- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 23-03-2018.

Major US stock indices fell significantly on Friday, suffering from another collapse in financial and technological sectors.

Investors also continued to assess the consequences of a potential trade war between the US and China. Trump the day before signed a decree on the introduction of new tariffs on Chinese imports, as well as restrictions on Chinese investment in the US economy. The reason for imposing these restrictions are accusations that Beijing for years has been engaged in the theft of intellectual property of US companies. The new 25-percent tariffs will affect the goods, the annual import of which is up to $ 60 billion. In response, Beijing announced plans to introduce tariffs for 128 American products (including pork, wine, fruits and steel), import of which into China is about $ 3 billion According to the Chinese side, measures against American goods will be taken in two stages if they fail to reach an agreement with the United States.

In the focus of market participants were also several important economic reports, including orders for goods and sales of new buildings for February.

A report from the US Department of Commerce showed that orders for durable goods in February, adjusted for seasonal fluctuations, increased by 3.1% compared to the previous month, which was the most significant growth since June 2017. Economists expected to see an increase of 1.5%. According to the report, new orders for capital goods of non-military use without aircraft, an important indicator of the company's capital investments, increased by 1.8% compared to January, having recorded the maximum growth since September and reaching the highest level since 2014.

A separate report from the Ministry of Commerce said that sales of new buildings in the US fell slightly in February, continuing the trend of intermittent lateral traffic for a narrow segment of the housing market. According to the report, sales of newly built single-family homes decreased 0.6% from the previous month to the seasonally adjusted annual figure of 618,000. The sales were just below the 623,000 annual rates expected by economists.

Almost all components of the DOW index finished trading in the red (28 of 30). Outsider shares were DowDuPont Inc. (DPDP, -3.86%). The leader of growth was the shares of The Boeing Company (BA, + 0.42%).

All sectors of the S & P index recorded a decline. The financial sector fell the most (-2.1%).

At closing:

Dow -1.77% 23.533.20 -424.69

Nasdaq -2.43% 6,992.67 -174.01

S & P -2.10% 2.588.26 -55.43

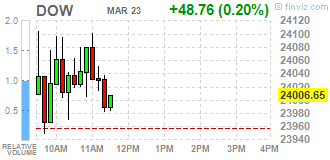

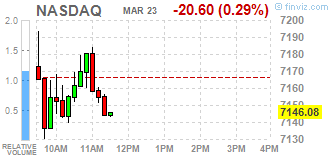

Major U.S. stock-indexes were mixed on Friday. The S&P 500 and the Dow edged up, helped by gains in NIKE (NKE), which climbed 3% on better-than-expected quarterly results and upbeat outlook for its North America business. Meanwhile, the Nasdaq fell, weighed down by losses in the technology sector. Investors also assessed the implications of a potential trade war between the United States and China, and the U.S. reports on durable goods orders and new home sales for February.

Most of Dow stocks in negative area (19 of 30). Top loser - DowDuPont Inc. (DPDP, -3.17%). Top gainer - NIKE, Inc. (NKE, +2.90%).

Most of S&P sectors in positive area. Top gainer - Basic Materials (+0.7%). Top loser - Financials (-0.7%).

At the moment:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Dow | 23989.00 | +26.00 | +0.11% |

| S&P 500 | 2645.25 | +2.00 | +0.08% |

| Nasdaq 100 | 6680.50 | -11.50 | -0.17% |

| Crude Oil | 65.49 | +1.19 | +1.85% |

| Gold | 1347.80 | +20.40 | +1.54% |

| U.S. 10yr | 2.83% | 0.00 | 0.00% |

U.S. stock-index futures were flat on Friday, after a sharp drop in the previous session on increased concerns over a trade war between China and the United States.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 20,617.86 | -974.13 | -4.51% |

| Hang Seng | 30,309.29 | -761.76 | -2.45% |

| Shanghai | 3,153.09 | -110.39 | -3.38% |

| S&P/ASX | 5,820.70 | -116.50 | -1.96% |

| FTSE | 6,923.77 | -28.82 | -0.41% |

| CAC | 5,108.01 | -59.20 | -1.15% |

| DAX | 11,938.46 | -161.62 | -1.34% |

| Crude | 64.75 | | +0.70% |

| Gold | 1,346.70 | | +1.45% |

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 223 | -0.17(-0.08%) | 6783 |

| ALCOA INC. | AA | 45 | 0.08(0.18%) | 653 |

| ALTRIA GROUP INC. | MO | 59.9 | -0.49(-0.81%) | 2392 |

| Amazon.com Inc., NASDAQ | AMZN | 1,544.00 | -0.92(-0.06%) | 116629 |

| American Express Co | AXP | 91.33 | -0.08(-0.09%) | 1628 |

| Apple Inc. | AAPL | 169 | 0.15(0.09%) | 337143 |

| AT&T Inc | T | 35.5 | 0.13(0.37%) | 14560 |

| Barrick Gold Corporation, NYSE | ABX | 12.41 | 0.24(1.97%) | 50251 |

| Boeing Co | BA | 320.4 | 0.79(0.25%) | 65467 |

| Caterpillar Inc | CAT | 147.58 | 0.68(0.46%) | 16591 |

| Chevron Corp | CVX | 113.91 | 0.21(0.18%) | 5891 |

| Cisco Systems Inc | CSCO | 43.35 | 0.28(0.65%) | 76239 |

| Citigroup Inc., NYSE | C | 70.54 | 0.23(0.33%) | 73836 |

| Deere & Company, NYSE | DE | 150.92 | -0.66(-0.44%) | 2005 |

| Exxon Mobil Corp | XOM | 73.81 | 0.31(0.42%) | 17099 |

| Facebook, Inc. | FB | 165.3 | 0.41(0.25%) | 466356 |

| FedEx Corporation, NYSE | FDX | 236.51 | 0.24(0.10%) | 11766 |

| Ford Motor Co. | F | 10.77 | 0.02(0.19%) | 55234 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 18.03 | -0.02(-0.11%) | 1986 |

