- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 24-01-2019.

Major US stock indices closed mixed: Nasdaq rose moderately against the backdrop of rising prices for chip manufacturers and airlines, while the Dow Industrials and S & P 500 were under pressure due to concerns about the Sino-US trade dispute and the longest US government closing.

In addition, investors analyzed data for the United States. The Department of Labor said that the number of Americans applying for unemployment benefits fell to a more than 49-year low, but this decline probably overestimates the state of the labor market, as expected, in several states, including California. The initial volume of claims for unemployment benefits fell from 212,000 to 199,000 seasonally adjusted for the week ending January 19. This is the lowest level since mid-November 1969, when 197,000 applications were registered. Economists have predicted that the number of applications will be 220,000. The number of federal workers who have applied for unemployment benefits rose by 14,965 to 25,419 in the week to 12 January. Re-applications for benefits decreased by 24,000 to 1.71 million in the week to January 12. The 4-week follow-up moving average increased by 1,250 to 1.73 million.

Meanwhile, the Conference Board data showed that in December, the leading indicators index (LEI) for the USA decreased by 0.1 percent, to 111.7 (2016 = 100), after increasing by 0.2 percent in November and falling by 0, 3 percent in October. The leading economic index now significantly exceeds the previous peak at 102.4, set in March 2006. "The leading index declined slightly in December, and the recent LEI moderation suggests that US economic growth may slow this year. Although the effects of government closures are not yet reflected, LEI suggests that the economy may slow to 2 percent by the end of 2019 growth, ”said Ataman Ozildirim, director and chairman of the global research council of the Conference.

Most of the DOW components recorded a decline (17 of 30). The growth leader was shares of Intel Corporation (INTC, + 3.80%). The outsider was Merck & Co., Inc. (MRK, -3.01%).

Most sectors of the S & P ended in a plus. The largest growth was shown by the technology sector (+ 0.8%), the largest decrease was by the health sector (-0.8%).

At the time of closing:

Dow 24,553.24 -22.38 -0.09%

S&P 500 2,642.33 +3.63 +0.14%

Nasdaq 100 7,073.46 +47.70 +0.68%

Before the bell: S&P futures -0.03%, NASDAQ futures +0.30%

U.S. stock-index were mixed on Thursday, as investors digested the comments by the U.S. Commerce Secretary Wilbur Ross that the United States and China were “miles and miles” from resolving their trade dispute.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 20,574.63 | -19.09 | -0.09% |

Hang Seng | 27,120.98 | +112.78 | +0.42% |

Shanghai | 2,591.69 | +10.69 | +0.41% |

S&P/ASX | 5,865.70 | +22.00 | +0.38% |

FTSE | 6,810.62 | -32.26 | -0.47% |

CAC | 4,856.48 | +16.10 | +0.33% |

DAX | 11,076.33 | +4.79 | +0.04% |

Crude | $52.48 | -0.27% | |

Gold | $1,285.00 | -0.40% |

(company / ticker / price / change ($/%) / volume)

ALCOA INC. | AA | 28.19 | -0.11(-0.39%) | 1250 |

ALTRIA GROUP INC. | MO | 44.6 | -0.10(-0.22%) | 6599 |

Amazon.com Inc., NASDAQ | AMZN | 1,638.52 | -1.50(-0.09%) | 35962 |

Apple Inc. | AAPL | 153.8 | -0.12(-0.08%) | 118907 |

AT&T Inc | T | 30.98 | 0.09(0.29%) | 12691 |

Boeing Co | BA | 357 | -1.61(-0.45%) | 4567 |

Caterpillar Inc | CAT | 131.87 | 0.05(0.04%) | 8343 |

Cisco Systems Inc | CSCO | 45.68 | 0.22(0.48%) | 18582 |

Citigroup Inc., NYSE | C | 61.85 | -0.28(-0.45%) | 13265 |

Deere & Company, NYSE | DE | 157.65 | 0.04(0.03%) | 900 |

Exxon Mobil Corp | XOM | 71.34 | 0.04(0.06%) | 6592 |

Facebook, Inc. | FB | 144.5 | 0.20(0.14%) | 43730 |

Ford Motor Co. | F | 8.36 | 0.02(0.24%) | 47908 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11.65 | -0.66(-5.36%) | 148986 |

