- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 27-10-2017.

The main US stock indexes rose against the background of strong quarterly data from technological giants. The quarterly reports of Amazon (AMZN), Microsoft (MSFT), Intel (INTC) and Alphabet (GOOG) released earlier were quarterly better than forecasted by analysts.

In addition, the support of the market provided statistical data for the United States. As it became known, US GDP grew by 3% per annum in the third quarter, despite the damage from two hurricanes, according to the Ministry of Commerce. This is higher than the expectations of economists (+ 2.5%), and only slightly below the growth rate of 3.1% in the second quarter. The last time the economy had two consecutive quarters above 3% growth in 2014. The government said it can not say for sure how hurricanes Harvey and Irma reduced growth in the quarter from July to September. Since Puerto Rico is not a state, the impact of Hurricane Maria is not taken into account in GDP calculations.

However, the final results of the studies presented by Thomson-Reuters and the Michigan Institute showed that in October US consumers felt more optimistic about the economy than last month. According to the data, in October the consumer sentiment index rose to 100.7 points compared with the final reading for September 95.1 points and the preliminary value for October 101.1 points. It was predicted that the index will be 100.9 points.

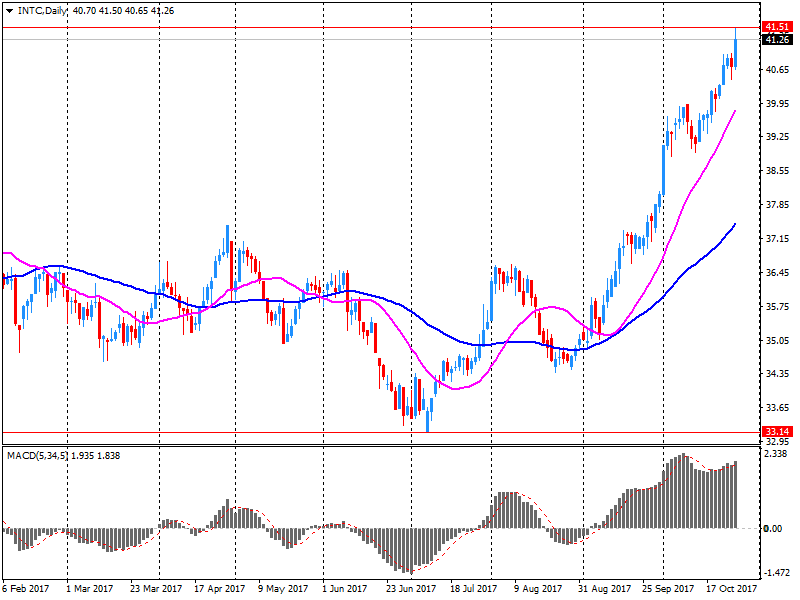

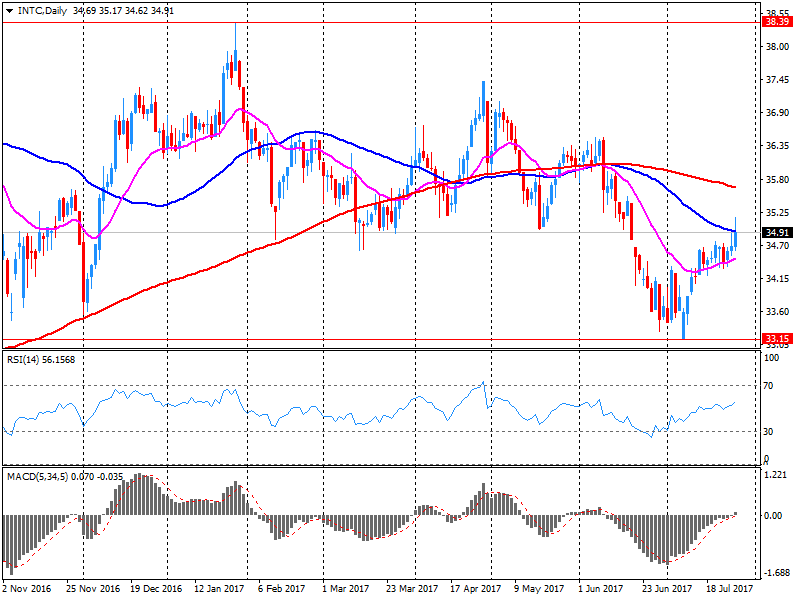

Most components of the DOW index finished trading in the red (18 out of 30). The leader of growth was shares of Intel Corporation (INTC, + 7.59%). Outsider were the shares of Merck & Co., Inc. (MRK, -6.28%).

