- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 21-03-2018.

| index | closing price | change items | % change |

| Nikkei | | | |

| TOPIX | | | |

| Hang Seng | -135.41 | 31414.52 | -0.43% |

| CSI 300 | -16.65 | 4061.05 | -0.41% |

| Euro Stoxx 50 | -11.04 | 3401.04 | -0.32% |

| DAX | +1.82 | 12309.15 | +0.01% |

| CAC 40 | -12.69 | 5239.74 | -0.24% |

| DJIA | -44.96 | 24682.31 | -0.18% |

| S&P 500 | -5.01 | 2711.93 | -0.18% |

| NASDAQ | -19.02 | 7345.29 | -0.26% |

Major U.S. stock-indexes rose on Wednesday before the announcement of the Federal Reserve's policy decision (18:00 GMT), as energy sector rallied, underpinned by a jump in oil prices after a surprise drop in U.S. inventories. Meanwhile, Facebook (FB; +1.4%) rebounded after steep declines in the previous two sessions.

Most of Dow stocks in positive area (18 of 30). Top gainer - Chevron Corp. (CVX, +2.04%). Top loser - The Procter & Gamble Co. (GE, -0.93%).

Most of S&P sectors in positive area. Top gainer - Basic Materials (+2.2%). Top loser - Conglomerates(-0.6%).

At the moment:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Dow | 24794.00 | +29.00 | +0.12% |

| S&P 500 | 2726.50 | +3.00 | +0.11% |

| Nasdaq 100 | 6909.50 | -8.00 | -0.12% |

| Crude Oil | 65.04 | +1.50 | +2.36% |

| Gold | 1326.20 | +14.30 | +1.09% |

| U.S. 10yr | 2.90% | +0.02 | +0.83% |

U.S. stock-index futures fell on Wednesday as investors were cautious ahead of the announcement of the Fed's policy decision, while Facebook (FB) shares continued to slide in reaction to the Cambridge Analytica scandal.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | - | - | - |

| Hang Seng | 31,414.52 | -135.41 | -0.43% |

| Shanghai | 3,281.59 | -9.05 | -0.27% |

| S&P/ASX | 5,950.30 | +13.90 | +0.23% |

| FTSE | 7,024.91 | -36.36 | -0.51% |

| CAC | 5,231.71 | -20.72 | -0.39% |

| DAX | 12,270.85 | -36.48 | -0.30% |

| Crude | 64.11 | | +0.90% |

| Gold | 1,316.50 | | +0.35% |

(company / ticker / price / change ($/%) / volume)

