- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 19-11-2015.

Major U.S. stock-indexes wobbled on Thursday as healthcare stocks snapped a three-day rally after UnitedHealth cut its profit forecast, offsetting gains in technology and consumer stocks.

Investors also digested minutes from the Federal Reserve's October meeting released on Wednesday, which hardened expectations of a December interest rate hike and hinted at a cautious approach after that.

Data on Thursday appeared to support the Fed's view of a strengthening labor market as the number of Americans filing for unemployment benefits fell last week.

Most of Dow stocks in positive area (18 of 30). Top looser - UnitedHealth Group Incorporated (UNH, -5.19%). Top gainer - The Coca-Cola Company (KO +2.02%).

Most of S&P index sectors also in positive area. Top looser - Consumer goods (+0,6%). Top looser - Healthcare (-1.3%).

At the moment:

Dow 17691.00 +2.00 +0.01%

S&P 500 2077.50 -2.25 -0.11%

Nasdaq 100 4665.25 +12.75 +0.27%

Oil 41.56 -0.39 -0.93%

Gold 1081.50 +12.80 +1.20%

U.S. 10yr 2.23 -0.04

Stock indices closed higher on the Fed's minutes. The Fed released its October monetary policy meeting minutes on Wednesday. The minutes showed that an interest rate hike in December is possible.

The European Central Bank's (ECB) its minutes of October meeting on Thursday. According to the minutes, the central bank will review its stimulus measures at the December monetary policy meeting, and is ready to add further stimulus measures if needed.

"The Governing Council was willing and able to act, if warranted, by using all available tools within its mandate, including by adjusting the size, composition and duration of the APP [asset purchase programme]," the minutes said.

The central bank said that current measures may not be sufficient to reach the inflation target.

The European Central Bank (ECB) Executive Board member Peter Praet said in a speech on Thursday that the uncertainty about the economy increased.

He noted that the economy in the Eurozone improved, adding that downside risks increased, while tail risks receded.

Meanwhile, the economic data from the Eurozone was positive. The European Central Bank (ECB) released its current account on Thursday. Eurozone's current account surplus rose to a seasonally adjusted €29.4 billion in September from €18.7 billion in August. August's figure was revised up from a surplus of €17.7 billion.

The Office for National Statistics released its retail sales data for the U.K. on Thursday. Retail sales in the U.K. fell 0.6% in October, missing expectations for a 0.5% decline, after a 1.7% rise in September. September's figure was revised down from a 1.9% increase.

The decline was driven by lower food stores, department stores and clothing sales.

Food sales declined 1.3% in October, non-food sales fell 0.3%, and clothing and footwear sales slid 1.8%, while household goods sales dropped 0.8%.

Sales of auto fuel climbed 1.7% in October.

On a yearly basis, retail sales in the U.K. climbed 3.8% in October, missing forecasts of 4.2% increase, after a 6.2% rise in September. September's figure was revised down from a 6.5% gain.

The Confederation of British Industry (CBI) released its industrial order books balance on Thursday. The CBI industrial order books balance rose to -11% in November to -18% in October.

Decline in export demand weighed on new orders.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,329.93 +50.96 +0.81 %

