- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1340 +0,36%

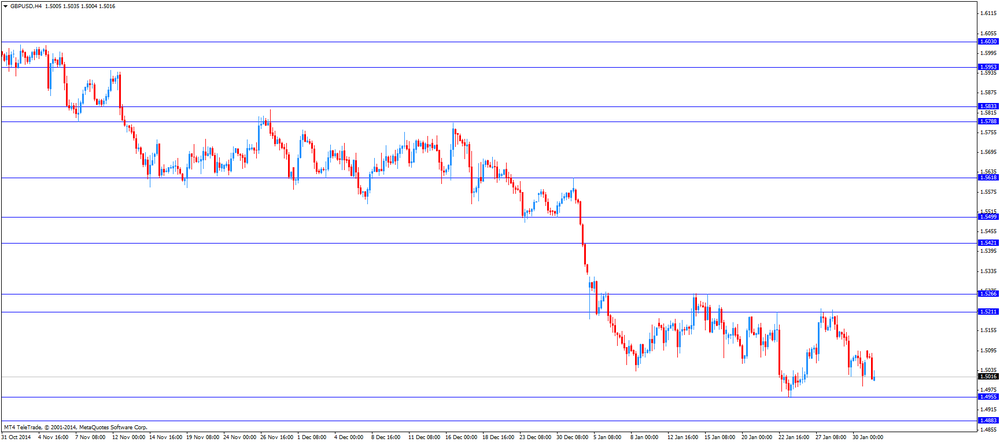

GBP/USD $1,5038 -0,15%

USD/CHF Chf0,9278 +1,06%

USD/JPY Y117,55 +0,13%

EUR/JPY Y133,35 +0,52%

GBP/JPY Y176,78 -0,01%

AUD/USD $0,7802 +0,26%

NZD/USD $0,7304 +0,27%

USD/CAD C$1,2562 -1,16%

(time / country / index / period / previous value / forecast)

00:30 Australia Building Permits, m/m December +7.5% -4.8%

00:30 Australia Building Permits, y/y December +10.1%

00:30 Australia Trade Balance December -0.93 -0.85

03:30 Australia Announcement of the RBA decision on the discount rate 2.50% 2.50%

03:30 Australia RBA Rate Statement

07:00 Switzerland Trade Balance December 3.87

09:30 United Kingdom PMI Construction January 57.6 56.9

10:00 Eurozone Producer Price Index, MoM December -0.4% -0.7%

10:00 Eurozone Producer Price Index (YoY) December -1.6%

13:30 Canada Industrial Product Prices, m/m December -0.4% +0.3%

13:30 Canada Raw Material Price Index December -5.8% -4.6%

15:00 U.S. Factory Orders December -0.7% -1.8%

19:30 U.S. Total Vehicle Sales, mln January 16.9 17.0

21:30 U.S. API Crude Oil Inventories January +12.7

21:45 New Zealand Employment Change, q/q Quarter IV +0.8% +0.8%

21:45 New Zealand Unemployment Rate Quarter IV 5.4% 5.3%

22:30 Australia AIG Services Index January 47.5

23:00 New Zealand RBNZ Governor Graeme Wheeler Speaks

The U.S. dollar traded mixed to lower against the most major currencies after the mostly weaker-than-expected U.S. economic data. The Institute for Supply Management's manufacturing purchasing managers' index for the U.S. declined to 53.5 in January from 55.5 in December, missing expectations for a decline to 54.9.

Personal spending decreased 0.3% in December, missing expectations for a 0.1% decline, after a 0.5% rise in November. November's figure was revised down from a 0.6% increase.

That was the largest decline since September 2009.

Personal income climbed 0.3% in December, exceeding expectations for 0.2% increase, after a 0.3% rise in November. November's figure was revised down from a 0.4% gain.

The personal consumption expenditures (PCE) price index excluding food and energy was flat in December, in line with expectations, after a flat reading in November.

On a yearly basis, the PCE price index excluding food and index rose 1.3% in December, after a 1.4% increase in November. Analysts had expected an increase of 1.4%.

