- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

(time / country / index / period / previous value / forecast)

01:30 Japan Unemployment Rate December 3.5% 3.5%

01:30 Japan Tokyo Consumer Price Index, y/y January +2.1%

01:30 Japan Tokyo CPI ex Fresh Food, y/y January +2.3% +2.2%

01:30 Japan Household spending Y/Y December -2.5% -2.5%

01:30 Japan National Consumer Price Index, y/y December +2.4%

01:30 Japan National CPI Ex-Fresh Food, y/y December +2.7% +2.6%

01:50 Japan Industrial Production (MoM) (Preliminary) December -0.6% +1.3%

01:50 Japan Industrial Production (YoY) (Preliminary) December -3.7%

02:05 United Kingdom Gfk Consumer Confidence January -4 -2

02:30 Australia Producer price index, q / q Quarter IV +0.2%

02:30 Australia Producer price index, y/y Quarter IV +1.2%

02:30 Australia Private Sector Credit, m/m December +0.5%

02:30 Australia Private Sector Credit, y/y December +5.9%

07:00 Japan Housing Starts, y/y December -14.3%

09:00 Germany Retail sales, real adjusted December +1.0%

09:00 Germany Retail sales, real unadjusted, y/y December -0.8%

09:45 France Consumer spending December +0.4%

09:45 France Consumer spending, y/y December -1.1%

10:00 Switzerland KOF Leading Indicator January 98.7 97.8

11:30 United Kingdom Net Lending to Individuals, bln December 3.3

11:30 United Kingdom Mortgage Approvals December 59

12:00 Eurozone Unemployment Rate December 11.5% 11.5%

12:00 Eurozone Harmonized CPI, Y/Y (Preliminary) January -0.2% -0.5%

15:30 Canada GDP (m/m) November +0.3%

15:30 U.S. Employment Cost Index Quarter IV +0.7%

15:30 U.S. PCE price index, q/q Quarter IV +3.2%

15:30 U.S. PCE price index ex food, energy, q/q Quarter IV +1.4%

15:30 U.S. GDP, q/q (Preliminary) Quarter IV +5.0% +3.3%

16:45 U.S. Chicago Purchasing Managers' Index January 58.3 58.1

17:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) January 98.2 98.1

The U.S. dollar traded higher against the most major currencies after the mixed U.S. economic data. The number of initial jobless claims in the week ending January 24 in the U.S. fell by 43,000 to 265,000 from 308,000 in the previous week.

Pending home sales in the U.S. declined 3.7% in December, missing expectations for a 0.6% increase, after a 0.6% gain in November. November's figure was revised down from a 0.8% rise.

That was the biggest monthly decrease since December 2013.

The euro traded lower against the U.S. dollar. German preliminary consumer price index dropped 1.0% in January, missing expectations for a 0.7% decline, after a flat reading in December.

On a yearly basis, German preliminary consumer price index decreased to -0.3% in January from 0.2% in December, missing forecasts for a flat reading. That was the lowest level since July 2009.

The number of unemployed people in Germany declined by 8,000 in January, missing expectations for a 13,000 decline, after a 25,000 drop in December. December's figure was revised down from a 27,000 decrease.

Germany's adjusted unemployment rate fell to 6.5% in January from 6.6% in December, in line with expectations. December's figure was revised down from 6.5%.

Eurozone's adjusted M3 money supply rose 3.6% in December, after a 3.1 gain in November.

Investors remained cautious amid concerns over Greece's future policy. Syriza party won the country's parliament elections on Sunday. The party has pledged to renegotiate the terms of the country's €240 billion euro financial bailout and to reverse many of the austerity measures.