DAX 11,085.44 +125.49 +1.14 %

CAC 40 4,915.10 +8.38 +0.17 %

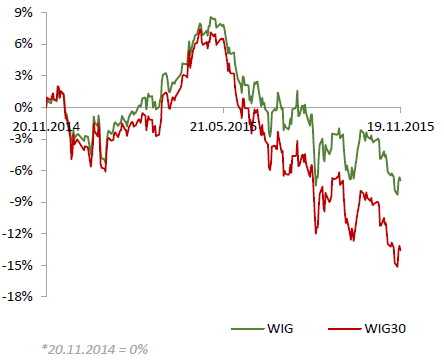

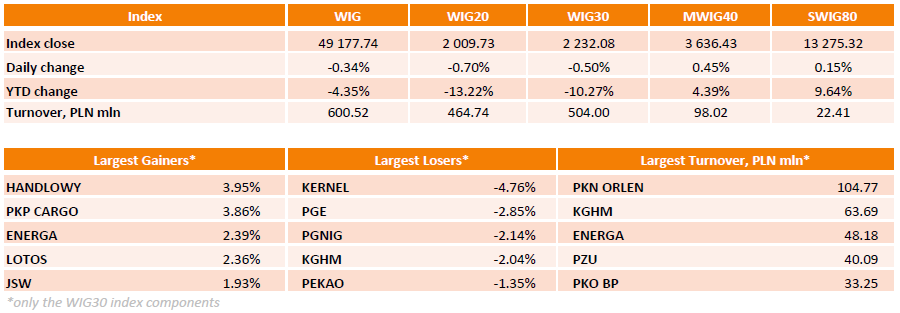

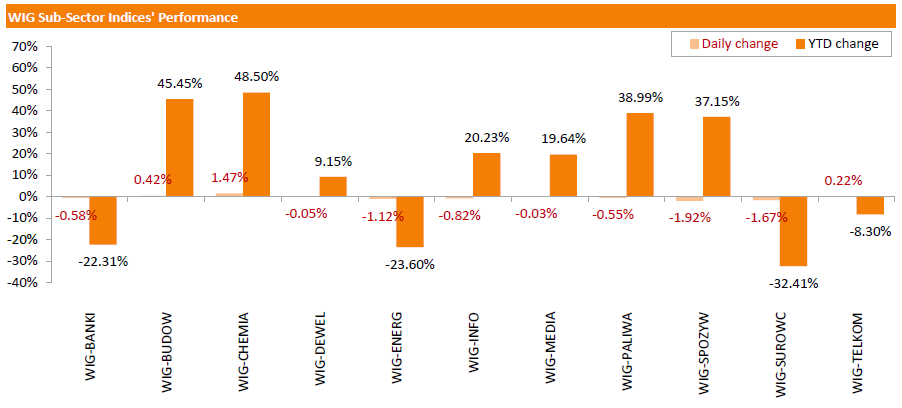

Polish equity market closed lower on Thursday. The broad market measure, the WIG Index, posted a 0.34% drop. Sector-wise, food sector (-1.92%) and materials (-1.67%) fared the worst, while chemicals (+1.47%) outperformed.

The large-cap stocks' benchmark, the WIG30 Index, fell by 0.5 %. KERNEL (WSE: KER) was the index's sharpest decliner, retreating by 4.76% It was followed by PGE (WSE: PGE), PGNIG (WSE: PGN) and KGHM (WSE: KGH), losing 2.85%, 2.14% and 2.04% respectively. On the contrary, HANDLOWY (WSE: BHW) and PKP CARGO (WSE: PKP) gained the most, adding 3.95% and 3.86% respectively. Other noticeable advancers were ENERGA (WSE; ENG) and LOTOS (WSE: LTS), soaring by 2.39% and 2.36% respectively.

The People's Bank of China (PBoC) lowered its seven-day Standing Lending Facility (SLF) interest rate for local financial institutions to 3.25% from 5.5%. The overnight SLF rate for some local financial institutions was cut to 2.75% from 4.5%.

The central bank hopes with this decision to stimulate the country's economy.

The interest rate cut would be effective from November 20.

The Organization for Economic Cooperation and Development (OECD) released its preliminary real gross domestic product (GDP) growth figures on Thursday. Real GDP of 34 OECD member countries rose 0.4% in the third quarter, after a 0.6% gain in the second quarter.

Real GDP of the United States was down to 0.4% from 1.0%, real GDP of Germany fell to 0.3% from 0.4%, while Britain's economy decreased to 0.5% from 0.7%.

GDP of China remained unchanged at 1.8% in the third quarter.

GDP of France increased to 0.3% from 0.0%, Italy's economy decreased to 0.2% from 0.3%, while Japan's GDP contracted by 0.2%.

Eurozone's economy expanded at 0.4% in the third quarter, after a 0.4% rise in the second quarter.

On a yearly basis, GDP of 34 OECD member countries was up 2.0% in the third quarter, after a 2.2% gain in the previous quarter.

Cleveland Fed President Loretta Mester hinted in an interview with CNBC on Thursday that an interest rate hike by the Fed is possible soon.

"Things are on track," she said.

Mester noted that the U.S. labour market is near or reached full employment, while inflation is moving toward the 2% target.

Cleveland Fed president pointed out that terrorist attacks are unlikely to have a negative impact on the outlook of the U.S. economy.

Spain's Economy Ministry released its trade data on Thursday. The trade deficit narrowed to €2.57 billion in September from €2.37 billion in September a year ago.

Exports rose at an annual rate of 1.1% in September, while imports rose 1.8%.

In the January to September period, the trade deficit totalled €18.64 billion, down 1.1% from the same period of 2014.