Almost all sectors of the S & P index recorded an increase. The technological sector grew most (+ 2.1%). The sector of industrial goods decreased only (-0.1%).

At closing:

Dow + 0.14% 23.434.19 +33.33

Nasdaq + 2.20% 6,701.26 +144.49

S & P + 0.81% 2.581.07 +20.67

U.S. stock-index futures rose on Friday as strong earnings from technology giants and a better-than-expected quarterly GDP growth boosted investor sentiment.

Global Stocks:

Nikkei 21,739.78 +32.16 +0.15%

Nikkei 22,008.45 +268.67 +1.24%

Hang Seng 28,438.85 +236.47 +0.84%

Shanghai 3,416.42 +8.85 +0.26%

S&P/ASX 5,903.16 -13.14 -0.22%

FTSE 7,502.49 +15.99 +0.21%

CAC 5,497.97 +42.57 +0.78%

DAX 13,228.46 +95.18 +0.72%

Crude $52.40 (-0.46%)

Gold $1,265.40 (-0.33%)

IBM (IBM) initiated with a Buy at Pivotal Research Group; target $180

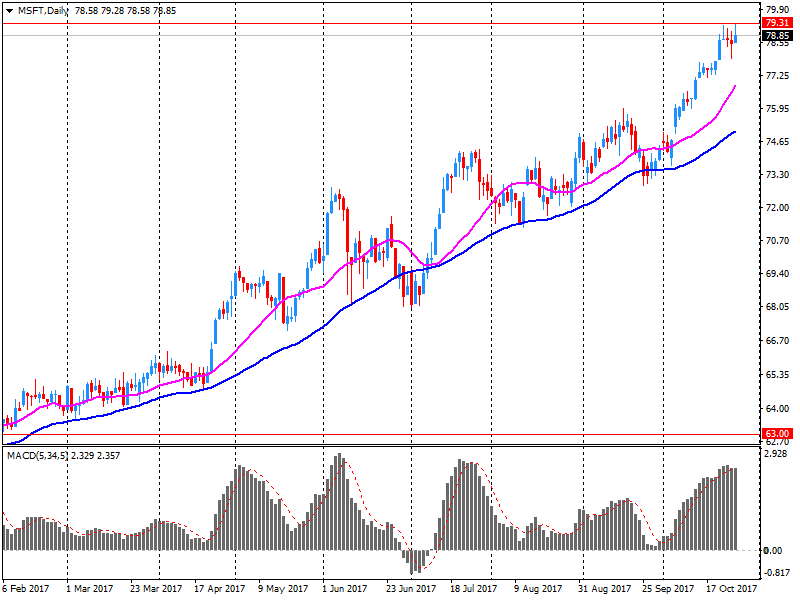

Microsoft (MSFT) target raised to $94 from $86 at BMO Capital Markets

Microsoft (MSFT) target raised to $88 from $85 at RBC Capital Mkts

Microsoft (MSFT) target raised to $90 from $85 at Stifel

Alphabet A (GOOGL) target raised to $1,125 from $1,050 at RBC Capital Mkts

Alphabet A (GOOGL) target raised to $1,200 from $1,050 at B Riley

Alphabet A (GOOGL) target raised to $1,180 from $1,050 at Oppenheimer

Alphabet A (GOOGL) target raised to $1,150 from $1,075 at Stifel

Intel (INTC) target raised to $47 from $45 at Mizuho Securities

Intel (INTC) target raised to $53 from $46 at B. Riley

Intel (INTC) target raised to $44 from $40 at RBC Capital Mkts

Tesla (TSLA) downgraded to In-line from Outperform at Evercore ISI

Facebook (FB) upgraded to Buy at Monness Crespi & Hardt; target $210

Amazon (AMZN) upgraded to Buy at Monness Crespi & Hardt; target $1250

Amazon (AMZN) upgraded to Outperform from Mkt Perform at Raymond James

Intel (INTC) upgraded to Buy from Neutral at BofA/Merrill

Twitter (TWTR) upgraded to Neutral from Sell at UBS

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 232.95 | 0.01(0.00%) | 3844 |

