- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 19-07-2016.

(index / closing price / change items /% change)

Nikkei 225 16,723.31 +225.46 +1.37 %

Hang Seng 21,673.2 -129.98 -0.60 %

S&P/ASX 200 5,451.25 -7.22 -0.13 %

Shanghai Composite 3,036.2 -7.37 -0.24 %

FTSE 100 6,697.37 +1.95 +0.03 %

CAC 40 4,330.13 -27.61 -0.63 %

Xetra DAX 9,981.24 -81.89 -0.81 %

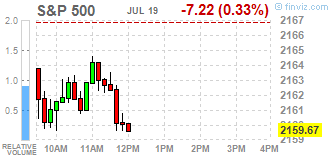

S&P 500 2,163.78 -3.11 -0.14 %

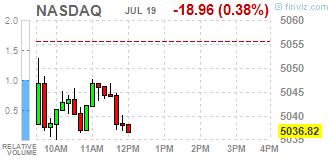

NASDAQ Composite 5,036.37 -19.41 -0.38 %

Dow Jones 18,559.01 +25.96 +0.14 %

Major US stock indexes closed with no unified dynamics on the background of deterioration in the global growth forecast from the International Monetary Fund because of the uncertainty about the impending release of Great Britain from the European Union.

In addition, as it became known today, bookmarks of new homes and building permits rose more than expected in June, partly reflecting a rebound in housing starts in the northeast. Bookmarks new homes in the US rose more than expected in June. The Commerce Department reported that the establishment of new homes jumped 4.8% to an annual rate of 1.189 million in June compared with the revised estimate for May at the level of 1.135 million. Economists had expected the establishment of new homes will rise slightly by 0.5% to 1,170 million to 1.164 million, which was originally reported in the previous month.

Oil prices dropped slightly today, as the market has concerns about the global oversupply of oil. A further fall in prices hinder the news of disruptions to oil supply from Libya. Protest over wages led to the closure of the eastern Libyan oil terminal Harigo, forcing to stop production at the field Safir. As a result, the supply of Libyan oil decreased by about 100 thousand. Barrels per day.

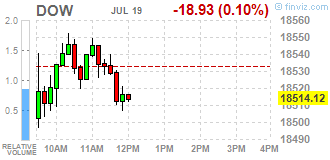

DOW index components closed mostly in the red (18 of 30). Outsider were shares of Microsoft Corporation (MSFT, -1,86%). Most remaining shares rose McDonald's Corp. (MCD, + 2,15%).

All business sectors S & P index showed a decline. Most of the basic materials sector fell (-1.2%).

At the close:

Dow + 0.14% 18,559.08 +26.03

Nasdaq -0.38% 5,036.37 -19.41

S & P -0.14% 2,163.78 -3.11

Major U.S. stock-indexes slightly fell on Tuesday morning, led by a drop in technology and consumer discretionary stocks after Netflix's weak results. Also weighing on sentiment was the International Monetary Fund's move to cut its global growth forecasts for the next two years due to uncertainty over Britain's looming exit from the European Union.

Most of Dow stocks in negative area (22 of 30). Top looser - The Goldman Sachs Group, Inc. (GS, -1,21%). Top gainer - McDonald's Corp. (MCD, +1,68%).

All S&P sectors in negative area. Top looser - Conglomerates (-0,8%).

At the moment:

