- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 31-01-2019.

Major US stock indices predominantly rose on Thursday, as strong revenues from Facebook Inc (FB) added optimism after the meager remarks of the Federal Reserve System. The focus of investors' attention was also on trade negotiations between the United States and China and data on the United States.

President Trump said that it may be necessary to extend trade talks with China after March 1 to work out the details. “The agreement with China will not be small. The agreement with China should be comprehensive, or I will postpone its adoption for some time, ”said Trump. In addition, he made it clear that he was ready to meet again the chairman of the PRC. In his Twitter account, the president wrote that reaching a final agreement would not work until he meets with the PRC Chairman and discusses the most difficult issues in bilateral relations with him.

As for the data, sales of new homes in the US in November jumped to the highest rates in eight months, as lower prices helped attract more buyers. Sales of single-family homes increased by 16.9% compared with the previous month, to 657,000 year-on-year, according to government data, which were postponed due to the closure of the government. This exceeded the estimates of economists (569,000). Meanwhile, the October reading was revised to 562,000 from 544,000.

Most of the components of DOW recorded an increase (19 of 30). The top gainers were Johnson & Johnson (JNJ, + 2.51%). The outsider was DowDuPont Inc. (DWDP, -9.23%).

All sectors of the S & P completed the auction plus. The largest growth was shown by the utility sector (+ 2.0%),

At the time of closing:

Dow 24,999.67 -15.19 -0.06%

S & P 500 2,704.10 +23.05 +0.86%

Nasdaq 100 7,281.74 +98.66 +1.37%

U.S. stock-index were flat on Thursday, as investors digested the latest policy statement by the Federal Reserve, as well as a raft of earnings reports.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 20,556.54 | -108.10 | -0.52% |

Hang Seng | 27,642.85 | +111.17 | +0.40% |

Shanghai | 2,575.58 | -18.68 | -0.72% |

S&P/ASX | 5,886.70 | +12.50 | +0.21% |

FTSE | 6,961.41 | +127.48 | +1.87% |

CAC | 4,961.10 | +32.92 | +0.67% |

DAX | 11,175.41 | -43.42 | -0.39% |

Crude | $53.79 | +0.90% | |

Gold | $1,314.90 | -0.02% |

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 199.3 | 0.03(0.02%) | 223 |

