- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 21-07-2017.

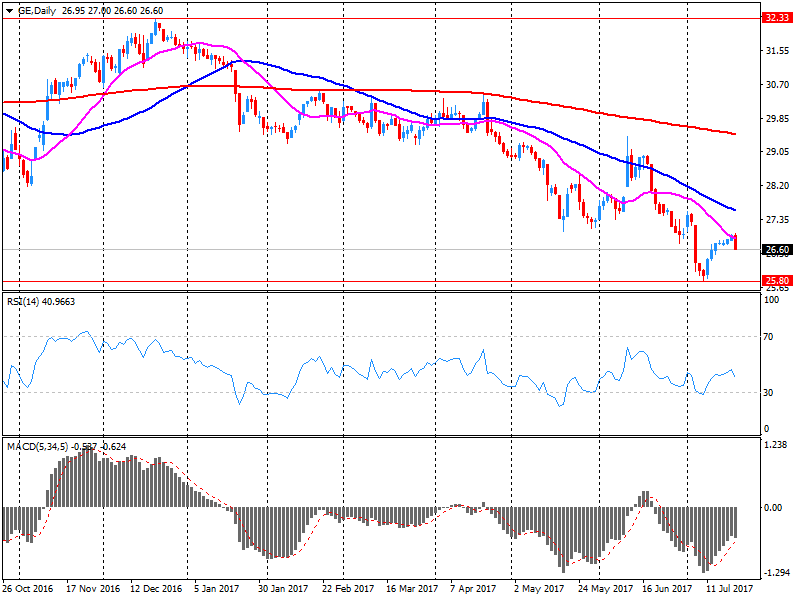

Major US stock indexes fell slightly, retreating from record levels, due to the weak reporting of the industrial heavyweight General Electric (GE) and a significant drop in oil prices.

As it became known, GE net profit fell by 34% per annum in the first half of 2017, to $ 1.9 billion. Revenues decreased by 7% to $ 57.2 billion. In the second quarter, GE net profit amounted to $ 1.4 billion , Which was 2.1 times less than last year. Revenue fell 12% to $ 29.6 billion.

Oil fell by about 2.7%, continuing yesterday's dynamics, which was due to another concern about the persistence of oil surplus in the world market after reports of growth in OPEC supplies in July. Supplies from OPEC members in July will exceed 33 million barrels per day, which is more than 600,000 barrels per day more than the average in the first half of 2017, according to Petro-Logistics SA, which tracks tanker movements.

Next week, Exxon Mobil (XOM), Chevron (CVX), Verizon (VZ), Boeing (BA), Procter & Gamble (PG), Intel (INTC), Caterpillar (CAT), Merck (MRK), Coca -Cola (KO), 3M (MMM) and many others. In addition, an important event next week will be a meeting of the Fed, which is scheduled for July 25-26.

Most components of the DOW index finished trading in the red (19 out of 30). Leader of growth were shares of Visa Inc. (V, + 1.50%). Outsider were shares of General Electric (GE, -2.92%).

S & P sectors demonstrated mixed dynamics. The utilities sector grew most (+ 0.7%). The largest decrease was shown by the sector of basic materials (-0.8%).

At this moment:

Dow -0.15% 21.580.07 -31.71

Nasdaq -0.04% 6.387.75 -2.25

S & P -0.04% 2.472.54 -0.91

U.S. stock-index futures fell slightly as investors digested a slew of earnings from notable companies like Microsoft (MSFT), General Electric (GE), Honeywell (HON) and Visa (V), among others.

Global Stocks:

Nikkei 20,099.75 -44.84 -0.22%

Hang Seng 26,706.09 -34.12 -0.13%

Shanghai 3,238.16 -6.71 -0.21%

S&P/ASX 5,722.84 38.61 -0.67%

FTSE 7,477.81 -10.06 -0.13%

CAC 5,147.73 -51.49 -0.99%

DAX 12,255.53 -191.72 -1.54%

Crude $46.50 (-0.90%)

Gold $1,251.70 (+0.50%)

