGDANKA (WSE: LWB) recorded the biggest drop of 3.06%, retreating after last week's energetic bounce. Other underperformers were coking coal producer JSW (WSE: JSW) and bank PEKAO (WSE: PEO), falling by 2% and 0.24% respectively. On the other side of the ledger, bank BZ WBK (WSE: BZW) topped the list of outperformers, climbing by 4.33%. It was followed by oil refiner PKN ORLEN (WSE: PKN), agricultural producer KERNEL (WSE: KER) and insurer PZU (WSE: PZU), jumping by 3.57%, 3.11% and 2.66% respectively.

From the morning the Warsaw market is clearly controlled by demand side, which naturally enjoys the bulls camp. The reasons for joy may derive from comparison today's preserve of our parquet against neutral Euroland. It is also needed to add the strength of the zloty and stronger performance of the debt market in Poland.

The market in the US, as well as trading in Euroland, took off flat. It is worth to remember, that the S&P500 is still at the top of the bull market and the demand not really can afford at this point to allow for a moment of hesitation, as taught by the experience of previous years, market participants can quickly and willingly accede to increase activity on the short side of the market.

U.S. stock-index futures rose, erasing losses triggered by the failed military coup in Turkey.

Global Stocks:

Nikkei Closed.

Hang Seng 21,803.18 +143.93 +0.66%

Shanghai Composite 3,043.91 -10.39 -0.34%

FTSE 6,690.58 +21.34 +0.3%

CAC 4,352.44 -20.07 -0.5%

DAX 10,048.08 -18.82 -0.2%

Crude $45.50 (-0.98%)

Gold $1326.60 (-0.06%)

(company / ticker / price / change ($/%) / volume)

| Amazon.com Inc., NASDAQ | AMZN | 736.05 | 0.61(0.0829%) | 27438 |

| AMERICAN INTERNATIONAL GROUP | AIG | 54.08 | -0.36(-0.6613%) | 100 |

| Cisco Systems Inc | CSCO | 29.95 | 0.13(0.436%) | 1006 |

| Citigroup Inc., NYSE | C | 44.42 | 0.09(0.203%) | 20198 |

| Deere & Company, NYSE | DE | 83.53 | 0.12(0.1439%) | 100 |

| Exxon Mobil Corp | XOM | 94.82 | -0.30(-0.3154%) | 925 |

| Facebook, Inc. | FB | 117.2 | 0.34(0.2909%) | 52558 |

| Ford Motor Co. | F | 13.57 | -0.00(-0.00%) | 43680 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 12.9 | -0.21(-1.6018%) | 82851 |

| General Motors Company, NYSE | GM | 30.8 | 0.03(0.0975%) | 1653 |

| Google Inc. | GOOG | 721.01 | 1.16(0.1611%) | 901 |

| JPMorgan Chase and Co | JPM | 64.2 | 0.02(0.0312%) | 3215 |

| Merck & Co Inc | MRK | 59.2 | -0.43(-0.7211%) | 437 |

| Microsoft Corp | MSFT | 53.78 | 0.08(0.149%) | 13439 |

| Nike | NKE | 57.87 | -0.00(-0.00%) | 7528 |

| Pfizer Inc | PFE | 36.67 | -0.10(-0.272%) | 8615 |

| Starbucks Corporation, NASDAQ | SBUX | 57.5 | 0.09(0.1568%) | 650 |

| Tesla Motors, Inc., NASDAQ | TSLA | 219.74 | -0.66(-0.2995%) | 16620 |

| The Coca-Cola Co | KO | 45.7 | 0.07(0.1534%) | 3380 |

| Twitter, Inc., NYSE | TWTR | 18.28 | 0.20(1.1062%) | 89329 |

| Yahoo! Inc., NASDAQ | YHOO | 37.83 | 0.11(0.2916%) | 8042 |

| Yandex N.V., NASDAQ | YNDX | 21.56 | 0.13(0.6066%) | 600 |

Upgrades:

Downgrades:

Merck (MRK) downgraded to Market Perform from Outperform at BMO Capital; target $62

Other:

Intel (INTC) target raised to $36 from $34 at RBC Capital Mkts

Intel (INTC) target raised to $40 from $38 at Canaccord Genuity

Yandex N.V. (YNDX) initiated with a Buy at HSBC Securities

European stocks traded mixed on the news of the failure of the military coup in Turkey and M&A deals.

