- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 29-01-2019.

Major US stock indices ended mixed: the S & P 500 fell slightly, the Dow rose slightly, and the high-tech Nasdaq fell by about 0.8%, as mixed income reports and concerns about the upcoming trade negotiations between the US and China gave little incentive to recover markets from falling the day before.

Investors also awaited the start of a two-day Fed meeting. This will be the first meeting of the American regulator this year. Investors expect the Fed to take a more cautious stance on monetary policy this year than in 2018, under pressure from the peak of US corporate income and the threat of slowing economic growth both domestically and globally.

A certain impact on the course of trading has data for the United States. The Consumer Confidence Index from the Conference Board deteriorated markedly in January after it recorded a decline in December. The index now stands at 120.2 (1985 = 100), compared with 126.6 in December (revised from 128.1). Analysts had expected the index to be 124.9. The current situation index, based on consumers ’assessment of the current business and labor market conditions, fell from 169.9 to 169.6, while the expectations index, based on short-term consumer forecasts for income, business and labor market conditions, fell from 97.7 in December to 87.3 in January.

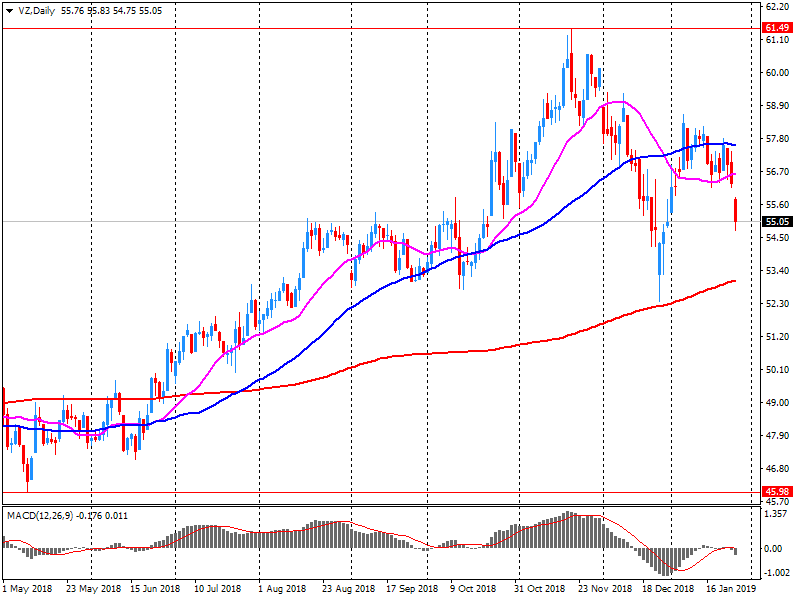

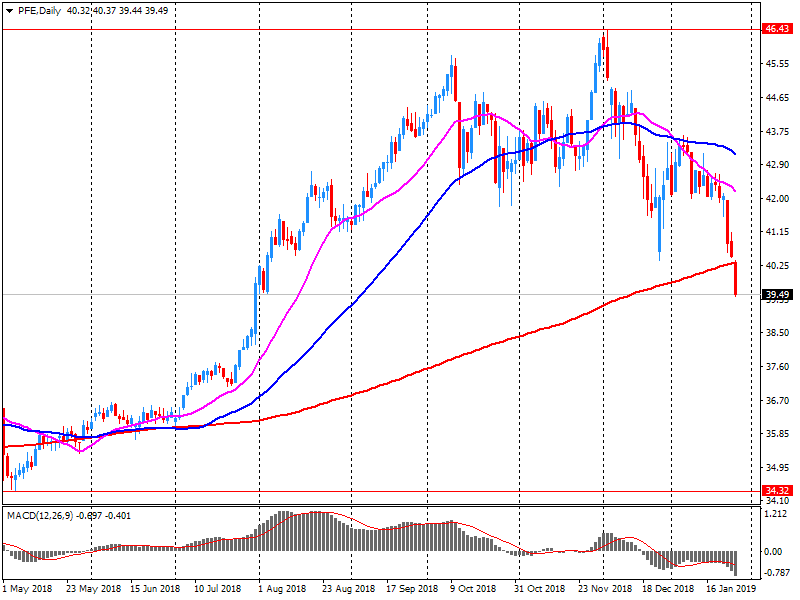

Most of the components of DOW finished trading in positive territory (16 of 30). The growth leader was Pfizer Inc. (PFE, + 3.14%). The outsider was Verizon Communications Inc. (VZ, -3.36%).