Exports increased 4.4% in the January to September period, while imports gained 3.9%.

The Conference Board released its leading economic index (LEI) for the U.S. on Thursday. The leading economic index climb 0.6% in October, exceeding expectations a 0.5% gain, after a 0.1% fall in September. September's figure was revised up from a 0.2% decrease.

The coincident economic index rose 0.2% in October, after a 0.1% gain in September.

"The U.S. LEI rose sharply in October, with the yield spread, stock prices, and building permits driving the increase. Despite lacklustre third quarter growth, the economic outlook now appears to be improving. While the U.S. LEI's six-month growth rate has moderated, the U.S. economy remains on track for continued expansion heading into 2016," director of business cycles and growth research at The Conference Board, Ataman Ozyildirim, said.

Statistics New Zealand released its output and input producer price index (PPI) data on the late Wednesday evening. New Zealand's input PPI rose 1.6% in the third quarter, after a 0.3% drop in the second quarter.

Output PPI climbed 1.3% in the third quarter, after a 0.2% fall in the second quarter.

Producer prices were driven by higher meat and farm-gate milk prices.

"Prices were up 10 percent for sheep, beef, and grain farmers. This meant meat product manufacturers had an 8.0 percent rise in their input prices. The prices they received rose 5.5 percent, due to higher meat export prices on the back of a weaker New Zealand dollar," Statistics New Zealand's prices manager Chris Pike said.

The Ministry of Finance released its trade data for Japan on the late Wednesday evening. Japan's trade deficit turned into a surplus of ¥115.5 billion in October from a deficit of ¥114.5 billion in September.

Analysts had expected a deficit of ¥292 billion.

Exports rose 7.6% year-on-year in October, while imports dropped 13.4%.

Exports to Asia declined by 3.6% year-on-year, exports to the United States increased by 6.3%, exports to China fell by 3.6%, while exports to the European Union were up 5.6%.

Imports from Asia decreased 4.7% year-on-year, imports from the United States jumped 1.0%, while imports from China slid 5.2%.

U.S. stock-index futures fluctuated.

Global Stocks:

Nikkei 19,859.81 +210.63 +1.07%

Hang Seng 22,500.22 +311.96 +1.41%

Shanghai Composite 3,617.85 +49.38 +1.38%

FTSE 6,339.97 +61.00 +0.97%

CAC 4,931.34 +24.62 +0.50%

DAX 11,102.87 +142.92 +1.30%

Crude oil $40.29 (-1.15%)

Gold $1070.00 (+0.12%)

The European Central Bank's (ECB) its minutes of October meeting on Thursday. According to the minutes, the central bank will review its stimulus measures at the December monetary policy meeting, and is ready to add further stimulus measures if needed.

"The Governing Council was willing and able to act, if warranted, by using all available tools within its mandate, including by adjusting the size, composition and duration of the APP [asset purchase programme]," the minutes said.

The central bank said that current measures may not be sufficient to reach the inflation target.

"The impact of external factors and heightened uncertainty raised the possibility that the ECB's measures, despite their magnitude, might not be gaining sufficient traction in the present environment to achieve their ultimate objective in terms of inflation rates, also in view of low price pressures globally," the ECB said.

The central bank also said that it will likely miss its inflation target.

"The anticipated timing of inflation normalising towards 2% was likely to be pushed back again, as had already been the case in previous staff projections," the ECB noted.

(company / ticker / price / change, % / volume)

| ALCOA INC. | AA | 8.50 | 1.07% | 10.8K |

| Yahoo! Inc., NASDAQ | YHOO | 33.21 | 0.70% | 19.6K |

| Twitter, Inc., NYSE | TWTR | 26.06 | 0.62% | 45.2K |

| Nike | NKE | 126.50 | 0.57% | 0.7K |

| ALTRIA GROUP INC. | MO | 57.30 | 0.42% | 1.3K |

| Merck & Co Inc | MRK | 54.45 | 0.41% | 0.7K |

| Boeing Co | BA | 148.82 | 0.36% | 0.1K |

| Tesla Motors, Inc., NASDAQ | TSLA | 221.80 | 0.33% | 5.5K |

| Citigroup Inc., NYSE | C | 55.15 | 0.31% | 0.6K |

| Procter & Gamble Co | PG | 76.13 | 0.30% | 0.1K |

| International Business Machines Co... | IBM | 136.22 | 0.29% | 1.1K |

| Travelers Companies Inc | TRV | 115.00 | 0.28% | 0.6K |

| Barrick Gold Corporation, NYSE | ABX | 7.25 | 0.28% | 65.1K |

| Amazon.com Inc., NASDAQ | AMZN | 665.39 | 0.28% | 9.1K |

| Ford Motor Co. | F | 14.50 | 0.28% | 1.1K |

| JPMorgan Chase and Co | JPM | 67.63 | 0.27% | 10.2K |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 8.79 | 0.23% | 20.9K |

