- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 20-11-2015.

Major U.S. stock-indexes rose on Friday, with the S&P 500 on track for its best week in a year, as healthcare and consumer stocks rose.

The Dow Jones industrial average turned positive for the year, led by a 4.6% rise in Nike (NKE) which announced a $12 billion share buyback and share split.

Healthcare was the top gainer among the 10 major S&P sectors, led by Allergan's (AGN) 3.3% increase. The drugmaker rose on reports that the U.S. Treasury's new tax inversion rules were unlikely to thwart its proposed deal with Pfizer (PFE).

Most of Dow stocks in positive area (22 of 30). Top looser - Chevron Corporation (CVX, -0.97%). Top gainer - NIKE, Inc. (NKE +4.31%).

Most of S&P index sectors also in positive area. Top looser - Basic Materials (-0.6%). Top gainer - Conglomerates (+1,6%).

At the moment:

Dow 17804.00 +97.00 +0.55%

S&P 500 2087.75 +8.50 +0.41%

Nasdaq 100 4678.75 +18.75 +0.40%

Oil 41.77 +0.05 +0.12%

Gold 1077.20 -0.70 -0.06%

U.S. 10yr 2.24 -0.01

Stock indices closed mixed on speeches by the European Central Bank (ECB) officials. The ECB President Mario Draghi said in a speech in Frankfurt on Friday that the central bank is ready to use "all the instruments" to boost inflation in the Eurozone.

The ECB president pointed out that there are downside risks to the central bank's scenario.

"The downside risks to our baseline scenario for the euro area economy have increased in recent months due to the deterioration of the external environment. The outlook for global demand, especially in emerging markets, has notably worsened, while uncertainty in financial markets has increased," he noted.

The ECB Governing Council member Jens Weidmann said in a speech in Frankfurt on Friday that the low inflation in the Eurozone was driven by lower energy prices. He pointed out that the ultra-loose monetary policy could lead to risks.

"We need to be aware that the longer we stay in ultra-loose monetary policy mode, the less effective this policy will become and the more the attendant risks and side-effects will come into play," Weidmann said.

Meanwhile, the economic data from the Eurozone was positive. The European Commission released its preliminary consumer confidence figures for the Eurozone on Friday. Eurozone's preliminary consumer confidence index increased to -6.0 in November from -7.6 in October, beating expectations for a rise to -7.5%. October's figure was revised up from -7.7%.

The Office for National Statistics released public sector net borrowing for the U.K. on Tuesday. The public sector net borrowing in the U.K. fell to £7.47 billion in October from £8.33 billion in September. September's figure was revised down from £8.63 billion.

Analysts had expected a decrease to £5.5 billion.

Public sector net borrowing excluding public sector banks increased to £8.2 billion in October from £7.1 billion in October 2014.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,334.63 +4.70 +0.07 %