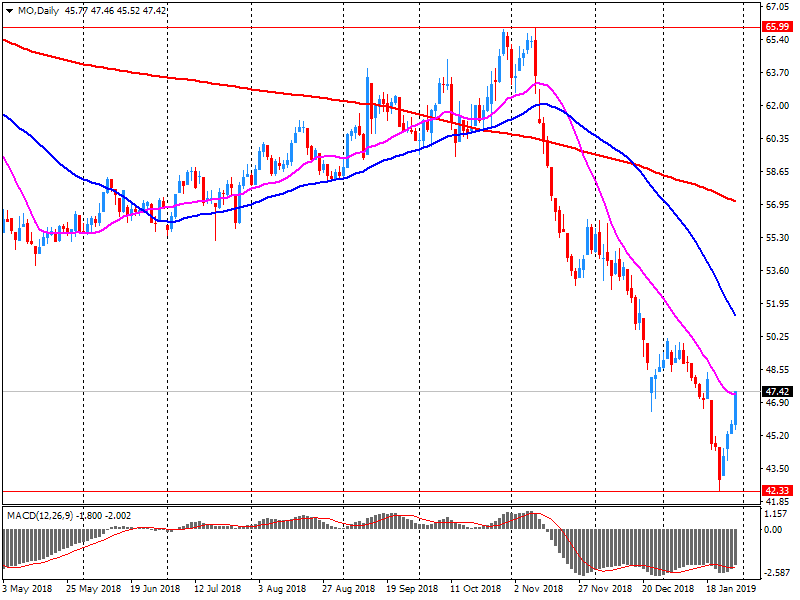

ALTRIA GROUP INC. | MO | 49.1 | 1.30(2.72%) | 152657 |

Amazon.com Inc., NASDAQ | AMZN | 1,703.10 | 32.67(1.96%) | 97894 |

AMERICAN INTERNATIONAL GROUP | AIG | 42.88 | 0.07(0.16%) | 200 |

Apple Inc. | AAPL | 166.31 | 1.06(0.64%) | 235009 |

AT&T Inc | T | 29.42 | 0.05(0.17%) | 104819 |

Boeing Co | BA | 388.8 | 1.08(0.28%) | 10297 |

Caterpillar Inc | CAT | 129.57 | -0.54(-0.42%) | 13620 |

Chevron Corp | CVX | 113.5 | 0.49(0.43%) | 2062 |

Cisco Systems Inc | CSCO | 46.95 | 0.24(0.51%) | 7606 |

Citigroup Inc., NYSE | C | 63.94 | -0.28(-0.44%) | 6497 |

Deere & Company, NYSE | DE | 163.2 | 0.29(0.18%) | 192 |

Exxon Mobil Corp | XOM | 72.54 | 0.25(0.35%) | 5484 |

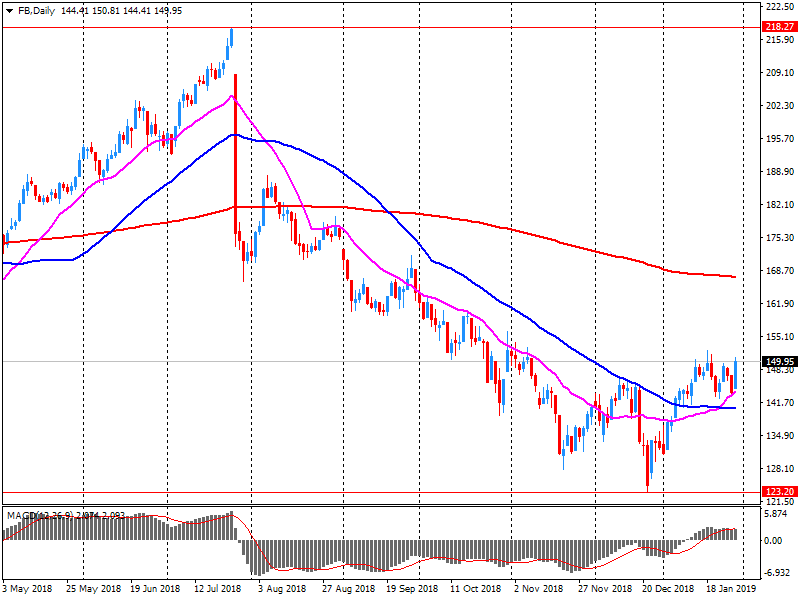

Facebook, Inc. | FB | 167 | 16.58(11.02%) | 1413941 |

FedEx Corporation, NYSE | FDX | 179.35 | 1.88(1.06%) | 3154 |

Ford Motor Co. | F | 8.62 | -0.09(-1.03%) | 32043 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11.43 | 0.16(1.42%) | 18095 |