| McDonald's Corp | MCD | 112.78 | 0.22% | 0.1K |

| Home Depot Inc | HD | 126.80 | 0.21% | 9.5K |

| Intel Corp | INTC | 33.23 | 0.21% | 0.3K |

| E. I. du Pont de Nemours and Co | DD | 67.23 | 0.19% | 1.8K |

| Microsoft Corp | MSFT | 53.95 | 0.19% | 8.7K |

| Goldman Sachs | GS | 194.01 | 0.18% | 0.6K |

| Starbucks Corporation, NASDAQ | SBUX | 61.91 | 0.18% | 3.7K |

| Wal-Mart Stores Inc | WMT | 61.02 | 0.15% | 2.4K |

| Google Inc. | GOOG | 741.10 | 0.15% | 0.7K |

| The Coca-Cola Co | KO | 42.34 | 0.14% | 0.7K |

| Walt Disney Co | DIS | 118.30 | 0.14% | 0.5K |

| AT&T Inc | T | 33.58 | 0.12% | 2.7K |

| Visa | V | 80.55 | 0.11% | 1.7K |

| Cisco Systems Inc | CSCO | 27.15 | 0.11% | 1K |

| Caterpillar Inc | CAT | 70.39 | 0.10% | 2.2K |

| Johnson & Johnson | JNJ | 102.77 | 0.10% | 1.0K |

| 3M Co | MMM | 157.41 | 0.01% | 0.1K |

| United Technologies Corp | UTX | 97.71 | 0.00% | 1.4K |

| Verizon Communications Inc | VZ | 45.37 | -0.02% | 7.1K |

| Facebook, Inc. | FB | 107.74 | -0.03% | 38.8K |

| Apple Inc. | AAPL | 117.17 | -0.10% | 333.8K |

| General Motors Company, NYSE | GM | 36.41 | -0.14% | 1.7K |

| General Electric Co | GE | 30.47 | -0.16% | 71.0K |

| Exxon Mobil Corp | XOM | 80.58 | -0.20% | 430.7K |

| American Express Co | AXP | 71.99 | -0.22% | 13.4K |

| Chevron Corp | CVX | 91.71 | -0.54% | 3.5K |

| Pfizer Inc | PFE | 33.00 | -0.93% | 32.5K |

| Yandex N.V., NASDAQ | YNDX | 16.78 | -2.21% | 12.1K |

| UnitedHealth Group Inc | UNH | 110.25 | -5.97% | 140.5K |

The Philadelphia Federal Reserve Bank released its manufacturing index on Thursday. The index increased to 1.9 in November from-4.5 in October, exceeding expectations for a rise to -1.0.

A reading above zero indicates expansion, while a reading below zero indicates contraction.

"Manufacturing conditions in the region showed slight improvement this month, according to firms responding to the November Manufacturing Business Outlook Survey. The indicator for general activity was slightly positive this month, following two months in negative territory," the Philadelphia Federal Reserve Bank said in its survey.

The shipments index was up to -2.5 in November from -6.1 in October.

The new orders index increased to -3.7 in November from 10.6 in October.

The prices paid index slid to -4.9 in November from -0.1 in October, while the prices received index decreased to -0.4 from 1.3.

The number of employees index climbed to 2.6 in November from -1.7 in October.

According to the report, the future general activity index was up to 43.4 in November from 36.7 in October.

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending November 14 in the U.S. fell to 271,000 from 276,000 in the previous week, in line with expectations.

Jobless claims remained below 300,000 the 37th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims decreased by 2,000 to 2,175,000 in the week ended November 07.

Statistics Canada released wholesale sales figures on Thursday. Wholesale sales fell 0.1% in September, missing expectations for a 0.3% gain, after a 0.1% decline in August.

The decline was driven by lower sales in the motor vehicle and parts and the building material and supplies subsectors.

Sales of automobiles and parts were down 3.0% in September.

Sales in the building material and supplies subsector declined 2.1% in September, while sales in the food, beverage and tobacco subsector increased 1.6%.