| ALTRIA GROUP INC. | MO | 61.25 | -0.27(-0.44%) | 3061 |

| Amazon.com Inc., NASDAQ | AMZN | 1,587.40 | 0.89(0.06%) | 43869 |

| American Express Co | AXP | 94.92 | -0.03(-0.03%) | 999 |

| Apple Inc. | AAPL | 175.05 | -0.19(-0.11%) | 79482 |

| AT&T Inc | T | 36.4 | 0.06(0.17%) | 840 |

| Barrick Gold Corporation, NYSE | ABX | 12.1 | 0.06(0.50%) | 26916 |

| Boeing Co | BA | 337.7 | 0.07(0.02%) | 2873 |

| Cisco Systems Inc | CSCO | 44.29 | -0.08(-0.18%) | 5939 |

| Citigroup Inc., NYSE | C | 72.94 | 0.02(0.03%) | 3570 |

| Deere & Company, NYSE | DE | 159.4 | -0.59(-0.37%) | 700 |

| Exxon Mobil Corp | XOM | 74.13 | 0.14(0.19%) | 2820 |

| Facebook, Inc. | FB | 166.7 | -1.45(-0.86%) | 788056 |

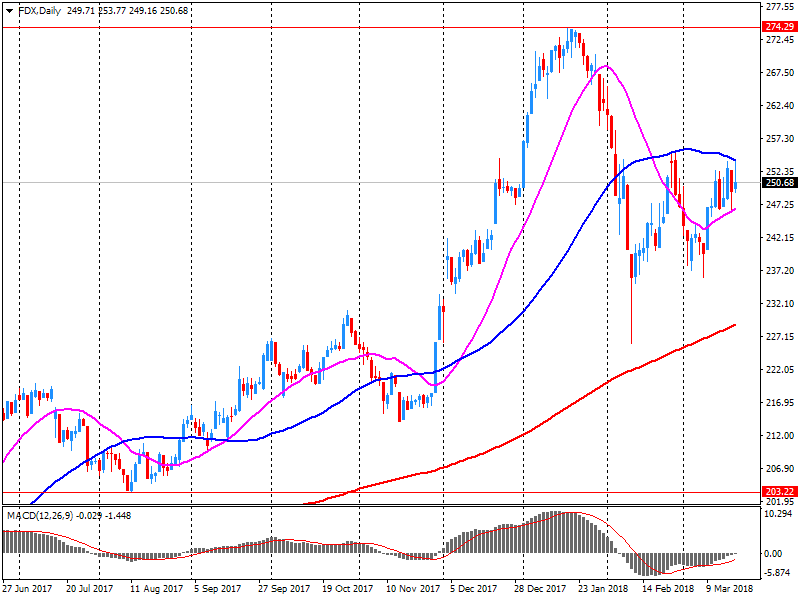

| FedEx Corporation, NYSE | FDX | 250.4 | -1.59(-0.63%) | 71309 |

| Ford Motor Co. | F | 11 | 0.01(0.09%) | 14651 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 18.5 | 0.01(0.05%) | 2016 |

| General Electric Co | GE | 13.68 | 0.04(0.29%) | 81889 |

| General Motors Company, NYSE | GM | 37.1 | 0.21(0.57%) | 2159 |

| Home Depot Inc | HD | 178 | -0.16(-0.09%) | 334 |

| Intel Corp | INTC | 51.54 | -0.01(-0.02%) | 48779 |

| International Business Machines Co... | IBM | 156.81 | 0.61(0.39%) | 655 |

| Johnson & Johnson | JNJ | 131.32 | 0.11(0.08%) | 8462 |

| Microsoft Corp | MSFT | 92.97 | -0.16(-0.17%) | 11071 |

| Pfizer Inc | PFE | 36.26 | -0.07(-0.19%) | 939 |

| Procter & Gamble Co | PG | 78.17 | -0.14(-0.18%) | 4766 |

| Tesla Motors, Inc., NASDAQ | TSLA | 310.5 | -0.05(-0.02%) | 8590 |

| The Coca-Cola Co | KO | 43.13 | -0.03(-0.07%) | 2544 |

| Twitter, Inc., NYSE | TWTR | 32.15 | 0.80(2.55%) | 570211 |

| Verizon Communications Inc | VZ | 47.7 | 0.01(0.02%) | 730 |

| Visa | V | 125 | 0.09(0.07%) | 945 |

| Wal-Mart Stores Inc | WMT | 88.24 | 0.29(0.33%) | 2191 |

| Yandex N.V., NASDAQ | YNDX | 42.9 | 0.12(0.28%) | 500 |

Facbook (FB) reiterated with a Overweight at KeyBanc Capital Mkts; target $245

FedEx (FDX) reported Q3 FY 2018 earnings of $3.72 per share (versus $2.35 in Q3 FY 2017), beating analysts' consensus estimate of $3.12.

The company's quarterly revenues amounted to $16.526 bln (+10.2% y/y), beating analysts' consensus estimate of $16.171 bln.

The company also issued upside guidance for FY 2018, raising EPS to $15.00-15.40 from $12.70-13.30 versus analysts' consensus estimate of $13.63.

FDX fell to $251.00 (-0.39%) in pre-market trading.

Stock markets rose Wednesday in Asia, following modest rebounds in Europe and the U.S. that partially reversed Monday's global declines. Despite the strong start, trading volume across asset classes is likely to be muted in Asia through the day, ahead of the looming Federal Reserve interest-rate hike and updated economic projections.

European stocks ended higher on Tuesday, aided by a pullback for the euro following a weak German business sentiment reading. As well, a drop in the pound after a slowdown in British inflation helped lift U.K. blue-chip stocks.

U.S. stocks ended higher Tuesday, led by strong gains in the energy sector as the overall market reclaimed some lost ground from the previous day, when tech shares fell sharply. Market participants also were anticipating the Federal Reserve's two-day policy meeting, which started in the early afternoon. Investors are watching for signs that the central bank will take a more aggressive path toward normalizing monetary policy.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.