The euro traded higher against the U.S. dollar. Eurozone's final manufacturing purchasing managers' index (PMI) remained unchanged at 51.0 in January, in line with expectations.

Germany's final manufacturing PMI declined to 50.9 in January from a preliminary reading of 51.0. Analysts had expected the final index to remain at 51.0.

France's final manufacturing PMI decreased to 49.2 in January from a preliminary reading of 49.5. Analysts had expected the final index to remain at 49.5.

The British pound traded mixed against the U.S. dollar despite the better-than-expected manufacturing PMI from the U.K. The U.K. manufacturing PMI increased to 53.0 in January from 52.5 in December, beating expectations for a rise to 52.9.

The Swiss franc traded higher against the U.S. dollar. The manufacturing purchasing managers' index in Switzerland dropped to 48.2 in January from 53.6 in December, missing expectations for a rise to 54.5.

Speculation that the Swiss National Bank (SNB) was unofficially targeting a new exchange floor for the Swiss franc against the euro weighed on the franc. Swiss newspaper Schweiz am Sonntag reported over the weekend that the SNB's next exchange floor might be CHF1.0500 to CHF1.1000 per euro.

The New Zealand dollar traded higher against the U.S. dollar. In the overnight trading session, the kiwi traded lower against the greenback in the absence of any major economic reports from New Zealand.

The Australian dollar traded higher against the U.S. dollar. In the overnight trading session, the Aussie traded slightly higher against the greenback after the economic data from Australia. The AIG manufacturing index rose to 49.0 in January from 46.9 in December.

Australia's commodity prices declined at annual rate of 20.4% in January.

The Japanese yen traded higher against the U.S. dollar. In the overnight trading session, the yen fell against the greenback. Japan's final manufacturing PMI climbed to 52.2 in January from 52.1 in December.

The Swiss National Bank (SNB) released its monetary policy data for the week ending 30 January 2015 on Monday. The report showed that the amount of cash commercial banks hold with the SNB rose last week. Sight deposits increased to 383.325 billion Swiss francs in the week ended January 30 from 365.486 billion francs a week earlier, according to SNB data.

Data indicates that the central bank may have intervened after discontinuing the 1.20 per euro exchange rate floor on January 15th.

The SNB declined to comment.

The Institute for Supply Management released its manufacturing purchasing managers' index for the U.S. on Monday. The index declined to 53.5 in January from 55.5 in December, missing expectations for a decline to 54.9.

A reading above 50 indicates expansion, below indicates contraction.

Most components of the index fell, showing a slow growth in the manufacturing sector.

The new orders index fell to 52.9 in January from 57.8 in December.

The prices paid index declined to 35 in January from 38.5 in December. The employment index decreased to 54.1 from 56.

Swiss newspaper Schweiz am Sonntag reported over the weekend that the Swiss National Bank (SNB) was unofficially targeting a new exchange floor for the Swiss franc against the euro.

The newspaper said that the SNB's next exchange floor might be CHF1.0500 to CHF1.1000 per euro.

The SNB declined to comment.

The U.S. Commerce Department released personal spending and income figures on Monday. Personal spending decreased 0.3% in December, missing expectations for a 0.1% decline, after a 0.5% rise in November. November's figure was revised down from a 0.6% increase.

That was the largest decline since September 2009.

Consumer spending makes more than two-thirds of U.S. economic activity.

Falling gasoline prices and a strengthening labour market are expected to support consumer spending in the U.S. in the first quarter.

Personal income climbed 0.3% in December, exceeding expectations for 0.2% increase, after a 0.3% rise in November. November's figure was revised down from a 0.4% gain.

The personal consumption expenditures (PCE) price index excluding food and energy was flat in December, in line with expectations, after a flat reading in November.

On a yearly basis, the PCE price index excluding food and index rose 1.3% in December, after a 1.4% increase in November. Analysts had expected an increase of 1.4%.

The PCE index are below the Fed's 2% inflation target. The PCE index is the Fed's preferred measure of inflation.

