- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 23-01-2019.

Major US stock indices rose slightly due to positive earnings reports from IBM, United Technologies and Procter & Gamble, as well as improved utility sector quotes.

In addition, as it became known, the production activity of the Fifth District has noticeably improved in January, and exceeded experts' forecasts, according to the latest Richmond Fed survey. The index of manufacturing activity from the Richmond Federal Reserve Bank rose to -2 points from -8 points in December. It was expected that the index will be -6 points. The increase in the index in January was due to an increase in the employment and supply components. The index of new orders fell to −11 points (the lowest since June 2016). Meanwhile, the index of outstanding orders fell to −21 points, which is the lowest since May 2009. However, manufacturers were optimistic that conditions will improve in the coming months.

Most of the components of DOW recorded an increase (18 out of 30). The growth leader was the shares of International Business Machines Corporation (IBM, + 8.66%). The outsider was Exxon Mobil Corporation (XOM, -0.79%).

Most sectors of the S & P ended in a plus. The largest growth was shown by the utility sector (+ 1.0%), the largest decrease was by the base materials sector (-0.5%)

At the time of closing:

Dow 24,575.62 +171.14 +0.70%

S & P 500 2,638.70 +5.80 +0.22%

Nasdaq 100 7,025.77 +5.41 +0.08%

U.S. stock-index futures pointed to a higher open on Wednesday after the release of strong quarterly results from companies like IBM (IBM), United Technologies (UTX) and Procter & Gamble (PG).

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 20,593.72 | -29.19 | -0.14% |

Hang Seng | 27,008.20 | +2.75 | +0.01% |

Shanghai | 2,581.00 | +1.30 | +0.05% |

S&P/ASX | 5,843.70 | -15.10 | -0.26% |

FTSE | 6,880.47 | -20.92 | -0.30% |

CAC | 4,866.01 | +18.48 | +0.38% |

DAX | 11,116.50 | +26.39 | +0.24% |

Crude | $53.27 | +0.49% | |

Gold | $1,287.10 | -0.19% |

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 192.53 | 0.27(0.14%) | 1421 |

ALCOA INC. | AA | 28.03 | 0.22(0.79%) | 10710 |

ALTRIA GROUP INC. | MO | 45.15 | 0.18(0.40%) | 13222 |

Amazon.com Inc., NASDAQ | AMZN | 1,647.78 | 15.61(0.96%) | 73312 |

American Express Co | AXP | 100.09 | 0.26(0.26%) | 2208 |

Apple Inc. | AAPL | 153.9 | 0.60(0.39%) | 96200 |

AT&T Inc | T | 30.68 | 0.10(0.33%) | 17986 |

Boeing Co | BA | 360.61 | 2.71(0.76%) | 12969 |

Caterpillar Inc | CAT | 133.01 | 0.77(0.58%) | 18331 |

Chevron Corp | CVX | 113 | 0.66(0.59%) | 2349 |

Cisco Systems Inc | CSCO | 44.91 | 0.13(0.29%) | 11602 |

Citigroup Inc., NYSE | C | 62.06 | 0.21(0.34%) | 15978 |

Exxon Mobil Corp | XOM | 72.04 | 0.15(0.21%) | 1947 |

Facebook, Inc. | FB | 148.3 | 0.73(0.49%) | 51274 |

Ford Motor Co. | F | 8.54 | 0.04(0.47%) | 57576 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 12.4 | 0.02(0.16%) | 9917 |