Investors are cautiously watching developments in Turkey after the failed attempt of a military coup last weekend.

On Sunday, the Turkish government announced the full restoration of control over the country and the economy after the collapse of an alleged military coup on Friday evening to overthrow President Erdogan.

Over the weekend, the government arrested some 6,000 military and judges, who are suspected of involvement in the coup

At the same time, oil prices traded without major dynamics, fluctuating between growth and decline, amid signs of continued recovery of drilling activity in the US.

The composite index of Europe's largest enterprises Stoxx 600 rose by 0.14% - to 338.39 points.

Quotes of British ARM Holdings jumped 43%, as the Japanese mobile operator SoftBank bought the company for $ 32 billion, which means a premium on close of trading last Friday, about 43%.

Shares of oil services group SBM Offshore, based in the Netherlands, grew by 12% after reaching an agreement on the settlement of an investigation of bribery in Brazil.

The price of shares of the largest Italian bank Unicredit SpA increased by 3%, Intesa Sanpaolo - by 1.6%.

Norwegian Marine Harvest ASA, the world's leading producer of Atlantic salmon, added 2.4%. The company expects to reduce the catch of fish this year, which is likely to lead to further price increases, which, in June, updated the historical maximum.

At the same time the market value of the Swedish Ericsson AB decreased by 2.9%. According to the newspaper Svenska Dagbladet, Ericsson, probably overstated revenue figures.

The course of the securities of the largest operator of container traffic in Germany's Hapag-Lloyd AG fell by 10% due to the announcement of the expected reduction of profit in 2016.

At the moment

FTSE 6692.39 23.15 0.35%

DAX 10057.54 -9.36 -0.09%

CAC 4360.68 -11.83 -0.27%

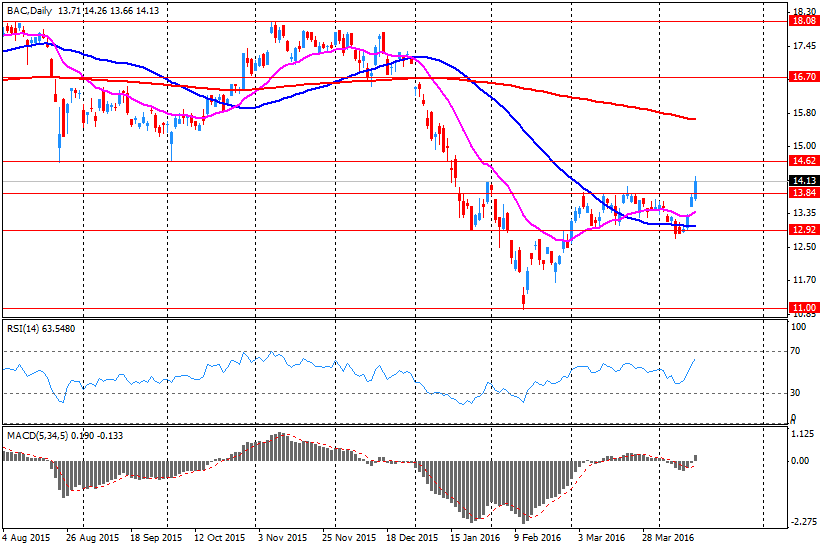

Bank of America reported Q2 FY 2016 earnings of $0.36 per share (versus $0.45 in Q2 FY 2015), beating analysts' consensus estimate of $0.33.

The company's quarterly revenues amounted to $20.600 bln (-7.2% y/y), generally in-line with consensus estimate of $20.519 bln.

BAC rose to $13.70 (+0.29%) in pre-market trading.

The Warsaw Stock Exchange presents today a very good form, which in part may be due to a shift of part of resources from Turkey to Polish. Strengthening of the Polish currency is continued and the Warsaw Stock Exchange came out to new highs. Medium and smaller companies are also on the gain, and the indexes have a new local maxima. At the same time in Europe the situation is not so successful, the German DAX slightly lost (0.2%) and is located at session minima. Generally improves the situation in emerging markets and this in turn means that the environment can favor the Warsaw parquet. It remains an open question whether the politicians will not throw a roadblocks in the market - till the end of July the topic of foreign currency mortgage loans should be resolved.

In the mid-session the WIG20 index was at the level of 1,789 points (+ 1.70%).

July 18

Before the Open:

Bank of America (BAC). Consensus EPS $0.33, Consensus Revenue $20518.78 mln.

