- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 24-10-2017.

(index / closing price / change items /% change)

Nikkei +108.52 21805.17 +0.50%

TOPIX +11.67 1756.92 +0.67%

Hang Seng -150.91 28154.97 -0.53%

CSI 300 +28.60 3959.40 +0.73%

Euro Stoxx 50 +1.82 3610.69 +0.05%

FTSE 100 +2.09 7526.54 +0.03%

DAX +10.05 13013.19 +0.08%

CAC 40 +7.99 5394.80 +0.15%

DJIA +167.80 23441.76 +0.72%

S&P 500 +4.15 2569.13 +0.16%

NASDAQ +11.60 6598.43 +0.18%

S&P/TSX +49.38 15905.14 +0.31%

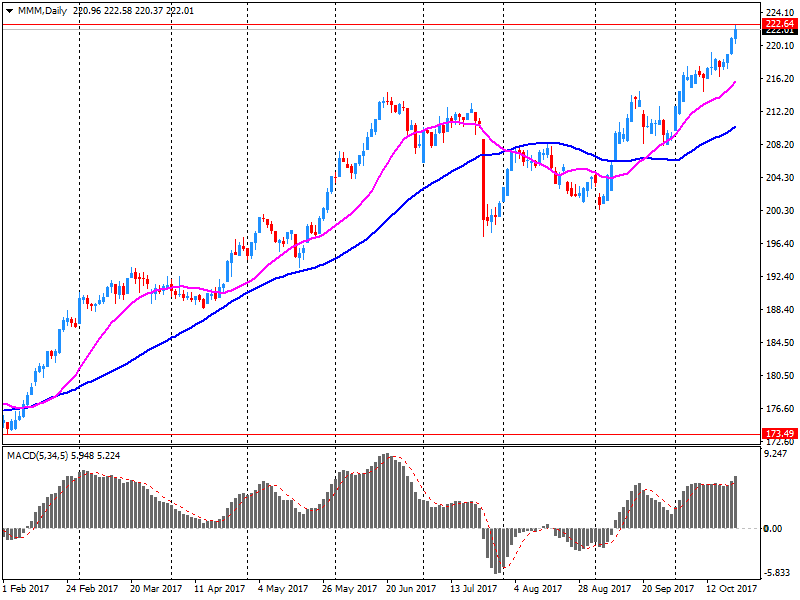

Major US stock indices rose on Tuesday, while the Dow Jones index renewed its record high, helped by good reports from the industrial giants 3M (MMM) and Caterpillar (CAT).

In addition, data for October indicated a reliable and accelerated expansion of business activity in the private sector of the United States. The upswing was supported by the fastest growth in the manufacturing sector for eight months, along with yet another reliable growth in output in the services sector. Taking into account seasonal fluctuations, the composite PMI index from IHS Markit increased to 55.7 from 54.8 in September. The last reading reflected the fastest growth in private sector activity since January.

At the same time, the index of production activity from the Federal Reserve Bank of Richmond remained positive in October, although the composite index fell due to a noticeable decline in the supply sub-index, which weakened from 22 to 9. Despite this, the index remained positive for all components, indicating continuing growth. Although most sub-indices fell in October, the employment index increased from 17 to 24, which is the highest level since May 2000.

Oil rose more than 1%, as Saudi Arabia reiterated its intention to strike a balance between supply and demand for oil. Support for prices was also provided by the remaining geopolitical risks for global reserves.

Most components of the DOW index recorded a rise (16 out of 30). The leader of the growth were shares of 3M Company (MMM, + 6.47%). Outsider were shares of International Business Machines Corporation (IBM, -2.40%).

Most sectors of the S & P index finished trading in positive territory. The industrial goods sector grew most (+ 0.8%). The health sector showed the greatest decline (-0.8%).

At closing:

DJIA + 0.72% 23.442.11 +168.15

Nasdaq + 0.18% 6,598.43 +11.60

S & P + 0.17% 2.569.23 +4.25

U.S. stock-index futures rose as investors assessed a slew of Q3 corporate earnings.