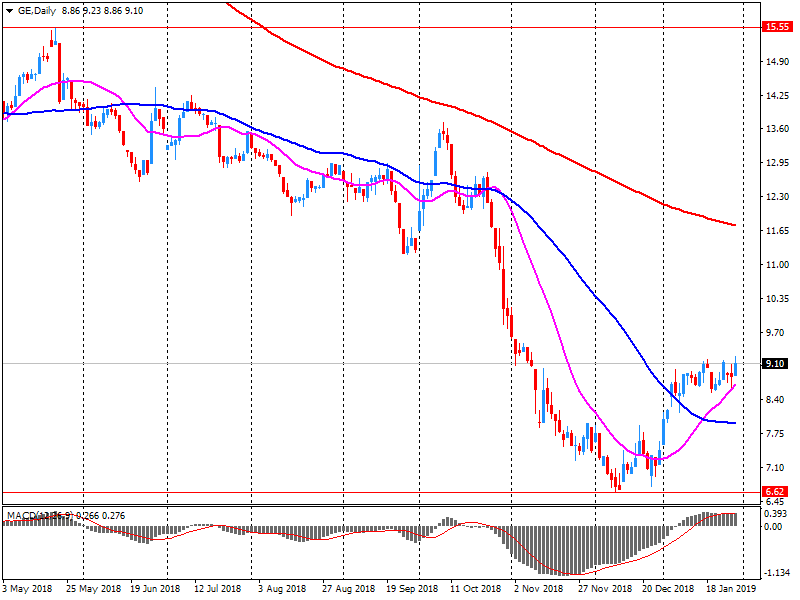

General Electric Co | GE | 9.97 | 0.87(9.56%) | 14826837 |

General Motors Company, NYSE | GM | 39 | -0.09(-0.23%) | 461 |

Goldman Sachs | GS | 201.5 | -0.98(-0.48%) | 1395 |

Google Inc. | GOOG | 1,105.00 | 15.94(1.46%) | 3264 |

Home Depot Inc | HD | 182 | -0.18(-0.10%) | 261 |

HONEYWELL INTERNATIONAL INC. | HON | 143.51 | 0.23(0.16%) | 6667 |

Intel Corp | INTC | 47.4 | -0.14(-0.29%) | 25582 |

International Business Machines Co... | IBM | 134.82 | 0.44(0.33%) | 517 |

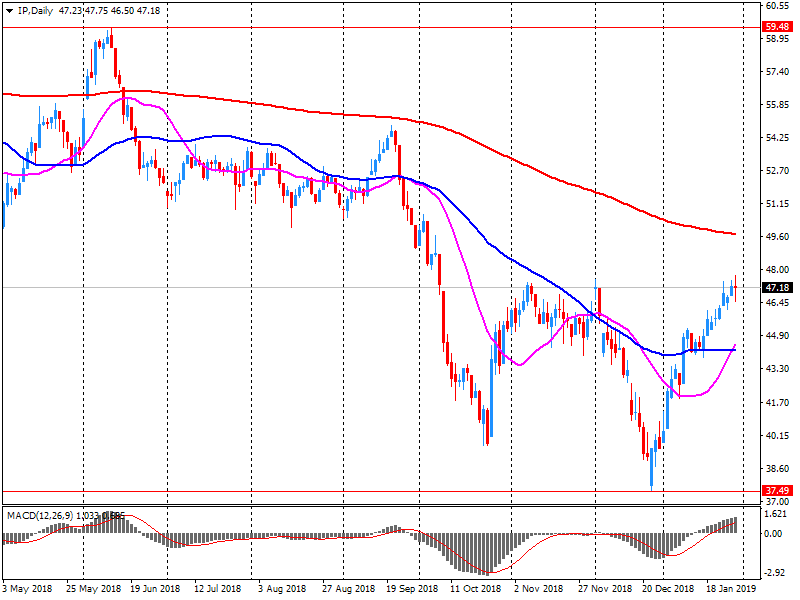

International Paper Company | IP | 48.55 | 1.24(2.62%) | 1727 |

Johnson & Johnson | JNJ | 132 | 0.36(0.27%) | 936 |

JPMorgan Chase and Co | JPM | 103.85 | -0.56(-0.54%) | 7580 |

McDonald's Corp | MCD | 181.2 | -0.57(-0.31%) | 2394 |

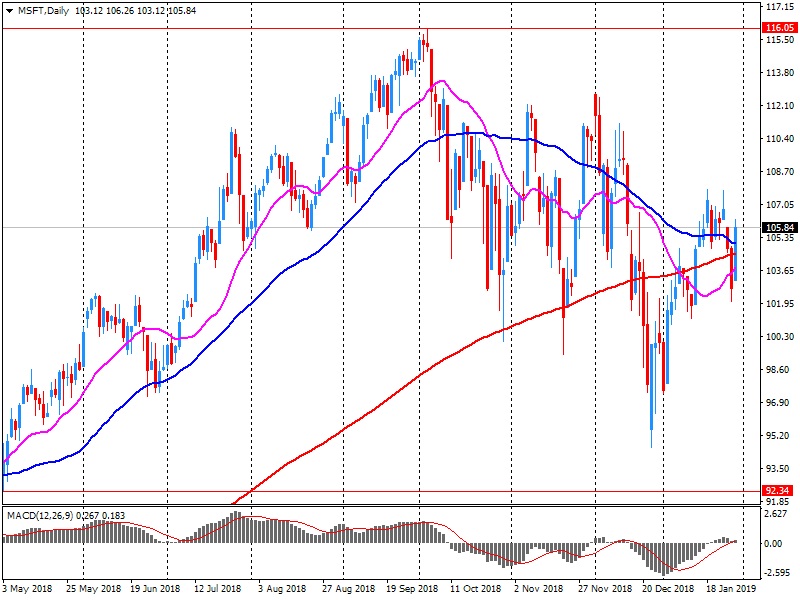

Microsoft Corp | MSFT | 103.58 | -2.80(-2.63%) | 413826 |

Nike | NKE | 81.11 | -0.17(-0.21%) | 2947 |

Pfizer Inc | PFE | 41.67 | 0.45(1.09%) | 46806 |

Procter & Gamble Co | PG | 94.48 | -0.04(-0.04%) | 181 |

Starbucks Corporation, NASDAQ | SBUX | 68.37 | 0.22(0.32%) | 760 |

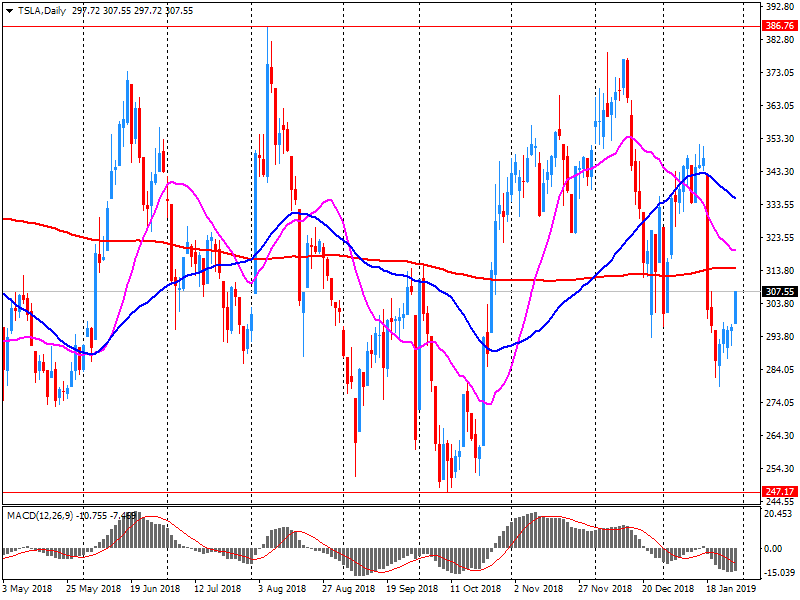

Tesla Motors, Inc., NASDAQ | TSLA | 298.49 | -10.28(-3.33%) | 235536 |

The Coca-Cola Co | KO | 47.93 | 0.07(0.15%) | 675 |

Twitter, Inc., NYSE | TWTR | 33.36 | 1.10(3.41%) | 127766 |

Verizon Communications Inc | VZ | 54.04 | 0.04(0.07%) | 4959 |

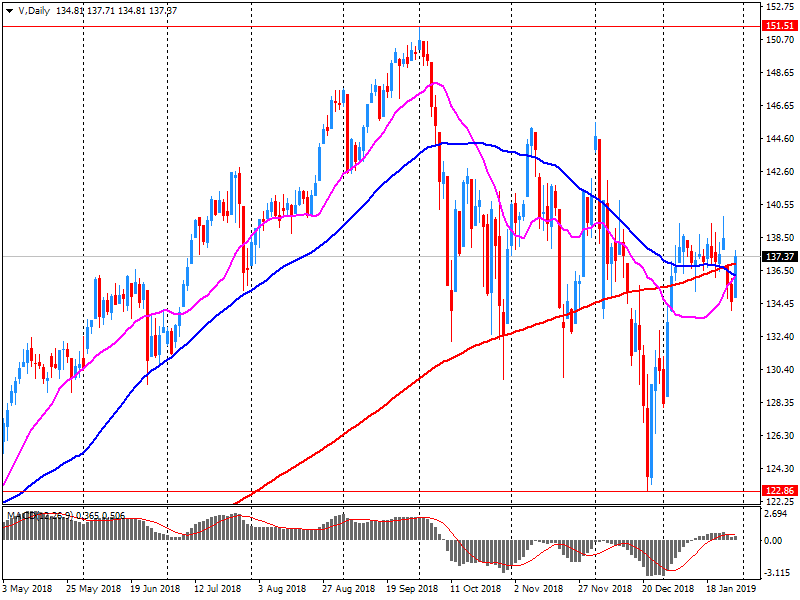

Visa | V | 134.9 | -2.70(-1.96%) | 166082 |

Wal-Mart Stores Inc | WMT | 94.6 | -0.20(-0.21%) | 2409 |

Walt Disney Co | DIS | 110.22 | 0.09(0.08%) | 3756 |