EUR/USD: $1.1645(E200mn)

USD/JPY: Y118.15($200mn), Y119.00($194mn)

EUR/JPY: Y133.00(E330mn)

AUD/USD: $0.7750(A$450mn), $0.7800(A$200mn), $0.7840(A$206mnM), $0.7900(A$420mn)

The Swiss SVME and Credit Suisse released its manufacturing purchasing managers' index (PMI) for Switzerland on Monday. The index dropped to 48.2 in January from 53.6 in December, missing expectations for a rise to 54.5. That was the lowest level since October 2012.

A reading above 50 indicates expansion, below indicates contraction.

This figure added to concerns over the health of the Switzerland's economy after the Swiss National Bank (SNB) has discontinued the minimum exchange rate of 1.20 per euro on January 15, 2015.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

02:35 Japan Manufacturing PMI (Finally) January 52.1 Revised From 49.8 49.8 52.2

02:45 China HSBC Manufacturing PMI (Finally) January 49.8 49.8 49.7

06:30 Australia RBA Commodity prices, y/y January -21.2% -20.4%

09:30 Switzerland Manufacturing PMI January 53.6 54.5 48.2

09:50 France Manufacturing PMI (Finally) January 49.5 49.5 49.2

09:55 Germany Manufacturing PMI (Finally) January 51.0 51.0 50.9

10:00 Eurozone Manufacturing PMI (Finally) January 51.0 51.0 51.0

10:30 United Kingdom Purchasing Manager Index Manufacturing January 52.5 52.9 53.0

The U.S. dollar traded mixed to higher against the most major currencies ahead of the U.S. economic data. Personal income in the U.S. is expected to rise 0.2% in December, after a 0.4% gain in November.

Personal spending in the U.S. is expected to decline 0.1% in December, after a 0.6% increase in November.

The ISM manufacturing purchasing managers' index is expected to decline to 54.9 in January from 55.5 in December.

The euro traded mixed against the U.S. dollar after the mostly weaker-than-expected economic data from the Eurozone. Eurozone's final manufacturing purchasing managers' index (PMI) remained unchanged at 51.0 in January, in line with expectations.

Germany's final manufacturing PMI declined to 50.9 in January from a preliminary reading of 51.0. Analysts had expected the final index to remain at 51.0.

France's final manufacturing PMI decreased to 49.2 in January from a preliminary reading of 49.5. Analysts had expected the final index to remain at 49.5.

Comments by Greece's new government weighed on the euro. It said that it will not cooperate with the International Monetary Fund and the European Union.

The British pound traded lower against the U.S. dollar despite the better-than-expected manufacturing PMI from the U.K. The U.K. manufacturing PMI increased to 53.0 in January from 52.5 in December, beating expectations for a rise to 52.9.

The Swiss franc traded lower against the U.S. dollar. The manufacturing purchasing managers' index in Switzerland dropped to 48.2 in January from 53.6 in December, missing expectations for a rise to 54.5.

Speculation that the Swiss National Bank (SNB) was unofficially targeting a new exchange floor for the Swiss franc against the euro weighed on the franc. Swiss newspaper Schweiz am Sonntag reported over the weekend that the SNB's next exchange floor might be CHF1.0500 to CHF1.1000 per euro.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair declined to $1.5004

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

14:30 U.S. Personal spending December +0.6% -0.1%

14:30 U.S. Personal Income, m/m December +0.4% +0.2%

14:30 U.S. PCE price index ex food, energy, m/m December 0.0% 0.0%

14:30 U.S. PCE price index ex food, energy, Y/Y December +1.4% +1.4%

16:00 U.S. ISM Manufacturing January 55.5 54.9

EUR/USD

Offers $1.1500, $1.1450/60, $1.1400, $1.1380/85, $1.1370

Bids $1.1260, $1.1220, $1.1200, $1.1100

GBP/USD

Offers $1.5200, $1.5145/50, $1.5115, $1.5100

Bids $1.4985, $1.4955

AUD/USD

Offers $0.7900, $0.7850, $0.7800

Bids $0.7700, $0.7650, $0.7600

EUR/JPY

Offers Y135.00, Y134.45/50, Y133.90

Bids Y132.20, Y132.00, Y130.15

USD/JPY

Offers Y119.00, Y118.50, Y118.00

Bids Y116.90, Y116.50, Y115.85

EUR/GBP

Offers stg0.7700, stg0.7600, stg0.7535

Bids stg0.7440, stg0.7400

EUR/USD: $1.1645(E200mn)