Global Stocks:

Nikkei 21,805.17 +108.52 +0.50%

Hang Seng 28,154.97 -150.91 -0.53%

Shanghai 3,388.25 +7.55 +0.22%

S&P/ASX 5,897.61 +3.65 +0.06%

FTSE 7,521.47 -2.98 -0.04%

CAC 5,407.11 +20.30 +0.38%

DAX 13,039.94 +36.80 +0.28%

Crude $52.27 (+0.71%)

Gold $1,278.70 (-0.17%)

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 227.2 | 5.65(2.55%) | 13015 |

| Amazon.com Inc., NASDAQ | AMZN | 970.11 | 3.81(0.39%) | 14603 |

| Apple Inc. | AAPL | 156.61 | 0.44(0.28%) | 281994 |

| AT&T Inc | T | 35.29 | 0.04(0.11%) | 23703 |

| Barrick Gold Corporation, NYSE | ABX | 16.08 | -0.07(-0.43%) | 1418 |

| Boeing Co | BA | 263.32 | 1.00(0.38%) | 5007 |

| Caterpillar Inc | CAT | 140.9 | 9.22(7.00%) | 714904 |

| Chevron Corp | CVX | 119 | 0.07(0.06%) | 248 |

| Cisco Systems Inc | CSCO | 34.4 | 0.05(0.15%) | 13983 |

| Citigroup Inc., NYSE | C | 74.15 | 0.62(0.84%) | 21472 |

| Deere & Company, NYSE | DE | 131.45 | 1.86(1.44%) | 2735 |

| Exxon Mobil Corp | XOM | 83.51 | 0.27(0.32%) | 8496 |

| Facebook, Inc. | FB | 172.1 | 0.83(0.48%) | 41705 |

| Ford Motor Co. | F | 12.19 | 0.15(1.25%) | 238219 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 15.02 | 0.21(1.42%) | 15396 |