| General Electric Co | GE | 13.41 | 0.06(0.45%) | 234353 |

| General Motors Company, NYSE | GM | 36.55 | 0.20(0.55%) | 15266 |

| Goldman Sachs | GS | 253.99 | 1.39(0.55%) | 8594 |

| Google Inc. | GOOG | 1,050.50 | 1.42(0.14%) | 8439 |

| Hewlett-Packard Co. | HPQ | 22.61 | 0.14(0.62%) | 5467 |

| Home Depot Inc | HD | 177.15 | 1.86(1.06%) | 15349 |

| Intel Corp | INTC | 50.69 | -0.14(-0.28%) | 88010 |

| International Business Machines Co... | IBM | 152.37 | 0.28(0.18%) | 15400 |

| International Paper Company | IP | 51.37 | -0.04(-0.08%) | 573 |

| Johnson & Johnson | JNJ | 127.53 | 0.15(0.12%) | 4688 |

| JPMorgan Chase and Co | JPM | 110.45 | 0.50(0.45%) | 49003 |

| McDonald's Corp | MCD | 157 | -0.04(-0.03%) | 5767 |

| Merck & Co Inc | MRK | 54.08 | -0.04(-0.07%) | 6708 |

| Microsoft Corp | MSFT | 89.51 | -0.28(-0.31%) | 131628 |

| Nike | NKE | 67.21 | 2.79(4.33%) | 124529 |

| Pfizer Inc | PFE | 35.3 | -0.30(-0.84%) | 76964 |

| Tesla Motors, Inc., NASDAQ | TSLA | 311.01 | 1.91(0.62%) | 45046 |

| The Coca-Cola Co | KO | 42.73 | -0.03(-0.07%) | 7580 |

| Twitter, Inc., NYSE | TWTR | 31.34 | 0.14(0.45%) | 204695 |

| United Technologies Corp | UTX | 123.72 | -0.35(-0.28%) | 16056 |

| UnitedHealth Group Inc | UNH | 217.32 | 2.11(0.98%) | 3477 |

| Visa | V | 119.83 | -0.16(-0.13%) | 17346 |

| Wal-Mart Stores Inc | WMT | 87.23 | 0.09(0.10%) | 24362 |

| Walt Disney Co | DIS | 100.79 | 0.19(0.19%) | 6855 |

| Yandex N.V., NASDAQ | YNDX | 42.09 | 0.25(0.60%) | 7421 |

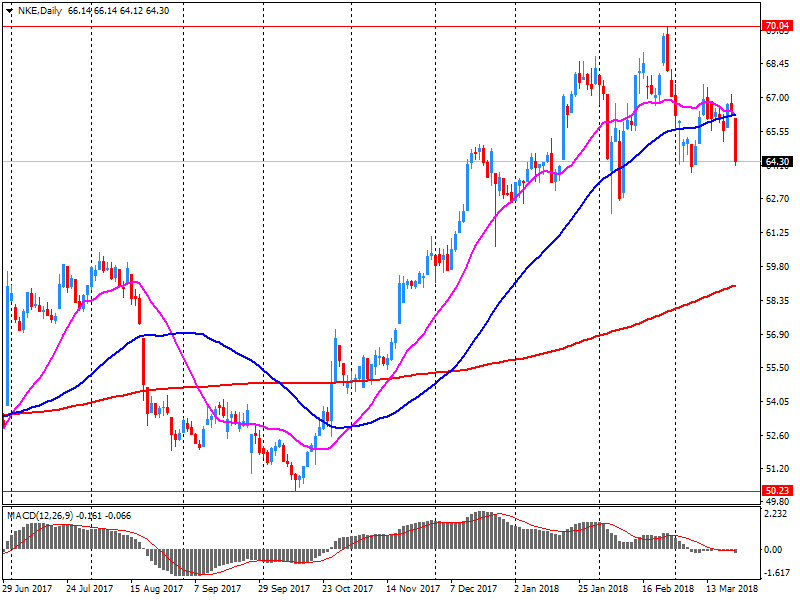

NIKE (NKE) target raised to $68 from $63 at B. Riley FBR

NIKE (NKE) target raised to $68 from $65 at Pivotal Research

NIKE (NKE) reported Q3 FY 2018 earnings of $0.68 per share (versus $0.68 in Q3 FY 2017), beating analysts' consensus estimate of $0.53.

The company's quarterly revenues amounted to $8.984 bln (+1.5% y/y), beating analysts' consensus estimate of $8.853 bln.

The company also announced it had acquired consumer data analytics firm Zodiac to help accelerate Consumer Direct Offense strategy to serve consumers faster and more personally at scale. It did not disclose the financial terms of the deal.

NKE rose to $67.25 (+4.39%) in pre-market trading.

| index | closing price | change items | % change |

| Nikkei | +211.02 | 21591.99 | +0.99% |

| TOPIX | +11.10 | 1727.39 | +0.65% |

| Hang Seng | -343.47 | 31071.05 | -1.09% |

| CSI 300 | -40.70 | 4020.35 | -1.00% |

| Euro Stoxx 50 | -52.85 | 3348.19 | -1.55% |

| DAX | -209.07 | 12100.08 | -1.70% |

| CAC 40 | -72.53 | 5167.21 | -1.38% |

| DJIA | -724.42 | 23957.89 | -2.93% |

| S&P 500 | -68.24 | 2643.69 | -2.52% |

| NASDAQ | -178.61 | 7166.68 | -2.43% |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.