General Electric Co | GE | 8.73 | 0.07(0.81%) | 382694 |

General Motors Company, NYSE | GM | 38.45 | 0.30(0.79%) | 1259 |

Goldman Sachs | GS | 198.24 | 0.56(0.28%) | 4624 |

Google Inc. | GOOG | 1,077.77 | 7.25(0.68%) | 1754 |

Home Depot Inc | HD | 177.29 | 0.18(0.10%) | 1119 |

Intel Corp | INTC | 48.46 | 0.19(0.39%) | 44059 |

International Business Machines Co... | IBM | 131.4 | 8.88(7.25%) | 245332 |

International Paper Company | IP | 46.52 | 0.78(1.71%) | 840 |

Johnson & Johnson | JNJ | 128.9 | 0.10(0.08%) | 3815 |

JPMorgan Chase and Co | JPM | 103.23 | 0.29(0.28%) | 5852 |

McDonald's Corp | MCD | 184.61 | 0.04(0.02%) | 1811 |

Merck & Co Inc | MRK | 75.34 | -0.49(-0.65%) | 1757 |

Microsoft Corp | MSFT | 106.04 | 0.36(0.34%) | 78219 |

Nike | NKE | 80.9 | 0.15(0.19%) | 2279 |

Pfizer Inc | PFE | 41.96 | -0.31(-0.73%) | 18290 |

Procter & Gamble Co | PG | 94.23 | 3.79(4.19%) | 231733 |

Starbucks Corporation, NASDAQ | SBUX | 65.75 | 0.36(0.55%) | 17177 |

Tesla Motors, Inc., NASDAQ | TSLA | 292.55 | -6.37(-2.13%) | 222584 |

The Coca-Cola Co | KO | 47.82 | 0.10(0.21%) | 1635 |

Twitter, Inc., NYSE | TWTR | 32.45 | 0.20(0.62%) | 49618 |

United Technologies Corp | UTX | 115.8 | 4.74(4.27%) | 123355 |

UnitedHealth Group Inc | UNH | 266.65 | 0.96(0.36%) | 5192 |

Verizon Communications Inc | VZ | 57 | 0.01(0.02%) | 2446 |

Visa | V | 138.51 | 0.46(0.33%) | 4861 |

Wal-Mart Stores Inc | WMT | 98.7 | 1.21(1.24%) | 14535 |

Walt Disney Co | DIS | 110.99 | 0.39(0.35%) | 2890 |

Yandex N.V., NASDAQ | YNDX | 31.17 | 0.64(2.10%) | 7024 |

Tesla (TSLA) downgraded to Underperform from Sector Perform at RBC Capital Mkts

Merck (MRK) downgraded to Market Perform from Outperform at BMO Capital Markets

Pfizer (PFE) downgraded to Neutral from Buy at UBS

Wal-Mart (WMT) upgraded to Overweight from Equal-Weight at Morgan Stanley

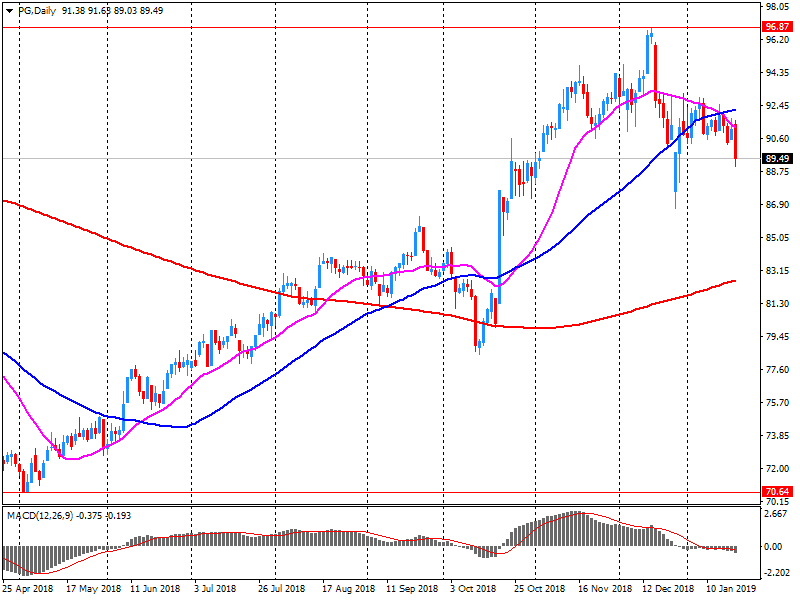

Procter & Gamble (PG) reported Q4 FY 2018 earnings of $1.25 per share (versus $1.19 in Q4 FY 2017), beating analysts’ consensus estimate of $1.21.

The company’s quarterly revenues amounted to $17.438 bln (+0.2% y/y), beating analysts’ consensus estimate of $17.158 bln.

PG rose to $94.17 (+4.12%) in pre-market trading.