Inventories fell by 0.4% in September.

The Confederation of British Industry (CBI) released its industrial order books balance on Thursday. The CBI industrial order books balance rose to -11% in November to -18% in October.

Decline in export demand weighed on new orders.

"Poor export performance is weighing on the UK economy, as manufacturers are held back by a strong pound and a weakening global growth outlook," the CBI director of economics Rain Newton-Smith said.

Stock indices traded higher on the Fed's minutes. The Fed released its October monetary policy meeting minutes on Wednesday. The minutes showed that an interest rate hike in December is possible.

The European Central Bank (ECB) Executive Board member Peter Praet said in a speech on Thursday that the uncertainty about the economy increased.

He noted that the economy in the Eurozone improved, adding that downside risks increased, while tail risks receded.

Meanwhile, the economic data from the Eurozone was positive. The European Central Bank (ECB) released its current account on Thursday. Eurozone's current account surplus rose to a seasonally adjusted €29.4 billion in September from €18.7 billion in August. August's figure was revised up from a surplus of €17.7 billion.

The Office for National Statistics released its retail sales data for the U.K. on Thursday. Retail sales in the U.K. fell 0.6% in October, missing expectations for a 0.5% decline, after a 1.7% rise in September. September's figure was revised down from a 1.9% increase.

The decline was driven by lower food stores, department stores and clothing sales.

Food sales declined 1.3% in October, non-food sales fell 0.3%, and clothing and footwear sales slid 1.8%, while household goods sales dropped 0.8%.

Sales of auto fuel climbed 1.7% in October.

On a yearly basis, retail sales in the U.K. climbed 3.8% in October, missing forecasts of 4.2% increase, after a 6.2% rise in September. September's figure was revised down from a 6.5% gain.

Current figures:

Name Price Change Change %

FTSE 100 6,359.92 +80.95 +1.29 %

DAX 11,144.06 +184.11 +1.68 %

CAC 40 4,950.2 +43.48 +0.89 %

The European Central Bank (ECB) Executive Board member Peter Praet said in a speech on Thursday that the uncertainty about the economy increased.

He noted that the economy in the Eurozone improved.

"The incoming data points to an overall picture of normalisation in the euro area economy. Domestic demand is gradually strengthening," Praet said.

But he added that downside risks increased, while tail risks receded.

The Bank of Japan (BoJ) Governor Haruhiko Kuroda played down the weak GDP data at a press conference on Thursday, saying the Japanese economy shrank in the third quarter due to a reduction in inventories.

He added that he expects business capital expenditure to improve.

Kuroda noted that underlying long-term inflation was picking up.

The BoJ government pointed out that terrorist attacks in Paris will have only limited impact on the economy.

The Swiss Federal Customs Administration released its trade data on Thursday. The Swiss trade surplus rose to CHF4.16 billion in October from CHF3.25 billion in the previous month. September's figure was revised up from a surplus of CHF3.05 billion.

Exports climbed 5.1% in October, while imports rose 3.5%.

Exports dropped 1.5% year-on-year in October, while imports were down 5.3% year-on-year.

The Office for National Statistics released its retail sales data for the U.K. on Thursday. Retail sales in the U.K. fell 0.6% in October, missing expectations for a 0.5% decline, after a 1.7% rise in September. September's figure was revised down from a 1.9% increase.

The decline was driven by lower food stores, department stores and clothing sales.

Food sales declined 1.3% in October, non-food sales fell 0.3%, and clothing and footwear sales slid 1.8%, while household goods sales dropped 0.8%.

Sales of auto fuel climbed 1.7% in October.

On a yearly basis, retail sales in the U.K. climbed 3.8% in October, missing forecasts of 4.2% increase, after a 6.2% rise in September. September's figure was revised down from a 6.5% gain.

The European Central Bank (ECB) released its current account on Thursday. Eurozone's current account surplus rose to a seasonally adjusted €29.4 billion in September from €18.7 billion in August. August's figure was revised up from a surplus of €17.7 billion.

The trade surplus climbed to €29.8 billion in September from €22.1 billion in August.

The surplus on services remained unchanged at €4.5 billion in September.

The secondary income deficit decreased to €9.8 billion in September from €11.6 billion in August, while the primary income surplus increased to €4.8 billion from €3.8 billion.

Eurozone's unadjusted current account surplus jumped to €33.1 billion in September from €14.6 billion in August. August's figure was revised down from a surplus of €18.7 billion.