| ALCOA INC. | AA | 48.5 | -0.65(-1.32%) | 5033 |

| ALTRIA GROUP INC. | MO | 66 | 0.21(0.32%) | 1820 |

| Amazon.com Inc., NASDAQ | AMZN | 1,060.60 | 88.17(9.07%) | 402838 |

| American Express Co | AXP | 95.55 | -0.14(-0.15%) | 1093 |

| Apple Inc. | AAPL | 159.65 | 2.24(1.42%) | 383865 |

| AT&T Inc | T | 33.8 | 0.12(0.36%) | 65091 |

| Barrick Gold Corporation, NYSE | ABX | 14.58 | 0.07(0.48%) | 77994 |

| Boeing Co | BA | 258.85 | -0.42(-0.16%) | 2462 |

| Caterpillar Inc | CAT | 137.5 | 0.56(0.41%) | 3503 |

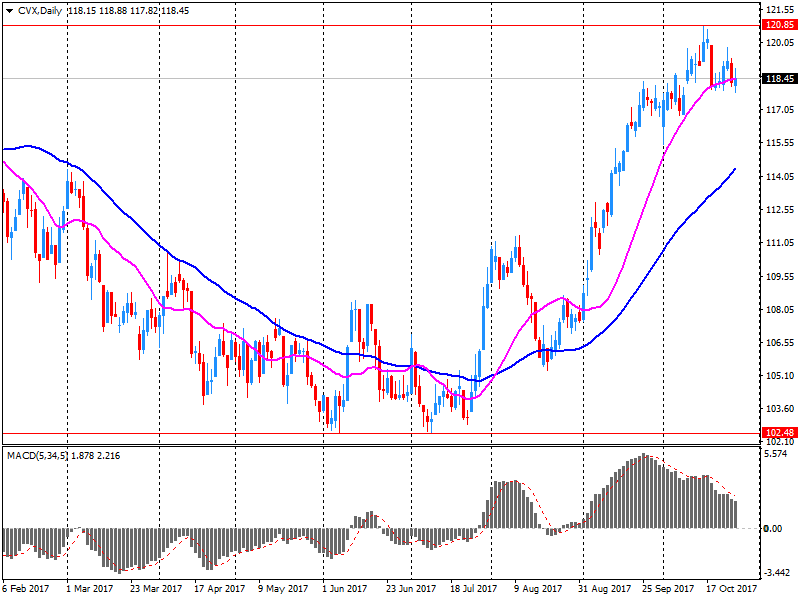

| Chevron Corp | CVX | 117 | -1.44(-1.22%) | 17820 |

| Cisco Systems Inc | CSCO | 34.25 | -0.02(-0.06%) | 27556 |

| Citigroup Inc., NYSE | C | 73.88 | 0.09(0.12%) | 14297 |

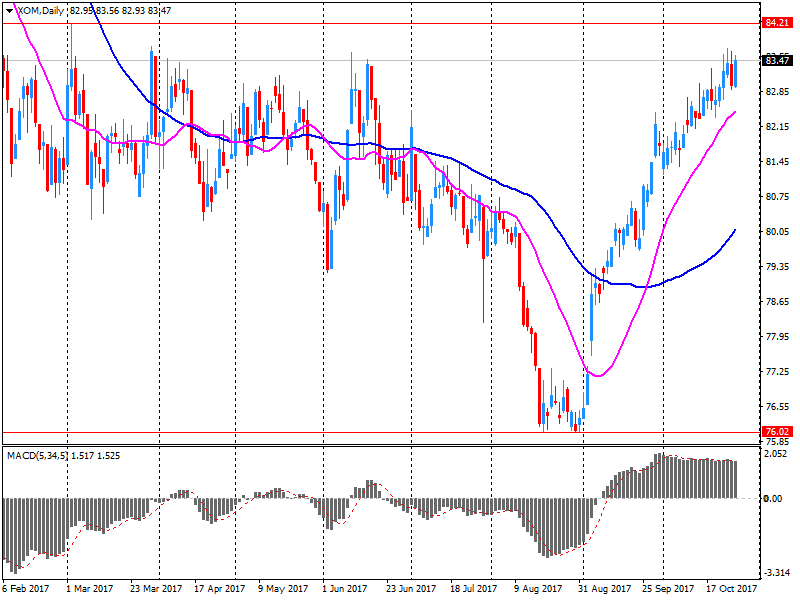

| Exxon Mobil Corp | XOM | 83.98 | 0.51(0.61%) | 80873 |

| Facebook, Inc. | FB | 174.02 | 3.39(1.99%) | 184638 |

| Ford Motor Co. | F | 12.25 | -0.02(-0.16%) | 21081 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 14.35 | -0.34(-2.31%) | 118824 |