DAX 11,119.83 +34.39 +0.31 %

CAC 40 4,910.97 -4.13 -0.08 %

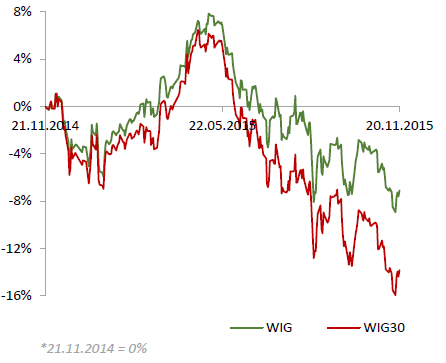

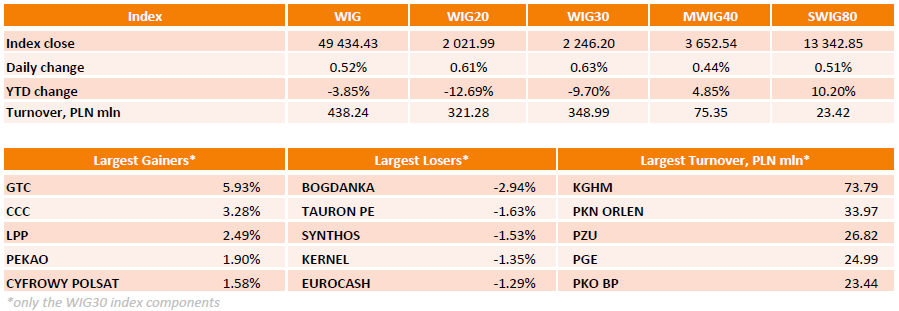

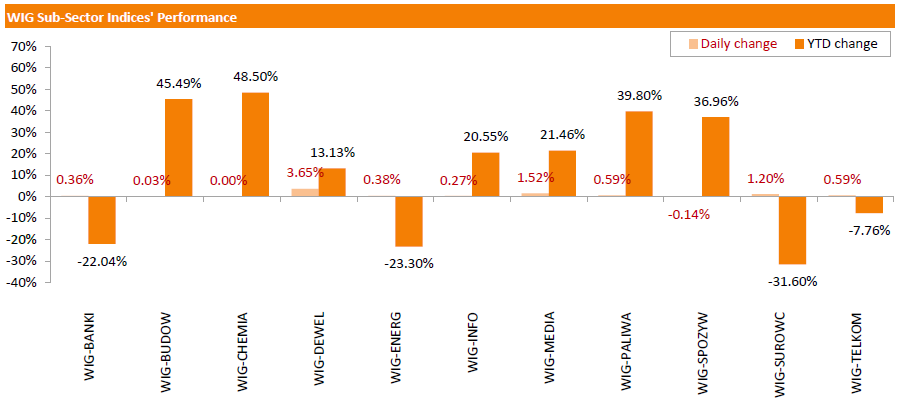

Polish equity market closed higher on Friday. The broad market measure, the WIG index, advanced 0.52%. All sectors, but for food sector (-0.14%), did well with developers sector (+3.65%) outperforming.

The large-cap stocks' measure, the WIG30 Index, surged by 0.63%. In the index basket, developer GTC (WSE: GTC) generated the biggest positive return, soaring by 5.93% on news the company bought property in Budapest for EUR 52 mln. Retailers CCC (WSE: CCC) and LPP (WSE: LPP) also were among top performers, adding 3.28% and 2.49% respectively. On the other side of the ledger, coal miner BOGDANKA (WSE: LWB) led the decliners with a 2.94% drop, followed by utilities name TAURON PE (WSE: TPE) and chemicals name SYNTHOS (WSE: SNS), falling by 1.63% and 1.53% respectively.

St. Louis Fed President James Bullard said in a speech on Friday that the U.S. inflation will reach 2% target by the end of 2016.

"Let's suppose that oil prices stabilize at the current level and stay around that level for several years. Let's further suppose that all other prices continue to increase at the same pace as they have during 2015 so far. Under such a scenario, the headline consumer price index inflation rate at the end of 2016 would be more than 2%," he said.

Bullard also said that the probability of a hard landing in China is low now, and that the U.S. labour market "largely normalized".

The Conference Board released its leading economic index (LEI) for China on Thursday. The leading economic index climb 0.6% in October, after a 1.6% gain in September.

The index was mainly driven by total loans issued by financial institutions.

The coincident economic index rose 2.0% in October, after a 1.5% drop in September.

The European Commission released its preliminary consumer confidence figures for the Eurozone on Friday. Eurozone's preliminary consumer confidence index increased to -6.0 in November from -7.6 in October, beating expectations for a rise to -7.5%. October's figure was revised up from -7.7%.

European Union's consumer confidence index climbed by 1.3 points to -4.4 in November.

The Bank of Greece released its current account data on Friday. Greece's current account surplus fell to €0.84 billion in September from €2.09 billion in September last year.

The Greek deficit on trade in goods declined to €1.4 billion in September from €2.1 billion in September last year, while the services surplus fell to €2.3 billion from €2.8 billion.

The surplus on primary income increased to €55.8 million in September from €2.8 million in September last year, while the deficit on secondary income declined to €37.1 million from €50.0 million last year.

The capital account surplus rose to €61.2 in September from 56.7 last year.

U.S. stock-index futures advanced.