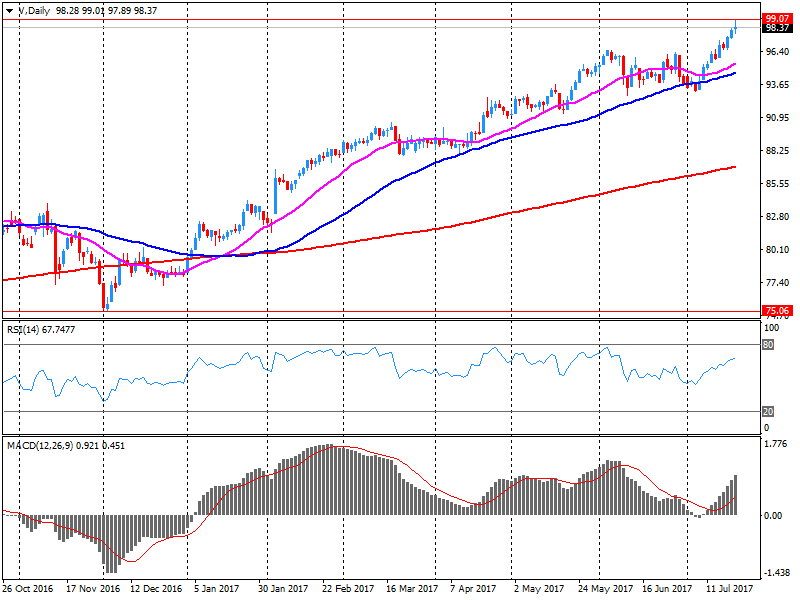

Visa (V) target raised to o $111 from $98 at RBC Capital

Visa (V) target raised to $114 from $107 at JPM

Visa (V) target raised to $107 from $105 at Cowen & Co.

Visa (V) target raised to $120 from $105 at Instinet

Microsoft (MSFT) target raised to $86 from $75 at BMO

Johnson & Johnson (JNJ) downgraded to Sell from Neutral at BTIG Research

Johnson & Johnson (JNJ) downgraded to Underweight from Neutral at Alembic Global Advisors

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 36.5 | -0.22(-0.60%) | 641 |

| ALTRIA GROUP INC. | MO | 73.5 | -0.09(-0.12%) | 1472 |

| Amazon.com Inc., NASDAQ | AMZN | 1,021.00 | -7.70(-0.75%) | 17869 |

| Apple Inc. | AAPL | 150.1 | -0.24(-0.16%) | 31407 |

| AT&T Inc | T | 36.57 | 0.05(0.14%) | 849 |

| Barrick Gold Corporation, NYSE | ABX | 16.49 | 0.17(1.04%) | 22270 |

| Cisco Systems Inc | CSCO | 31.8 | -0.06(-0.19%) | 5352 |

| Citigroup Inc., NYSE | C | 66.2 | -0.16(-0.24%) | 6151 |

| Exxon Mobil Corp | XOM | 80.85 | -0.01(-0.01%) | 685 |

| Facebook, Inc. | FB | 164.28 | -0.25(-0.15%) | 35212 |

| Ford Motor Co. | F | 11.63 | -0.07(-0.60%) | 136235 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 13.15 | 0.11(0.84%) | 30717 |