Dow 18430.00 -21.00 -0.11%

S&P 500 2153.25 -6.75 -0.31%

Nasdaq 100 4594.00 -14.25 -0.31%

Crude Oil 45.69 -0.25 -0.54%

Gold 1333.00 +3.70 +0.28%

U.S. 10yr 1.55 -0.04

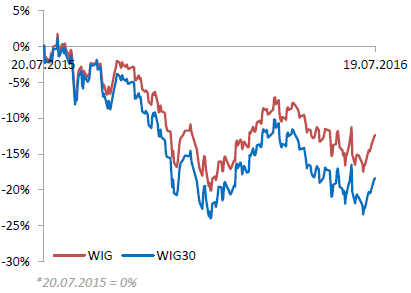

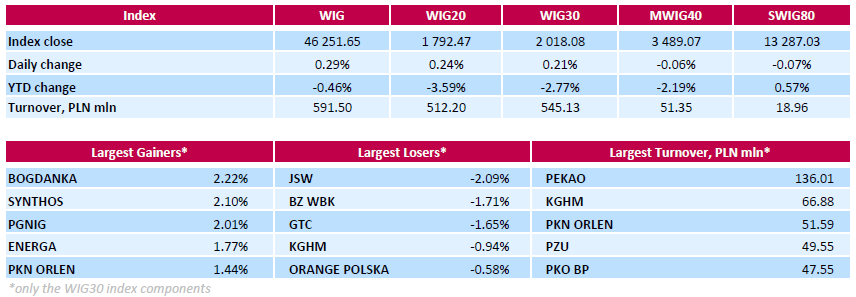

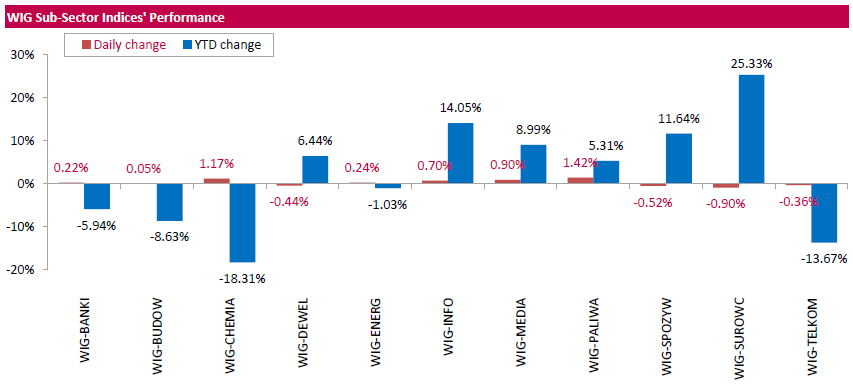

Polish equity market closed higher on Tuesday. The broad market measure, the WIG Index, rose by 0.29%. Sector performance within the WIG Index was mixed. Oil and gas sector (+1.42%) was the strongest group, while materials (-0.90%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, added 0.21%. In the index basket, thermal coal miner BOGDANKA (WSE: LWB) led the way up, climbing by 2.22%. The company announced it could boost coal reserves by 200-350 mln tonnes if it obtains a mining license for Ostrow deposit. Other major gainers were chemical producer SYNTHOS (WSE: SNS), oil and gas producer PGNIG (WSE: PGN) and genco ENERGA (WSE: ENG), which advanced 2.1%, 2.01% and 1.77% respectively. On the other side of the ledger, coking coal producer JSW (WSE: JSW) recorded the largest decline of 2.09%. It was followed by bank BZ WBK (WSE: BZW) and property developer GTC (WSE: GTC), dropping by 1.71% and 1.65% respectively.

The quotations on Wall Street started on the red side of the market. It seems that after many successful sessions where demand calmly controlled the situation, keeping the S&P500 at new levels, the market today prepares us to test the possibility of demand. It is very important that for the last more than two years, each attempt to go to new levels ended in failure. Therefore, the market may now be very sensitive to any sign of indisposition of buyers. Condition of Wall Street also will affect the global risk aversion, thereby preserving of emerging markets, which for us is more direct guideline.

U.S. stock-index futures slipped following a mix of earnings reports, as investors weighed the prospects for further gains after equities closed Monday at fresh records.

Global Stocks:

Nikkei 16,723.31 +225.46 +1.37%

Hang Seng 21,673.2 -129.98 -0.60%

Shanghai Composite 3,036.2 -7.37 -0.24%

FTSE 6,692.18 -3.24 -0.05%

CAC 4,325.57 -32.17 -0.74%

DAX 9,963.83 -99.30 -0.99%

Crude $45.09 (-0.33%)

Gold $1331.90 (+0.20%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 10.8 | -0.12(-1.0989%) | 91255 |

| ALTRIA GROUP INC. | MO | 68.93 | -0.24(-0.347%) | 4109 |

| Amazon.com Inc., NASDAQ | AMZN | 734.67 | -1.40(-0.1902%) | 5297 |

| American Express Co | AXP | 63.56 | -0.43(-0.672%) | 2665 |

| Apple Inc. | AAPL | 99.53 | -0.30(-0.3005%) | 52539 |

| AT&T Inc | T | 42.81 | -0.04(-0.0933%) | 539 |

| Barrick Gold Corporation, NYSE | ABX | 21.55 | -0.06(-0.2777%) | 36555 |

| Chevron Corp | CVX | 106.05 | -0.04(-0.0377%) | 695 |

| Cisco Systems Inc | CSCO | 29.9 | -0.01(-0.0334%) | 8839 |

| Citigroup Inc., NYSE | C | 44.32 | -0.25(-0.5609%) | 10971 |

| Exxon Mobil Corp | XOM | 95 | 0.18(0.1898%) | 1820 |

| Facebook, Inc. | FB | 119.07 | -0.30(-0.2513%) | 90293 |

| Ford Motor Co. | F | 13.6 | -0.05(-0.3663%) | 6690 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 12.95 | -0.19(-1.446%) | 134719 |