| General Electric Co | GE | 22.04 | -0.28(-1.25%) | 432236 |

| General Motors Company, NYSE | GM | 47 | 1.85(4.10%) | 581368 |

| Goldman Sachs | GS | 243.5 | 1.37(0.57%) | 1796 |

| Google Inc. | GOOG | 971.99 | 3.54(0.37%) | 2056 |

| Hewlett-Packard Co. | HPQ | 22.28 | 0.16(0.72%) | 608 |

| Home Depot Inc | HD | 163.99 | -0.75(-0.46%) | 4100 |

| Intel Corp | INTC | 41.05 | 0.22(0.54%) | 17923 |

| International Business Machines Co... | IBM | 159.9 | 0.35(0.22%) | 911 |

| International Paper Company | IP | 58.75 | 0.50(0.86%) | 372 |

| Johnson & Johnson | JNJ | 143.65 | 0.03(0.02%) | 1445 |

| JPMorgan Chase and Co | JPM | 99.97 | 0.63(0.63%) | 32179 |

| McDonald's Corp | MCD | 165.8 | 2.46(1.51%) | 305272 |

| Merck & Co Inc | MRK | 63.62 | 0.22(0.35%) | 1032 |

| Microsoft Corp | MSFT | 79.05 | 0.22(0.28%) | 9081 |

| Nike | NKE | 53.47 | -0.19(-0.35%) | 1073 |

| Pfizer Inc | PFE | 36.43 | 0.03(0.08%) | 993 |

| Procter & Gamble Co | PG | 87.34 | 0.04(0.05%) | 1121 |

| Starbucks Corporation, NASDAQ | SBUX | 54.5 | 0.23(0.42%) | 625 |

| Tesla Motors, Inc., NASDAQ | TSLA | 339.55 | 2.53(0.75%) | 21692 |

| The Coca-Cola Co | KO | 46.29 | -0.03(-0.06%) | 544 |

| Twitter, Inc., NYSE | TWTR | 17.4 | 0.03(0.17%) | 8039 |

| United Technologies Corp | UTX | 121.1 | 0.21(0.17%) | 12718 |

| Verizon Communications Inc | VZ | 49.1 | 0.11(0.22%) | 7435 |

| Visa | V | 107.88 | 0.35(0.33%) | 4375 |

| Wal-Mart Stores Inc | WMT | 88.93 | 0.28(0.32%) | 2553 |

| Yandex N.V., NASDAQ | YNDX | 31.91 | 1.14(3.70%) | 270138 |

Int'l Paper (IP) initiated with a Equal Weight rating at Stephens

American Express (AXP) upgraded to Neutral from Underweight at Atlantic Equities

General Electric (GE) downgraded to Underperform at Oppenheimer

General Electric (GE) downgraded to Hold at Stifel; target lowered to $22

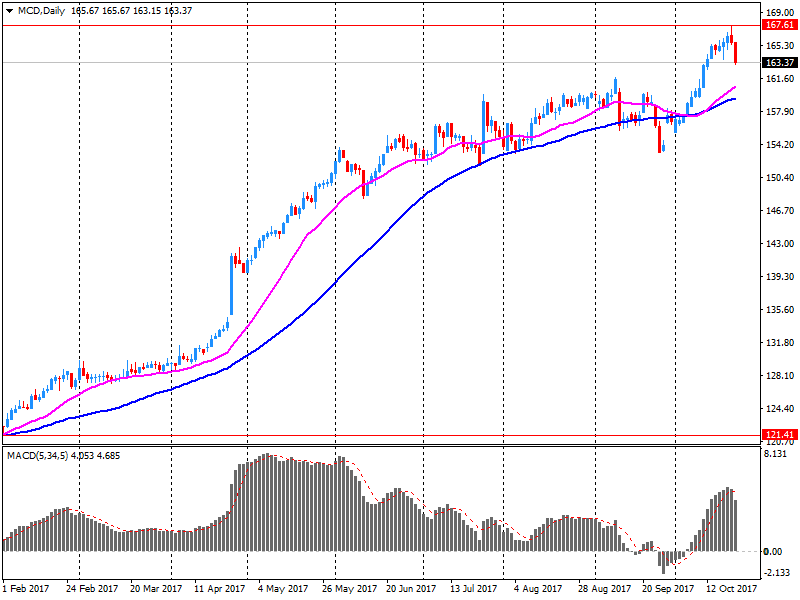

McDonald's (MCD) reported Q3 FY 2017 earnings of $1.76 per share (versus $1.62 in Q3 FY 2016), missing analysts' consensus estimate of $1.77.

The company's quarterly revenues amounted to $5.755 bln (-10.4% y/y), generally in-line with analysts' consensus estimate of $5.749 bln.

MCD rose to $164.10 (+0.47%) in pre-market trading.

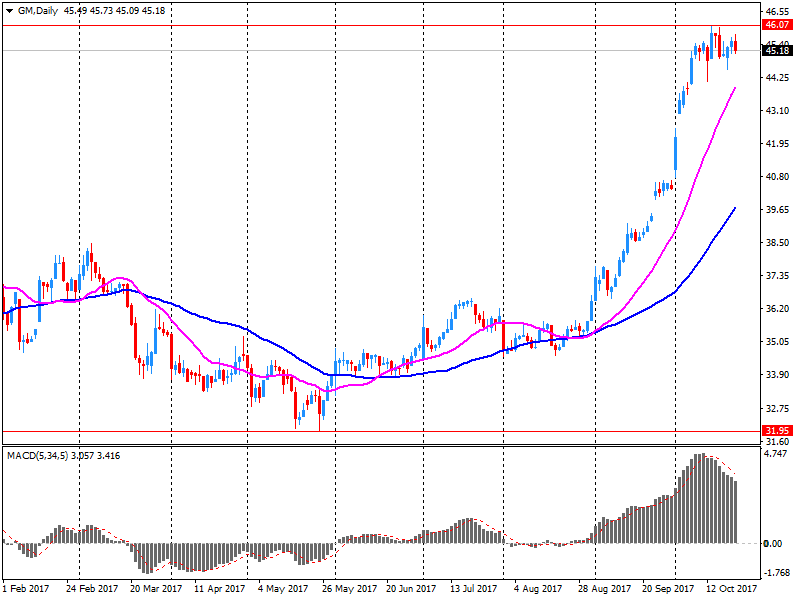

General Motors (GM) reported Q3 FY 2017 earnings of $1.32 per share (versus $1.72 in Q3 FY 2016), beating analysts' consensus estimate of $1.11.