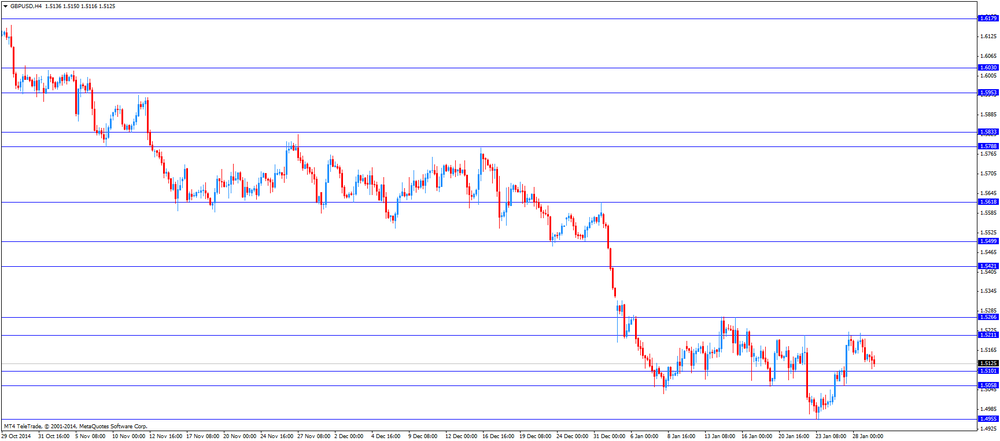

The British pound declined against the U.S. dollar. The Nationwide Building Society released its house price inflation figures for the U.K. on Thursday. The U.K. house price index increased 0.3% in December, missing expectations for a 0.4% gain, after a 0.2% rise in November.

On a yearly basis, the U.K. house price inflation fell to 6.8% in December from 7.2% in November, beating expectations for a decline to 6.6%.

The New Zealand dollar traded mixed against the U.S. dollar. In the overnight trading session, the kiwi fell against the greenback after the Reserve Bank of New Zealand's (RBNZ) interest decision. The RBNZ kept interest rate unchanged at 3.50%.

New Zealand' trade deficit narrowed to NZ$159 million in December from NZ$285 million in November. November's figure was revised down from NZ$213 million Analysts had expected the trade deficit to decline to NZ$27million.

The Australian dollar traded lower against the U.S. dollar. In the overnight trading session, the Aussie decreased against the greenback in the absence of any major economic reports from Australia.

The Japanese yen traded lower against the U.S. dollar. In the overnight trading session, the yen traded lower against the greenback after the weaker-than-expected retail sales from Japan. Retail sales in Japan rose 0.2% in December, missing forecasts of a 0.9% gain, after a 0.5% increase in November. November's figure was revised up from a 0.4% increase.

The National Association of Realtors (NAR) released its pending home sales figures for the U.S. on Thursday. Pending home sales in the U.S. declined 3.7% in December, missing expectations for a 0.6% increase, after a 0.6% gain in November. November's figure was revised down from a 0.8% rise.

That was the biggest monthly decrease since December 2013.

The NAR's chief economist Lawrence Yun said that the drop was partly driven by rising prices and low availability of houses for sale.

EUR/USD: $1.1100(E378mn), $1.1250(E252mn), $1.1400(E278mn)

USD/JPY: Y116.50($732M), Y117.00($490mn), Y117.65($400mn), Y118.50($2.0bn), Y119.00($2.7bn), Y119.50($886mn)

GBP/USD: $1.5100(stg1.0bn), $1.5250(stg302mn), $1.5400(stg744mn)

EUR/GBP: stg0.7500(E270mn), stg0.7600(E200mn)

NZD/USD: $0.7295(NZ$500mn), $0.7300(NZ$800mn), $0.7450(NZ$250mn), $0.7575(NZ$373mn), $0.7620(NZ$434mn)

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Export Price Index, q/q Quarter IV -3.9% 0.0%

00:30 Australia Import Price Index, q/q Quarter IV -0.8% +0.9%

07:00 United Kingdom Nationwide house price index January + +0.2% +0.4% +0.3%

07:00 United Kingdom Nationwide house price index, y/y January +7.2% +6.6% +6.8%

08:55 Germany Unemployment Change January -25 Revised From -27 -13 -8

08:55 Germany Unemployment Rate s.a. January 6.6% Revised From 6.5% 6.5% 6.5%

09:00 Eurozone Private Loans, Y/Y December -2.7% Revised From -0.9% +3.1%

09:00 Eurozone M3 money supply, adjusted y/y December +3.1% +3.6%

10:00 Eurozone Business climate indicator January 0.15 Revised From 0.2 0.16

10:00 Eurozone Economic sentiment index January 100.8 101.4 101.2

10:00 Eurozone Industrial confidence January -4.0 -4.7 -5.0

11:00 United Kingdom CBI retail sales volume balance January 61 39

13:00 Germany CPI, m/m (Preliminary) January 0.0% -0.7% -1.0%

13:00 Germany CPI, y/y (Preliminary) January +0.2% 0.0% -0.3%

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. economic data.

Pending home sales in the U.S. are expected to climb 0.6% in December, after a 0.8% increase in October.

The euro traded higher against the U.S. dollar after the mostly weaker-than-expected economic data from Eurozone. German preliminary consumer price index dropped 1.0% in January, missing expectations for a 0.7% decline, after a flat reading in December.