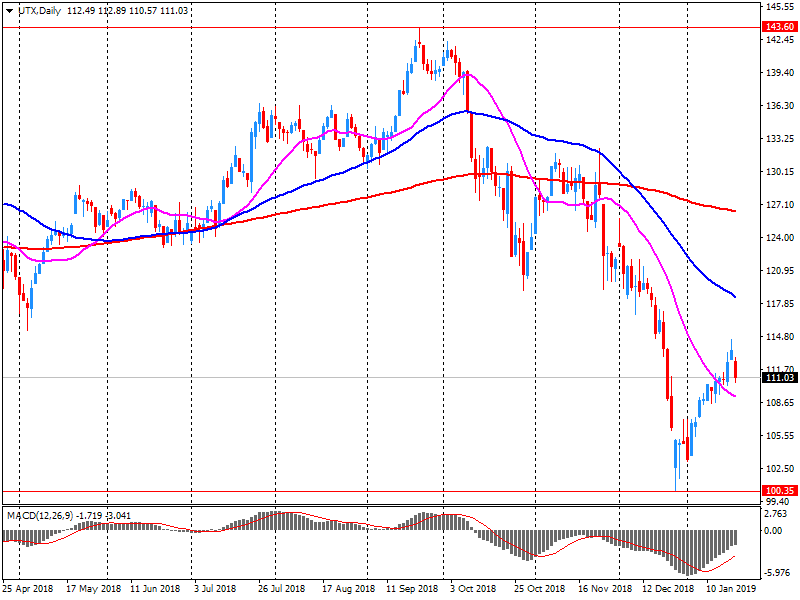

United Tech (UTX) reported Q4 FY 2018 earnings of $1.95 per share (versus $1.60 in Q4 FY 2017), beating analysts’ consensus estimate of $1.53.

The company’s quarterly revenues amounted to $18.044 bln (+15.1% y/y), beating analysts’ consensus estimate of $16.872 bln.

The company also issued guidance for FY 2019, projecting EPS of $7.70-8.00 (versus analysts’ consensus estimate of $7.80) and revenues of $75.5-77 bln (versus analysts’ consensus estimate of $77.18 bln).

UTX rose to $114.54 (+3.13%) in pre-market trading.

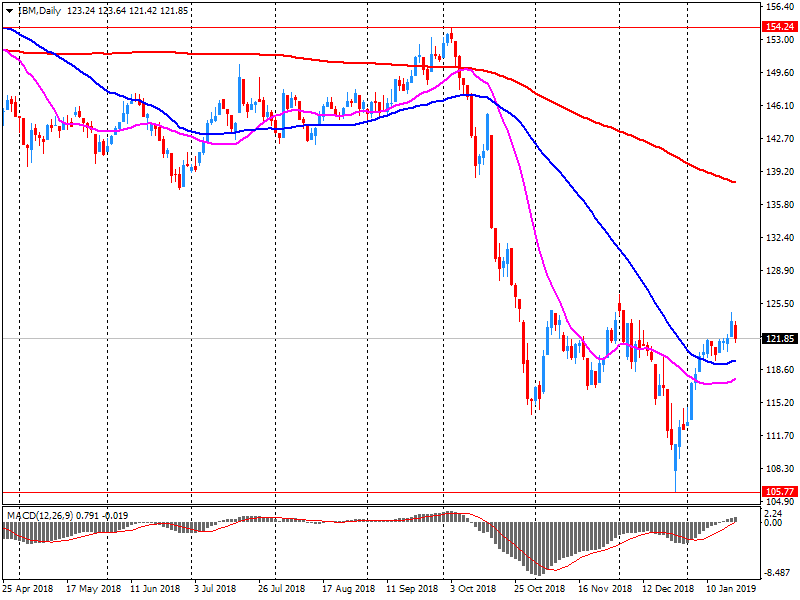

IBM (IBM) reported Q4 FY 2018 earnings of $4.87 per share (versus $5.18 in Q4 FY 2017), beating analysts’ consensus estimate of $4.82.

The company’s quarterly revenues amounted to $21.760 bln (-3.5% y/y), generally in line with analysts’ consensus estimate of $21.793 bln.

The company also issued upside guidance for FY 2019, projecting EPS of at least $13.90 versus analysts’ consensus estimate of $13.81.

IBM rose to $130.39 (+6.42%) in pre-market trading.

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -96.42 | 20622.91 | -0.47 |

| Hang Seng | -191.09 | 27005.45 | -0.7 |

| KOSPI | -6.84 | 2117.77 | -0.32 |

| ASX 200 | -31.6 | 5858.8 | -0.54 |

| FTSE 100 | -69.2 | 6901.39 | -0.99 |

| Dow Jones | -301.87 | 24404.48 | -1.22 |

| S&P 500 | -37.81 | 2632.9 | -1.42 |

| NASDAQ Composite | -136.87 | 7020.36 | -1.91 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.