The Bank of Japan (BoJ) released its interest rate decision on Thursday. The BoJ kept its monetary policy unchanged (interest rate: 0.00-0.10%, monetary base target: 275 trillion yen). The central bank will expand its monetary base at an annual pace of 80 trillion yen. This decision was expected by analysts.

The BoJ board members voted 8-1 to keep monetary policy unchanged.

The BoJ noted that the country's economy continued to recover moderately, "although exports and production are affected by the slowdown in emerging economies".

The central bank said that the annual inflation in Japan was flat, but inflation expectations seems to be rising.

The BoJ expect the inflation to be about 0% "for the time being", due to low energy prices.

The Fed released its October monetary policy meeting minutes on Wednesday. The minutes showed that an interest rate hike in December is possible.

"Some participants thought that the conditions for beginning the policy normalization process had already been met. Most participants anticipated that, based on their assessment of the current economic situation and their outlook for economic activity, the labour market, and inflation, these conditions could well be met by the time of the next meeting," the minutes said.

Members noted that there should be no "unanticipated shocks", which could "adversely affect the economic outlook and that incoming data support the expectation that labour market conditions will continue to improve and that inflation will return to the Committee's 2 percent objective over the medium term".

Most members said that the downside risks to the outlook arising from economic and financial developments abroad diminished.

FOMC members voted 9-1in September to keep interest rates unchanged. Only Richmond Fed President Jeffrey Lacker voted to raise interest rate by 0.25%.

New Federal Reserve Bank of Dallas President Robert Steven Kaplan, a former vice chairman of Goldman Sachs Group Inc. and professor at Harvard Business School, said that the Fed's monetary policy should remain accommodative for some time.

"In my view, the FOMC-in the previous two meetings-has been prudent in waiting for more data before taking policy action," he said.

"Accommodative policy does not necessarily mean a zero fed funds rate. There are various costs to maintaining a zero fed funds rate for too long-particularly in terms of potential distortions in investment and business decisions. These distortions can create imbalances in investments, inventory and hiring decisions that may later need to be (painfully) unwound when policy normalizes," Kaplan added.

U.S. stock indices rose on Wednesday after the minutes of the latest Federal Open Market Committee meeting signaled an interest rate hike in December was possible.

The Dow Jones Industrial Average rose 247.66 points, or 1.4%, to 17,737.16. The S&P 500 gained 33.14 points, or 1.6%, to 2,083.58 (all of its 10 sectors closed higher). The Nasdaq Composite surged 89.19 points, or 1.8%, to 5,075.20.

"Members emphasized that this change was intended to convey the sense that, while no decision had been made, it may well become appropriate to initiate the normalization process at the next meeting," the minutes said. Recent economic data mostly supported the central bank's view that conditions in the labor market improved.

Meanwhile construction of new homes declined in October as less apartments and condominiums were built (they supported demand throughout most of the summer). Housing starts fell by 11% to an annualized level of 1.06 million. Starts of single-family homes, which account for almost two thirds of the market, fell by 2.4%. Building permits, which determine future construction, rose by 4.1% to an annualized level of 1.15 million on a seasonally adjusted basis. Building permits rose to the highest level since December 2007.

This morning in Asia Hong Kong Hang Seng rose 1.10%, or 243.62, to 22,431.88. China Shanghai Composite Index lost 0.15%, or 5.36, to 3.563.10. The Nikkei 225 gained 1.14%, or 224.61, to 19,873.79.

Asian indices traded mixed.

Japanese stocks climbed on positive data. For the first time in six months Japanese trade balance had recovered from a deficit in October. Exports exceeded imports by ¥111.5 billion. Japanese exports declined by 2.1% in October despite a weaker yen. However imports fell by 13.4%.

Today the Bank of Japan has decided to keep its monetary policy unchanged.

(index / closing price / change items /% change)

Nikkei 225 19,649.18 +18.55 +0.09 %

Hang Seng 22,188.26 -75.99 -0.34 %

Shanghai Composite 3,569.79 -35.01 -0.97 %

FTSE 100 6,278.97 +10.21 +0.16 %

CAC 40 4,906.72 -30.59 -0.62 %

Xetra DAX 10,959.95 -11.09 -0.10 %

S&P 500 2,083.58 +33.14 +1.62 %

NASDAQ Composite 5,075.2 +89.19 +1.79 %

Dow Jones 17,737.16 +247.66 +1.42 %

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.