| General Electric Co | GE | 32.8 | -0.11(-0.3342%) | 9654 |

| General Motors Company, NYSE | GM | 30.72 | -0.15(-0.4859%) | 13724 |

| Goldman Sachs | GS | 162 | -1.33(-0.8143%) | 127320 |

| Google Inc. | GOOG | 731.9 | -1.88(-0.2562%) | 2321 |

| Home Depot Inc | HD | 136.3 | -0.04(-0.0293%) | 1397 |

| Intel Corp | INTC | 34.95 | -0.10(-0.2853%) | 14421 |

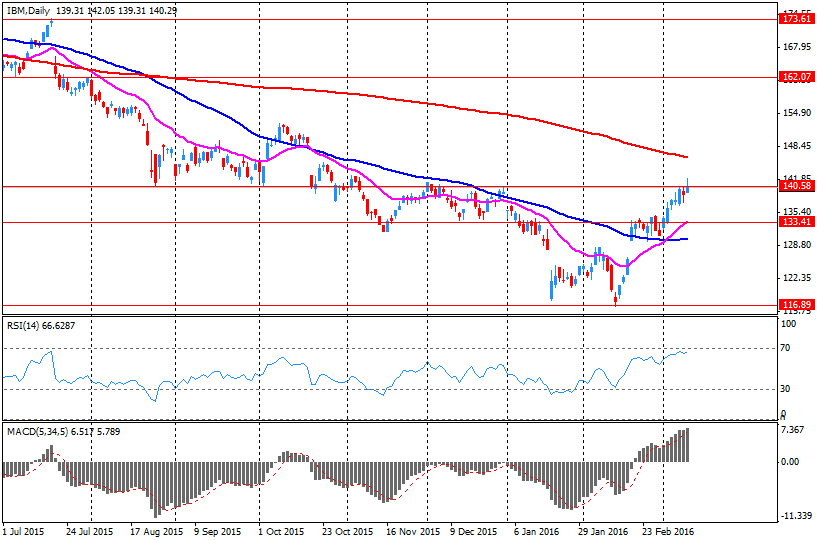

| International Business Machines Co... | IBM | 162 | 2.14(1.3387%) | 22038 |

| Johnson & Johnson | JNJ | 125.76 | 2.62(2.1277%) | 166431 |

| JPMorgan Chase and Co | JPM | 63.69 | -0.27(-0.4221%) | 7447 |

| McDonald's Corp | MCD | 124.23 | 0.43(0.3473%) | 939 |

| Merck & Co Inc | MRK | 59.11 | 0.09(0.1525%) | 262 |

| Microsoft Corp | MSFT | 54 | 0.04(0.0741%) | 29006 |

| Pfizer Inc | PFE | 36.64 | -0.00(-0.00%) | 5417 |

| Tesla Motors, Inc., NASDAQ | TSLA | 225 | -1.25(-0.5525%) | 15054 |

| The Coca-Cola Co | KO | 45.57 | -0.06(-0.1315%) | 1550 |