| General Electric Co | GE | 25.91 | -0.78(-2.92%) | 2539638 |

| General Motors Company, NYSE | GM | 36.1 | -0.31(-0.85%) | 6138 |

| Goldman Sachs | GS | 221.75 | -0.55(-0.25%) | 8787 |

| Google Inc. | GOOG | 968 | -0.15(-0.02%) | 1439 |

| Hewlett-Packard Co. | HPQ | 18.95 | 0.01(0.05%) | 3521 |

| Home Depot Inc | HD | 147.7 | 0.67(0.46%) | 10313 |

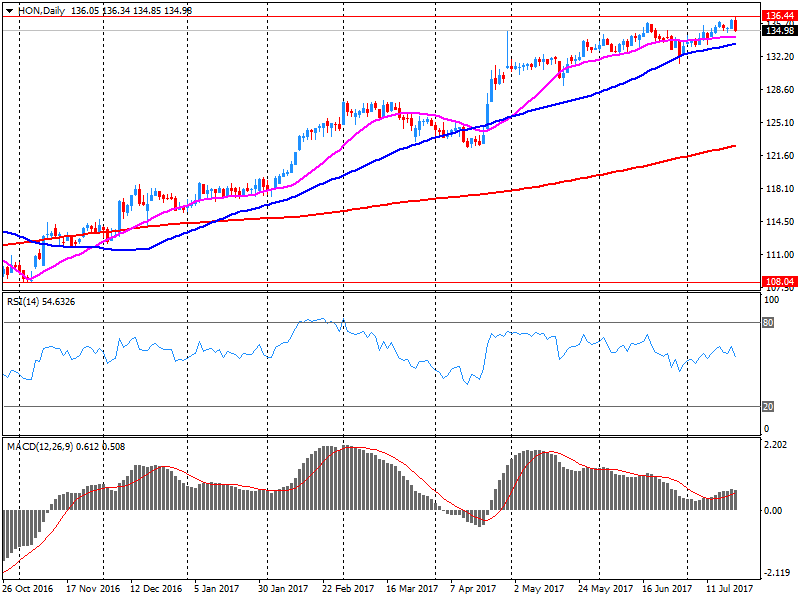

| HONEYWELL INTERNATIONAL INC. | HON | 135.25 | 0.30(0.22%) | 7520 |

| International Business Machines Co... | IBM | 147.6 | -0.06(-0.04%) | 289 |

| Johnson & Johnson | JNJ | 135.7 | -0.87(-0.64%) | 2002 |

| JPMorgan Chase and Co | JPM | 90.95 | -0.25(-0.27%) | 2931 |

| McDonald's Corp | MCD | 154.7 | 0.49(0.32%) | 343 |

| Microsoft Corp | MSFT | 74 | -0.22(-0.30%) | 1484857 |

| Nike | NKE | 58.84 | -0.26(-0.44%) | 2278 |

| Pfizer Inc | PFE | 33.64 | 0.10(0.30%) | 1078 |

| Procter & Gamble Co | PG | 88.38 | -0.22(-0.25%) | 2637 |

| Starbucks Corporation, NASDAQ | SBUX | 58 | -0.03(-0.05%) | 2381 |

| Tesla Motors, Inc., NASDAQ | TSLA | 329.2 | -0.72(-0.22%) | 20484 |

| The Coca-Cola Co | KO | 44.99 | 0.17(0.38%) | 215 |

| Twitter, Inc., NYSE | TWTR | 20.36 | -0.17(-0.83%) | 56744 |

| Visa | V | 98.8 | 0.69(0.70%) | 58103 |

| Yandex N.V., NASDAQ | YNDX | 31.3 | -0.06(-0.19%) | 1300 |

Honeywell (HON) reported Q2 FY 2017 earnings of $1.80 per share (versus $1.64 in Q2 FY 2016), beating analysts' consensus estimate of $1.78.

The company's quarterly revenues amounted to $10.078 bln (+0.9% y/y), beating analysts' consensus estimate of $9.886 bln.

HON rose to $135.25 (+0.22%) in pre-market trading.

General Electric (GE) reported Q2 FY 2017 earnings of $0.28 per share (versus $0.51 in Q2 FY 2016), beating analysts' consensus estimate of $0.25.

The company's quarterly revenues amounted to $29.558 bln (-11.8% y/y), beating analysts' consensus estimate of $29.068 bln.

GE fell to $25.85 (-3.15%) in pre-market trading.

Visa (V) reported Q2 FY 2017 earnings of $0.86 per share (versus $0.69 in Q2 FY 2016), beating analysts' consensus estimate of $0.81.

The company's quarterly revenues amounted to $4.545 bln (+25.8% y/y), beating analysts' consensus estimate of $4.355bln.

V rose to $98.80 (+0.70%) in pre-market trading.

Microsoft (MSFT) reported Q2 FY 2017 earnings of $0.75 per share (versus $0.69 in Q2 FY 2016), beating analysts' consensus estimate of $0.71.

The company's quarterly revenues amounted to $24.700 bln (+9.1% y/y), beating analysts' consensus estimate of $24.294 bln.

MSFT fell to $73.86 (-0.48%) in pre-market trading.

Equities across the Asia-Pacific region were lower on Friday, taking a breather from the recent surge where gains in Australian shares lagged behind other indexes as sharp moves its currency plagued stocks. Though the Aussie dollar retreated slightly against the greenback Friday after hitting a two-year high on Wednesday, it was still up 1.2% this week, driven in part by strong jobs data and a recent surge in the price of iron-ore, one of the country's main commodity exports.

European stocks reversed course and closed lower Thursday as investors weighed the possibility the European Central Bank is moving closer to reducing monetary stimulus for the eurozone economy that has helped pushed equities to record highs. German, French, Spanish and Italian shares flipped down at the same time the euro leapt to its highest in more than a year against the U.S. dollar. Those moves were made on the prospect that the ECB will soon say it's time to start winding down its massive program of bond purchases.

U.S. stocks finished mostly lower on Thursday as Home Depot weighed on the Dow, but the Nasdaq bucked the trend to match its best win streak since February 2015 and closed at a record.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.