- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 19-07-2017.

(index / closing price / change items /% change)

Nikkei +20.95 20020.86 +0.10%

TOPIX +1.39 1621.87 +0.09%

Hang Seng +147.22 26672.16 +0.56%

CSI 300 +62.57 3729.75 +1.71%

Euro Stoxx 50 +21.60 3500.28 +0.62%

FTSE 100 +40.69 7430.91 +0.55%

DAX +21.66 12452.05 +0.17%

CAC 40 +42.80 5216.07 +0.83%

DJIA +66.02 21640.75 +0.31%

S&P 500 +13.22 2473.83 +0.54%

NASDAQ +40.74 6385.04 +0.64%

S&P/TSX +95.14 15244.71 +0.63%

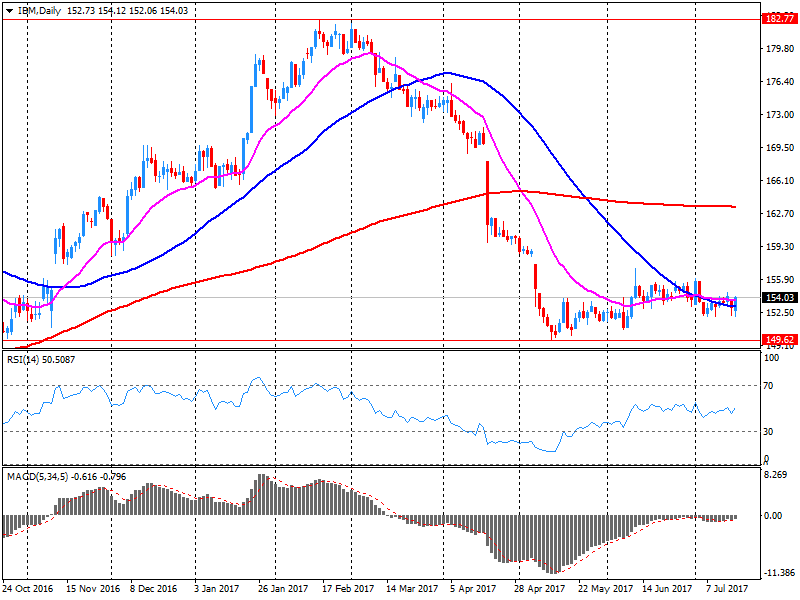

The main US stock indexes finished the auction with an increase, updating the record highs, which contributed to corporate reporting and statistics on the US housing market. At the same time, a significant decline in IBM shares prevented the Dow index from showing more serious growth.

According to the Ministry of Trade, housing construction finished the second quarter on a stronger note, as the bookings of new houses were restored in June at the fastest pace in four months. The laying of new homes increased by 8.3% to 1.22 million units (recalculated for annual rates). The laying of new houses for May was revised to 1.12 million from 1.09 million. Construction permits grew by 7.4% to 1.25 million per annum. The construction of single-family houses grew by 6.3% to 849,000 on an annualized basis. Bookmarks for apartment buildings jumped by 13.3% in June, to 366,000 in annual terms.

Oil prices rose by more than 1.5%, receiving support from statistics on oil products in the US, which indicated a more significant than expected decline in oil reserves. The US Energy Ministry reported that in the week of July 8-14, oil reserves fell by 4.727 million barrels to 490.62 million barrels. Analysts had expected a reduction of only 3.21 million barrels. Oil reserves in the Cushing terminal fell by 23 thousand barrels to 57.54 million barrels.

Most components of the DOW index recorded a rise (24 out of 30). The leader of growth was the shares of E. I. du Pont de Nemours and Company (DD, + 1.55%). Outsider were the shares of International Business Machines Corporation (IBM, -4.39%).

All sectors of the S & P index showed growth. The maximum increase was shown by the conglomerate sector (+ 1.2%).

At closing:

DJIA + 0.29% 21.636.50 +61.77

Nasdaq + 0.64% 6.385.04 +40.73

S & P + 0.53% 2.473.67 +13.06

U.S. stock-index futures rose slightly as investors focused on Q2 earnings reports of the U.S. companies.

Global Stocks:

Nikkei 20,020.86 +20.95 +0.10%

Hang Seng 26,672.16 +147.22 +0.56%

Shanghai 3,232.87 +45.30 +1.42%

S&P/ASX 5,732.13 +44.73 +0.79%

FTSE 7,409.90 +19.68 +0.27%

CAC 5,190.43 +17.16 +0.33%

DAX 12,441.59 +11.20 +0.09%

Crude $46.45 (+0.11%)

Gold $1,240.80 (-0.09%)