Global Stocks:

Nikkei 19,879.81 +20.00 +0.10%

Hang Seng 22,754.72 +254.50 +1.13%

Shanghai Composite 3,630.82 +13.76 +0.38%

FTSE 6,348.31 +18.38 +0.29%

CAC 4,919.23 +4.13 +0.08%

DAX 11,132.37 +46.93 +0.42%

Crude oil $40.11 (-1.06%)

Gold $1080.90 (+0.28%)

(company / ticker / price / change, % / volume)

| Nike | NKE | 131.28 | 4.37% | 42.8K |

| ALCOA INC. | AA | 8.86 | 1.14% | 40.5K |

| Twitter, Inc., NYSE | TWTR | 26.55 | 0.87% | 9.5K |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 8.48 | 0.83% | 5.7K |

| Barrick Gold Corporation, NYSE | ABX | 7.60 | 0.80% | 23.6K |

| Walt Disney Co | DIS | 119.37 | 0.56% | 6.0K |

| Tesla Motors, Inc., NASDAQ | TSLA | 223.05 | 0.56% | 3.3K |

| International Business Machines Co... | IBM | 137.49 | 0.55% | 3.6K |

| Facebook, Inc. | FB | 106.82 | 0.53% | 70.0K |

| Intel Corp | INTC | 34.48 | 0.52% | 29.4K |

| Pfizer Inc | PFE | 32.45 | 0.50% | 1.2K |

| Google Inc. | GOOG | 742.00 | 0.49% | 9.8K |

| Ford Motor Co. | F | 14.64 | 0.48% | 9.7K |

| Home Depot Inc | HD | 127.44 | 0.46% | 1.6K |

| General Electric Co | GE | 30.40 | 0.43% | 37.6K |

| ALTRIA GROUP INC. | MO | 57.70 | 0.42% | 2.2K |

| JPMorgan Chase and Co | JPM | 67.94 | 0.41% | 25.1K |

| Starbucks Corporation, NASDAQ | SBUX | 61.70 | 0.39% | 4.2K |

| AT&T Inc | T | 33.74 | 0.36% | 1.9K |

| Amazon.com Inc., NASDAQ | AMZN | 663.56 | 0.35% | 7.5K |

| UnitedHealth Group Inc | UNH | 111.00 | 0.33% | 1.5K |

| Microsoft Corp | MSFT | 54.12 | 0.33% | 10.0K |

| Wal-Mart Stores Inc | WMT | 60.90 | 0.33% | 0.3K |

| Exxon Mobil Corp | XOM | 80.55 | 0.31% | 3.7K |

| Cisco Systems Inc | CSCO | 27.45 | 0.29% | 1.7K |

| Yahoo! Inc., NASDAQ | YHOO | 32.72 | 0.29% | 4.3K |

| Visa | V | 80.36 | 0.26% | 1.2K |

| Citigroup Inc., NYSE | C | 55.20 | 0.25% | 48.0K |

| The Coca-Cola Co | KO | 43.20 | 0.21% | 2.7K |

| Verizon Communications Inc | VZ | 45.85 | 0.20% | 3.2K |

| Chevron Corp | CVX | 90.99 | 0.18% | 6.8K |

| Boeing Co | BA | 149.50 | 0.17% | 10.5K |

| Apple Inc. | AAPL | 118.96 | 0.15% | 82.0K |

| Deere & Company, NYSE | DE | 75.05 | 0.15% | 1.0K |

| Caterpillar Inc | CAT | 70.08 | 0.09% | 0.5K |

| Hewlett-Packard Co. | HPQ | 13.70 | -0.65% | 0.2K |

Statistics Canada released retail sales data on Friday. Canadian retail sales plunged by 0.5% in September, missing expectations for a 0.2% gain, after a 0.5% increase in August.

The decline was mainly driven by lower sales at gasoline stations. Sales at gasoline stations declined 3.7% in September.

Motor vehicle and parts sales decreased 0.5% in September, while sales at furniture and home furnishings stores were down 1.2%.

Sales at food and beverage stores were up 0.1% in September.

Sales fell in 8 of 11 subsectors.

Canadian retail sales excluding automobiles dropped 0.5% in September, missing expectations for a 0.2% decline, after a flat reading in August.

Upgrades:

Intel (INTC) upgraded to Market Outperform from Market Perform at JMP Securities

Downgrades:

Other:

UnitedHealth (UNH) target lowered to $131 from $155 at Mizuho

Intel (INTC) target raised to $38 from $36 at Topeka Capital Markets

Intel (INTC) target raised to $35 from $34 at RBC Capital Markets

IBM (IBM) initiated with a Market Outperform at JMP Securities; target $167

Statistics Canada released consumer price inflation data on Friday. Canadian consumer price inflation rose 0.1% in October, in line with expectations, after a 0.2% decline in September.