| Travelers Companies Inc | TRV | 117.38 | -0.00(-0.00%) | 950 |

| Twitter, Inc., NYSE | TWTR | 18.52 | -0.13(-0.697%) | 35888 |

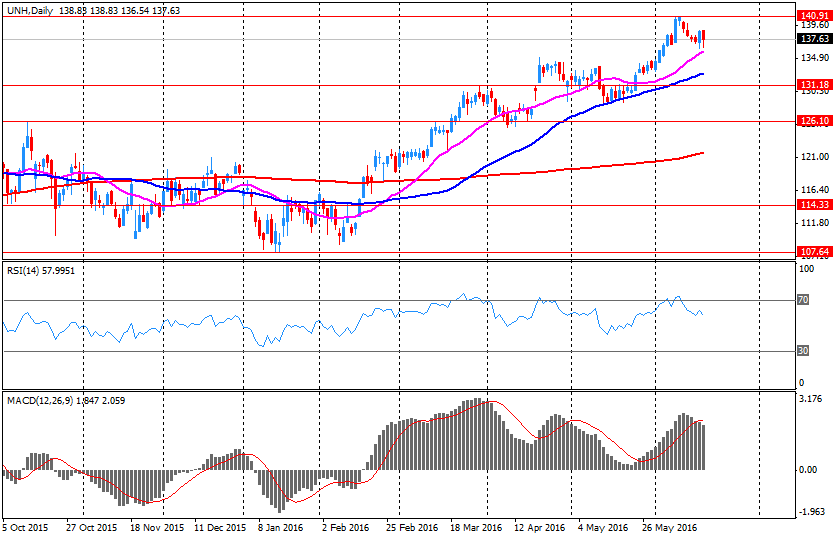

| UnitedHealth Group Inc | UNH | 140.55 | -0.20(-0.1421%) | 3161 |

| Visa | V | 78.31 | -0.00(-0.00%) | 2606 |

| Wal-Mart Stores Inc | WMT | 73.85 | 0.01(0.0135%) | 200 |

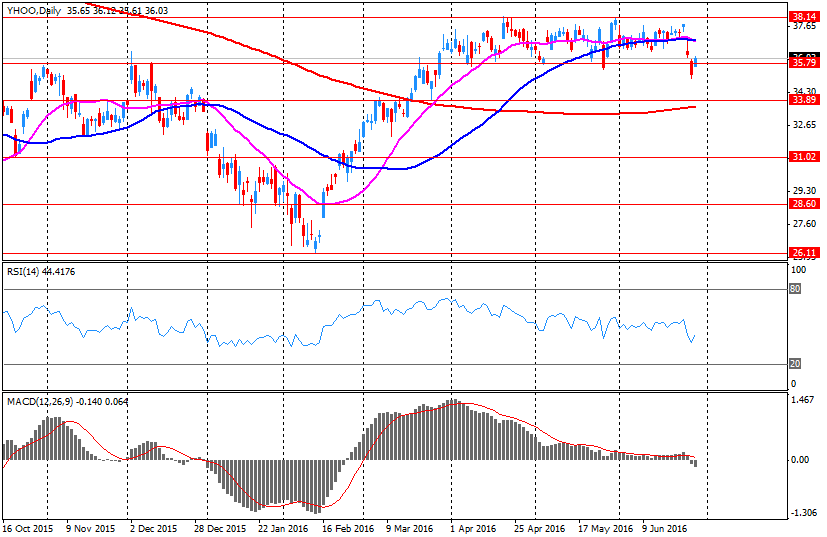

| Yahoo! Inc., NASDAQ | YHOO | 37.79 | -0.16(-0.4216%) | 8212 |

| Yandex N.V., NASDAQ | YNDX | 21.61 | 0.11(0.5116%) | 43461 |

Upgrades:

Downgrades:

Other:

Microsoft (MSFT) initiated with a Market Perform at William Blair

Yahoo! (YHOO) target raised to $39 from $38 at RBC Capital Mkt

Yahoo! (YHOO) target raised to $43 from $42 at UBS

Yahoo! (YHOO) maintained with a Neutral at Mizuho

IBM (IBM) target raised to $186 from $166 at Drexel Hamilton

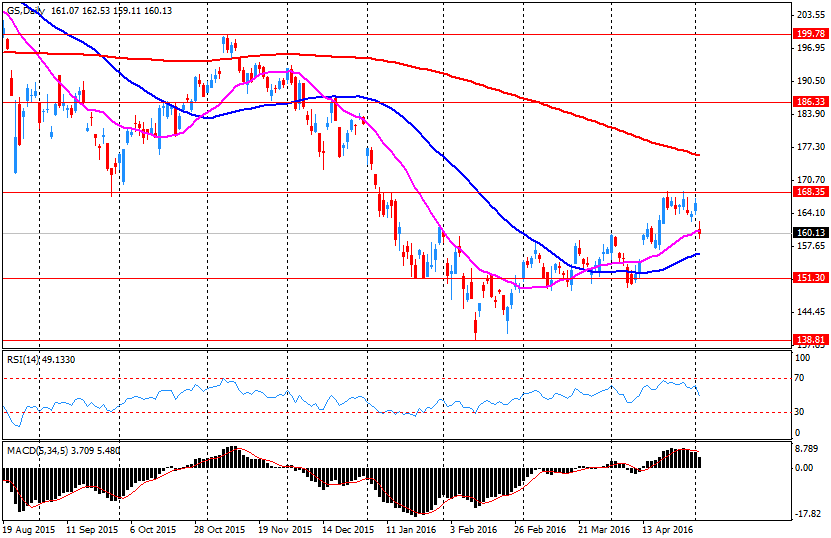

Goldman Sachs reported Q2 FY 2016 earnings of $3.72 per share (versus $4.75 in Q2 FY 2015), beating analysts' consensus estimate of $3.05.