Most sectors of the S & P recorded an increase. The largest growth was shown by the industrial goods sector (+ 1.2%). The technological sector decreased more than others (-1.0%)

At the time of closing:

Dow 24,579.96 +51.74 +0.21%

S & P 500 2,640.00 -3.85 -0.15%

Nasdaq 100 7,028.29 -57.40 -0.81%

U.S. stock-index rose slightly on Tuesday, as stock market stabilized after a slide a day earlier driven by concerns that the fallout from the U.S.-China trade dispute could outweight corporate earnings season and weaken future profits.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 20,664.64 | +15.64 | +0.08% |

Hang Seng | 27,531.68 | -45.28 | -0.16% |

Shanghai | 2,594.25 | -2.72 | -0.10% |

S&P/ASX | 5,874.20 | -31.40 | -0.53% |

FTSE | 6,842.11 | +95.01 | +1.41% |

CAC | 4,945.19 | +56.61 | +1.16% |

DAX | 11,242.09 | +31.78 | +0.28% |

Crude | $52.43 | +0.85% | |

Gold | $1,313.80 | +0.34% |

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 198.55 | 5.35(2.77%) | 88180 |

ALCOA INC. | AA | 28.15 | 0.17(0.61%) | 551 |

ALTRIA GROUP INC. | MO | 45.5 | 0.20(0.44%) | 14658 |

Amazon.com Inc., NASDAQ | AMZN | 1,636.50 | -1.39(-0.08%) | 40964 |

American Express Co | AXP | 100.8 | 0.42(0.42%) | 1011 |

Apple Inc. | AAPL | 156.6 | 0.30(0.19%) | 136299 |

AT&T Inc | T | 30.45 | -0.22(-0.72%) | 64879 |

Boeing Co | BA | 363.38 | 0.41(0.11%) | 9826 |

Caterpillar Inc | CAT | 125.65 | 1.28(1.03%) | 64451 |

Chevron Corp | CVX | 112.71 | 0.54(0.48%) | 6537 |

Cisco Systems Inc | CSCO | 45.72 | -0.03(-0.07%) | 5485 |

Citigroup Inc., NYSE | C | 64.04 | 0.19(0.30%) | 1052 |

Exxon Mobil Corp | XOM | 71.45 | 0.21(0.29%) | 3607 |

Facebook, Inc. | FB | 148.16 | 0.69(0.47%) | 45776 |

Ford Motor Co. | F | 8.7 | 0.04(0.46%) | 12857 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 10.35 | 0.07(0.68%) | 68082 |

General Motors Company, NYSE | GM | 38.45 | -0.01(-0.03%) | 661 |

Goldman Sachs | GS | 199.65 | -0.07(-0.04%) | 1896 |

Hewlett-Packard Co. | HPQ | 21.99 | 0.01(0.05%) | 300 |

HONEYWELL INTERNATIONAL INC. | HON | 141 | 0.52(0.37%) | 1084 |

Intel Corp | INTC | 46.72 | 0.01(0.02%) | 25078 |

International Business Machines Co... | IBM | 134.2 | -0.07(-0.05%) | 670 |

Johnson & Johnson | JNJ | 129.22 | 0.23(0.18%) | 549 |

McDonald's Corp | MCD | 183 | -0.60(-0.33%) | 826 |

Merck & Co Inc | MRK | 72.85 | -0.07(-0.10%) | 956 |

Microsoft Corp | MSFT | 105.24 | 0.16(0.15%) | 112829 |

Pfizer Inc | PFE | 38.3 | -1.23(-3.11%) | 273228 |

Procter & Gamble Co | PG | 93.48 | -0.04(-0.04%) | 1457 |

Starbucks Corporation, NASDAQ | SBUX | 66.72 | -0.18(-0.27%) | 829 |

Tesla Motors, Inc., NASDAQ | TSLA | 295.6 | -0.78(-0.26%) | 37798 |

Twitter, Inc., NYSE | TWTR | 33.47 | 0.34(1.03%) | 60867 |

UnitedHealth Group Inc | UNH | 266.5 | -0.27(-0.10%) | 208 |

Verizon Communications Inc | VZ | 53.09 | -1.98(-3.60%) | 1096830 |

Visa | V | 137 | 1.01(0.74%) | 9685 |

Walt Disney Co | DIS | 110.77 | -0.04(-0.04%) | 896 |

Yandex N.V., NASDAQ | YNDX | 32.85 | -0.21(-0.64%) | 1483 |

American Express (AXP) upgraded to Overweight from Neutral at Atlantic Equities

Verizon (VZ) reported Q4 FY 2018 earnings of $1.12 per share (versus $0.86 in Q4 FY 2017), beating analysts’ consensus estimate of $1.09.