General Electric Co | GE | 8.7 | -0.03(-0.34%) | 83794 |

General Motors Company, NYSE | GM | 37.75 | 0.08(0.21%) | 1029 |

Goldman Sachs | GS | 196.56 | -0.34(-0.17%) | 2630 |

Google Inc. | GOOG | 1,077.20 | 1.63(0.15%) | 2787 |

Home Depot Inc | HD | 177 | 0.11(0.06%) | 564 |

Intel Corp | INTC | 48.6 | 0.66(1.38%) | 99206 |

International Business Machines Co... | IBM | 132.6 | -0.29(-0.22%) | 12271 |

International Paper Company | IP | 45.85 | 0.02(0.04%) | 201 |

Johnson & Johnson | JNJ | 128.85 | 0.05(0.04%) | 2089 |

JPMorgan Chase and Co | JPM | 102.26 | -0.42(-0.41%) | 1710 |

McDonald's Corp | MCD | 187 | 0.91(0.49%) | 1385 |

Microsoft Corp | MSFT | 106.8 | 0.09(0.08%) | 58075 |

Nike | NKE | 80.43 | -0.07(-0.09%) | 5552 |

Procter & Gamble Co | PG | 94.51 | -0.33(-0.35%) | 10072 |

Starbucks Corporation, NASDAQ | SBUX | 66.45 | 0.02(0.03%) | 13050 |

Tesla Motors, Inc., NASDAQ | TSLA | 282.35 | -5.24(-1.82%) | 77076 |

Twitter, Inc., NYSE | TWTR | 31 | 0.03(0.10%) | 11947 |

United Technologies Corp | UTX | 117.24 | 0.20(0.17%) | 3014 |

Verizon Communications Inc | VZ | 57.83 | 0.07(0.12%) | 563 |

Visa | V | 137.63 | 0.62(0.45%) | 2074 |

Wal-Mart Stores Inc | WMT | 98.67 | -0.04(-0.04%) | 2358 |

Walt Disney Co | DIS | 110.91 | -0.21(-0.19%) | 1027 |

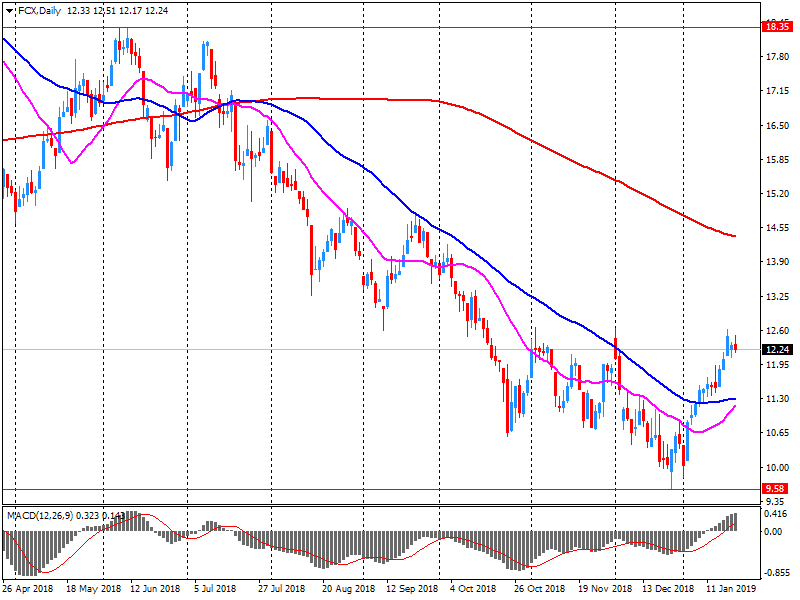

Freeport-McMoRan (FCX) reported Q4 FY 2018 earnings of $0.11 per share (versus $0.51 in Q4 FY 2017), missing analysts’ consensus estimate of $0.19.

The company’s quarterly revenues amounted to $3.684 bln (-26.9% y/y), missing analysts’ consensus estimate of $3.858 bln.

FCX fell to $11.75 (-4.55%) in pre-market trading.

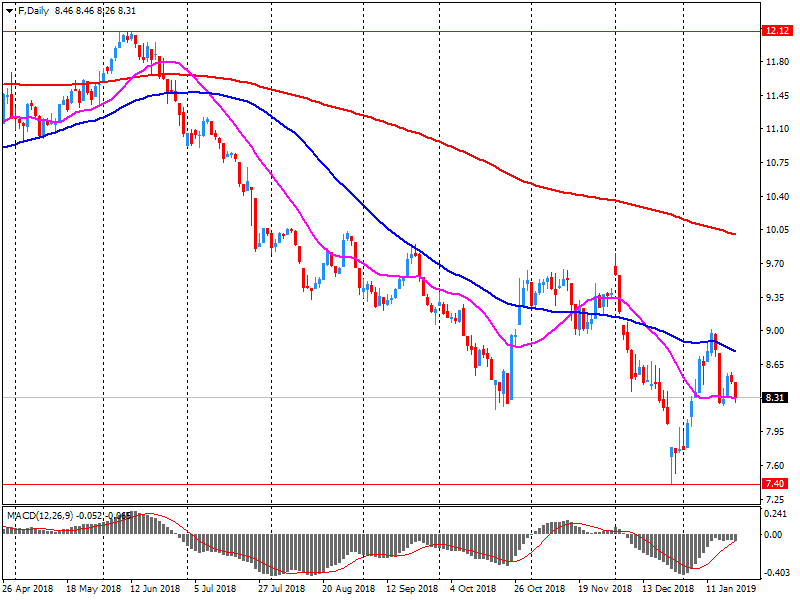

Ford Motor (F) reported Q4 FY 2018 earnings of $0.30 per share (versus $0.39 in Q4 FY 2017), being in line with analysts’ consensus estimate.

The company’s quarterly revenues amounted to $38.700 bln (+0.5% y/y), beating analysts’ consensus estimate of $36.834 bln.

F rose to $8.37 (+0.36%) in pre-market trading

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -29.19 | 20593.72 | -0.14 |

| Hang Seng | 2.75 | 27008.2 | 0.01 |

| KOSPI | 10.01 | 2127.78 | 0.47 |

| ASX 200 | -15.1 | 5843.7 | -0.26 |

| FTSE 100 | -58.51 | 6842.88 | -0.85 |

| DAX | -18.57 | 11071.54 | -0.17 |

| Dow Jones | 171.14 | 24575.62 | 0.7 |

| S&P 500 | 5.8 | 2638.7 | 0.22 |

| NASDAQ Composite | 5.41 | 7025.77 | 0.08 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.