The monthly increase was mainly driven by a rise in clothing and footwear prices, which climbed 1.0% in October.

On a yearly basis, the consumer price index remained unchanged at 1.0% in October, in line with expectations.

The consumer price index was partly driven by higher food prices. Food prices climbed 4.1% year-on-year in October, while transportation prices decreased 3.2%.

The index for recreation, education and reading climbed by 1.9% in October from the same month a year earlier, the shelter index gained 1.1%, while gasoline prices dropped 17.1%.

The Canadian core consumer price index, which excludes some volatile goods, rose 0.3% in October, after a 0.2% gain in September.

On a yearly basis, core consumer price index in Canada remained unchanged at 2.1% in October, in beating expectations for a fall to 2.0%.

The Bank of Canada's inflation target is 2.0%.

Stock indices traded little changed on speeches by the European Central Bank (ECB) officials. The ECB President Mario Draghi said in a speech in Frankfurt on Friday that the central bank is ready to use "all the instruments" to boost inflation in the Eurozone.

The ECB president pointed out that there are downside risks to the central bank's scenario.

"The downside risks to our baseline scenario for the euro area economy have increased in recent months due to the deterioration of the external environment. The outlook for global demand, especially in emerging markets, has notably worsened, while uncertainty in financial markets has increased," he noted.

The ECB Governing Council member Jens Weidmann said in a speech in Frankfurt on Friday that the low inflation in the Eurozone was driven by lower energy prices. He pointed out that the ultra-loose monetary policy could lead to risks.

"We need to be aware that the longer we stay in ultra-loose monetary policy mode, the less effective this policy will become and the more the attendant risks and side-effects will come into play," Weidmann said.

The Office for National Statistics released public sector net borrowing for the U.K. on Tuesday. The public sector net borrowing in the U.K. fell to £7.47 billion in October from £8.33 billion in September. September's figure was revised down from £8.63 billion.

Analysts had expected a decrease to £5.5 billion.

Public sector net borrowing excluding public sector banks increased to £8.2 billion in October from £7.1 billion in October 2014.

Current figures:

Name Price Change Change %

FTSE 100 6,329.25 -0.68 -0.01 %

DAX 11,085.92 +0.48 0.00%

CAC 40 4,890.58 -24.52 -0.50 %

The European Central Bank (ECB) Governing Council member Jens Weidmann said in a speech in Frankfurt on Friday that the low inflation in the Eurozone was driven by lower energy prices.

"At the moment, the sharp fall in energy prices is what is mainly driving the low rates. This drop has pushed down headline inflation by about one percentage point. Correspondingly, the core inflation rate stands at 1% and should gradually increase towards our definition of price stability, which is - let me remind you - a medium-term concept," he said.

"Crucially, the decline in oil prices is more of an economic stimulus for the euro area than a harbinger of deflation. Lower oil prices reduce energy bills for both households and firms," Weidmann added.

He pointed out that the ultra-loose monetary policy could lead to risks.

"We need to be aware that the longer we stay in ultra-loose monetary policy mode, the less effective this policy will become and the more the attendant risks and side-effects will come into play," Weidmann said.

The European Central Bank (ECB) President Mario Draghi said in a speech in Frankfurt on Friday that the central bank is ready to use "all the instruments" to boost inflation in the Eurozone.

"If we conclude that the balance of risks to our medium-term price stability objective is skewed to the downside, we will act by using all the instruments available within our mandate," he said.

"If we decide that the current trajectory of our policy is not sufficient to achieve our objective, we will do what we must to raise inflation as quickly as possible," Draghi added.

The ECB president pointed out that there are downside risks to the central bank's scenario.

"The downside risks to our baseline scenario for the euro area economy have increased in recent months due to the deterioration of the external environment. The outlook for global demand, especially in emerging markets, has notably worsened, while uncertainty in financial markets has increased," he noted.

The Office for National Statistics released public sector net borrowing for the U.K. on Tuesday. The public sector net borrowing in the U.K. fell to £7.47 billion in October from £8.33 billion in September. September's figure was revised down from £8.63 billion.

Analysts had expected a decrease to £5.5 billion.

Public sector net borrowing excluding public sector banks increased to £8.2 billion in October from £7.1 billion in October 2014.