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 210.99 | -0.69(-0.33%) | 320 |

| ALTRIA GROUP INC. | MO | 73.2 | -0.17(-0.23%) | 373 |

| Amazon.com Inc., NASDAQ | AMZN | 1,005.10 | -4.94(-0.49%) | 28093 |

| Apple Inc. | AAPL | 149.05 | -0.51(-0.34%) | 74367 |

| AT&T Inc | T | 36.4 | 0.01(0.03%) | 4115 |

| Barrick Gold Corporation, NYSE | ABX | 16.28 | 0.20(1.24%) | 13277 |

| Caterpillar Inc | CAT | 108.25 | 0.19(0.18%) | 865 |

| Chevron Corp | CVX | 104.8 | 0.59(0.57%) | 4041 |

| Cisco Systems Inc | CSCO | 31.53 | 0.03(0.10%) | 1525 |

| Citigroup Inc., NYSE | C | 66.48 | -0.35(-0.52%) | 15762 |

| Deere & Company, NYSE | DE | 125.91 | 0.03(0.02%) | 2583 |

| Exxon Mobil Corp | XOM | 81.1 | 0.24(0.30%) | 1080 |

| Facebook, Inc. | FB | 159.87 | 0.14(0.09%) | 58177 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 13.05 | 0.05(0.38%) | 18960 |

| General Electric Co | GE | 26.81 | -0.01(-0.04%) | 7450 |

| Goldman Sachs | GS | 226.55 | -2.71(-1.18%) | 115471 |

| Google Inc. | GOOG | 954.99 | 1.57(0.16%) | 1731 |

| Home Depot Inc | HD | 154.03 | 0.14(0.09%) | 295 |

| Intel Corp | INTC | 34.37 | -0.10(-0.29%) | 521 |

| International Business Machines Co... | IBM | 153.1 | 0.09(0.06%) | 2352 |

| Johnson & Johnson | JNJ | 132.92 | 0.77(0.58%) | 64420 |

| JPMorgan Chase and Co | JPM | 90.87 | -0.52(-0.57%) | 13932 |

| Microsoft Corp | MSFT | 73.4 | 0.05(0.07%) | 46429 |

| Procter & Gamble Co | PG | 87.57 | 0.02(0.02%) | 569 |

| Starbucks Corporation, NASDAQ | SBUX | 58.35 | 0.02(0.03%) | 1730 |

| Tesla Motors, Inc., NASDAQ | TSLA | 318.82 | -0.75(-0.23%) | 25803 |

| The Coca-Cola Co | KO | 44.81 | 0.08(0.18%) | 4222 |

| Twitter, Inc., NYSE | TWTR | 19.85 | -0.09(-0.45%) | 33231 |

| UnitedHealth Group Inc | UNH | 186.75 | 0.40(0.21%) | 10299 |

| Verizon Communications Inc | VZ | 43.75 | 0.09(0.21%) | 919 |

| Visa | V | 97 | 0.17(0.18%) | 13641 |

| Wal-Mart Stores Inc | WMT | 76.35 | -0.02(-0.03%) | 747 |

| Walt Disney Co | DIS | 104.7 | -0.09(-0.09%) | 902 |

| Yandex N.V., NASDAQ | YNDX | 31.47 | 0.13(0.41%) | 3011 |

NIKE (NKE) initiated with a Hold at Needham

UnitedHealth (UNH) target raised to $235 from $200 at Mizuho

Facebook (FB) target raised to $185 from $165 at Needham

Goldman Sachs (GS) downgraded to Mkt Perform from Outperform at Keefe Bruyette

Boeing (BA) upgraded to Neutral from Underperform at BofA/Merrill

Morgan Stanley (MS) reported Q2 FY 2017 earnings of $0.87 per share (versus $0.75 in Q2 FY 2016), beating analysts' consensus estimate of $0.77.

The company's quarterly revenues amounted to $9.503 bln (+6.7% y/y), beating analysts' consensus estimate of $9.052 bln.

MS rose to $46.10 (+2.13%) in pre-market trading.

IBM (IBM) reported Q2 FY 2017 earnings of $2.97 per share (versus $2.95 in Q2 FY 2016), beating analysts' consensus estimate of $2.74.

The company's quarterly revenues amounted to $19.289 bln (-4.7% y/y), generally in-line with analysts' consensus estimate of $19.452 bln.

The company also reaffirmed guidance for FY 2017, projecting EPS of 'at least' $13.80 versus analysts' consensus estimate of $13.68.

IBM fell to $149.50 (-2.92%) in pre-market trading.

Equity markets lacked direction in Asia on Wednesday, as was the case overnight in the U.S., though Australian stocks outperformed on strong gains among the country's biggest banks. Markets are expected to remain in narrow ranges ahead of policy statements from the European and Japanese central banks, due Thursday. Some investors are avoiding aggressive trading as a result.

Stocks across Europe dropped on Tuesday, with the exporter-heavy DAX 30 index DAX, -1.25% ending 1.3% lower at 12,430.39-its worst session since June 29. More broadly, European benchmarks finished the session under pressure as the euro stepped up to a 14-month high against the U.S. dollar and as disappointing corporate earnings reports rolled in. A stronger euro can hurt European exporters as it makes products more expensive for overseas customers.

The S&P 500 and the Nasdaq closed at records on Tuesday as gains in tech stocks offset weakness in telecom services and energy shares. A surge in Netflix Inc. NFLX, +13.54% shares on the back of strong earnings gave the broader tech sector a boost and helped to underpin the large-cap index push into the positive territory.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.