| General Electric Co | GE | 21.38 | 0.06(0.28%) | 127384 |

| General Motors Company, NYSE | GM | 45.27 | 0.02(0.04%) | 500 |

| Goldman Sachs | GS | 241.5 | -0.22(-0.09%) | 2463 |

| Google Inc. | GOOG | 1,016.50 | 43.94(4.52%) | 51455 |

| Home Depot Inc | HD | 167.3 | -0.35(-0.21%) | 1797 |

| Intel Corp | INTC | 43.32 | 1.97(4.76%) | 1555872 |

| International Business Machines Co... | IBM | 154.14 | 0.54(0.35%) | 6282 |

| Johnson & Johnson | JNJ | 141.3 | -0.51(-0.36%) | 2176 |

| JPMorgan Chase and Co | JPM | 101.9 | 0.16(0.16%) | 20707 |

| McDonald's Corp | MCD | 164.02 | 0.01(0.01%) | 2505 |

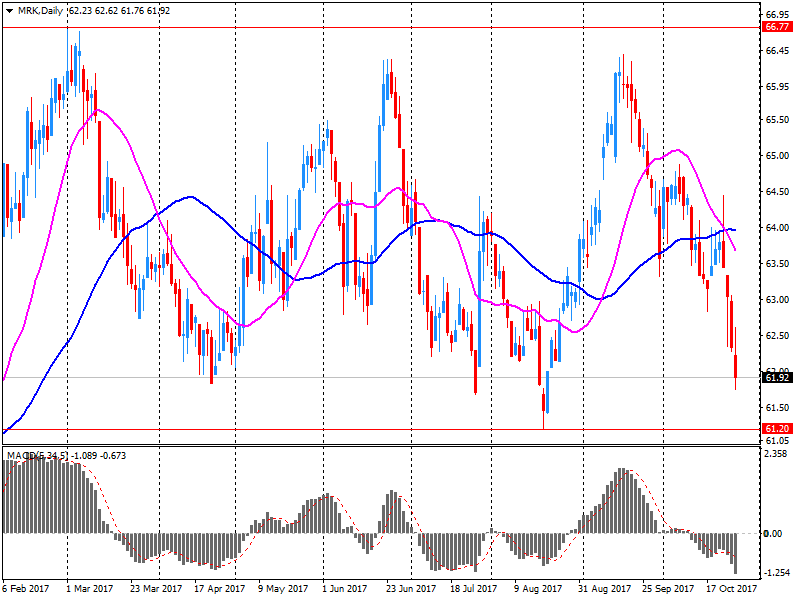

| Merck & Co Inc | MRK | 60.33 | -1.66(-2.68%) | 76180 |

| Microsoft Corp | MSFT | 84.6 | 5.84(7.41%) | 1528725 |

| Nike | NKE | 55.85 | -0.96(-1.69%) | 16993 |

| Pfizer Inc | PFE | 35.64 | -0.10(-0.28%) | 25292 |

| Starbucks Corporation, NASDAQ | SBUX | 54.75 | -0.16(-0.29%) | 6250 |

| Tesla Motors, Inc., NASDAQ | TSLA | 320.67 | -5.50(-1.69%) | 131842 |

| The Coca-Cola Co | KO | 46.12 | -0.11(-0.24%) | 1751 |

| Travelers Companies Inc | TRV | 131.82 | -0.12(-0.09%) | 298 |

| Twitter, Inc., NYSE | TWTR | 20.16 | -0.15(-0.74%) | 288743 |

| United Technologies Corp | UTX | 119.75 | -0.18(-0.15%) | 440 |

| UnitedHealth Group Inc | UNH | 210.78 | 1.63(0.78%) | 3050 |

| Verizon Communications Inc | VZ | 48.59 | -0.30(-0.61%) | 3019 |

| Visa | V | 109.91 | 0.11(0.10%) | 8227 |

| Wal-Mart Stores Inc | WMT | 88.25 | -0.37(-0.42%) | 5379 |

| Walt Disney Co | DIS | 98.54 | -0.02(-0.02%) | 2467 |

| Yandex N.V., NASDAQ | YNDX | 32.61 | -0.07(-0.21%) | 1700 |

Chevron (CVX) reported Q3 FY 2017 earnings of $1.03 per share (versus $0.68 in Q3 FY 2016), beating analysts' consensus estimate of $0.97.

The company's quarterly revenues amounted to $36.205 bln (+20.1% y/y), beating analysts' consensus estimate of $34.057 bln.

CVX fell to $117.00 (-1.22%) in pre-market trading.

Merck (MRK) reported Q3 FY 2017 earnings of $1.11 per share (versus $1.07 in Q3 FY 2016), beating analysts' consensus estimate of $1.03.

The company's quarterly revenues amounted to $10.325 bln (-2.0% y/y), missing analysts' consensus estimate of $10.545 bln.

MRK fell to $60.92 (-1.73%) in pre-market trading.