USD/JPY: Y118.15($200mn), Y119.00($194mn)

EUR/JPY: Y133.00(E330mn)

AUD/USD: $0.7750(A$450mn), $0.7800(A$200mn), $0.7840(A$206mnM), $0.7900(A$420mn)

France's Manufacturing PMI for January came in at 49.2, below forecasts of 49.5 with a previous reading of 49.5.

In Germany, the biggest economy in the Eurozone, the Manufacturing PMI for January showed a reading of 50.9. Analysts had expected the German Manufacturing PMI to remain unchanged at 51.0.

Eurozone's PMI remained unchanged at 51 and in line with expectations.

U.K's Manufacturing PMI improved from 52.5 to 53.0. Analysts expected the index to have a reading of to 52.9.

BLOOMBERG

American CEOs Most Bearish on Earnings Since 2008 Crisis

(Bloomberg) -- U.S. chief executive officers are more pessimistic about corporate earnings than any time since the financial crisis, according to research from Bespoke Investment Group LLC.

The percentage of companies cutting profit forecasts during this earnings season has outpaced those with upward revisions by 8.6 percentage points, the widest margin in six years, according to data compiled by Bespoke. Consumer companies and drugmakers are the most bearish among 10 major industries, with at least 18 percent of each group providing lower guidance, the data show.

Plunging oil and a strengthening dollar are wreaking havoc on earnings this month as Procter & Gamble Co. to Caterpillar Inc. and Pfizer Inc. joined an increased number for companies to announce disappointing forecasts. While the reduction in projections sets a lower bar for companies to exceed, the dismal outlook undermines the bull market where five years of profit expansions have helped the Standard & Poor's 500 Index triple.

REUTERS

ECB's Coeure says union without risk sharing is vulnerable

(Reuters) - European Central Bank money printing has giveneuro zone governments the chance to make structural reforms, a senior policy maker said on Monday, warning that a union without risk sharing was vulnerable.

"Our recent decision to expand our asset purchases ... has opened a unique window of opportunity for euro area governments to act together, remove structural obstacles to growth, and pull our economy out of the low growth, low confidence trap," Benoit Coeure, a member of the ECB's Executive Board, said in the text of a speech.

Source: http://www.reuters.com/article/2015/02/02/us-ecb-coeure-idUSKBN0L60KD20150202

REUTERS

Deflation the danger as China's factories struggle

(Reuters) - The risk of global deflation looms large for 2015 as surveys of China's mammoth manufacturing sector showed excess supply and deficient demand in January drove down prices and production.

While the pulse of activity was livelier in Japan, India and South Korea, they shared a common condition of slowing inflation that argued for yet more policy stimulus ahead.

"The slide in global oil prices and inflation has turned out to be even bigger than anticipated," said David Hensley, an economist at JPMorgan, and central banks from Europe to Canada to Indiahave responded by easing policy.

Source: http://www.reuters.com/article/2015/02/02/us-global-economy-idUSKBN0L60AT20150202

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:35 Japan Manufacturing PMI (Finally) January 49.8 49.8 52.2

01:45 China HSBC Manufacturing PMI (Finally) January 49.8 49.8 49.7

05:30 Australia RBA Commodity prices, y/y January -21.2% -20.4%

The U.S. dollar traded mixed against its major peers after the mostly weak-than-expected U.S. economic data on Friday. The U.S. preliminary gross domestic product increased at an annual rate of 2.6% in the fourth quarter, missing expectations for a 3.3% gain, after a 5.0% rise in the third quarter. Consumers spending strengthened in the fourth quarter, but businesses investment, trade and government spending weakened. For 2014 as a whole, GDP expanded 2.4% compared to 2.2% in 2013. During the Asian session the dollar weakened against the Japanese yen, the aussie and the kiwi but gained against the euro and sterling. Data released on inflation in the Eurozone and concerns over Greece's future in the Eurozone weighed on the single currency.