On a yearly basis, German preliminary consumer price index decreased to -0.3% in January from 0.2% in December, missing forecasts for a flat reading. That was the lowest level since July 2009.

The number of unemployed people in Germany declined by 8,000 in January, missing expectations for a 13,000 decline, after a 25,000 drop in December. December's figure was revised down from a 27,000 decrease.

Germany's adjusted unemployment rate fell to 6.5% in January from 6.6% in December, in line with expectations. December's figure was revised down from 6.5%.

Eurozone's adjusted M3 money supply rose 3.6% in December, after a 3.1 gain in November.

Investors remained cautious amid concerns over Greece's future policy. Syriza party won the country's parliament elections on Sunday. The party has pledged to renegotiate the terms of the country's €240 billion euro financial bailout and to reverse many of the austerity measures.

The British pound traded mixed against the U.S. dollar after the mixed house prices from the U.K. The Nationwide Building Society released its house price inflation figures for the U.K. on Thursday. The U.K. house price index increased 0.3% in December, missing expectations for a 0.4% gain, after a 0.2% rise in November.

On a yearly basis, the U.K. house price inflation fell to 6.8% in December from 7.2% in November, beating expectations for a decline to 6.6%.

EUR/USD: the currency pair rose to $1.1326

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair climbed to $118.18

The most important news that are expected (GMT0):

13:30 U.S. Initial Jobless Claims January 307

15:00 U.S. Pending Home Sales (MoM) December +0.8% +0.6%

23:30 Japan Tokyo Consumer Price Index, y/y January +2.1%

23:30 Japan Tokyo CPI ex Fresh Food, y/y January +2.3% +2.2%

23:30 Japan Household spending Y/Y December -2.5% -2.5%

23:30 Japan National Consumer Price Index, y/y December +2.4%

23:30 Japan National CPI Ex-Fresh Food, y/y December +2.7% +2.6%

23:50 Japan Industrial Production (MoM) (Preliminary) December -0.6% +1.3%

23:50 Japan Industrial Production (YoY) (Preliminary) December -3.7%

EUR/USD

Offers $1.1445/60, $1.1400, $1.1380/85, $1.1360-70, $1.1340/45, $1.1320-25

Bids $1.1220, $1.1200

GBP/USD

Offers

Bids $1.5100

AUD/USD

Offers $0.7950, $0.7900, $0.7850

Bids $0.7750, $0.7700, $0.7650

EUR/JPY

Offers Y134.45/50, Y133.80/00, Y133.50

Bids Y132.55/50, Y132.10/00, Y131.50

USD/JPY

Offers Y118.50, Y118.00

Bids Y117.10/00, Y116.95/85, Y116.50

EUR/USD: $1.1100(E378mn), $1.1250(E252mn), $1.1400(E278mn)

USD/JPY: Y116.50($732M), Y117.00($490mn), Y117.65($400mn), Y118.50($2.0bn), Y119.00($2.7bn), Y119.50($886mn)

GBP/USD: $1.5100(stg1.0bn), $1.5250(stg302mn), $1.5400(stg744mn)

EUR/GBP: stg0.7500(E270mn), stg0.7600(E200mn)

NZD/USD: $0.7295(NZ$500mn), $0.7300(NZ$800mn), $0.7450(NZ$250mn), $0.7575(NZ$373mn), $0.7620(NZ$434mn)

BLOOMBERG

Fed Raises Assessment of Economy While Staying Patient on Rates

(Bloomberg) -- The Federal Reserve boosted its assessment of the economy and played down low inflation while repeating a pledge to stay "patient" on raising interest rates.

The Federal Open Market Committee described the expansion as "solid," an improvement over the "moderate" performance it saw in December. It substituted "strong" for "solid" in its evaluation of job gains after a meeting Wednesday in Washington.

While inflation "is anticipated to decline further in the near term," the FOMC said in a statement, it is likely to rise gradually toward its 2 percent goal "over the medium term" as the impact of low oil prices diminishes. Policy makers also said cheaper energy will help boost consumer buying power.

The Fed's confidence in the outlook for higher inflation and lower unemployment suggests it will stick to plans to raise interest rates this year for the first time since 2006. One caveat: officials will take "international developments" into account when considering an increase, language that contributed to a decline in stocks and Treasury yields.

REUTERS

ECB' Coeure tells Greece: stick to 'rules of game' - paper

Jan 29 (Reuters) - The Greek government must continue to respect its commitments, a senior policy maker at the European Central Bank told an Italian newspaper on Thursday.