Destatis released its producer price index (PPI) for Germany on Friday. German PPI producer prices declined 0.4% in October, missing expectations for a 0.2% fall, after a 0.4% drop in September.

On a yearly basis, German PPI dropped 2.3% in October, missing expectations for a 2.0% decrease, after a 2.1% fall in September.

PPI excluding energy sector fell by 0.7% year-on-year in October.

Energy prices were down 6.5% year-on-year in October.

Consumer non-durable goods prices fell 0.5% year-on-year in October, intermediate goods sector prices decreased by 1.9%, while capital goods prices increased 0.6% and durable consumer goods sector prices rose 1.3%.

The Fed Vice Chairman Stanley Fischer said on Thursday that some central bank could raise its interest rates in the near future.

"In the relatively near future probably some major central banks will begin gradually moving away from near-zero interest rates," he said.

Fischer also said that the Fed has done everything to prepare markets for the possible interest rate hike.

"While we continue to scrutinize incoming data, and no final decisions have been made, we have done everything we can to avoid surprising the markets and governments when we move," the Fed vice president noted.

Atlanta Fed President Dennis Lockhart said on Thursday that the pace of interest rate hikes will be slow once the Fed starts raising its interest rate.

"The pace of increases may be somewhat slow and possibly more halting than historic episodes of rising rates. Moreover, to the extent the evolving economic picture allows a process leading to a "resting place" (a neutral or equilibrium rate), that point might be lower than in the past, as implied by a somewhat lower trend rate of economic growth," he said.

Lockhart noted that the Fed should raise its interest rate soon.

"I'm comfortable with moving off zero soon, conditioned on no marked deterioration in economic conditions. Given my reading of current conditions and my outlook views, I believe it will soon be appropriate to begin a new policy phase," Atlanta Fed president said.

The Bank of Japan (BoJ) released its monthly report on Friday. The central bank said that Japan's economy continued to recover moderately. The slowdown in emerging economies weighed on exports, the central bank added.

"Exports are expected to remain more or less flat for the time being, but after that, they are likely to increase moderately, as emerging economies move out of their deceleration phase," the BoJ noted.

Private consumption is expected to remain resilient, according to the BoJ.

Producer price inflation declined due to lower commodity prices, the central bank said.

U.S. stock indices closed flat on Thursday as gains in consumer sector offset declines in health-care stocks.

The Dow Jones Industrial Average edged down 4.34 points, or 0.02%, to 17,732.82. The S&P 500 declined 2.35 points, or 0.11%, to 2,081.23. The Nasdaq Composite slid 1.56 points, or 0.03%, to 5,073.64.

Stocks of UnitedHealth Group Incorporated plunged 5.78% after the company cut its earnings forecast.

Atlanta Fed President Dennis Lockhart said in prepared remarks that volatility in financial markets has declined and he would be comfortable if the central bank raised its benchmark interest rate "soon". Lockhart did not say how he intends to vote when the Federal Open Market Committee meets in December and refused to try to predict the outcome of this meeting.

This morning in Asia Hong Kong Hang Seng declined 0.23%, or 52.83, to 22,447.39. China Shanghai Composite Index gained 0.28%, or 10.03, to 3.627.10. The Nikkei 225 lost 0.37%, or 73.89, to 19,785.92.

Asian indices traded mixed.

Japanese stocks declined amid profit taking after several days of growth. A stronger yen weighed on stocks too.

November BOJ economic report released today showed that exports and production had been influenced by slowdown in emerging markets. The report also noted that "producer prices are declining relative to three months earlier, mainly due to the fall in international commodity prices" and "inflation expectations appear to be rising on the whole from a somewhat longer-term perspective".

(index / closing price / change items /% change)

HANG SENG 22,494.57 +306.31 +1.38%

S&P/ASX 200 5,242.57 +109.45 +2.13%

TOPIX 1,600.38 +13.85 +0.87%

SHANGHAI COMP 3,617.85 +49.38 +1.38%

FTSE 100 6,329.93 +50.96 +0.81 %

CAC 40 4,915.1 +8.38 +0.17 %

Xetra DAX 11,085.44 +125.49 +1.14 %

S&P 500 2,081.24 -2.34 -0.11 %

NASDAQ Composite 5,073.64 -1.56 -0.03 %

Dow Jones Industrial Average 17,732.75 -4.41 -0.02 %

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.