The Australian dollar further recovered from a 2% slump on Thursday last week despite a weaker-than-expected Chinese HSBC Manufacturing PMI coming in at 49.7 in January compared to a previous reading of 49.8 with a forecast of 49.8. China is Australia's most important trade partner. Australia's AIG Manufacturing Index rose from 46.9 to 49 in January. Market participants expect that the central bank is likely to cut rates on February 3rd. The aussie recently was under pressure as falling energy and commodity prices weighed, lsing 5.1% in January, its biggest monthly decline since September. RBA Commodity Prices for January declined at -20.4% in January compared to -21.2% in December last year.

New Zealand's dollar firmed against the greenback in Asian trade halting the recent slump. The kiwi lost 6.)% against the U.S. dollar in January. The Reserve Bank of New Zealand opened the door for a possible rate cut at its policy meeting on Wednesday.

The Japanese yen traded higher against the greenback on Monday after data on U.S. GDP and a shrinking China's factory sector making the haven-currency more attractive. Japan's Manufacturing PMI for January rose from revised 52.1 unexpectedly to 52.2, beating forecasts of 49.8.

EUR/USD: the euro traded slightly stronger against the greenback

(time / country / index / period / previous value / forecast)

08:30 Switzerland Manufacturing PMI January 54.0 54.5

08:50 France Manufacturing PMI (Finally) January 49.5 49.5

08:55 Germany Manufacturing PMI (Finally) January 51.0 51.0

09:00 Eurozone M3 money supply, adjusted y/y (Finally) January 51.0 51.0

09:30 United Kingdom Purchasing Manager Index Manufacturing January 52.5 52.9

13:30 U.S. Personal spending December +0.6% -0.1%

13:30 U.S. Personal Income, m/m December +0.4% +0.2%

13:30 U.S. PCE price index ex food, energy, m/m December 0.0% 0.0%

13:30 U.S. PCE price index ex food, energy, Y/Y December +1.4% +1.4%

14:45 U.S. Manufacturing PMI (Finally) January 53.7 54.1

15:00 U.S. Construction Spending, m/m January -0.3% +0.9%

15:00 U.S. ISM Manufacturing January 55.5 54.9

23:50 Japan Monetary Base, y/y January +38.2% +40.1%

EUR / USD

Resistance levels (open interest**, contracts)

$1.1519 (3292)

$1.1442 (3111)

$1.1381 (1894)

Price at time of writing this review: $1.1301

Support levels (open interest**, contracts):

$1.1237 (2683)

$1.1188 (2579)

$1.1120 (1266)

Comments:

- Overall open interest on the CALL options with the expiration date February, 6 is 84964 contracts, with the maximum number of contracts with strike price $1,2100 (6527);

- Overall open interest on the PUT options with the expiration date February, 6 is 78507 contracts, with the maximum number of contracts with strike price $1,1700 (6676);

- The ratio of PUT/CALL was 0.92 versus 0.90 from the previous trading day according to data from January, 30

GBP/USD

Resistance levels (open interest**, contracts)

$1.5301 (657)

$1.5203 (1255)

$1.5106 (917)

Price at time of writing this review: $1.5079

Support levels (open interest**, contracts):

$1.4994 (1034)

$1.4897 (1938)

$1.4799 (1188)

Comments:

- Overall open interest on the CALL options with the expiration date February, 6 is 17566 contracts, with the maximum number of contracts with strike price $1,5200 (1255);

- Overall open interest on the PUT options with the expiration date February, 6 is 17560 contracts, with the maximum number of contracts with strike price $1,4900 (1938);

- The ratio of PUT/CALL was 1.00 versus 1.02 from the previous trading day according to data from January, 30

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.