The company's quarterly revenues amounted to $30.475 bln (-16.6% y/y), beating analysts' consensus estimate of $29.927 bln.

The company reaffirmed guidance for FY2017, projecting EPS at middle of $6.00-6.50 (versus analysts' consensus estimate of $6.16), and revenues generally in-line with 2016. It also announced plans to return $7 bln in buybacks and dividends.

GM rose to $46.99 (+4.08%) in pre-market trading.

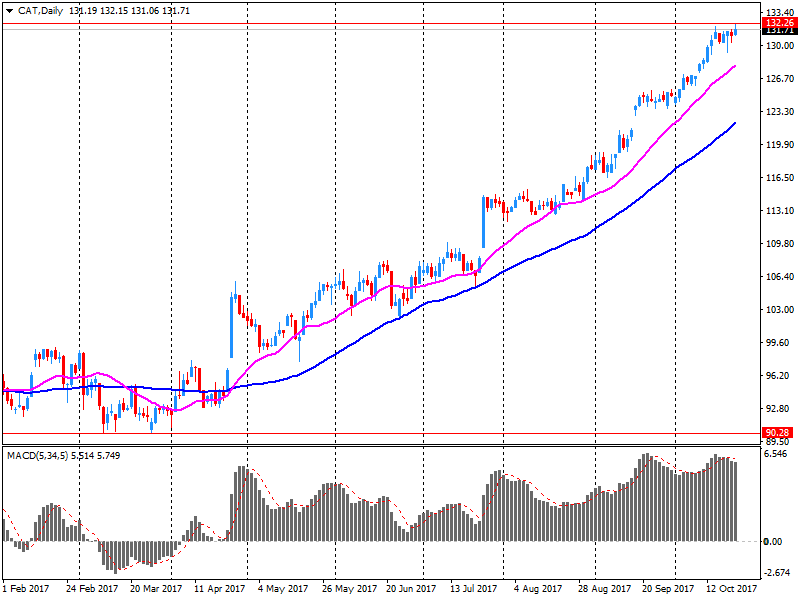

Caterpillar (CAT) reported Q3 FY 2017 earnings of $1.95 per share (versus $0.85 in Q3 FY 2016), beating analysts' consensus estimate of $1.27.

The company's quarterly revenues amounted to $11.413 bln (+24.6% y/y), beating analysts' consensus estimate of $10.691 bln.

The company raised guidance for FY2017 EPS to $6.25 (versus analysts' consensus estimate of $5.24, up from $5.00; FY2017 revenues guidance to $44 bln (versus analysts' consensus estimate of $42.97 bln), up from $42-44 bln.

CAT rose to $140.61 (+6.78%) in pre-market trading.

3M (MMM) reported Q3 FY 2017 earnings of $2.33 per share (versus $2.15 in Q3 FY 2016), beating analysts' consensus estimate of $2.21.

The company's quarterly revenues amounted to $8.172 bln (+6.0% y/y), beating analysts' consensus estimate of $7.927 bln.

The company also issued raised guidance for FY2017 EPS of $9.00-9.10 from $8.80-9.05, versus analysts' consensus estimate of $8.96.

MMM rose to $229.39 (+3.54%) in pre-market trading.