The company's quarterly revenues amounted to $7.932 bln (-12.5% y/y), beating analysts' consensus estimate of $7.485 bln.

GS rose to $164.25 (+0.56%) in pre-market trading.

The reading of the ZEW index (-6.8; forecast 9.1), which fell to negative values clearly disappointed. The data for the first time take into account the outcome of the referendum in the UK. Anxiety respondents focuses on exports, the stability of the banking and financial system in Europe. The market reaction to the data was minimal, because it does not contribute many of the new, to the situation.

Our market catches a shortness of breath today, although only consolation is the fact that is a smaller scale than in Euroland. In the mid-session the WIG20 index was at 1,783 points (-0,24%) and with the turnover of PLN 231 mln.

Johnson & Johnson reported Q2 FY 2016 earnings of $1.74 per share (versus $1.71 in Q2 FY 2015), beating analysts' consensus estimate of $1.68.

The company's quarterly revenues amounted to $18.482 bln (+3.9% y/y), beating analysts' consensus estimate of $17.986 bln.

JNJ rose to $126.01 (+2.33%) in pre-market trading.

In today's mid trading, European stock indices down influenced by stock prices of mining and oil companies.

The composite index of the largest companies in the region Stoxx Europe 600 fell by 0.9% - to 335.82 points.

Stock indices on Monday trading mixed, with Britain's FTSE rose 0.4% to its highest level since August 2015.

Economic data also put presurre on stocks as sentiment in the business environment of the ZEW Institute in Germany and the euro zone declined sharply. The indicator of economic sentiment in Germany fell in July to its lowest level in more than three years, amid Brexit and, consequently, uncertainty for the economy.

The index of sentiment in the business environment from the ZEW Institute in Germany fell to -6.8 from 19.2 in June. The last reading was the lowest since November 2012 and well below the long-term average of 24.3 points.

"Brexit Voting surprised the majority of financial market experts. The uncertainty about the consequences of the vote for the German economy is largely responsible for the significant decline in economic sentiment," said ZEW President Achim Wambach.

"In particular, concerns about export prospects for and stability of the European banking and financial system, probably will fall heavily on the economic outlook."

The index of current conditions survey fell to 49.8 from 54.5. Economists expected the index to be 51.8.

The index of sentiment in the business environment of the ZEW institute in the euro zone decreased by 34.9 points to minus 14.7 points.

The indicator of the current economic situation declined by 2.4 points to minus 12.4 points.

Shares of oil companies are getting cheaper in the course of trading: the price of BP shares fell 0.4%.

The value of Rio Tinto fell 3%. One of the world's largest mining companies increased shipments of iron ore in the second quarter of 2016 by 7% compared with the previous quarter - to 82.2 million tons. The indicator, however, was worse than market expectations.

Shares of other mining companies also cheaper: Glencore's stock price has fallen by 3%, BHP Billiton - by 3.2%.

Shares of Dutch chemical company Akzo Nobel fell by 5%. The company's profit in the second quarter grew by 8.6%, exceeding market expectations. However, Akzo Nobel has warned that the market environment remains uncertain with the difficult conditions in some countries and segments.

Shares of the Swedish rubber products manufacturer Trelleborg fell by 5.6%. Earnings coincided with analysts' expectations, but the company reported an increase in economic uncertainty in connection with the decision of the UK to withdraw from the European Union and has given careful forecast for the future.

At the moment:

FTSE 6667.42 -28.00 -0.42%

DAX 9938.17 -124.96 -1.24%

CAC 4318.07 -39.67 -0.91%

UnitedHealth reported Q2 FY 2016 earnings of $1.96 per share (versus $1.64 in Q2 FY 2015), beating analysts' consensus estimate of $1.89.

The company's quarterly revenues amounted to $46.485 bln (+28.2% y/y), beating analysts' consensus estimate of $45.039 bln.

UNH closed Monday's trading session at $140.75 (-0.41%).