Responding to a question from Corriere della Sera whether Athens must continue to meet its financial obligations, Benoit Coeure, a member of the ECB's Executive Board, said: "Greece must continue to abide by the rules of the game."

Coeure also spelt out the benchmark of success that will determine the duration of government bond buying by the ECB, a programme that was announced last week.

"It will end only once we get a strong sense that inflation is converging towards 2 percent." (Reporting By John O'Donnell Editing by Jeremy Gaunt)

Source: http://www.reuters.com/article/2015/01/29/ecb-policy-greece-idUSL6N0V81KP20150129

BLOOMBERG

Oil Trades Near Six-Year Low Amid Surging U.S. Crude Stockpiles

(Bloomberg) -- Oil traded near the lowest price in almost six years after government data showed U.S. crude stockpiles increased to the highest level since at least August 1982, adding to signs that a global glut will persist.

Futures were little changed in New York after falling 3.9 percent on Wednesday. Crude inventories in the U.S., the world's biggest oil consumer, expanded by 8.87 million barrels to 406.7 million last week, the Energy Information Administration reported. Oil may recover as early as the first half of this year as production is reduced, said Harold Hamm, the chief executive officer of Continental Resources Inc.

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia Export Price Index, q/q Quarter IV -3.9% 0.0%

00:30 Australia Import Price Index, q/q Quarter IV -0.8% +0.9%

07:00 United Kingdom Nationwide house price index January +0.2% +0.4% +0.3%

07:00 United Kingdom Nationwide house price index, y/y January +7.2% +6.6% +6.8%

The U.S. dollar traded mixed against its major peers. Yesterday the Federal Open Market Committee gave a confident outlook on higher inflation and lower unemployment which can be seen as indication that the FED will stick to its plan on hiking interest rates in 2015 for the first time since 2006. The bank will take "international developments" into account when deciding on the exact timing. All members of the FOMC unanimously backed the statement as solid economic growth fuels optimism despite a stronger dollar and slumping oil prices. The dollar gained against the Japanese yen but traded lower against the euro and sterling.

The Australian dollar traded at its weakest since July 2009 as market participants expect that the central bank is likely to cut rates on February 3rd. Australia's Import Prices rose from -0.8% in the previous quarter by +0.9% in the fourth quarter of 2014. Export Prices for the fourth quarter have a reading of 0.0% compared to -3.9% in the previous period.

New Zealand's dollar halted its fall and declined slightly after trading at the weakest since 2011 on Wednesday slumping by 1.9% on comments of the RBNZ that it's prepared to lower interest rates. The New Zealand central bank held the overnight cash rate steady at 3.5%.

The Japanese yen traded lower against the greenback on Thursday. Japanese Retail sales for the month of December rose by +0.2%, below expectations of an increase by +0.9%. In the previous month Retail Sales rose by 0.4%. A set of economic data is due late in the day including Household Spending, the National CPI and Industrial Production.

EUR/USD: the euro traded slightly stronger against the greenback

(time / country / index / period / previous value / forecast)

08:55 Germany Unemployment Change January -27 -13

08:55 Germany Unemployment Rate s.a. January 6.5% 6.5%

09:00 Eurozone Private Loans, Y/Y December -0.9%

09:00 Eurozone M3 money supply, adjusted y/y December +3.1%

10:00 Eurozone Business climate indicator January 0.2

10:00 Eurozone Economic sentiment index January 100.8 101.4

10:00 Eurozone Industrial confidence January -4.0 -4.7

11:00 United Kingdom CBI retail sales volume balance January 61

13:00 Germany CPI, m/m (Preliminary) January 0.0% -0.7%

13:00 Germany CPI, y/y (Preliminary) January +0.2% 0.0%

13:30 U.S. Initial Jobless Claims January 307

15:00 U.S. Pending Home Sales (MoM) December +0.8% +0.6%

21:45 New Zealand Building Permits, m/m December +10.0%

21:45 New Zealand Visitor Arrivals December +3.1%

23:30 Japan Unemployment Rate December 3.5% 3.5%

23:30 Japan Tokyo Consumer Price Index, y/y January +2.1%

23:30 Japan Tokyo CPI ex Fresh Food, y/y January +2.3% +2.2%

23:30 Japan Household spending Y/Y December -2.5% -2.5%

23:30 Japan National Consumer Price Index, y/y December +2.4%

23:30 Japan National CPI Ex-Fresh Food, y/y December +2.7% +2.6%

23:50 Japan Industrial Production (MoM) (Preliminary) December -0.6% +1.3%

23:50 Japan Industrial Production (YoY) (Preliminary) December -3.7%

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.