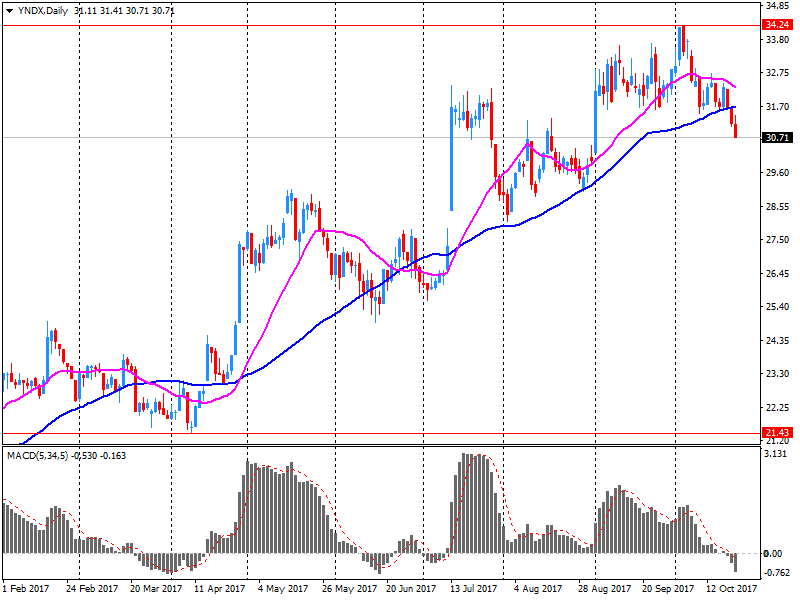

Yandex N.V. (YNDX) reported Q3 FY 2017 earnings of RUB7.16 per share (versus RUB11.64 in Q3 FY 2016), missing analysts' consensus estimate of RUB9.21.

The company's quarterly revenues amounted to RUB23.438 bln (+21.5% y/y), in-line with analysts' consensus estimate.

The company also issued upside guidance for FY2017, projecting revenues of +22%-23% y/y to $92.63-93.38 bln versus analysts' consensus estimate of $93.08 bln.

YNDX rose to $31.40 (+2.05%) in pre-market trading.

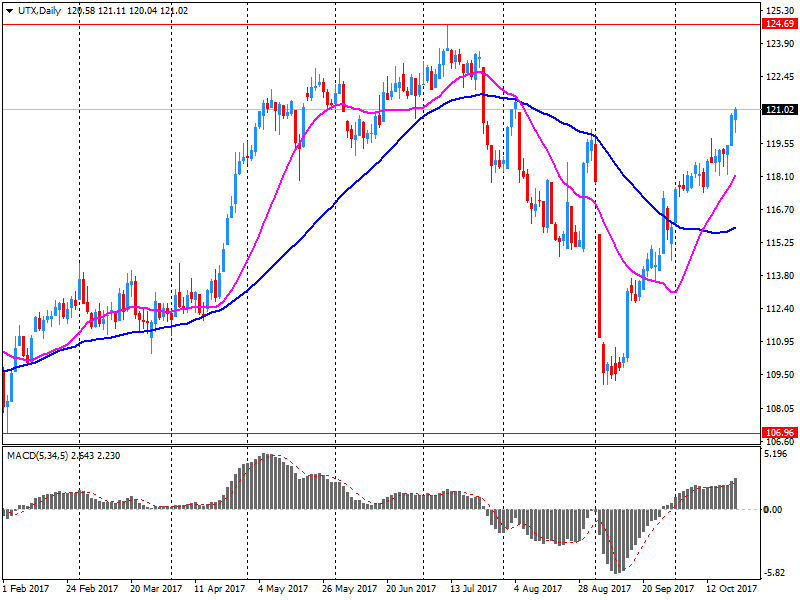

United Tech (UTX) reported Q3 FY 2017 earnings of $1.73 per share (versus $1.76 in Q3 FY 2016), beating analysts' consensus estimate of $1.69.

The company's quarterly revenues amounted to $15.062 bln (+4.9% y/y), generally in-line with analysts' consensus estimate of $14.994 bln.

The company also raised its guidance for FY2017 EPS to $6.58-6.63 from $6.45-6.50 (versus analysts' consensus estimate of $6.57) and FY2017 revenues to $59.0-59.5 bln from $58.5-59.5 bln (versus analysts' consensus estimate of $59.4 bln).

UTX rose to $122.20 (+1.08%) in pre-market trading.

Spanish stocks fell Monday as the political standoff between Madrid and the Catalan region wore on, but a drop in the euro appeared to provide a lift to other European markets. The Stoxx Europe 600 index SXXP, +0.16% ended 0.2% higher at 390.74, for a second straight session of gains.

The S&P 500 and the Dow snapped a six-day winning streak on Monday as investors weighed prospects for tax cuts while parsing the latest corporate earnings for clues on where stocks are headed in the near term.

Japan's benchmark Nikkei 225 Index NIK, +0.14% was pushing Tuesday toward a 16th consecutive rise, having posted a 0.17% gain to the 21,733.10 level. The yen, meanwhile, rebounded against the U.S. dollar USDJPY, -0.06% overnight and gained a bit in the Asian session.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.