Yahoo! reported Q2 FY 2016 earnings of $0.09 per share (versus $0.16 in Q2 FY 2015), missing analysts' consensus estimate of $0.10.

The company's quarterly revenues amounted to $0.842 bln (-19.3% y/y), generally in-line with analysts' consensus estimate of $0.837 bln.

YHOO closed Monday's trading session at $37.95 (+0.61%).

IBM reported Q2 FY 2016 earnings of $2.95 per share (versus $3.84 in Q2 FY 2015), beating analysts' consensus estimate of $2.89.

The company's quarterly revenues amounted to $20.238 bln (-2.8% y/y), beating analysts' consensus estimate of $20.063 bln.

IBM rose to $161.83 (+1.23%) in pre-market trading.

WIG20 index opened at 1787.40 points (-0.04%)*

WIG 46226.05 0.23%

WIG30 2014.84 0.05%

mWIG40 3488.05 -0.09%

*/ - change to previous close

Changes in our environment from yesterday's closing are not too large, therefore, there is also reason for no major shift in the market within the opening. Today, one of the most interesting topics will be whether the relative strength of Polish assets will be shown on, or was it just a one-day stress, perhaps associated with changes in allocation in the basket of Emerging Markets assets at the expense of Turkey.

Yesterday's session in the US ended with minor increases to new records. In Asia, after returning to parquet of Japanese investors, we may see increases on the Tokyo Stock Exchange (the Nikkei index +1,39%). Slightly falling contracts in the US (S&P500 Fut; -0.15%). The morning atmosphere can be assessed as calm, so the session in Warsaw should start at neutral levels.

In today's macro calendar appears the publication of the ZEW index and national data on industrial production and retail sales however investors are waiting for the ECB meeting on Thursday, as central banks are in the center of attention again.

On the Warsaw Stock Exchange today will be cut off rights to dividends from shares of PGNiG (PLN 0.18; dyvidend yield 3.14%), which will have a negative influence on the WIG20 in scale of approx. 0.2%. The WIG20 index yesterday had gone to the psychological level of 1,800 points, which is near a natural resistance. Crossing ot this level will open the way to the peaks of the Brexit referendum.

European stocks finished mostly higher Monday, led by ARM Holdings PLC soaring on the chip designer's $32 billion buyout deal.

But Turkish shares closed down in the wake of a failed military coup.

The Stoxx Europe 600 SXXP, +0.23% rose 0.2% to end at 338.70, after the pan-European index on Friday slipped 0.2%.

U.S. stocks eked out small gains Monday, pushing both the Dow Jones Industrial Average and the S&P 500 Index to fresh all-time closing highs and the Nasdaq Composite Index to its highest finish of 2016.

The S&P 500 SPX, +0.24% traded within a narrow 8-point range and closed up 5.15 points, or 0.2%, at 2,166.89, a new closing high, led by gains in tech, materials and financials.

The Dow industrials DJIA, +0.09% closed at a new high for the fifth day in a row while trading within a 66-point range.

The Nasdaq Composite Index COMP, +0.52% rose 26.19 points, or 0.5%, to close at 5,055.78, after trading within a 33-point range. The Nasdaq is up 1% for the year.

Stocks got a boost by a flurry of upbeat earnings reports from financial companies, most notably Bank of America Corp. BAC, +3.29%

Asian shares slipped on Tuesday, as a downturn in crude oil curbed the enthusiasm from fresh record highs on Wall Street.

China stocks were lower, with both the CSI300 index .CSI300 of the largest listed companies in Shanghai and Shenzhen and the Shanghai Composite Index .SSEC down 0.4 percent.

Japan's Nikkei stock index .N225 pared early gains but was still up 0.5 percent, as markets reopened after a public holiday on Monday and responded to a weaker yen.

In the previous week, the benchmark index had gained 9.2 percent to notch its biggest weekly gain since December 2009, helped by Wall Street as well as hopes that the Bank of Japan will deliver further stimulus as early as its next policy meeting later this month.

Japanese policymakers won't go as far as funding government spending through direct debt monetization, but might pursue a mix of aggressive fiscal and monetary expansion to battle deflation, according to sources familiar with the matter.

A failed coup in Turkey had dented risk sentiment and bolstered the perceived safe-haven yen before it ran its course. On Monday, Turkey purged its police force after rounding up thousands of soldiers and called for the United States to hand over a cleric that the Turkish government accuses of being behind the takeover attempt.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.