Microsoft (MSFT) reported Q1 FY 2018 earnings of $0.84 per share (versus $0.76 in Q1 FY 2017), beating analysts' consensus estimate of $0.72.

The company's quarterly revenues amounted to $24.500 bln (+11.7% y/y), beating analysts' consensus estimate of $23.566 bln.

MSFT rose to $83.50 (+6.02%) in pre-market trading.

Intel (INTC) reported Q3 FY 2017 earnings of $0.94 per share (versus $0.80 in Q3 FY 2016), beating analysts' consensus estimate of $0.80.

The company's quarterly revenues amounted to $16.149 bln (+2.4% y/y), beating analysts' consensus estimate of $15.725 bln.

INTC rose to $42.65 (+3.14%) in pre-market trading.

Amazon (AMZN) reported Q3 FY 2017 earnings of $0.52 per share (versus $0.52 in Q3 FY 2016), beating analysts' consensus estimate of -$0.01.

The company's quarterly revenues amounted to $43.744 bln (+33.7% y/y), beating analysts' consensus estimate of $42.260 bln.

AMZN rose to $1,049.00 (+7.87%) in pre-market trading.

Alphabet (GOOG) reported Q3 FY 2017 earnings of $9.57 per share (versus $9.06 in Q3 FY 2016), beating analysts' consensus estimate of $8.40.

The company's quarterly revenues amounted to $27.772 bln (+23.7% y/y), beating analysts' consensus estimate of $27.169 bln.

GOOG rose to $1,007.00 (+3.54%) in pre-market trading.

Spanish stocks finished off session highs Thursday after the leader of the Catalan region failed to call anticipated snap elections. Catalan President Carles Puigdemont said he wouldn't call early elections because there was no guarantee the central government in Madrid would halt its move toward stripping Catalonia of autonomous rule, local reports said.

U.S. stocks ended mostly higher on Thursday as a fusillade of better-than-expected corporate results helped to reinvigorate Wall Street buying appetite a day after the S&P 500 and the Dow posted their biggest drops in more than seven weeks.

Asia-Pacific equities rose broadly on Friday, buoyed by strength in U.S. corporate earnings and the prospect of continuing stimulus in Europe. Ahead of the start of Asian trading, three of the world's biggest companies - Google parent Alphabet Inc., Amazon.com Inc. and Microsoft Corp. - reported booming quarterly growth, sending shares of the three tech giants surging in after-hours trade.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.