After the Close:

IBM (IBM). Consensus EPS $2.89, Consensus Revenue $20063.32 mln.

Yahoo! (YHOO). Consensus EPS $0.10, Consensus Revenue $836.80 mln.

July 19

Before the Open:

Goldman Sachs (GS). Consensus EPS $3.05, Consensus Revenue $7484.56 mln.

Johnson & Johnson (JNJ). Consensus EPS $1.68, Consensus Revenue $17985.79 mln.

UnitedHealth (UNH). Consensus EPS $1.89, Consensus Revenue $45040.45 mln.

After the Close:

Microsoft (MSFT). Consensus EPS $0.58, Consensus Revenue $22135.10 mln.

July 20

After the Close:

American Express (AXP). Consensus EPS $1.72, Consensus Revenue $8365.82 mln.

Intel (INTC). Consensus EPS $0.53, Consensus Revenue $13547.05 mln.

July 21

Before the Open:

General Motors (GM). Consensus EPS $1.48, Consensus Revenue $37185.91 mln.

Travelers (TRV). Consensus EPS $2.07, Consensus Revenue $6131.06 mln.

After the Close:

AT&T (T). Consensus EPS $0.72, Consensus Revenue $40741.18 mln.

Starbucks (SBUX). Consensus EPS $0.49, Consensus Revenue $5338.87 mln.

Visa (V). Consensus EPS $0.67, Consensus Revenue $3655.01 mln.

July 22

Before the Open:

General Electric (GE). Consensus EPS $0.46, Consensus Revenue $31573.67 mln.

Honeywell (HON). Consensus EPS $1.64, Consensus Revenue $10136.24 mln.

WIG20 index opened at 1764.85 points (+0.31%)*

WIG 45741.46 0.44%

WIG30 1992.96 0.51%

mWIG40 3464.69 0.13%

*/ - change to previous close

From the morning there is no greater anxiety on the markets and after a slight weakening of the zloty and the Turkish lira after the start of trading in around midnight the currency are strengthen.

European markets from early morning are on the green side. Events in Turkey do not make much impression on anyone, and the Nicea also did not leave much trace on Friday. The market in Turkey losing more than 2%.

The most important information for investors seems to be the fact that the rating agency Fitch confirmed the rating for Poland and even did not change its perspective, which remained stable. This is a good news, though on Friday the behavior of the WSE and the Polish zloty indicated that investors do not care specially about this rating.

Friday's session on Wall Street ended with a relatively neutral and today's morning futures on the US indices grow by approx. 0.5%. Asian markets behave peacefully, the stock market in Tokyo is not working because of the holidays. Probably we will see today a reaction to a failed military coup in Turkey, in the morning it was seen on the zloty. The domestic currency opened up with upward gap indicating weakness, but quite quickly began to make up for the loss. Today's macro calendar remains empty and from this direction we should not expect an impulse to trade.

European stocks slipped Friday, with travel shares lower after a deadly terrorist attack left more than 80 people dead in Nice, France.

The Stoxx Europe 600 SXXP, -0.17% shed 0.2% to close at 337.92, partly erasing a 0.8% advance from Thursday.

Stocks in Europe were rallying earlier in the week on the prospect of more easing measures from global banks including the BOE and Bank of Japan, meant to ease concerns over slow global growth and the fallout from the Brexit vote.

U.S. stocks closed at their third-straight week of gains Friday, as the S&P 500 Index and the Nasdaq Composite Index retreated slightly on the session and the Dow Jones Industrial Average gained slightly for a fourth straight day of record closing highs. The Dow industrials DJIA, +0.05% rose 10.14 points, or less than 0.1%, to close at 18,516.55, a fresh closing high for the average, for a 2% weekly gain. The S&P 500 SPX, -0.09% slipped 2.01 points, or 0.1%, to close at 2,161.74, for a weekly gain of 1.5%. The Nasdaq COMP, -0.09% declined 4.47 points, or 0.1%, to finish at 5,029.59, for a weekly gain of 1.5%.

Stocks in Shanghai declined after posting three straight weekly gains, with developers leading losses on signs China's property market is cooling.

The Shanghai Composite Index slipped 0.1 percent at the midday break after dropping as much as 0.7 percent. Future Land Holdings Co. retreated the most in a week following data showing home-price gains tapered off last month as more cities imposed housing curbs. Yanzhou Coal Mining Co. slid for a fourth day, pacing losses for a measure of energy companies.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.