Yandex N.V., NASDAQ | YNDX | 33.45 | -0.34(-1.01%) | 17850 |

Pfizer (PFE) upgraded to Buy from Hold at Argus

Pfizer (PFE) upgraded to Outperform from Neutral at Credit Suisse

Altria (MO) reported Q4 FY 2018 earnings of $0.95 per share (versus $0.91 in Q4 FY 2017), in line with analysts’ consensus estimate.

The company’s quarterly revenues amounted to 4.786 bln (+1.5% y/y), generally in line with analysts’ consensus estimate of $4.819 bln.

MO rose to $48.99 (+2.49%) in pre-market trading.

Int'l Paper (IP) reported Q4 FY 2018 earnings of $1.65 per share (versus $1.27 in Q4 FY 2017), beating analysts’ consensus estimate of $1.59.

The company’s quarterly revenues amounted to $5.951 bln (+4.2% y/y), generally in line with analysts’ consensus estimate of $5.950 bln.

IP rose to $47.68 (+0.78%) in pre-market trading.

DowDuPont (DWDP) reported Q4 FY 2018 earnings of $0.88 per share (versus $0.83 in Q4 FY 2017), beating analysts’ consensus estimate of $0.87.

The company’s quarterly revenues amounted to $20.099 bln (+0.2% y/y), missing analysts’ consensus estimate of $20.926 bln.

DWDP fell to $55.00 (-7.22%) in pre-market trading.

General Electric (GE) reported Q4 FY 2018 earnings of $0.17 per share (versus $0.27 in Q4 FY 2017), missing analysts’ consensus estimate of $0.22.

The company’s quarterly revenues amounted to $33.278 bln (+5.3% y/y), beating analysts’ consensus estimate of $32.160 bln.

GE rose to $9.86 (+8.35%) in pre-market trading.

Visa (V) reported Q4 FY 2018 earnings of $1.30 per share (versus $1.08 in Q4 FY 2017), beating analysts’ consensus estimate of $1.25.