The company’s quarterly revenues amounted to $34.281 bln (+1.0% y/y), generally in line with analysts’ consensus estimate of $34.446 bln.

The company also issued in-line guidance for FY 2019, projecting EPS to be similar to FY 2018’s EPS of $4.71 versus analysts’ consensus estimate of $4.73.

VZ fell to $53.37 (-3.09%) in pre-market trading.

Pfizer (PFE) reported Q4 FY 2018 earnings of $0.64 per share (versus $0.62 in Q4 FY 2017), beating analysts’ consensus estimate of $0.63.

The company’s quarterly revenues amounted to $13.976 bln (+2.0% y/y), generally in line with analysts’ consensus estimate of $13.920 bln.

The company also issued downside guidance for FY 2019, projecting EPS of $2.82-2.92 (versus analysts’ consensus estimate of $3.04) and revenues of $52-54 bln (versus analysts’ consensus estimate of $54.31 bln).

PFE fell to $38.50 (-2.61%) in pre-market trading.

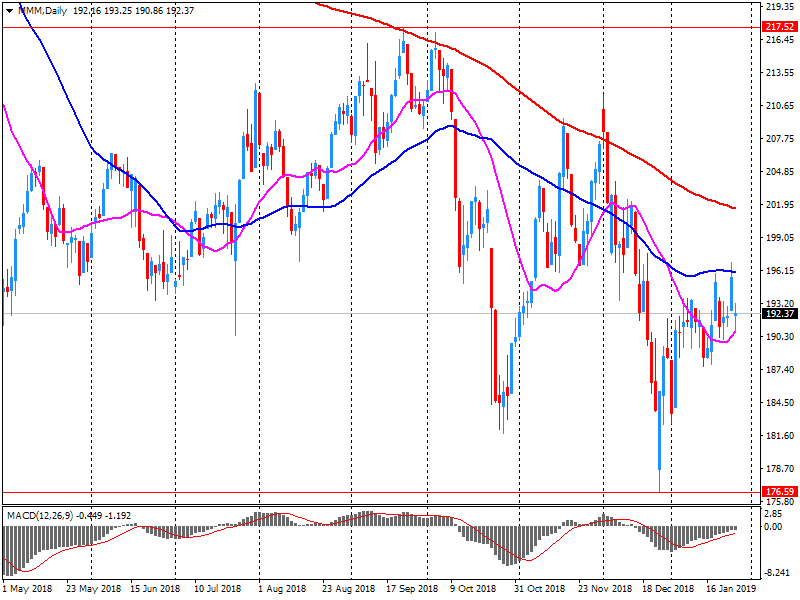

3M (MMM) reported Q4 FY 2018 earnings of $2.31 per share (versus $2.10 in Q4 FY 2017), beating analysts’ consensus estimate of $2.28.

The company’s quarterly revenues amounted to $7.945 bln (-0.6% y/y), being generally in line with analysts’ consensus estimate of $7.873 bln.

The company also lowered guidance for FY 2019, projecting EPS of $10.45 to $10.90 versus analysts’ consensus estimate of $10.70.

MMM rose to $198.50 (+2.74%) in pre-market trading.

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -124.56 | 20649 | -0.6 |

| Hang Seng | 7.77 | 27576.96 | 0.03 |

| KOSPI | -0.43 | 2177.3 | -0.02 |

| FTSE 100 | -62.12 | 6747.1 | -0.91 |

| DAX | -71.48 | 11210.31 | -0.63 |

| Dow Jones | -208.98 | 24528.22 | -0.84 |

| S&P 500 | -20.91 | 2643.85 | -0.78 |

| NASDAQ Composite | -79.18 | 7085.68 | -1.11 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.