The company’s quarterly revenues amounted to $5.506 bln (+13.2% y/y), beating analysts’ consensus estimate of $5.412 bln.

V fell to $135.00 (-1.89%) in pre-market trading.

Microsoft (MSFT) reported Q4 FY 2018 earnings of $1.10 per share (versus $0.96 in Q4 FY 2017), beating analysts’ consensus estimate of $1.09.

The company’s quarterly revenues amounted to $32.471 bln (+12.3% y/y), generally in line with analysts’ consensus estimate of $32.530 bln.

MSFT fell to $104.00 (-2.24%) in pre-market trading.

Facebook (FB) reported Q4 FY 2018 earnings of $2.38 per share (versus $2.21 in Q4 FY 2017), beating analysts’ consensus estimate of $2.18.

The company’s quarterly revenues amounted to $16.914 bln (+30.4% y/y), beating analysts’ consensus estimate of $16.396 bln.

FB rose to $168.07 (+11.73%) in pre-market trading.

Tesla (TSLA) reported Q4 FY 2018 earnings of $1.93 per share (versus -$3.04 in Q4 FY 2017), missing analysts’ consensus estimate of $2.02.

The company’s quarterly revenues amounted to $7.226 bln (+119.8% y/y), beating analysts’ consensus estimate of $7.087 bln.

TSLA fell to $296.00 (-4.14 %) in pre-market trading.

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -108.1 | 20556.54 | -0.52 |

| Hang Seng | 111.17 | 27642.85 | 0.4 |

| KOSPI | 22.84 | 2206.2 | 1.05 |

| ASX 200 | 12.5 | 5886.7 | 0.21 |

| FTSE 100 | 107.7 | 6941.63 | 1.58 |

| DAX | -37.17 | 11181.66 | -0.33 |

| Dow Jones | 434.9 | 25014.86 | 1.77 |

| S&P 500 | 41.05 | 2681.05 | 1.55 |

| NASDAQ Composite | 154.79 | 7183.08 | 2.2 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.